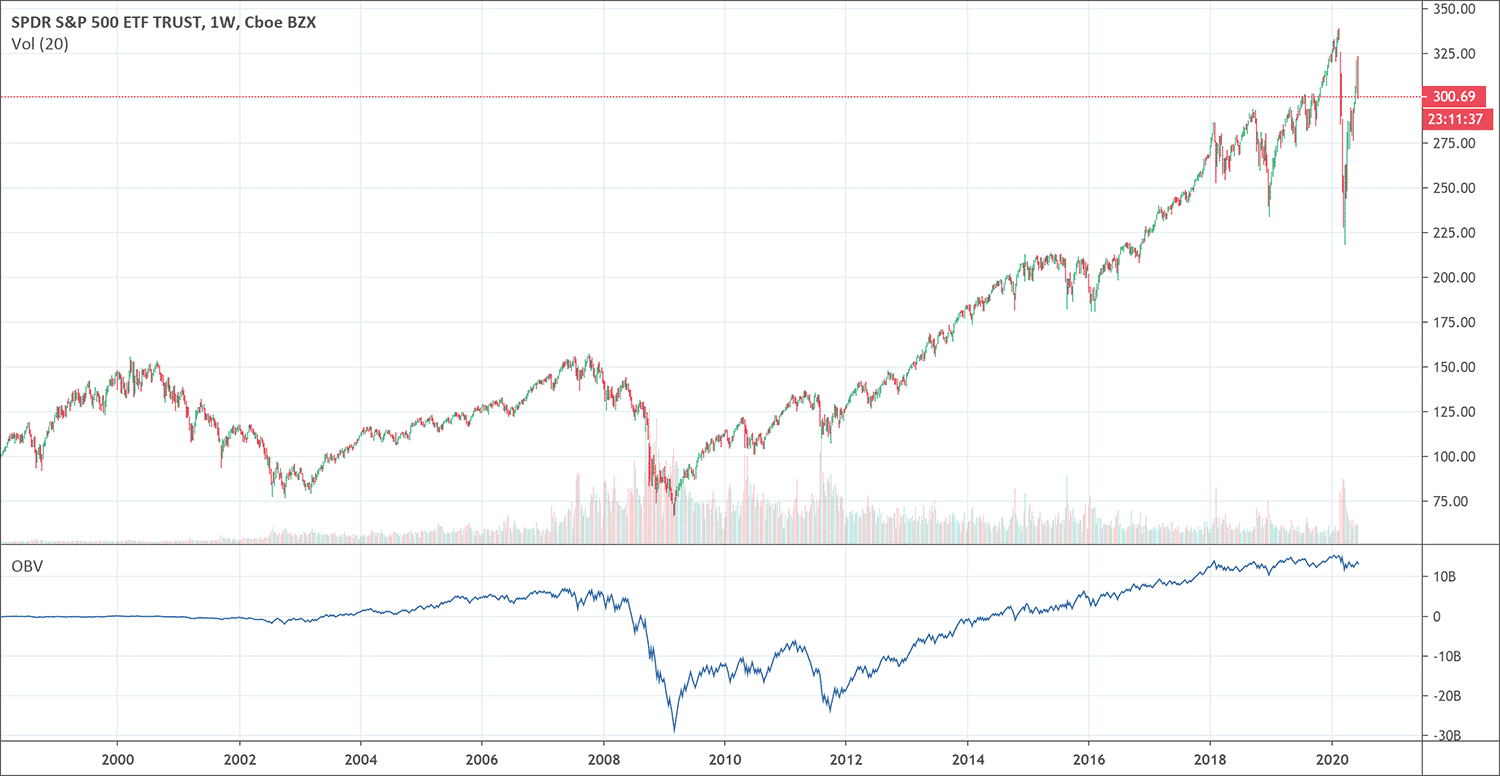

- The OBV (On Balance Volume) technical indicator uses volume to indicate momentum.

- The OBV indicator shows crowd sentiment and help traders predict a bullish or bearish outcome.

- It’s mainly useful when in divergence with price as it shows unexpected strength or weakness.

What is the On Balance Volume indicator?

Joe Granville create the On Balance Volume indicator (abbreviated OBV) in the 1960s. Back then, it was a revolutionary indicator. Today, a lot of professional traders use this leading indicator for trading and analysis. The indicator considers volume and if the volume is pushing prices up or down. Its main purpose in technical analysis is to measure buying and selling pressure.

On balance volume makes use of volume to determine price movements of a security in advance. Just like the other volume-based indicators, such as the Klinger volume oscillator, negative volume index, and money flow index, OBV works only on markets with exchange volume associated with them.

It works by keeping a running tally on volume according to the direction of a security. When the price of security increases, the volume adds to the running total making up the OBV figure. When the price of security decreases, the volume substracts from the running total making up the OBV figure.

The OBV indicator is seen by many professionals as one of the key momentum indicators and is best used to determine new trade opportunities in the following ways: trend line strategy, trend reversal – divergence, and forex trend strategy.

What does the On Balance Volume indicator tell traders?

A new peak in the OBV shows that buyers are strong and sellers are weak. The price of the trading instrument will probably rise. A new bottom in the OBV means that sellers are strong and buyers are weak, thus the price is likely to drop. If the OBV increases or decreases in consonance with the price, this means that the underlying trend has been confirmed.

The theory behind the OBV indicator is based on the difference between smart money (institutional investors) and less sophisticated retail investors. As mutual funds and pension funds start buying into an issue that retail investors are selling, volume may rise even as the price remains relatively level. Eventually, the volume pushes the price upward. When this occurs, larger investors start selling, and smaller investors begin to buy.

Despite being plotted on a price chart and measured numerically, the real individual quantitative value of OBV is not significant. The indicator itself is cumulative, while the time interval remains fixed by a dedicated starting point, which means that the real number value of OBV arbitrarily depends on the start date. Rather, traders and analysts look to the nature of OBV movements over time; the slope carries all of the weight of analysis.

Traders and analysts observe the volume numbers on the OBV to track huge, institutional investors. They treat divergences between volume and price as being similar to the relationship between smart money and the disparate masses, hoping to show buying opportunities against incorrect prevailing trends. For instance, institutional money may drive the price of an asset up, and then sell after other investors jump on the bandwagon.

How to use the On Balance Volume indicator?

- When both OBV and price are achieving higher peaks and higher troughs, the upward trend will probably go on

- When both OBV and price are attaining lower peaks and lower troughs, the downward trend will likely continue

- In a trading range, if the OBV is increasing, accumulation may be taking place, which is a warning of an upward breakout

- As a trading range is happening, if the OBV is decreasing, distribution may be taking place, which is a warning of a downward breakout

- When price keeps on making higher peaks and OBV doesn’t make higher peaks, the upward trend will probably fail or stall. This is known as a negative divergence

- When price keeps on making lower troughs and OBV fails to make lower troughs, the down trend will likely fail. This is referred to as positive divergence

Traders apply this indicator to determine price movements or when they want to confirm price trends. The calculation depends on the divergences between the volume and the price.

Bullish divergence

When the price action reduces and OBV increases, you can expect upward movements. In the same way, for a bullish divergence, the price will display lower lows while the indicator shows higher lows.

Bearish divergence

It can be identified when the price keeps on rising while the OBV decreases. When the price shows higher highs and on-balance volume has lower highs, it means it is a sign of a bearish divergence.

Trend confirmation

To confirm the direction of a trend, see if the OBV line moves in the same direction as the price. If on-balance volume rises when price rises, then you can confirm an upward trend and the volume moves to support the price growth.

Potential breakout or breakdown

When there are ranging market conditions, be on the lookout for an increasing or decreasing on-balance volume indicator values as it can show potential breakout or breakdown in price. A rising OBV line can tell potential upward breakout because accumulation is in place. A reducing on-balance volume line may indicate potential price breakdowns because of the distribution.

Biggest mistakes to avoid

One limitation of OBV is that it is a leading indicator, which means that it may produce predictions, but there is little it can say about what has actually occurred in terms of the signals it produces. Due to this, it is prone to produce false signals. It can therefore be balanced by lagging indicators. Include a moving average line to the OBV to look for OBV line breakouts; traders can confirm a breakout in the price if the OBV indicator makes a concurrent breakout.

Another mistake to avoid in using the OBV is that a large spike in volume on a single day can throw off the indicator for quite a while. For example, a surprise earnings announcement, being added or removed from an index, or massive institutional block trades can cause the indicator to plummet, but the spike in volume may not mean an trend.

Pros & Cons of the On Balance Volume Indicator

Pros

- It is easy to understand the calculation

- As a cumulative indicator, it can be used to confirm the direction of a trend

- As a good indicator, OBV can show signals for potential breakout or breakdown when the price moves sideways

- It offers traders a means of detecting divergences

Cons

- A huge spike during a trading day can cause OBV to spike, even though the major increase is not made due to a rise in volume. There are various reasons, such as company announcements, which can cause a huge price increase

- OBV indicator doesn’t use all vital data required for price action analysis

- The same volume will be added or subtracted regardless, whether the price moves a couple of dollars or a couple of cents. Therefore, an OBV indicator doesn’t account for the degree of price movement

- It can provide misleading trading alerts when plotted on a smaller time frame. At lower time frames, the price has noise due to the higher price volatility. Traders should avoid trading mainly on OBV on lower time frames, or try to combine it with other indicators

Conclusion

On Balance Volume is a simple indicator that makes use of price and volume to determine buying and selling pressure. Buying pressure is determined when positive volume goes beyond negative volume and the OBV line increases. Selling pressure is seen when negative volume exceeds positive volume and the OBV line falls.

Traders can use OBV to confirm the underlying trend or look for divergences that may cover a price change. As with all indicators, it is necessary to use OBV in conjunction with other technical analysis tools. It is not a standalone indicator; it can be combined with basic pattern analysis or to confirm signals from momentum oscillators.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!