Did you know there are more than 10 different harmonic patterns?

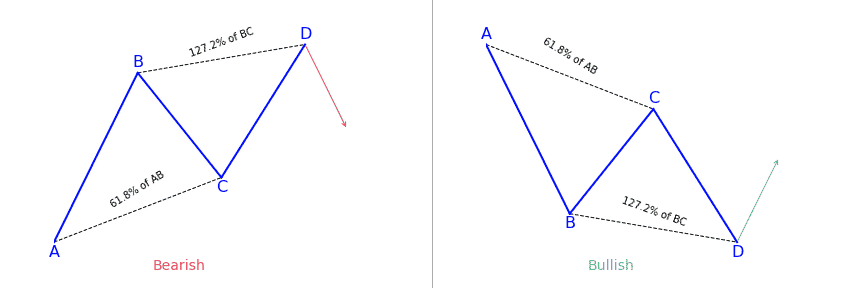

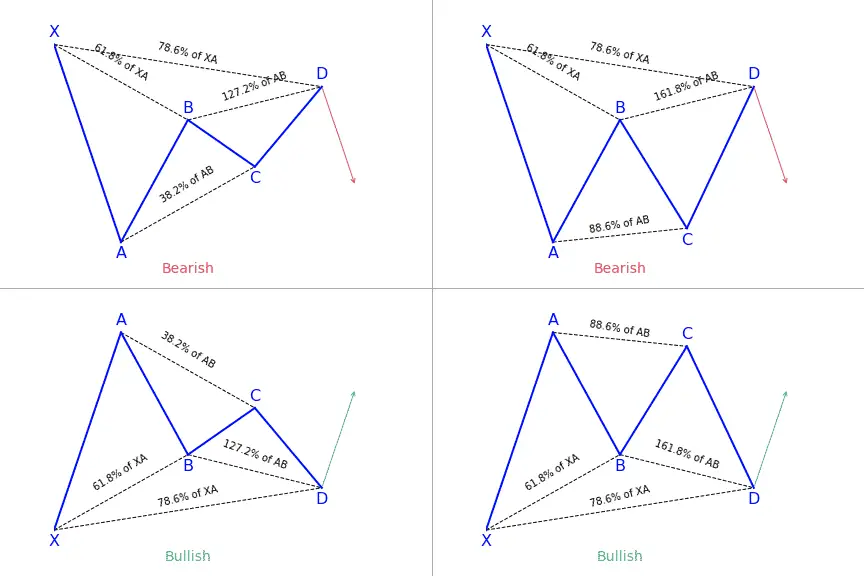

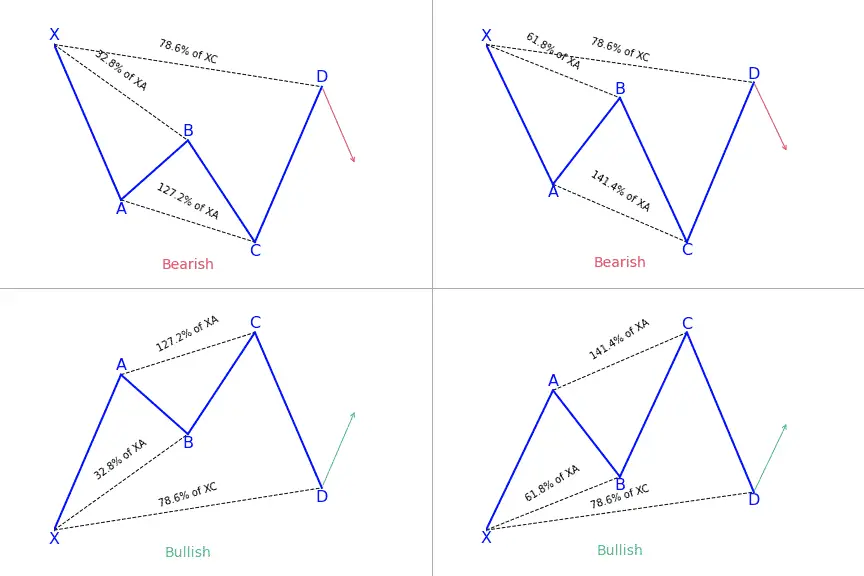

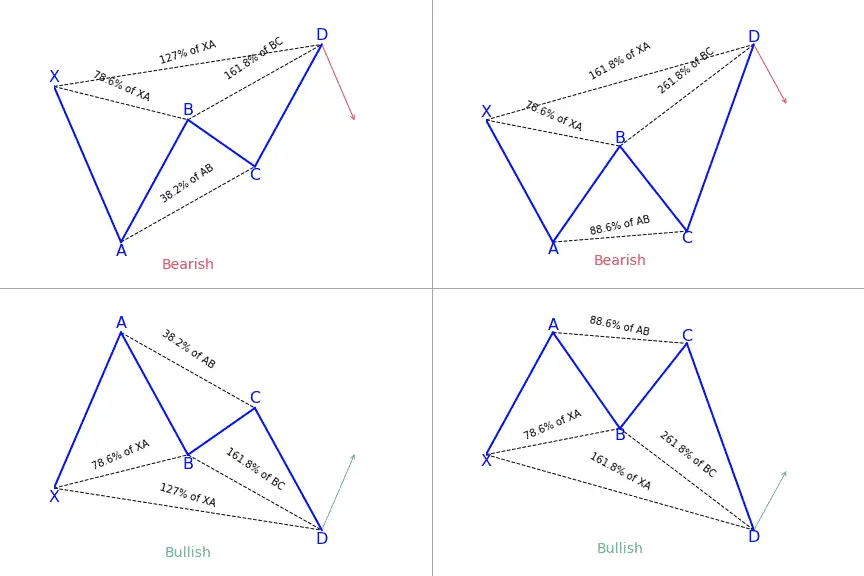

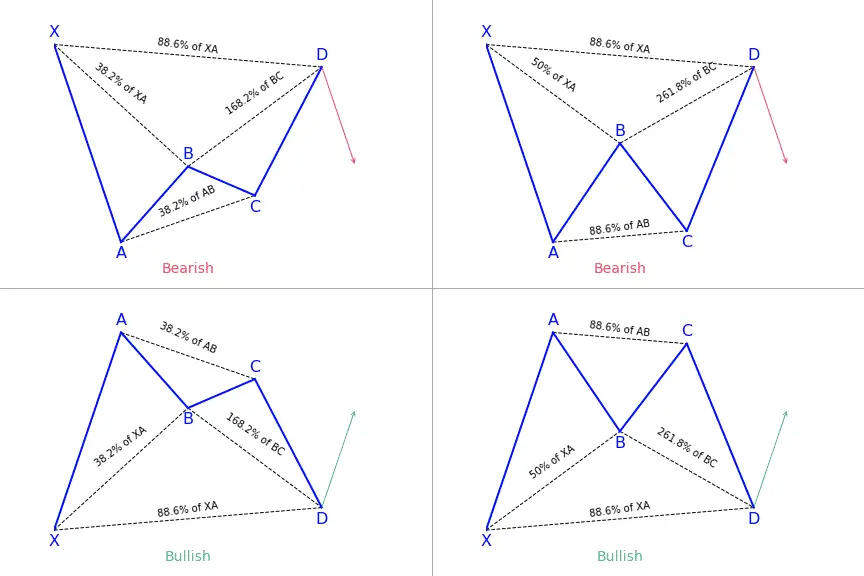

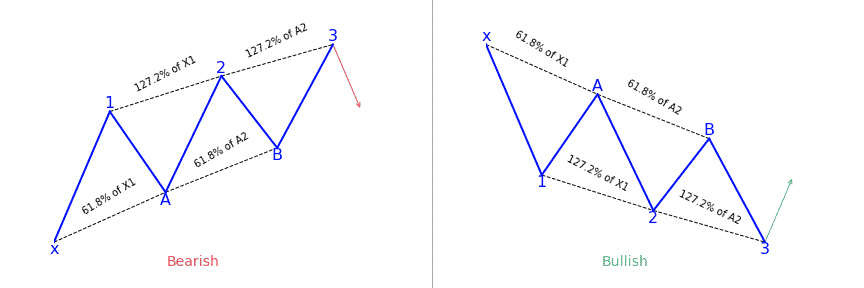

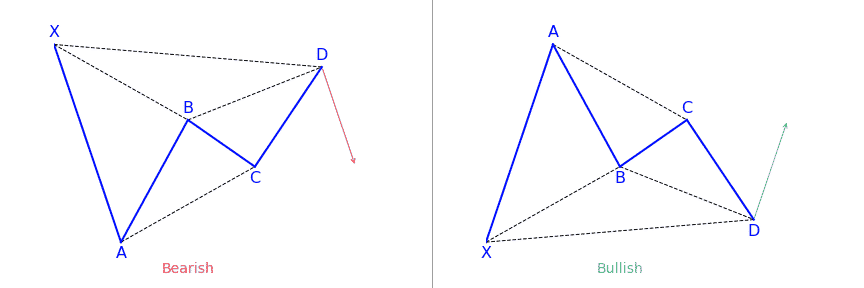

They come in different shapes and sizes but they all share something in common : they are made of mathematical ratios and are made of 4 to 6 points.

Every single harmonic trading pattern detailed

Below you’ll find the ultimate database with every single harmonic pattern (and all the other types of technical analysis chart patterns if you are interested: candlestick patterns and traditional patterns). Each harmonic pattern has a dedicated detailed article. Even though these patterns are quite complex patterns, we tried to make it as simple as possible and each article goes into detailed explanation, giving you examples and data. It’ll help you clearly understand each pattern and give you the knowledge and confidence to spot them and use them in real life. No more doubt about what makes a specific pattern and how well it works.

This extensive cheat sheet will definitely give you an edge and let you understand and recognize every pattern. Plus at PatternsWizard, our absolute focus is to bring you data-driven performance statistics. So for most patterns (articles below) you’ll find data about their performance and reliability (how often they confirm, reach the target or stop, how often they appear, …) to adjust your trading strategy.

Harmonic patterns follow very strict requirements

Scott Carney discovered and formalised most of the harmonic patterns of various financial markets. These patterns are a succession of up and down legs (price moves). Depending on the pattern, they are composed of 3 to 5 legs (created by 4 to 6 points). In addition, these legs follow strict mathematical ratios. Fibonacci levels are the main retracement levels used for harmonic patterns. Also, each Fibonacci ratio has a different fundamental to it (like the golden ratio: 1.618).

The Fibonacci retracements or extensions create potential reversal zones. Each pattern takes these notions into their conception with some specificities. For example, the most famous ones are the crab pattern, cypher pattern, shark pattern and many more (which you’ll find all below).

Looking for a way to automatically find harmonic patterns in your favorite markets?

You definitely need a screener for that! Check out this harmonic patterns scanner here!

If you come from us (simply click the link below), you’ll get a 7-days free trial and 50% off your first month’s subscription fee. Don’t think more, go test it out for free now!

Click here to sign up and claim your 7-days free trial of the best harmonic pattern scanner.

How can these harmonic patterns help you enhance your trading strategy?

Depending on the pattern (each pattern can tell a different story), they can be a hint for :

- Reversal patterns : it predicts price will reverse and move in the opposite direction

- Continuation patterns : it predicts price will continue its move in the same direction

Furthermore, this pattern can be a bullish pattern (meaning it hindsights for a price move up) or a bearish pattern (meaning it hindsights for a price move down).

If you want to learn more about these patterns, you can check each pattern’s article below. If you prefer to enroll in a video course (I know some people prefer videos, maybe it’s your case), you can check the two Udemy courses I shortlisted for you: Forex Harmonic Pattern Trading – With Multiple Chart Examples & Harmonic Trading: The Art Of Trading With Low Risk.

Want to go into the details of a specific harmonic pattern. You’re at the right place!

These patterns often have very imaginative names. Feel free to discover the detailed article for each and every harmonic pattern right below :

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

![Crab & Deep Crab Harmonic Pattern: The ultimate guide [2022]](https://patternswizard.com/wp-content/uploads/2020/06/crab.png)

![Shark Harmonic Pattern: Full Guide [2022]](https://patternswizard.com/wp-content/uploads/2020/06/shark.png)

![5-0 Harmonic Pattern: Complete guide [2022]](https://patternswizard.com/wp-content/uploads/2020/06/5-0.png)

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!