- A SMA (Simple Moving Average) indicator calculates the average of prices for a given number of periods.

- The SMA is used alone (for its slope) or with others MAs (for the crossing).

What is the Moving Average indicator?

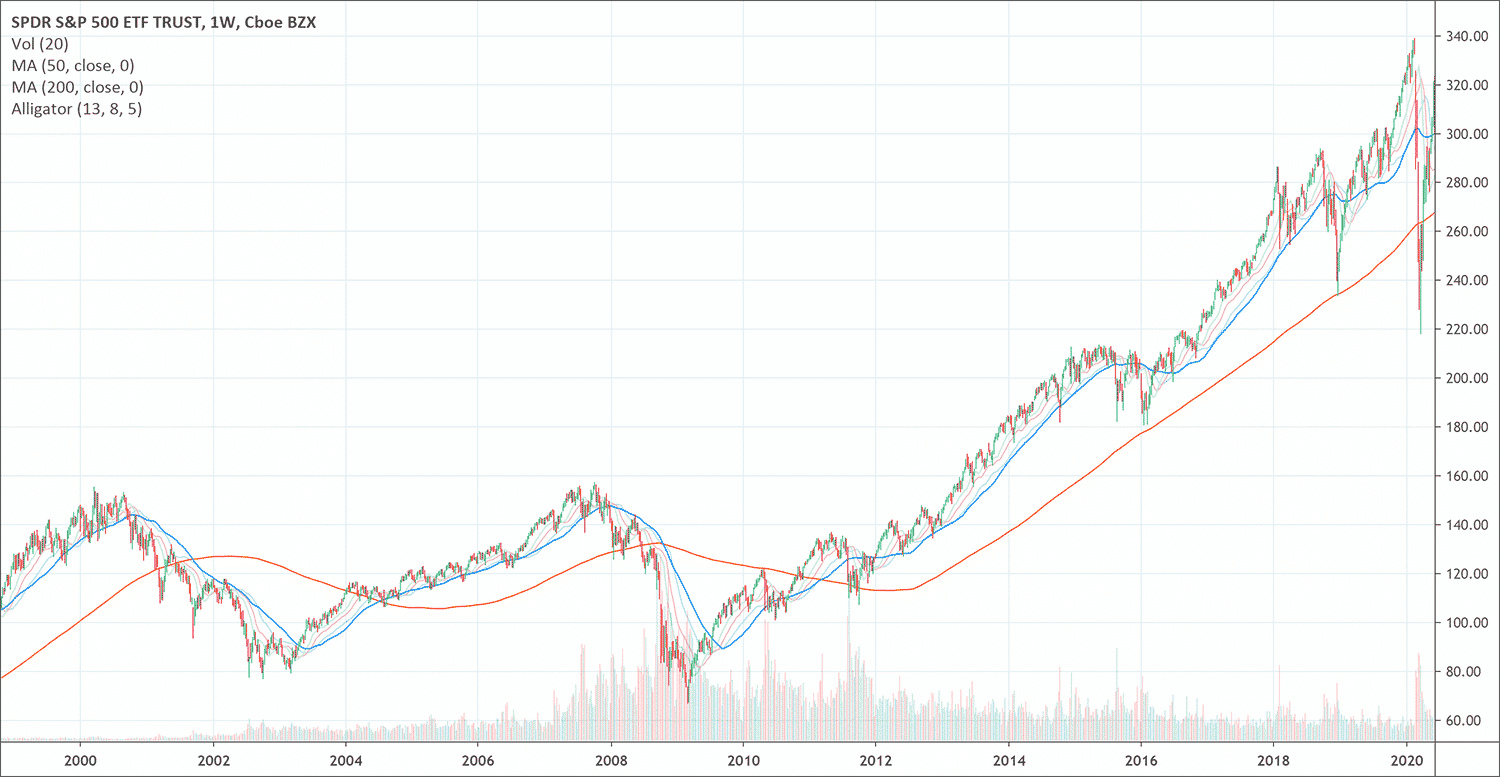

In technical analysis, the moving average is an indicator. It represents the average closing price of the market over a particular period. Traders often use the moving averages as it can be a good indication of current market momentum.

In statistics, a moving average is a calculation. It is useful to analyze data points. It computes various averages of different subsets of the full data set. In finance, a moving average is an indicator and is a important tool of technical analysis. The reason for calculating the moving average of a stock is to help smooth out the price data. It creates a constantly updated average price.

The moving average improves price data by making a constantly updated average price. The average computes over a specific time, from the minute to weeks or months.

Before you keep looking down this article, you should check 2 of courses I shortlisted in the New Trader University from Steve Burns (a very famous trader with about 400k followers on Twitter)!

- Moving Averages 101: this professional video series that will teach you how to use moving averages to be more profitable with less stress.

- Moving Average Signals: this course will illustrate how trading moving average signals with confidence and consistency can lead to profitability; consistently creating bigger wins and smaller losses.

Types of Moving Averages

Simple Moving Average (SMA)

The SMA is a basic average of price over the particular timeframe.

For instance, if one plots a 20-period SMA onto a chart, it will add up the previous 20 closing prices and divide by the number of periods (20) in order to determine what the current value of the SMA should be. The series of various points are linked together to form a line.

Exponential Moving Average (EMA)

Some traders prefer the exponential moving average. Unlike the SMA, it has multiplying factors that offer more weight to more recent data points than prior data points. Due to this, the EMA will swiftly react more to a price action. This can give traders an earlier indication relative to an SMA.

Similar to SMAs, periods of 50, 100, and 200 on EMAs are also mostly plotted by traders who track price action back weeks, months, or years. In terms of short-term moving averages, the 12-day and 26-day EMAs have been made popular by the MACD indicator.

EMAs tend to be common among day traders, who quickly trade in and out of positions, as they change more quickly with price. EMAs may also be more common in volatile markets for this same purpose.

The difference between them is that the simple moving average does not give any weighting to the averages in the data set, while the exponential moving average will give more weighting to current prices.

What does the Moving Average indicator tell traders?

A moving average can also be used as support or resistance. When there’s an uptrend, a 50-day, 100-day or 200-day moving average may act as a support level. Because the average acts like a floor (support level), so the price bounces up off of it. During a downtrend, a moving average may act as resistance; like a ceiling, the price hits the level and then begins dropping again.

The price will not always respect the moving average in this way. The price may run through it slightly or pause and reverse when it reaches it. As a general rule, if the price is more than a moving average, it indicates that the trend is up. If the price is lower than a moving average, the trend is down. However, moving averages can have different lengths, so one MA may mean an uptrend while another MA means a downtrend.

Moving averages smooth the price data to make a trend after an indicator. They do not predict price direction, but define the current direction, even though they lag due to being based on past prices. Despite this, moving averages assist in smoothing price actions and filtering out noise. They also make the building blocks of a lot of other technical indicators and overlays, like Bollinger Bands, MACD and the McClellan Oscillator.

How to use the Moving Average indicator?

A simple moving average is made by calculating the average price of a security over a specific number of times. A lot of moving averages are based on closing prices. For instance, a 5-day simple moving average is the five-day sum of closing prices divided by five. As its name implies, a moving average is an average that moves. Old data is dropped as new data comes up, making the average move along the time scale.

Biggest mistakes to avoid with MAs

Since they are lagging indicators, they shouldn’t be misinterpreted as indicators that can predict future movements of price with any degree of resolution.

For instance, by the time a moving average goes from being sloped in one direction or another to flattening, the price action has already switched because of the lagging nature of the moving average.

For traders who rely on support and resistance strategies to produce entry points, if you’re also waiting on a moving average crossover to confirm the signal you’ll have probably already missed it. Unless it returns to the level, by which point the moving average(s) will have changed again.

Traders use the moving averages to confirm where a trend heads or an idea of its magnitude. But it should have an ancillary role in an overall trading system.

Some traders make use of them as support and resistance levels. And some join many moving averages and use crossovers of different ones to confirm trend shifts and entry points. But like all indicators, there should be confluence among various tools and modes of analysis to raise the probability of any given trade working out.

Moving averages are most appropriate for use in trending markets. Traders will pay attention to both the direction of the moving average as well as its slope and rate of change. Moving averages can easily detect trend and momentum change. With MA, it’s easier than by looking at price candles alone (but it’s lagging).

Most times, traders will trade only in the direction of the trend as confirmed by the moving average, or a set of them. For instance, if 50-, 100-, and 200-period moving averages are all in alignment as positive sloped, the trader may place all his/her positions to the long side.

Pros & Cons

There are advantages to using a moving average while trading, and options on what type of moving average to use. Moving average strategies are popular. It can apply to any time, suiting both long-term and short-term traders.

Moving averages are calculated by using historical data, and nothing about the calculation can be predicted. Thus, results obtained from using moving averages can be random. Sometimes, the market respects MA support/resistance and trade indications, and at other times, it shows these indicators no respect.

A major problem here is that, if the price action becomes choppy, the price may swing back and forth, creating various trend reversals or trade signals. When this happens, it is best to step aside or use another indicator to help clarify the trend. The same thing can occur with MA crossovers when the MAs get tangled-up for a period, causing many multiple losing trades.

Moving averages best work in strong trending conditions but are poor in choppy or ranging conditions. Adjusting the time frame can temporarily solve this concern, although these issues will probably occur regardless of the time frame selected for the moving average(s).

Conclusion

The moving Average is a common indicator that traders use to determine trends in the market. A lot of traders use more than one moving average at a time. It helps them get a more holistic view of the market. Moving averages are often used to determine market entries as well as support and resistance levels. Just as it is with most technical analysis tools, moving averages should not be used on their own. Traders should use them in conjunction with other technical analysis tools.

Before you go, check this two tremendous courses to expand your understanding of the moving averages: Moving Averages 101 & Moving Average Signals.

They both are created by Steve Burns. You surely saw him on Twitter as he has about 400000 followers. These courses will teach you how to use moving averages to be more profitable with less stress.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!