John Bollinger created the technique of using a moving average with two trading bands below and above it. He introduced this technique in the 1980s and he trademarked this term in 2011. Bollinger was a long-time technician of the markets. Previously, it was known as trading bands, but with time, he evolved this concept and called it Bollinger Bands indicator. These bands simply add and subtract a standard deviation calculation unlike a percentage calculation from a normal moving average.

- The Bollinger Bands indicator is a volatility indicator.

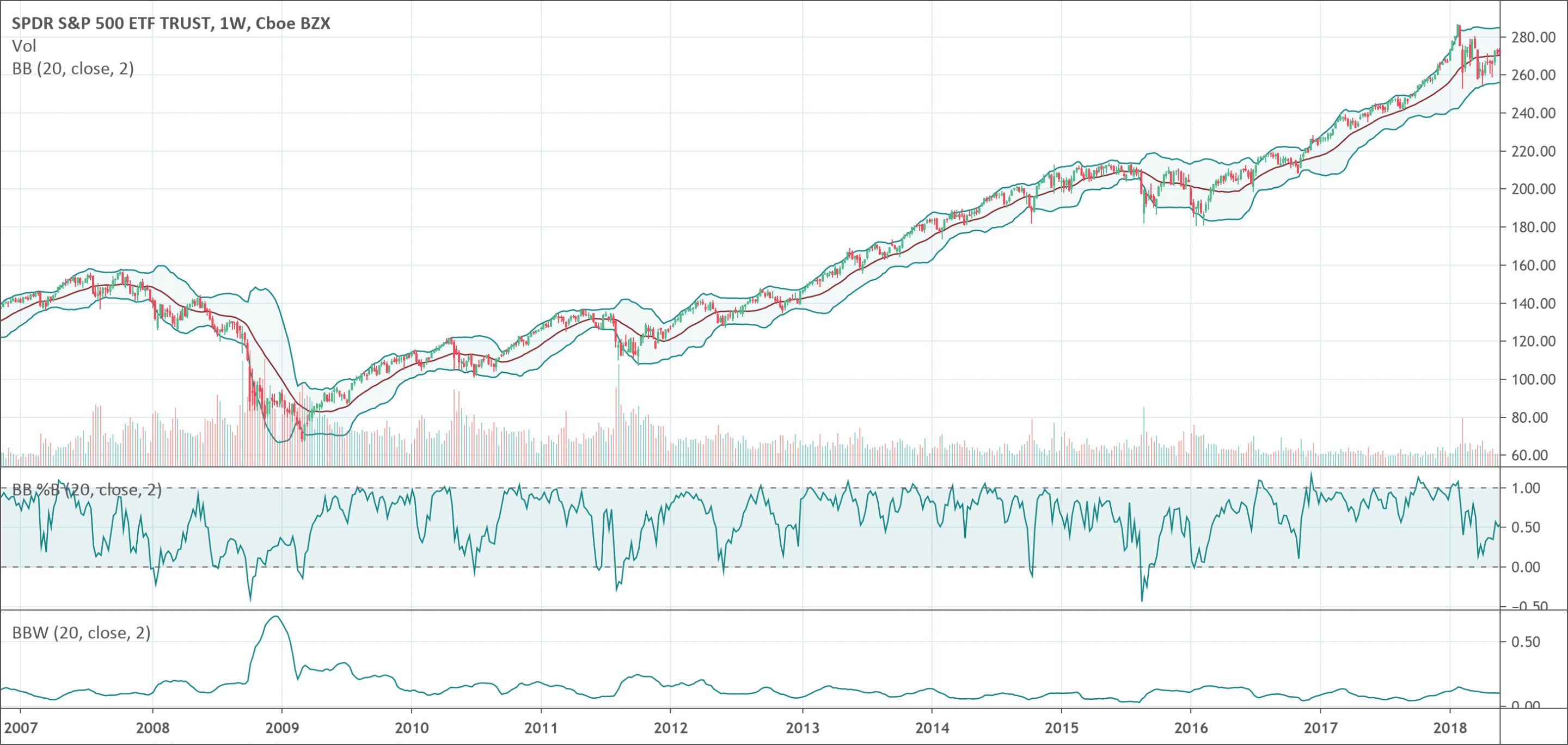

- It is composed of three lines:

- A simple moving average (in the middle) (typically 20-SMA)

- An upper band (typically 2 standard deviations)

- A lower band (typically 2 standard deviations)

Standard deviation is a mathematical formula that measures volatility. It indicates how the stock price can be different from its real value. By measuring price volatility, the bands adjust themselves to market situations. This is what makes them so significant to traders; they can find almost all the price data required between the two bands.

What is the Bollinger Bands indicator?

Bollinger Bands is one of the most used technical analysis tools, where three various lines are drawn, with one above and one below the security price line and a middle line that forms the envelop shows its specific period moving average. The lines indicate a volatility range in which a specific security price is moving up or down. Since standard deviation is a measure of volatility, the band is shown on the basis of standard deviation for a particular security, which is represented by lower or upper band.

Bollinger Band indicators show the levels of various lows and highs that the price of a security has reached in a specific duration and also its relative strength, where highs are close to the upper line and lows are close to lower line. That is to say that the price points close to the edges of the envelope formed. It can help traders determine a pattern at a specific period.

The bandwidth narrows and widens depending on volatility. If it is high, the band would widen and if the volatility lowers, then the band would become narrow. These bands indicate oversold and overbought situations in relation to a selected time period moving average.

These bands are similar to moving average envelopes, but drawing calculations for both varies. For Bollinger Bands, the levels of standard deviation draw the lower and upper lines. On the other hand, the lines for Moving Average Envelopes draw by taking a fixed percentage.

What does the BB indicator tell traders?

Bollinger Bands are very popular. A lot of traders believe that the closer the prices move to the upper band, the more overbought the market is, and the nearer the prices move to the lower band, the more oversold the market.

The Squeeze

The squeeze is the central concept of this indicator. When the bands come close together, constricting the moving average, it is known as a squeeze. A squeeze shows a time of low volatility and is seen by traders to be a good indication of possible trading opportunities and increased volatility.

On the other hand, the broader the bands move, the more likely a decrease in volatility and the higher the chance of leaving a trade. But these conditions are not trading signals. The bands give no indication when the change may take place or which direction price could go.

Breakouts

Approximately, 90 percent of price action happens between both bands. Any breakout below or above the bands is an important event, even though the breakout is not a trading signal. The mistake a lot of traders make is to trust that that price exceeding one of the bands is an indication to sell or buy. Breakouts offer no signal as to the direction and extent of future price movement.

A commodity may trade for a long period in a trend, even though it does this with some volatility from time to time. To better see the trend, traders apply the moving average to filter the price action. This way, they can get vital data about how the market is trading. For instance after a sharp increase or decline in a trend, the market may consolidate, trading in a narrow fashion and crisscrossing below or above the moving average. To better observe this behavior, traders make use the price channels, which make up the trading activity around the trend.

We are aware that on a daily basis, markets trade erratically even though they are still trading in an uptrend or downtrend. Processionals make use of moving averages with support and resistance lines to anticipate the price action of a stock.

The prices are said to be overbought when stock prices always touch the upper Bollinger band; on the other hand, they are considered oversold when they constantly touch the lower band, causing a buy signal.

How to use the Bollinger Bands?

- The probability of a sharp price move in either direction increases when the bands tighten during a time of low volatility. This could start a trending move. Always observe for false moves in opposite directions which may reverse before the appropriate trend starts.

- Volatility rises and any existing trend may close when the bands get separated by a large amount.

- Prices could bounce within the envelope of the bands, touching one band then moving to the other band. You can make use of these swings to help determine potential profit targets. For instance, if a price bounces off the lower band and then crosses above the moving average, the upper band then becomes the profit target.

- Price can go beyond a band envelope for long periods when there are strong trends. On divergence with a momentum oscillator, always carry out more research to know if taking additional profits is right for you.

- Traders can expect a strong trend continuation if the price moves out of the bands. But if prices move immediately back inside the band, then the suggested strength is negated.

Biggest mistakes to avoid with the indicator

The bands are not a standalone trading system. They are just an indicator to give traders information about price volatility. The creator suggests that traders should use them with other non-correlated indicators that have better direct market signals. It is vital to use indicators based on various data they provide.

Pros & Cons of the Bollinger Bands indicator

Pros

- Bollinger bands can be necessary indicators of a trend in a market – strong trends result to volatility, which can easily be seen as the Bollinger Bands narrow or widen.

- Bollinger Bands are one of the most popular of all the technical indicators. They are simple to apply and help with trends, volatility and momentum.

- The bands can also help with identifying new trends and the end of trends, making them a truly multiple purpose indicator.

- When automatically plotted by a trading platform, the bands are very user-friendly and can add another dimension to chart analysis for traders.

Cons

- The bands will not be able to predict price patterns as a lagging indicator, but rather, they follow recent market movements. This shows that traders may not get signals until the price movement is already underway.

- Have it in mind that the originator, John Bollinger has said that they should be used in conjunction with other forms of technical analysis and that they are not fool-proof or fail-safe indicators of market trends.

Conclusion

Even though every strategy has its shortcomings, Bollinger Bands have become one of the most significant and commonly used indicators in determining extreme short-term prices in a commodity. Buying when stock prices cross below the lower bands often helps traders take advantage of oversold conditions and profit when the stock price moves back up toward the center moving-average line.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!