- The Zig Zag indicator helps traders reduce market noise.

- It highlights underlying trends with its higher highs or lower lows.

- The indicator works best in strongly trending markets.

What is the Zig Zag indicator?

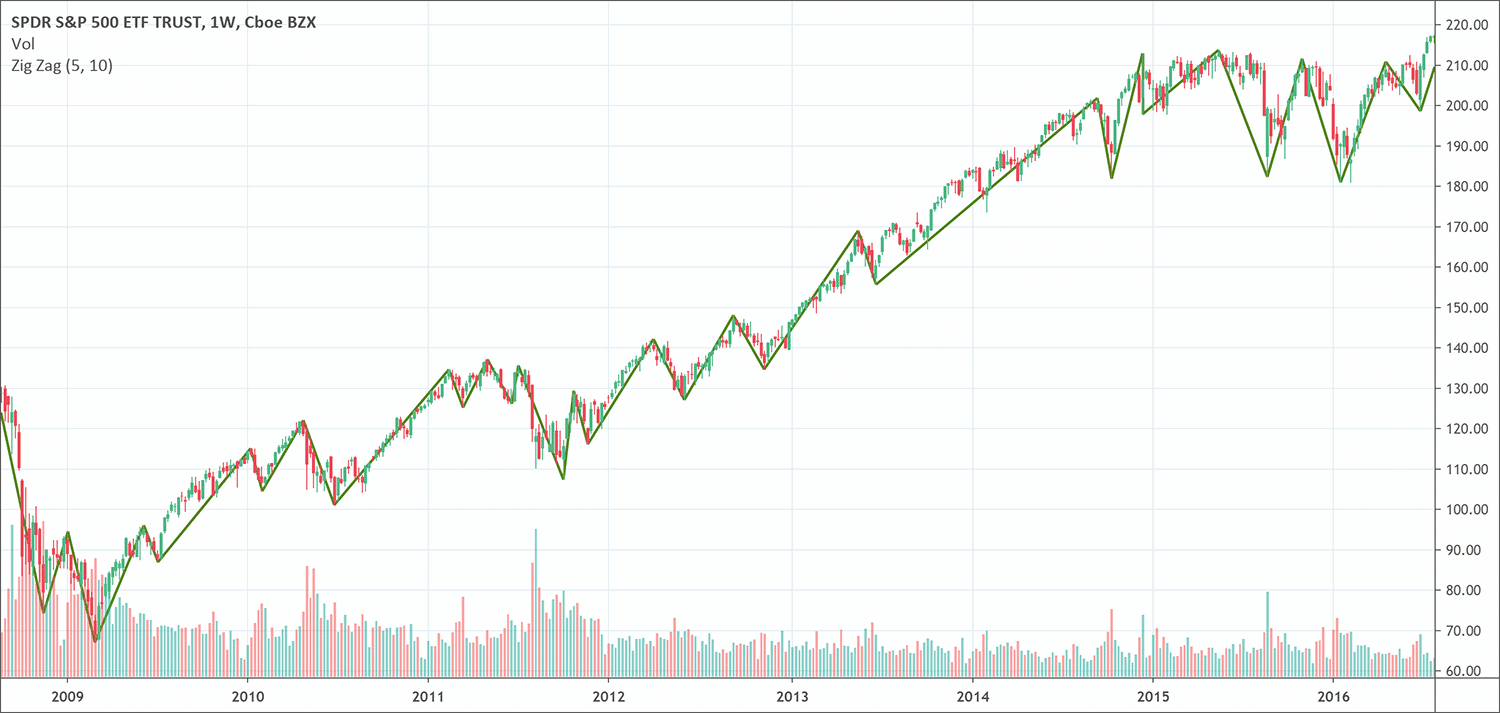

The Zig Zag indicator is a very well-known tool by traders. As its name suggests, it indicates swing highs and swing lows in prices. It helps traders to easily and efficiently identify those high and low points of the market.

It is a versatile indicator with a rather simple approach. As you know that market prices never move in a straight line because of continuous fluctuations. It works on the simple principle of ignoring all those small fluctuations and simply focuses on connecting higher and lower of the charts.

Moreover, it doesn’t provide predictions about future prices or price behaviors. It only highlights the major changes occurring in the past. Its way of functioning makes it possible for the traders to track important market movements without getting distracted by the trifling fluctuations.

Its working is based on three parameters, deviation, depth, and backstep. It is crucial to understand the working of these parameters to use the Zig Zag indicator. It is also one of the most popular indicators in the sense that the composition of almost all famous trading terminals can incorporate the zig zag indicator.

The history books are silent about the origin of the Zig Zag indicator or who invented this. However, it is crystal clear that it is one of the oldest indicators that was first used in the stock market. Later on, it became popular among the forex traders.

Parameters of the Zig Zag indicator

The use of the Zig Zag indicator is comparatively easy as compared to other indicators. Its functioning is based on three parameters that handle the calculations. It is interesting to note that despite having only three parameters, the Zig Zag indicator can be adjusted to fit different market conditions. These parameters make it easy to predict the functioning of the indicator. The reason is that these parameters determine the highs and lows the Zig Zag will consider. These three parameters are:

Deviation

Deviation is the parameter that assists the traders to set the minimum value of pips or points for the highs or lows to form. This value is expressed in percentage and it is set to 5% by default. That means 5% or above price movements are traced by the Zig Zag indicator and other small fluctuations are ignored.

Depth

Depth is the parameter that expresses the minimum number of bars on which there will be no construction of the second maximum or minimum deviation.

Backstep

Backstep is the parameter that shows the minimum number of bars between local highs or lows.

All these three parameters come together to make it easy for traders to plot the zig zag indicator. It is imperative to understand the working of these parameters. This understanding allows traders to understand how the Zig Zag indicator plots the values and traces the high and low points.

What does the indicator tell traders?

The Zig Zag indicator is a versatile indicator that serves many purposes. It tells traders about the trade direction and the highs and lows on the classic chart. Its functioning depends on its three parameters. The traders can experiment with those parameters to get the best results. It serves best when it is used in conjunction with other analysis techniques such as the Double Top, Support and Resistance, Elliott Wave, etc. The Zig Zag indicator helps the users of Elliott Wave Theory to determine the location of each wave in the trading cycle. It is also easy with the help of the Zig Zag to identify support and resistance zones lying in between the highs and lows. It also indicates the reversal patterns like head and shoulders top.

Technical analysts advise the traders to stay in a trade until the line of the zig zag indicator confirms in the opposite direction. For example, if the investors are looking to enter a long position, they should wait and avoid selling until the Zig Zag line confirms by turning downward. They also suggest using large timeframes to make the highest profits. Otherwise, the probability of losing trade will be quite high. This is all that makes the zig zag very versatile and only one of its kind.

How to use the Zig Zag indicator?

As we have discussed earlier that the use of the Zig Zag indicator is comparatively easy as compared to other indicators. Traders can use it in multiple possible ways. It can be employed as a confirmation tool or as a wave counter to assist traders in Elliot Wave. It is also being used to recognize Harmonic patterns. Being a technical analysis tool, it also makes the identification of classic chart patterns easy. It also assists traders to see a larger picture of trends or patterns and the trading direction of the market. As it does not provide automatically generated signals, the traders must manually draw the patterns to visualize the current trends. Technical analysts and experts have devised the following steps to calculate the zig zag indicator.

- Choose a starting swing high or swing low point

- Decide the price movement in percentage or points

- Identify the next high or low point that deviates away from the chosen starting point

- Trace the deviation by drawing a trendline joining the starting point to the new point

- Repeat step 3 and 4 to the most recent low and high points

It is important to understand that a trend line can only be drawn when there is a certain deviation between a swing low and swing high. This deviation can be in terms of percentage or points. Analysts advise using a larger retracement percentage of points. It will help to ignore price noise that is insignificant for the analysis of the traders.

Pros and Cons of the Zig Zag indicator?

The Zig Zag indicator is meant for analyzing price movements with a predefined value. Its trendlines connect the vortex and the main base on the price chart. It depicts the most important price reversals or other movements and ignores trifling fluctuations. Therefore, it is one of the most influential tools for the evaluation and analysis of the charts. It has numerous advantages for traders such as:

- It has the ability to bring forth the most important market trends and eliminates other price fluctuations

- This indicator can work at different timeframes

- It is even more influential when it works in conjunction with other technical analysis tools such as Elliot Wave

- It helps traders to see a broader picture of the price graph

- Being a versatile indicator, it has various uses for the serious traders

Like most of the other indicators, the Zig Zag indicator has also certain limitations. The biggest limitation is that it also depends on the past price history to give buy or sell signals. It is not reliable in this sense because it may not be predictive of future prices. Therefore, traders cannot use it for the purpose of forecasting future prices. Furthermore, it does not help to decide the timing of entry or exit because of the temporary nature of the trendline.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!