- Elliott Waves help traders better understand where price is within bigger trend.

- There are two types of waves: motive and corrective.

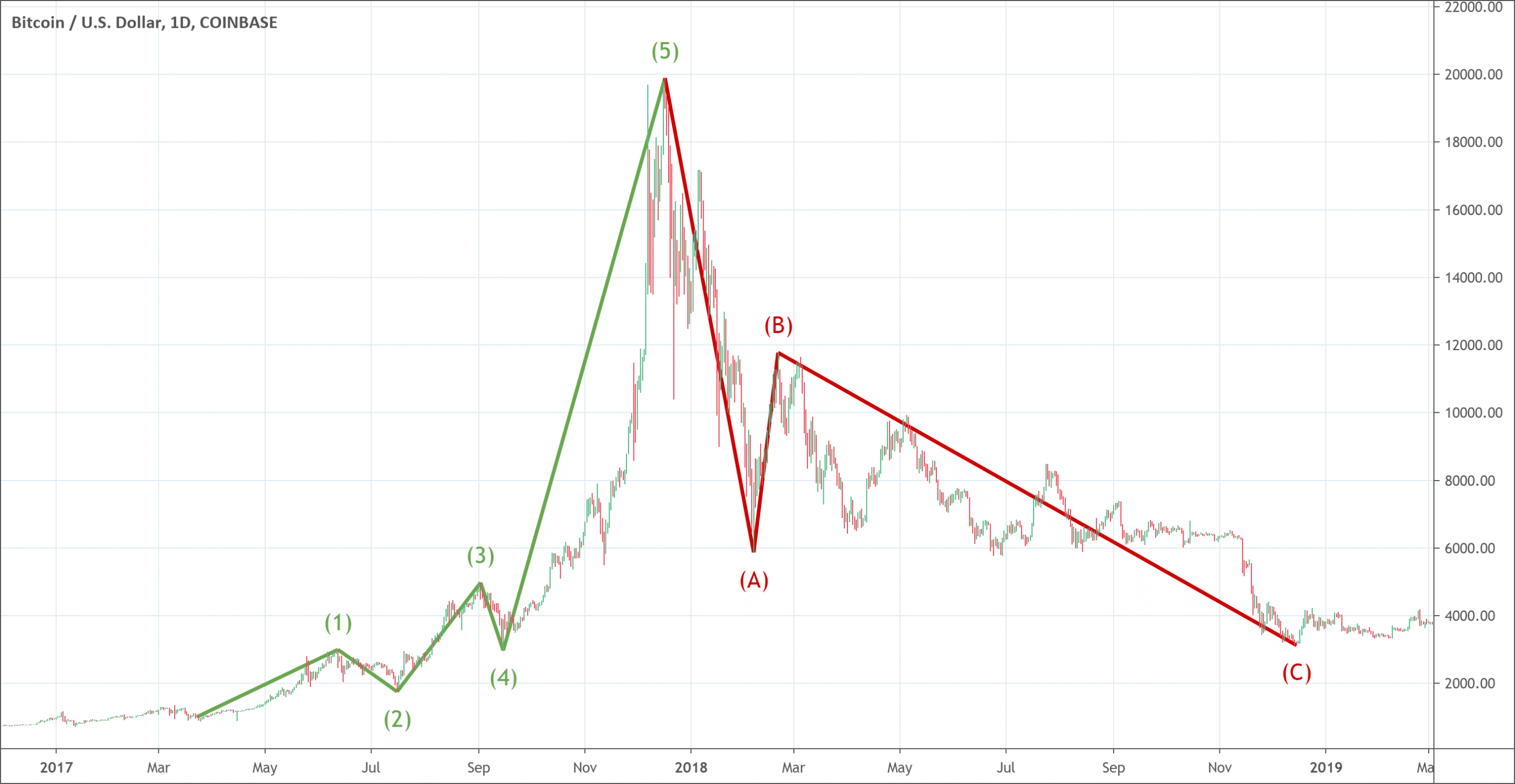

- Proper Elliott Waves follow strict counts (12345 for motive waves, ABC for corrective waves).

- The impulsive phases establish the trend and the corrective phases retrace those trends.

Forex trading is a great vocation because it gives traders a lot of freedom in their lives. This freedom factor is the main reason that forex trading has become more popular in recent years. Most of the traders nowadays are day-traders. Most of those day-traders trade by applying technical analysis tools. They consider technical analysis tools aa great instruments to trade forex better. That is the reason that traders always look for modern analysis tools that increase the odds of their success in forex trading. One such popular tool is the Elliott Waves Theory that has the potential to significantly improve your trading.

The word “theory” always brings into mind certain concerns about difficulties and sophistication. We always think that as this is a theory, it must be a very difficult phenomenon to understand without proper knowledge. We also think that its principles would be very complex. But this is not the case with the Elliott Wave Theory. It has some straightforward basics. It is a technical analysis tool that searches for the recurrent long-term patterns of prices related to repetitive changes occurring in the sentiment and psychology of the investors.

Looking for video courses? We shortlisted the best Elliott Wave courses on Udemy here.

The history of the Elliott Wave Theory

Before jumping on to the Elliott Wave Theory principles, it is apt to have a glimpse of the Elliott Wave history. The theory got its name from its inventor Ralph Nelson Elliott. Elliott was an American, accountant by profession, and an author by vocation. Dow Theory and a keen observation of nature inspired him for this theory. Both of these aspects combined to evolve the Elliott Wave Theory. Elliott concludes that observation and identification of repetitive patterns of waves can predict the movement of the stock prices.

Elliott was an expert analyst. He was adept at deeply analyzing markets, identifying unique traits of the wave patterns, and making detailed market predictions based on the wave patterns. A part of the Elliott Wave Theory is based on the Dow Theory that also predicts or defines price movements in the market through wave patterns. The other part of the Elliott Wave Theory is the most significant achievement of Elliott. He discovered and shed light on the fractal nature of the market action. He discovered the repetitive behavior of the stock markets suggesting that stock markets do not exhibit an unpredictable pattern. His predictions have been proved as these recurring market cycles are directly linked with the predominant psychology of the public at the time and the reaction of investors to those outside factors. He first published his findings in the book “The Wave Principle” in 1938.

The Elliott Wave Theory principle

Elliott Waves are based on human psychology

Trading involves a psychological element that is responsible for wave pattern rather than a straight line. This wave pattern is the biggest element of the Elliott Wave Theory principle. Elliott observed that typically there is a wave that moves with the trend and he named it impulsive wave. The impulsive wave is followed by a corrective wave that opposes the trend. He further observed that the impulse wave basically consists of five waves that combine to form one larger wave before a corrective phase offered by three waves. This combination of 5 waves to form one impulsive wave also highlights the fractal nature. That means that such patterns form on both timeframes, short-term and long-term.

For your convenience, we try to describe the Elliott Wave Theory principle in simple words. The price movement in the direction of the trend is revealed by 5 waves called motive waves. Three waves called corrective waves to bring correction against the trend. Motive waves are labeled as 1,2,3,4 and 5. The correction waves are marked as a, b, and c. Traders can observe these patterns in both, short-term and long-term. In short, the Elliott Wave principle revolves around the motive waves and corrective waves. Let us talk about the motive waves and corrective waves in detail.

Two types of waves alternate

- Motive waves function to push the prices to new highs. They are opposed by corrective waves that continuously interrupt and retrace previous gains. Wave 2 does not retrace all of wave 1. Similarly, wave 4 does not retrace all of the waves. Wave 3 is the longest wave (very often but not always) in the set of 3 ways 1,3, and 5 that tend to go beyond the end of wave 1. Motive waves always move in the direction of the trend channel. The trend channel consists of two parallel lines formed by a prevailing trend. Moreover, waves 1,3, and 5 are impulses. Waves 1 and 3 have waves 2,4 as smaller retraces.

- Corrective waves represent a very brief pullback. A saw-toothed price movement can easily be observed by looking at the price chart of any stock over a time period. That pattern is formed by upswings and downswings. These downswings are actually corrective waves that briefly interrupt the overall trend in the market. Corrective waves come in so many variations that it gets very difficult to recognize them. Moreover, they may also string together to form highly complicated corrections. Therefore, the recognition of the corrective waves is the most difficult challenge that the Elliott Wave Theory presents. In fact, it is the most challenging part to recognize those waves consistently right.

How does Elliott Waves Theory work?

Technical analysts and traders try to capitalize on the Elliott Wave principle. The principle suggests that the stock prices move up and down continuously in the same pattern called waves. These waves are formed by the psychology of the traders. The theory holds that because of those recurring patterns, it is easy to predict the movements of the stock prices. The wave observation allows investors to get an insight into prevailing trend dynamics and also helps to deeply observe and analyze price movements. However, it is important to note that it is subjective. It is interpreted in different ways by different sets of investors. Not all investors believe that the Elliott Wave Theory is a successful trading strategy.

How to use the Elliott Waves Theory?

Elliott Wave Theory analysis is absolutely crucial for forex trading success. The Theory helps to identify the current market trend and the rise and fall of the currency prices. It can be used to identify stop-losses and to predict the strength of potential movements in the market. However, technical analysts and experts suggest using the Elliott Wave analysis as a supportive measurement. It has the drawback that it does not provide any valuable information about points to enter or exit the trade.

The indicators such as the RSI and MACD known for defining the exit and entry points may work perfectly with the Elliott Wave Theory. Moreover, the Theory works more efficiently and effectively in the forex trading as compared to stock. The reason is stocks are very difficult to short while in forex trading, going short is easy. Therefore, the Elliott Wave Theory is more useful for forex trading where traders can gain profits by taking short positions.

The Fibonacci sequence and the Elliott Wave Theory

The Fibonacci sequence defines as the sequence of numbers 1,1,2,3,5,8,13,21 and so on. The ratio calculations of the two consecutive numbers in the series give approximately 1.618 or the inverse .618 after the first few numbers. This ratio is known as the Golden Ratio and it is used even by nature. How nature uses it is a matter of lengthy debate that is difficult to describe here. Our concern here is to illustrate the relationship between the Fibonacci sequence and the Elliott Wave Theory.

The stock market also exhibits the same phenomenon as does nature. The stock market’s every activity shows that a bull market is subdivided into five waves and the bear market is subdivided into three waves. It gives us the 5-3 relationship that is the mathematical base of the Elliott Wave Theory principle. Traders can use the Elliott Wave Theory principle of the progression of the trading market to generate a complete Fibonacci sequence.

Let us take an example of the simplest expression of the concept of a bear swing, we get one declining straight line. Conversely, we get an ascending straight line for a bullish swing. In the next step, we get corresponding numbers of 3, 5, and 8. This sequence can continue to infinity. These sequences significantly enhance the usability of the Elliott Wave Theory.

Conclusion

The Elliott Wave Theory is one of the most effective technical analysis tools. It is among the most accepted and widely used analysis tools as well. It sheds light on the natural rhythm of the psychology of the masses in the trading market that manifests itself in the form of waves.

The essence of the Elliott Wave Theory principle lies in the fact that the prices tend to alternate between impulsive and corrective phases. The impulsive phases establish the trend and the corrective phases retrace those trends. In the simplest terms, the impulses consist of five lower degree waves while three lower degree waves form the corrections. This combination of five impulsive waves and three corrective waves define a complete cycle.

The underlying patterns remain constant and traders can observe it in the short-term as well as long-term. That is the reason that Elliott Wave is fractal. Smart drawing tools can be used to visualize and identify different degrees of Elliott Waves on the chart. The degree of success heavily depends on correctly counting the Elliott Waves for which there are certain rules and guidelines that can be followed.

Additional resources to expand your learning on Elliott Wave Analysis

Want to continue learning about Elliott Waves?

You might be interested in checking our shortlist of the best Elliott Waves video courses on Udemy:

- Technical Analysis Elliott Wave Theory for Financial Trading: it’ll teach you how to identify important turning points in the financial markets using advanced technical analysis

- Predict the Market with Harmonic Elliott Wave Analysis: it’ll teach you how to distinguish trending market making new highs or lows from sideways or corrective market moving in countertrend direction.

- Trading Harmonic Elliott Waves like a PRO: it’ll teach you how to create reliable micro setups to enter trades, set multiple targets and set and adjust protective stop loss orders in the harmonic waves.

- Elliott Wave – Forex Trading With The Elliott Wave Theory: it’ll give you extended information on how to integrate the Elliott Wave Theory in your trading strategy.

- Elliott Wave for Beginners: it’ll help you understand how to label price wave patterns with confidence.

- Elliot Wave Principle – Key to the Market Behaviour: it’ll help you develop your knowledge base of the different rules and guidelines for carrying out Elliot Wave analysis.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!