- Trendlines connect two price points at least and may extend further forward to indicate support and resistance areas.

- It helps traders understand the trend and possible reversals.

Trendlines are an indicator that helps to identify and confirm trends. It is a simple but efficient tool to measure an increase in share price over a period of time. Trend lines indicate acceleration or deceleration of a trend in the market. It is different from the rest of the indicators that traders have to use their own mind instead of relying on formula calculations done on a computer. The trendline gives a clear picture of a current trend through a single line on a chart that is the greatest advantage of using trendline.

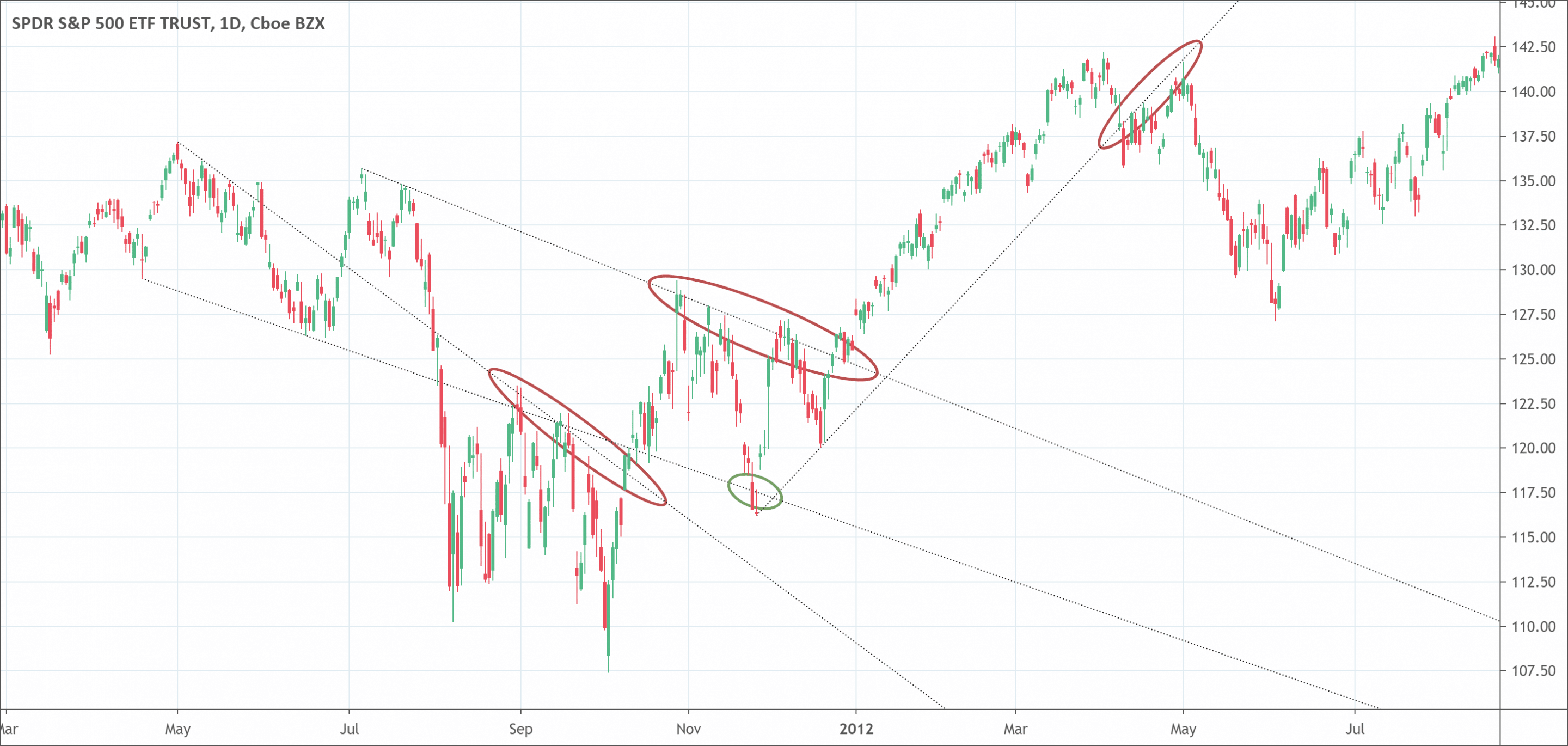

The working of the trendline is simple. It connects two price points at least and may extend further forward to indicate support and resistance areas. A positive slope of the trendline shows support price action that means an increase in net demand. We have a bullish trend until the price action stays above the trendline. On the other hand, a negative slope of the lines indicates resistance to the price action that means an increase in net supply. The bearish trend remains in the market until the price action remains below the trendline.

The price continues to retest a sloped line several times to break it. We may have a reversal in trend after the price is successful to break the line. It is interesting to note that a trendline gets stronger when there are more points to connect. Now, the trendline strategies can vary because they depend on the distance between the connected price points and also on the decision whether we use wicks or candle bodies to connect. However, all trendlines are destined to break.

What does trendlines tell traders?

A trendline is a magnificent tool that has the potential to clearly indicate a trend as well as sideways movement. A trendline works by connecting the lowest point of a downtrend to the highest point of an uptrend. The connection of low points with highs results in an ascending line on a chart indicating an upwards trend of prices. The trendline can also indicate the angle of ascent, the strength of the prevailing trend, and the strength of the price movement when a trendline is drawn to connect the individual high points.

Furthermore, when the price decreases, the high points also fall. Decreasing prices result in a descending line indicating a fall in prices. The descending angle and the strength of the downward price movement are indicated by drawing a line along with the swing lows.

Generally, a single line remains in action but there is also a choice to draw multiple trendlines indicating price movements over several periods of time. This option of drawing trendlines whenever possible suits new traders. It allows them to keep themselves updated about the overall trend in the market, any corrections in that overall trend, and the small trends.

What are the possible trendline trading strategies?

Correctly drawing trendlines is crucial

Before discussing the possible trendline strategies, it is crucial to know about correctly drawing a trendline. Drawing a trendline is not so complicated but it is a tricky task. Drawing the wrong trendline causes so many problems for your trendline strategy. First of all, it is crucial to choose the most important trendlines. You need to focus only on major swing points and ignore all other trifling movements. Now, by connecting at least two major swing points you are good to go. However, you need to adjust with the passage of time to get the most number of touches.

As we have discussed earlier that trendline is the best tool that indicates the overall direction of the current trend. It is also very easy to identify the area of support and resistance with the help of the trendline. This means that the trendline can be used to locate potential buying or selling points to maximize profits. However, it is important to note that buying or selling opportunities can only be capitalized on until the market continues to respect the trendline as support or resistance.

Markets play with trendlines

Now, let us consider the scenario what happens when the market does not respect the trendline, then what should be the trendline trading strategy? In fact, this is the point when traders have a chance to trade the market as the market takes a turn from swing low or swing high.

For example, if the market breaks trendline support then it retests the same trendline as new resistance. This retest gives traders a very good opportunity to sell. Furthermore, the trendline work even better when traders base their trendline strategy on a trendline with three or more touches. As a general rule, the more obvious and clear trendline yields better results.

Conversely, when the market breaks trendline resistance, it comes back to retest the trendline as new support. It indicates to the traders that it is a buying opportunity. These are the most obvious trendline trading strategies after spotting potential market reversals. These strategies definitely work and allow traders to catch big moves using trendline strategy whenever the market changes direction.

Conclusion

The trendline has become a very popular trading tool among traders. It helps to identify, confirm, and analyze a trend. Drawing a trendline is not a complex task. When drawing a trendline, the focus should be on all the major swing highs or swings lows and traders should adjust it to get as many touches as possible.

The more obvious and clear trendline helps to devise a better trendline trading strategy. The slope of the trendline indicates the current trend while the trendline break out shows potential entry or exit points.

However, traders should not make haste by trading on an unconfirmed trendline. It is also necessary not to move a trendline after entering a trade. Moreover, too much steepness of the curve may also temporarily that may cause problems. Therefore, we can conclude that the trendline gives a fantastic insight but its improper use may also generate false signals.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!