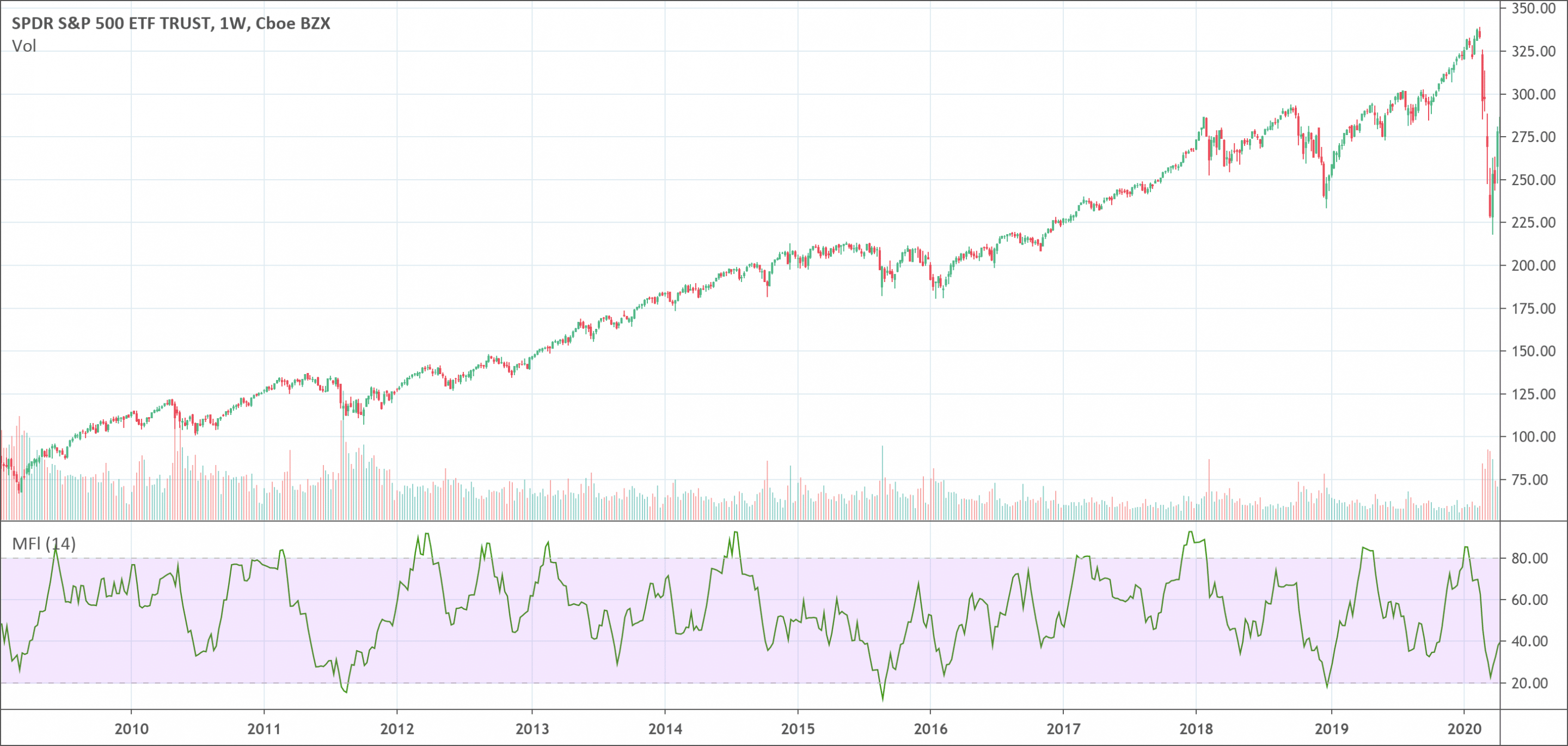

- The Money Flow Index (MFI) indicator is a momentum indicator.

- When MFI is above 80, the market is considered overbought.

- When MFI is below 20, the market is considered oversold.

- The indicator value can be used on its own, but it also can be used when it draws in divergence with the price.

What is the Money Flow Index?

Money Flow Index (MFI) is a momentum indicator that calculates the flow of money inside and outside of a security over a given time period. It is similar to the Relative Strength Index (RSI) but while MFI includes volume, RSI on the other hand only considers price. You can calculate the MFI by collecting positive and negative Money Flow values, after which it creates a money ratio. The money ratio normalizes into the MFI oscillator form.

How does the MFI indicator works?

The indicator value gives overbought and oversold signals

Oversold mark usually appears beneath 20 and overbought levels usually appear above 80. The levels vary based on market conditions. MFI is a technical oscillator that uses both price and volume for showing overbought or oversold signals in stocks and assets generally. It is used for revealing divergences which notify traders of a trend change in price.

Usually, both the oversold and overbought levels are not solid determinants as to either buy or sell. It is best for traders to go for additional technical analysis to ascertain the security turning point. Note that during strong trends, the MFI may stay as overbought or oversold for additional periods.

It can also create divergences with price

The divergence can result to a price reversal if the underlying price produces a new high or low that fails to be verified by the MFI. The marks of 90 and 10 are used as thresholds in MFI. Traders can also use other positions out of overbought or oversold region.

For instance, a pullback is over and the price uptrend is continuing if an asset is in an uptrend, drops below 20, and then moves back upwards. This is the case with downtrend as well. A short term rally is able to move MFI to around 70 or 80, but when it drops back beneath, that could be the time to go in for a short trade in readiness for another drop.

A major way to use Money Flow Index is if a divergence occurs. A divergence is when the oscillator is moving in the opposite direction of price. This is an indication of a likely reversal in the current price trend. For instance, a very high Money Flow Index which starts to move below the mark of 80 while the underlying security continues to go up is a price reversal indication to the down side. On the other hand, a really low MFI marking that goes above the marking of 20 while the underlying security continues to sell off is price reversal indication to the upside.

Traders also look out for much bigger divergences with the help of multiple waves in the price and MFI. For instance, a stock rises at $60, drops back to $55, and then rises again to $65. The price has made two successive highs, at $60 and $65. If the MFI makes a higher when the price attains $65, the indicator is not verifying the new high. This could portend a decline in price.

The formula for the Money Flow Index

Money Flow Index = 100 – 1001+Money Flow Ratio

Where:

- Money Flow Ratio = Positive Money FlowNegative Money Flow

- Money Flow = Typical Price * Volume

- Typical Price = High+Low+Close3

Calculations for MFI

The Money Flow Index involves a series of calculations.

- Firstly, calculate the Period’s Typical Price

Typical Price = (High + Low + Close) / 3

- Next, calculate the Money Flow by multiplying Period Typical Price by Volume

Money Flow = Typical Price * Volume

- If today’s Typical Price is larger than yesterday’s Typical Price, it is considered Positive Money Flow. If today’s price is lesser, then it is regarded as Negative Money Flow.

- Positive Money Flow is the sum of the Positive Money over the period of the last 14 days. Negative Money Flow is the sum of the Negative Money over the period of the last 14 days.

- The Money Ratio than calculates by dividing the Positive Money Flow by the Negative Money Flow

Money Ratio = Positive Money FlowNegative Money Flow

- Lastly, calculate the Money Flow Index by using the Money Ratio.

Benefits of using the Money Flow Index

One of the main advantages MFI has to offer traders its high sensitivity to price. Traders can easily benefit from it if an indicator is highly sensitive to price action so it could get signals with ease when the markets sends them out and then forwards them to traders rapidly.

Another major advantage of this indicator is its capability to easily foresee when a climax in price action occurs. Again, this is possible as a result of its high sensitivity to price. Immediately it spots this change, it alerts the traders and the traders can take part in the new trend by switching to the other wary from the initial trend.

Limitations of the Money Flow Index

It is very possible for the MFI to produce erroneous signals. This happens when the indicator carries out something that shows a good trading opportunity is available. And then it happens that the price doesn’t move as it should, which causes the trade to be lost. A divergence may not result in a price reversal, for example.

The indicator may as well fail to warn against something crucial. For instance, while a divergence may lead to price reversing some of the time, divergence won’t be available for every price reversals. As a result of this, it is advisable for traders to use other various forms of technical analysis tools and not depend solely on a single indicator.

The difference between the Money Flow Index (MFI) and the Relative Strength Index (RSI)

The MFI and RSI are very similar in nature. Money Flow Index Indicator is sometimes referred to as a volume-weighted version of RSI and can be interpreted similarly as RSI. The major difference between them is that while MFI includes volume, the RSI does not. Advocators of volume analysis believe it is a leading indicator. Traders also believe that MFI will give indications and notify traders of any likely reversals, in a timely manner, as opposed to the RSI.

Indicators are not necessarily better than one another they are basically just including diverse elements and as such provide signals at different time intervals.

Conclusion

It is advisable to note the divergence between the indicator and price. For instance, the price could start rising if the indicator is moving upwards while the price is moving downwards or flat.

The overbought and oversold marks are used to indicate likely trading opportunities. Positions below 10 and above 90 are scarce. Traders often look out for the MFI to go back beyond 10 to indicate a long trade and to move beneath 90 to indicate a short trade.

The Money Flow Index is a unique indicator that combines momentum and volume with an RSI formula. RSI momentum basically favors the bulls when the indicator is higher than 50 and the bears when beneath 50. Although MFI is regarded as a volume weighted RSI, using the centerline to know a bullish or bearish bias also does not work well.

Instead, MFI is best suited to identify possible reversals with overbought or oversold levels, bullish or bearish divergences and bullish or bearish failure swings. Just like every other indicators, traders should not use the MFI alone.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!