- The Volume Price Trend is a volume momentum indicator.

- It makes use of both percentage changes in price and volume.

- It uses them to confirm the strength of the trend in price.

The volume price indicator adds or subtracts multiples of a percentage change in recent stock volume. It also shares price following their upward or downward movement. In this article, we’ll go into details about the Volume Price Trend indicator.

It is a technical momentum indicator used by traders to detect the parity between the supply/demand of a stock. The percentage of change in the share price of a trend shows the relative supply or demand of a stock. Also, the volume shows the strength of the buying or selling momentum.

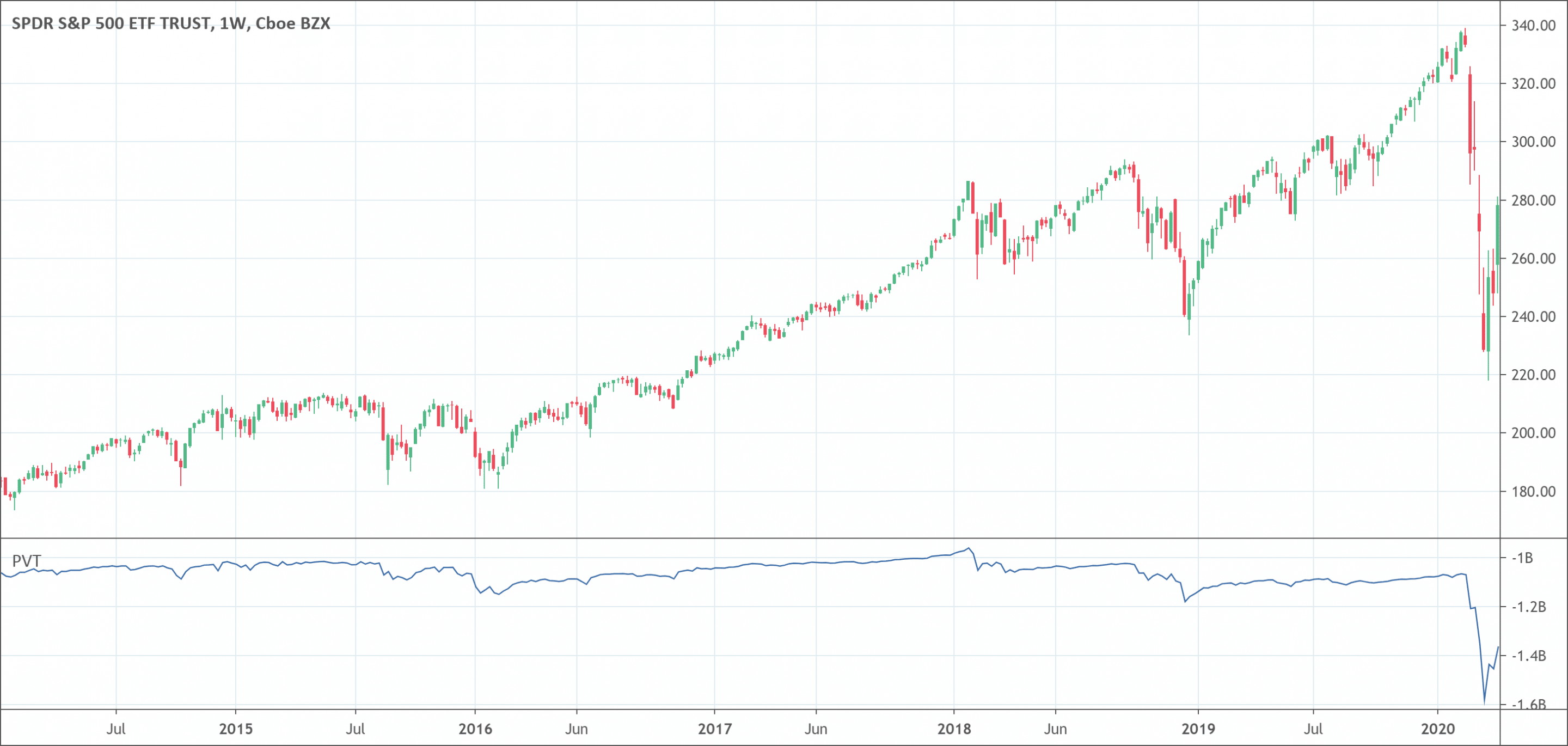

The VPT indicator makes use of both percentage changes in price and volume. It uses them to confirm the strength of the trend in price. VPT also uses them to show momentum divergence as a warning sign of a potential market reversal.

It is different from other price-volume indicators because it uses the percentage of price change as a factor of formulation. Rather than adding or subtracting volume based on the state of the current stock price compared to the price the initial day.

What is the Volume Price Trend indicator (VPT)?

VPT is an interesting volume indicator

Experts define the volume price trend (VPT) as a price-volume trend at times. It joins price and volume in the market to make a hybrid trading indicator of the two variables.

The basic idea behind the indicator is to multiply the volume of the market by the percentage change. It does this in the price over a particular interval. If the price goes down, the value of the indicator also goes lower because of the negative value. If the price rises, the value of the indicator goes higher.

This indicator is conceptually similar to On Balance Volume (OBV). With on-balance volume, the indicator rises or declines according to whether the price made a new high or low. It doesn’t include the extent of the move into its calculation. With VPT, the indicator moves according to the size of a shift in price.

Some general rules traders should know about the VPT

The general rule of the VPT is that the indicator has to move in the same direction as price. It should also match the magnitude of the move to a great extent. Traders assume that this puts a market at risk for a trend reversal. When low price moves follows low volume, this indicator forms.

The price-volume indicator is mostly used to measure money flow. The amount of volume added or subtracted to/from the PVT total depends on some factors. One of which is the amount of the price rising or falling. The price is of the present day compared to the close of the previous day.

The volume price trend indicator helps determine the price direction and strength of a security. A cumulative volume line that adds or subtracts a multiple of the percentage change makes up the indicator . It adds this in the price trend and current volume of a share. This depends on the upward or downward movements of a security.

Calculation of the VPT formula

You can calculate the formula in the following way:

Multiply the volume the percentage price rise on an up day. This calculation is between the recent close and the close of the previous time. Add the value to the price volume trend value of the previous day.

Multiply the volume by the percentage price decline on a down day. This should be between the recent close and the close time of the previous day. The value is then added to the PVT value of the previous day.

Measure the VPT as volume multiplied by change in price, and calculated as a running total from the previous period.

VPT = Previous VPT + Volume x (Today’s Close – Previous Close) / Previous Close

Traditionally, traders can calculate it daily. Although trades can measure it over any timeframe with which volume data is available. Remember that some charting software platforms do not offer volume data on a timeframe less than the daily level. Thus, this can also restrict the ability of a trader to trade using the indicator over various time intervals.

Interpretation of Volume Price Trend indicator

The volume price trend indicator can seen as follows:

- Increasing price followed by an increasing volume price trend value, confirms the price an upward trend.

- Decreasing price followed by a decreasing volume price trend value, confirms the price a downward trend.

- Increasing price followed by a decreasing or neutral price volume trend value is a divergence. It may mean that the price movement upward is weak and lacks conviction.

- Decreasing price followed by an increasing or neutral price volume trend value is a divergence. It may mean that the price movement downward is weak and lacks conviction.

What to look for with the Volume Price Trend indicator?

Trend Identification

Price volume trend (PVT), just as an On-Balance Volume (OBV), is vital for detecting or confirming general market trends. This can be beneficial for confirming setups created by signals depending on being able to detect to be effective.

Additionally, based on the theory that brings in positive or negative price, adjusted volume flow precedes changes in price. PVT can identify potential trend reversals. A lot of technical analysts believe that PVT is a more accurate representation of market conditions. This is because the volume is price adjusted. Regularly, PVT closely mirrors market price movements.

Signal line crossovers

Traders can use a signal line, which is a moving average of the indicator to create trading signals. For instance, a trader may purchase a stock when the VPT line crossover the signal line. That trader can sell when the VPT line goes below the signal line.

Confirmations

You can use the VPT indicator together with moving averages and the average directional index (ADX) to confirm trending markets. For example, a trader might purchase a stock if the 20-day moving average is more than the 50-day moving average.

The rising VPT should accompany the indicator values. On the other hand, the trader could decide to sell. Only if the 20-day moving average is below the 50-day moving average and the values of the indicator are falling.

The average directional index also measures momentum and trend. You can use it with the volume price trend indicator to confirm that a market is trending. Readings of ADX greater than 25 shows that a security is trending. And readings lower than 25 shows sideways price action.

A trader may purchase when the ADX is higher than 25 and the VPT line higher than the signal line. They might sell when the ADX is lower than 25 and the VPT lower than its signal line.

Divergence with the Volume Price Trend indicator

Divergence happens when price movement is not confirmed by the indicator. In most cases, these divergences can show a potential reversal. Particularly since the premise behind the PVT indicator which is negative and positive comes after changes in price.

Summary

The price volume trend indicator is a great analysis tool that traders use to measure buying and selling pressure. A lot of people think that buying and selling pressure precedes changes in price, making this indicator significant. A possible reversal in the current trend should always show divergences.

Remember that this indicator is similar to the On-Balance Volume (OBV) indicator. But it is mostly seen as being more closely tied to current price movements. Since it accumulates price adjusted volume rather than total volume. Just as it is with a lot of indicators, it is advisable for traders to use PVT with additional technical analysis tools.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!