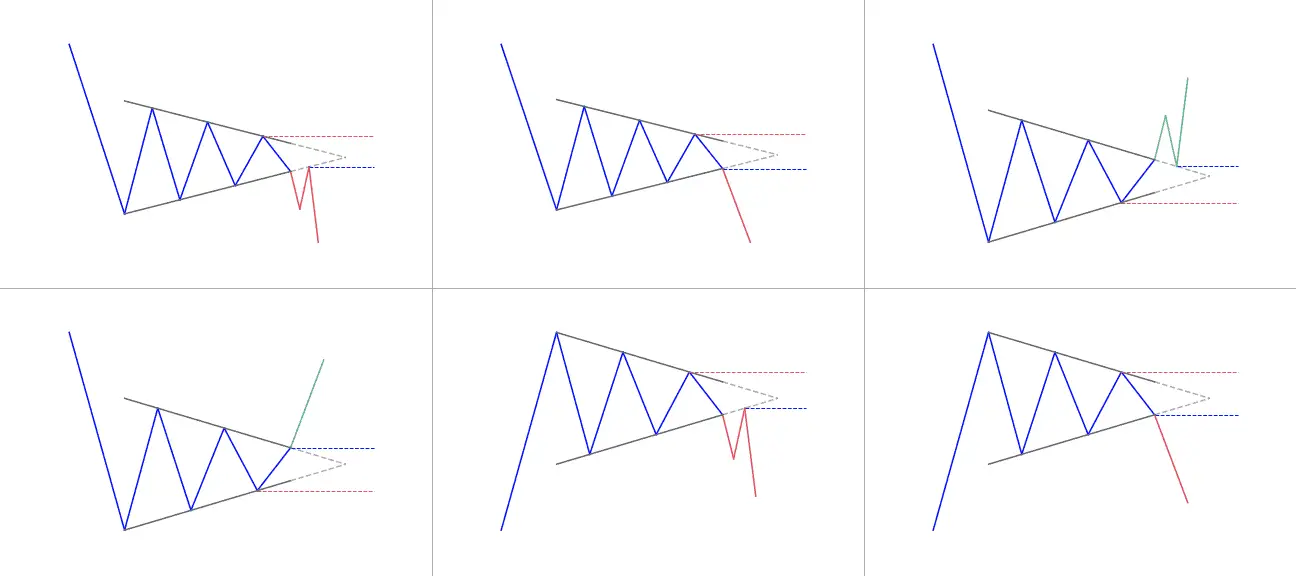

- A symmetrical triangles forms when the price of a security consolidates between two trend lines with similar slopes

- It can break in both directions, up or down

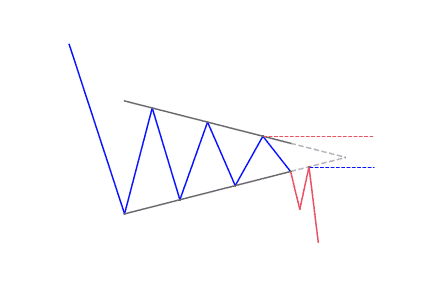

- The symmetrical triangle helps frame your entry, stop and target

What is the Symmetrical Triangle pattern?

Also known as a coil, the symmetrical triangle pattern forms as a continuation classical chart pattern when there is a trend. The pattern is made up of at least two lower highs and two higher lows. As the points connect, the lines come together as they are extended and the symmetrical triangle takes shape.

They trend lines have to meet at an approximately equal slope. Those that are meeting at slopes that are not equal are referred to as a falling wedge, rising wedge, ascending triangle or descending triangle. It can also be seen as a contracting wedge – wide at the start and narrow over time.

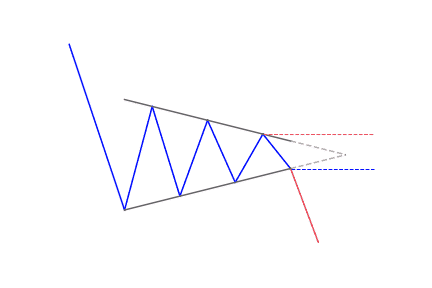

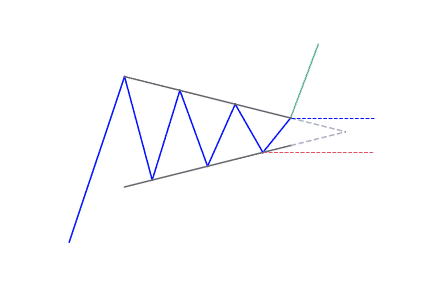

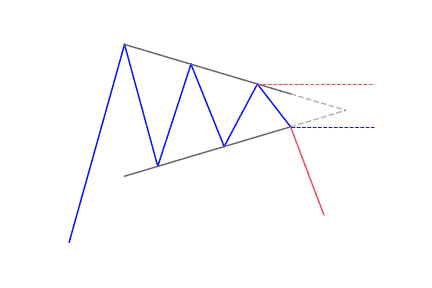

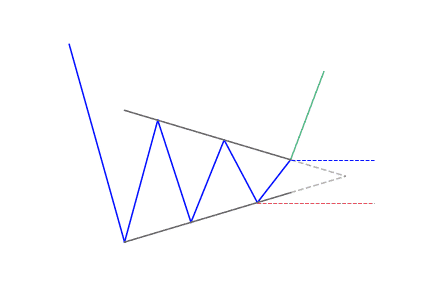

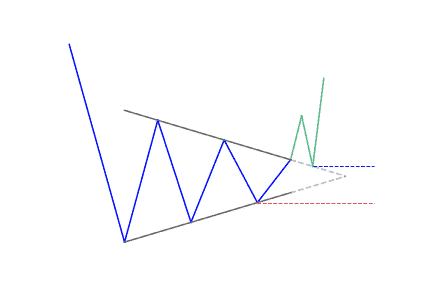

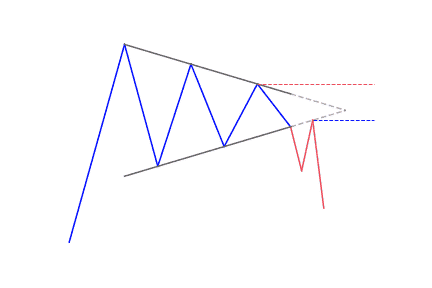

A symmetrical triangle chart pattern is a representation of a period of consolidation. It appears before the price is forced to breakdown or breakout. A breakdown from the lower trend line indicates the beginning of a new bearish trend. On the other hand, a breakout from the upper trend line shows the beginning of a new bullish trend.

As the name suggests, traders can trade a symmetrical triangle both ways. The price action needs to move in a series of lower highs and higher lows in order to be able to define a triangle. In terms of its characteristics, you need only look for two things:

- An ascending bottom trend line that goes in the upwards direction.

- A descending top trend line that goes in the downward direction.

How to identify a Symmetrical Triangle classical pattern?

They can be grouped as places of indecision. A market stops for a while and future direction is doubted. The forces of supply and demand at that moment are typically considered almost equal.

- The triangle has symmetrical or equal sides

- The triangle has lower highs AND higher lows – at least two of each

- It looks like a funnel, with the price “squeezing” from the left towards the right

What does the Symmetrical Triangle tell traders?

It is the most popular triangle chart pattern. Price creates a symmetrical triangle when each swing high or swing low is less than the previous. This coiling price movement makes a structure of a symmetrical triangle. As a symmetrical triangle forms, trading activity decreases along the way until it reaches the apex of the triangle.

Many experts believe that if a stock is rallying before the formation of a symmetrical triangle, the stock will eventually breakout to the upside. On the other hand, if a stock falls before a symmetrical triangle forms, it should continue its decline. Both of assumptions are not right. These triangles offer little or no indication regarding the direction the stock will eventually breakout. Have in mind that there is a lack of volume and price movement which gives rise to a coiling pattern. As a result of this, it is impossible to assess the direction a symmetrical triangle will inevitably breakout.

How to trade when you see a Symmetrical Triangle?

Identifying the real breakout

A great trading tool for identifying breakouts is a volume indicator. Real breakouts usually occur during high trading volumes and high volatility. The fake breakouts come up during low volumes and they look more like a range rather than a breakout. Since the levels of any triangle are inclined, a ranging move sometimes brings the price outside the frames of triangles. This way, traders get tempted that there is a breakout on the chart.

Setting a realistic target for your Symmetrical Triangle trade

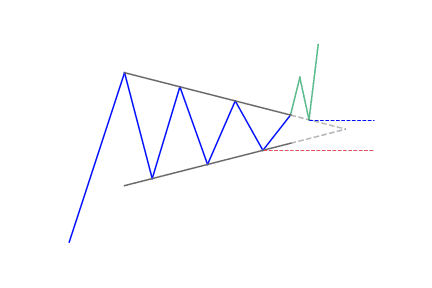

Each chart pattern you trade should inform you about your target for the trade. This is because chart patterns have targets, which is well-known to the more experienced traders. Have it in mind that when you trade chart patterns, your minimum target equals the size of the pattern itself. You should always have this rule at the back of your mind when you trade chart formations.

To measure the scale of a symmetrical triangle, you would like to first extend the shorter side to match the length of the opposite side. The scale of the third side of the triangle (which is missing) is the scale of the movement in price you should go after.

Protecting your trade with a wise stop loss

Before placing any trade, always know the amount you are willing to risk. If you need to risk more than you intended, simply avoid taking the trade and move forward to a much better one.

When trading symmetrical triangles, the right location of a stop loss is below the opposite side of the breakout. But this level is inclined, so, the more you move to stop the left, the larger the distance is between the stop and the entry price.

So, to stop a trade, apply some simple price action rules. Observe the price action in the symmetrical triangle. If you notice a bullish breakout, place the stop below the lower level of the triangle, under a larger price bottom. But if it is a bearish breakout, put the stop loss over the upper level of the triangle.

Difference of the Symmetrical Triangle with other triangles

Symmetrical triangles are different from ascending triangles and descending triangles in that the lower and upper trend lines are both sloping towards a central point. In contrast, ascending triangles have a horizontal upper trend line, predicting a potential breakout higher, and descending triangles have a horizontal lower trend line, predicting a potential breakdown lower. Symmetrical triangles are also similar to pennants and flags in some ways, but pennants have upward sloping trend lines rather than converging trend lines.

Just as it is with other forms of technical analysis, symmetrical triangle patterns work best together with other chart patterns and technical indicators. Traders often look for a high volume move as confirmation of a breakout. They may use other technical indicators to determine how long the breakout might last. For instance, you can use the relative strength index (RSI) to know when a security has become overbought after a breakout.

The Symmetrical Triangle trading strategy is one of the most efficient ways of trading consolidations because the triangle pattern generally occurs during ranging periods.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!