- Trading volume or volume of trade is a measure of completed trades in a particular security in a given period of time.

- It is a measure of two very important factors: market activity and liquidity.

- The higher the trading volume during a price move, the more significant the move (and the opposite).

Trading volume or volume of trade is a measure of completed trades in a particular security in a given period of time. In simple words, the trading volume shows the number of transactions of shares between a given time period. Volume analysis is very important in technical analysis because it is a measure of the strength of a market indicator. The volume of trade also indicates a high level of interest in security at its current price. There are several charting tools based on trading volumes such as On Balance Volume and Klinger Indicator.

What does the trading volume tell traders?

The volume of trade is a measure of two very important factors involved in trading, market activity, and liquidity. The volume of trade is a valuable tool for traders because they rely heavily on it to know the liquidity level of a security or an asset. Volume also helps traders to easily communicate and do transactions because of the highly active market. It is interesting to note that such a simple technical analysis tool becomes highly significant in situations of large price jumps or drops. The high volume becomes a catalyst during drastic price increases. It happens because the faith in that particular security also increases whenever a high volume of trade backs such level of changes.

How to understand the trading volume?

Understanding volume is absolutely imperative for the traders because it tells traders about multiple things. The volume of trade continues to increase with every transaction taking place between buyers and sellers. It is not that difficult to grasp because it is a simple concept. For example, suppose a market that comprises two traders. The first trader A buys 50 shares of a security and the second trader buys 100 shares, then the trading volume will be 150. Similarly, if the second trader also sells 200 shares of another security, the volume will now be 350.

All the exchange markets across the globe keep a track of its trading volume. They provide volume data for free or may charge a subscription fee for their services. Trading volumes are reported hourly and also at the end of the day. However, it is also crucial to understand that all this trading volume data is an estimate. The data reported on the following day is actual data.

Understanding buying volume

A trade is a two-way process in which one sells and the other buys. Similarly, trading activities are higher when trading volume is high. That means, the higher trading volume suggests an easy buying and selling small or large quantities of securities because there are several other traders in the market as well who will complete the second end of a transaction.

Buying and selling is a very easy phenomenon involved in trading because it is simply that there must be a buyer and a seller to complete a trading transaction. However, the complications arrive when we come across phrases like seller’s control of the market, heavy buying volume period, etc. Therefore, it is important to understand that higher stock prices bring the buyer’s control of the market. Sellers seek to part with their shares at the lowest advertised price. It is obvious that when traders push for buying at the current asking price, they desire the securities and also include in the buying volume metrics.

Understanding selling volume

Buyers have more control when the prices are pushed higher. On the contrary, sellers have more control when the prices are pushed low. The bid price is the point at which the selling volume occurs while the bid is the highest advertised price offered by buyers. Selling the stock and securities at the bid price indicates that sellers do not want the stock and selling volume begins to increase.

How to track the trading volume?

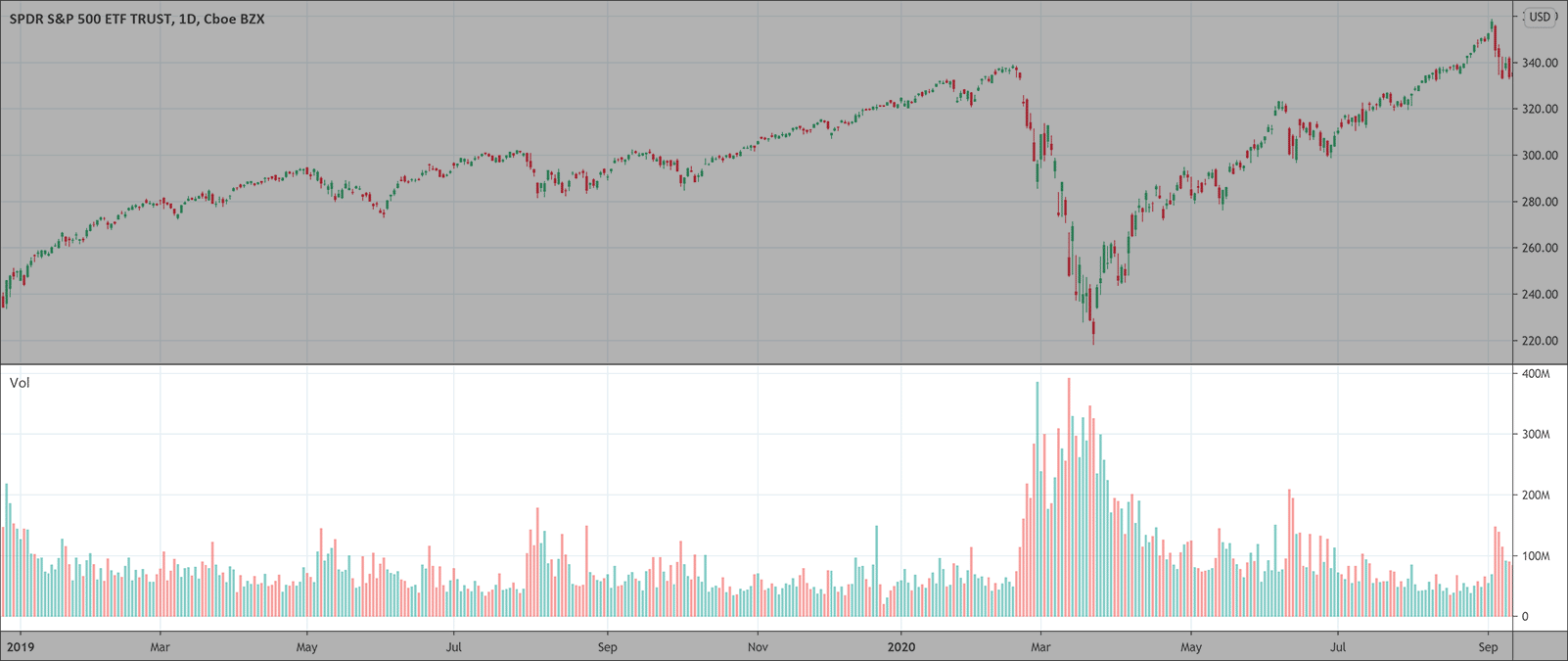

The volume appears along the bottom of the stock price chart. Stock price charts show the volume of trade through vertical bars at the bottom. These bars help traders to analyze the measures of shares changing hands during a given period of time. Volume bars are of red and green color. The red color bar indicates the declining prices during that period and the volume during that period is selling volume. The green color bar depicts the rising prices during that period and the market considers this volume as buying volume.

Moreover, bar charts help technical analysts to determine trends in volume in addition to the level of volume. Higher than average bar charts suggest high volume at a very particular price level. Bar chart analysis enables traders to use volume to confirm price movements. Increasing volume with up or down price movement indicates the strength of the price movement.

Uses of trading volume in technical analysis

The volume of trade is one of the most crucial indicators in technical analysis. It has the following uses.

- Trading volume helps to measure the relative importance of any market move that makes it the most significant indicator in technical analysis. A large movement during a period usually leads to two types of responses. Traders may give credibility to the strength of the movement or they may also be skeptical of the trading volume. The significance of the volume depends on the volume of the price move. That means higher the volume, the higher is the significance while lower volume indicates the lower significance of the price movement.

- Traders and technical analysts also use volume to determine the strength of a security. Whenever there is significant activity at a certain price level, it is highly likely that the volume will be higher at that level.

- Traders also base their trading strategies on the trading volume and decide to engage in a transaction on the basis of the trading volume. The volume of trading is significant as far as entry and exit points are concerned in the security trading.

- Volume also assists traders to look for a reversal of the trend in the market. The high buying volume is a clue to a potential reversal on a level of support. On the other hand, the low buying volume hints to a potential reversal on resistance. Similarly, high selling volume indicates reversal on a level of resistance while the low selling volume predicts a break in the level of resistance.

Conclusion

Trading volume helps to measure the completed trade transaction during a given period of time. The understanding volume of the trade is crucial for trading and technical analysis. Trading volume demands very particular attention towards the forces of supply and demand. Volume traders always look for the intervals during which buying or selling orders significantly increase. As a general rule, increased trading volume indicates higher buying orders and prompts traders to make a move for a new position.

Conversely, the decreasing volume depicts higher selling. Trading volume also helps to measure the relative importance of any market move, to determine the strength of security, making trading strategies, and to look for a reversal of the trend in the market. Volume indicators such as On Balance Volume and Klinger Indicator can help during the decision-making process. Hence, trading volume is apparently a simple indicator but when studied in-depth, it is of the most crucial indicators that help to increase the odds of maximizing the trading gains.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!