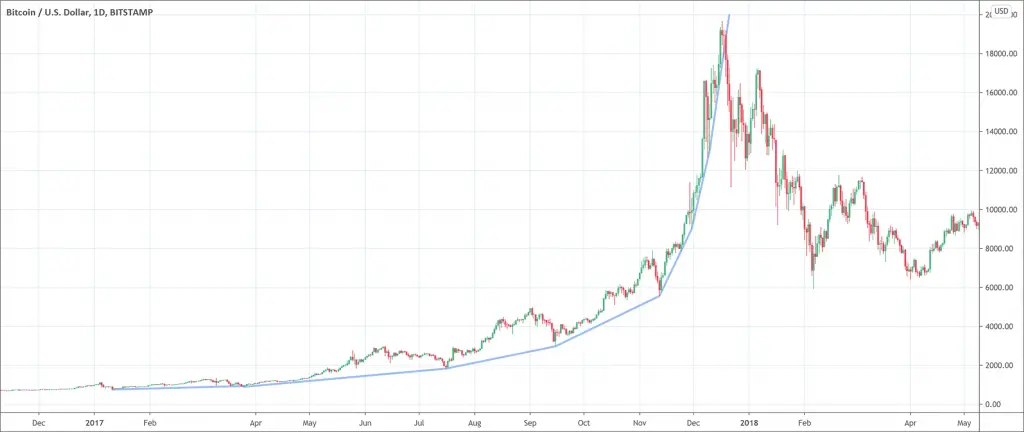

- The Parabolic curve pattern is a curved trend line looking like an arc, or an elliptical shape.

- It appears when price accelerate its rise. The more it rises, the quicker it rises.

- This growth is often not sustainable so price often dumps when it breaks the parabolic curve.

The Parabolic Curve is one of the most greatly expensive and pattern highly sought after. With this pattern you could realize the largest and fastest return in the shortest possible time. It also is the most speculative and risky (think of a bubble).

If you’re wondering where to go to see price and detect whether prices are getting parabolic, the best charting tool is TradingView. Click here to get started for free with TradingView!

The curve pattern is a snippet of curved traces fashioned by tracing the candlestick formation when cost goes up or comes down quickly. Visually, the snippet of the curved traces follows the adjustment factors.

Parabolic Curve patterns are usually located when the market is experiencing panic-buying or panic-selling situation. Beneath these situations, the opportunity to reap income is massively open.

In actual sense, the Parabolic Curve snippet represents the reason the place costs will begin to method the saturation mark (overbought or oversold). If the value has gotten to the saturation mark, the value alternative to reverse direction will possibly get bigger.

History and application

The parabolic curve pattern was initially observed more than 50 years ago and was wrongly named a parabolic trend. Back then, observing a parabolic curve pattern was not common.

This pattern started becoming popular among traders with the increase in market involvement. Traders can use the parabolic curve pattern to denote fast moving trend progression. As the time increases; so does the steepness of the curve.

This quick price is mostly either an indication of panic buying, driving rises to levels which can’t survive before the unavoidable rapid collapse. A characteristic of this trends when prices goes to the right side of the trend line to give a parabolic curve is the rapid collapse.

Parabolic Curve stock chart pattern

One of the strongest uptrend patterns a stock can possess is the parabolic curve stock chart pattern. The name, parabolic curve, comes from the parabola. This is so because the curving trend line coming downwards used in figuring out the strength of this pattern from this assist action resembles a parabola. Strong price pattern like this can provide a trend trader with magnificent high return within a short space of time.

The price action pattern that develops the parabolic curve looks like a stair rail. This pattern can stay up for weeks even months in some cases. The downfall arises close to the end of the formation after the largest move straight up to highly overbought region.

The strong upward price action usually comes to an end suddenly in a price crash that falls more quickly than it rose.

These patterns usually occur to growth stocks with new products, new business structure, new technology or new leadership. Stocks that behave this strongly are basically market leaders.

The point in trading a trend this strong is generating a move towards the upside as possible with trailing stops and securing a plan to leave and lock-in those gains and avoid riding it all through back down.

How a Parabolic Curve does looks like?

The Parabolic curve pattern is a curved trend line likened to an arc, or an elliptical shape. It rather takes the form of skewed parabola, and the final shape of the curve is as a result of a proprietary calculation.

There are some automated tools in existence which traders can use together with parabolic curves automatically anywhere they occur. An example of this tool is the GTE parabolic tool.

Trading the Parabolic Curve pattern

There are two methods which investors can use them for trading the parabolic curve pattern. They are the long and short trades.

Long Trades

Stock moves parabolic at the end of high uptrends. This pattern surfaces when panic buying comes in and prices gets nearly to a vertical point. It’s due to FOMO (Fear Of Missing Out) as the public wants to make money and buy at always higher prices.

Short Trade

This particular trade position is much safer to play and gives more guarantee. Parabolic curves will most time reach the point of price fall. If (or more likely when) the parabolic breaks down, beware… Prices will sometimes go back to the mark where the parabolic rise began.

Rules for trading the Parabolic Curve

This pattern gets traded with no reference to any other indicator. It is a standalone indicator. Immediately the price action gets broken via the right of the trend line mark, this is a great point to establish a short trade.

To be genuinely regarded as a parabolic curve, the trend line which gives rise to the parabolic curve must touch two points at least. But more suitably the trend line should touch three initial low points to create a valid trend line plot.

Advantages of using a parabolic curve pattern

- It is appropriate in keeping track of moves that evolves really quickly, mostly in cases where large panic purchase causes price to go up very rapidly.

- You can use it to discover accelerating trends.

- It provides traders with specific entry and exit point based on how the parabolic pattern gets traded.

- This parabolic curve can be best efficiently utilized with price or derivative leverages.

Disadvantages of the Parabolic Curve pattern

- As a buyer, if you join late when prices have gone up so steeply that the curve is almost vertical, and then you need to be conscious of the price fall that is bound to follow.

- It is mostly difficult to figure out this patter in the early periods of trend development.

The Parabolic Curve Pattern Strategy mostly surface at the time of sharp economy motions. Traders mostly notice themselves front-running an event. The time beforehand of the massive event is one of the public ways to identify a more parabolic arc.

Although the previously mentioned pattern is not near to the cubicle case, you are able to notice how a bold move in price has really brought about the parabolic pattern.

A crucial thing worth noting could be the fact that it takes some time for the pattern to form. In majority scenarios, the parabolic routine may happen only close to the break out of this blueprint. Traders will quickly identify a certain pattern along with commerce accordingly.

The sell price activity surrounding the break-out can on occasion be really quick as traders’ starts to unwind their trades. So taking commerce at the right point is indispensable.

If you’re still looking for a trusted source to get your price charts, TradingView is the solution! Most of the charts you can see on the website come from there. It’s both user friendly, performant and very affordable. They let you freely chart almost any asset with all indicators you could think about.

Click here to get start on TradingView for free!

Conclusion

Just like with any other trade strategies, it is advisable you practice and make use of the parabolic curve pattern on a virtual money account, before thinking of taking this strategy to an actual real money account. You could also make a search for tools that would aid you in spotting the parabolic pattern on time.

The parabolic curve is a very powerful tool used as a means to exchange the markets. A good rule of thumb in the trading world that is worth noting is that if the selling price is climbing too quickly, this type of increment may not be available or held for long.

It is one of the graph routines that get sought after the most because it signals a reversal in price. Although, one may be having the thought that parabolic curve mandates value to go in a specific order, it is not a big deal but a collection of moves in value which can shown using various fad lines.

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!