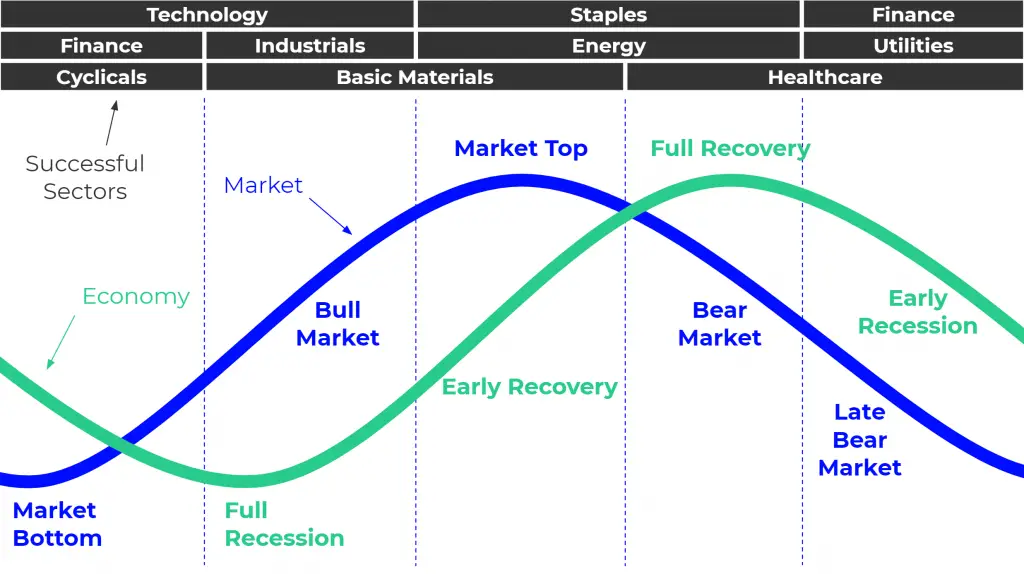

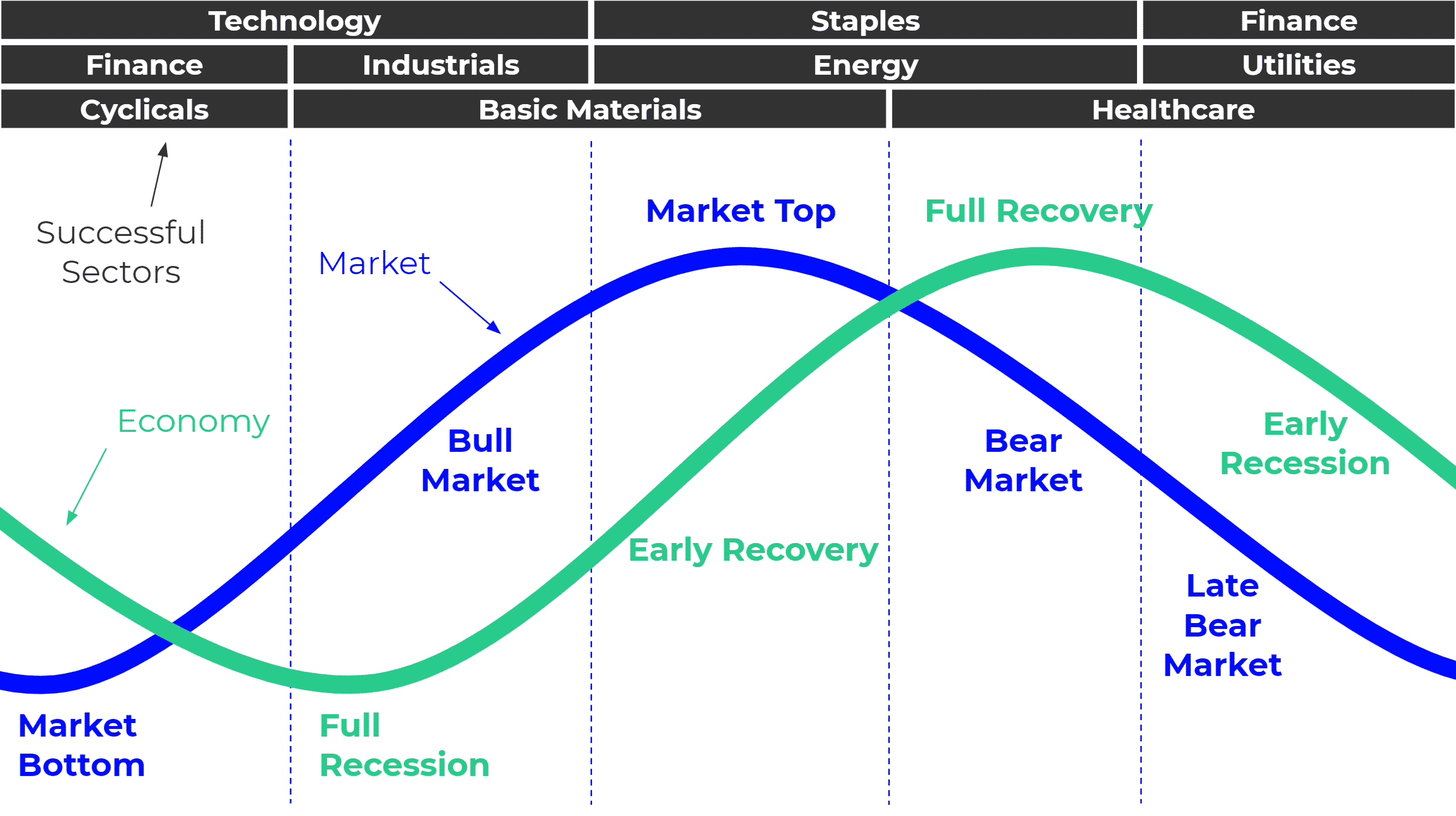

- The Sector Rotation Strategy assumes investors invest cyclically their funds in predictable industries.

- This theory is used by traders to anticipate investments & divestment and thus profit for price variations.

- It links market cycle to economic cycles.

Sector rotation strategy is an investment strategy that involves the movement of investments from one market sector to another. The purpose of the stock market sector rotation is to beat the market by shifting from one industry sector to another. For example, an investor might look to beat the market by rotating investments among energy securities, technologies, and consumer durables as market values and economic factors of these factors change.

The economy continuously changes and moves in certain predictable cycles. It is possible to predict the next economic stage and the economic conditions of that stage. It is normal that certain sectors perform better than others at any given time. Investors try to shift their investments to sectors that tend to better perform in the next economic stage. Therefore, the anticipation of the next economic stage is the most significant factor in sector rotation.

How does sector rotation strategy work?

The sector rotation strategy works on the basis of a simple fact that the economy operates in cycles. A sector rotation strategy divides the overall economy into different sectors such as energy, health care, consumer durables, utilities, etc. Different sectors tend to perform differently in different economic stages. Investors try to anticipate the sectors that are likely to perform better in the next economic stage and move their investments in that sector.

Stages in the business cycle

Sector rotation strategy also works on the assumption that a business cycle has four stages.

- Early recession: Early recession is the worst stage of the economic cycle. Bad economic conditions mark this period, low market productions, flat yield curve, high-interest rates, and low expectations. Historical facts state that sectors like services, utilities, transports, etc. Perform better in this economic cycle and investors shift their focus towards those sectors.

- Early recovery: Early recovery economic stage is a revival stage where economic conditions begin to recover. Industrial productions begin to increase, interest rates begin to decline, the yield curve begins to rise, and overall economic conditions start to pick up. Industry sectors like basic materials, energy, etc. thrive in such economic conditions.

- Late recovery: Late recovery is an economic stage marked by rising interest rates, flattening yield curve, declining consumer expectations, flat industrial productions, etc. Historical facts state that sectors like energy, consumer staples, services, etc thrive better in such economic conditions.

- Full recession: Full recession is the worst economic stage and is not good for business. It is marked by retracting gross domestic product, falling interest rates, lowest consumer expectations, and the normal yield curve. Sectors like transportation, technology, industrials, etc perform well in such economic conditions.

How to implement the sector rotation strategy

The implementation of the sector rotation strategy involves a top-down approach. The top-down approach means an analysis of the overall market including factors like interest rates, yield curve, commodity and material prices, monetary policy, etc. It helps investors to analyze the current economic environment and identify the current stage of the economic cycle. Moreover, the analysis of the important economic factors also enables investors to make an estimate of the level of future performance for each sector.

The next step in the sector rotation strategy is to find out those sectors which may better perform in the current and next phase of the economic cycle. It depends on the economic cycle that some sectors may be expected to perform better. Once investors identify those sectors, they shift their investments to those sectors in order to maximize their gains.

Limitation of the sector rotation strategy

The sector rotation strategy works on the assumption that investors can gain profit by monitoring the economic cycle and buying or selling stocks accordingly. However, there is no guarantee that the chosen sectors will perform according to the predictions of the investors. The reason is, sector rotation strategy is a general theory relying on the past performance of the stock market. Therefore, there isn’t any certainty that chosen stocks will follow past patterns in the future.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!