- Multiple types of orders exist and can be used to best suit your trading strategy.

- A market order buys or sells shares at the available price until all the order is filled.

- A limit order buys or sells shares at a fixed given price. There is no guarantee it’ll be fully executed.

- Stop orders trigger when price goes above or below a fixed given price and buy or sell stocks. They are often used to protect against loss.

A lot of investors are switching to buying and selling of stocks for themselves via the internet. They no longer use advisor services to execute trades. This is due to the popularity of digital technology and the internet. Before you start trading stocks, you need to know about the various types of order and when they are appropriate.

Based on your investing techniques, different types of order can help investors to trade stocks better. A market order basically purchases or sells shares at the predominant market prices until the order gets done.

A limit order determines a certain price at which the order should gets filled. Even though it is not assured that some or all of the order will gets traded if the limit appears to be high or low.

Stop orders, which is a variation of limit order formed when stock goes beyond or below a certain mark.

Market Order vs. Limit Order

The two main types of orders that investors need to get familiar with are the market and the limit order.

Market orders are the simplest form of trade. It is an order to purchase or sell instantly at the current price. If you intend to purchase a stock, you are to pay close to what you want. If you want to sell a stock, you will get a price that is or close to what the seller wants.

Note that the last traded price is not going to be the price the market order would be. Market orders don’t determine a price, but would rather determine the immediate execution of the order.

Market orders are common with individual investors who intend to purchase or sell a stock instantly. The benefit of making use of market orders is that you are certain of getting the trade filled. As a matter of fact, it executes almost instantaneously.

Although the trader wouldn’t be aware of the precise amount a stock will cost, market orders on stock which trades beyond tens of thousands of shares daily will most likely done close to the bid prices.

Limit Orders are one of the order types

A limit order, also known as a pending order enables traders to purchase and sell securities at a particular price in the future. This form of order executes a trade if the price hits the pre-defined mark. In summary, a limit order determines the highest or lowest price you are willing to purchase or sell.

For instance, if you intend to purchase a stock at $20, you could input that amount as the limit order. This simply means that you will not pay a cent beyond $20 for that specific stock.

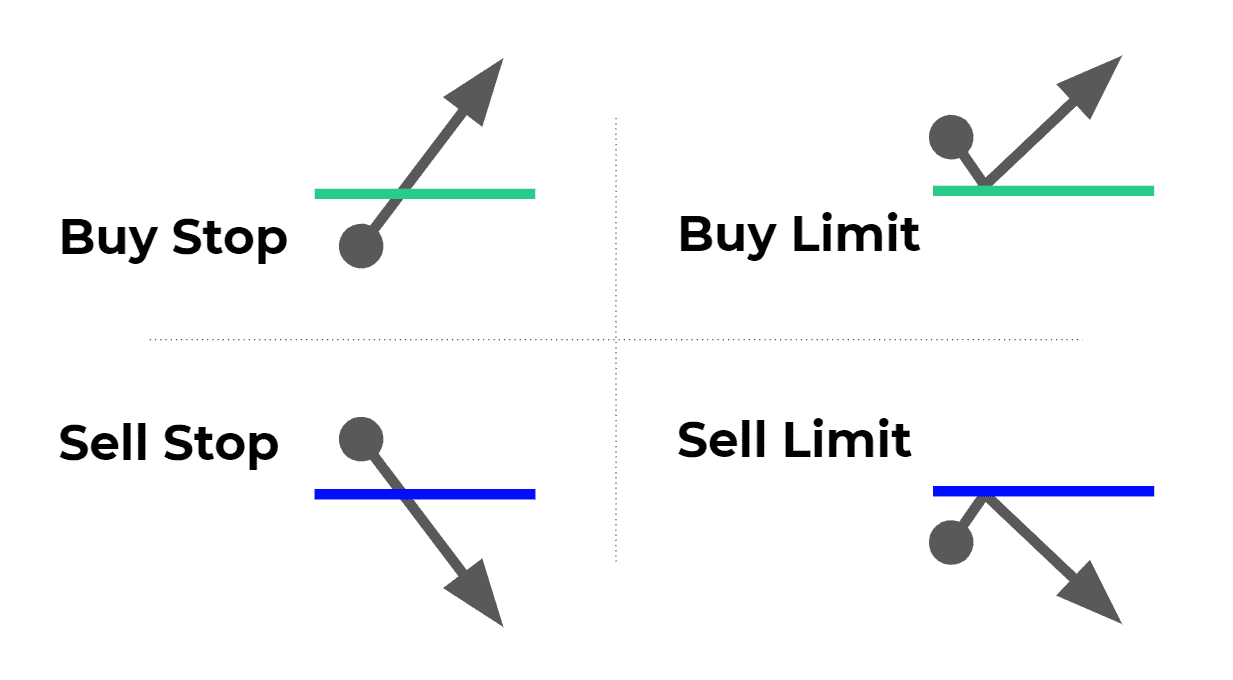

There are four types of limit order

i. Buy Limit: this is an order to buy a security at or below a certain price. Limit orders has to be set at the correct side of the market to make sure they will execute the need for improving the price. For a buy limit order, this denotes making the order at or beneath the recent market bid.

ii. Sell Limit: this is an order to sell a security at or beyond a certain price to make sure the price is better, the order must be at or beyond the present market bid.

iii. Buy Stop: this is an order to purchase a security at a fee beyond the recent market bid. A stop order to make a purchase becomes active right after a specific price mark occurs (referred to as the stop level). Buy stop are orders made beyond the market while sell orders form beneath the market. As soon as a stop level occurs, the order will instantly turn into a market or limit order.

iv. Sell Stop: this is an order for selling a security at a price beneath the recent market bid. As with the buy stop, a stop order to sell becomes active right after a certain price market forms.

What is Market Order and how do I use it?

A market order is an order to purchase or sell a stock at the market recent best available amount. A market order is usually the best when you perceive a stock price is right, when you are certain that you want to fill on your order, or when you want to make an instant execution.

Usually, you should make market orders only during market periods. When a market order appears at a period when the market closes, it can only operate the next time the market opens. And this can be significantly more or less from its prior close.

In the midst of market sessions, so many elements can influence a stock’s price such as the release of earnings, unforeseen circumstances that affect a whole industry, a section or the entire market at large.

What is a Limit Order and how does it work?

A limit order is an order to purchase or sell a stock having a limitation on the highest price or the lowest price. If you fill the order, the price will only be at a specific price or better. However, guarantee of execution is absent.

When you perceive that you can purchase at a price lower than, or sell at a price beyond the current quote, then a limit order would be suitable.

What is a Stop Order and how is it used?

A stop order is an order to purchase or sell a stock at the trading price immediately the stock gets sold at or through a specific price. If the stock attains the stop price, the order turns into a market order and gets filled during the next available market price. If the stock does not attain the stop price level, the order does not get processed.

A Stop Order can be suitable in the following cases:

- If the stock that belongs to you has gone up, and you want to attempt to safeguard your interest should in case it crashes.

- When you intend to purchase a stock as it shoots high above a specified mark, with the belief that there would be a continual upraise.

A sell stop order is also known as a stop loss order as it is capable of safeguarding an unrealized profit. You can as well us it to limit your loss. A sell stop order is input as a stop price beneath the present market price.

If the stock gets to the stop price or trades below it, the stop order to sell order is set and turns to a market order to done at the present market price. There is no assurance that the sell stop order would occur out near your stop price.

Traders can as well use a stop order to make a purchase. A stop order is input at a stop price above the present market price.

Summary for the different order types

In summary, a market order enables you to get into or get out of a position quickly. It’s the fastest means to fill an order, but the downside is that it has the smallest control on price. A limit order gives the least selling price and the highest buying price. The downside here is that if the execution would not be as fast as the market order.

Stop orders can control your losses with a market order when a trade fails to swing in your favor. Stop limit orders make use of the exact approach, but they make use of limit orders as opposed to market orders.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!