If you have an interest in financial trading, you must have knowledge of two concepts, moving averages and volume. Moving averages is one of the most common and widely used indicators in the financial trading world. Volume is also another important concept that is used to gauge the strength of a market trend. Volume is considered as a key to financial trading success. Both of these concepts are important to understand the volume-weighted moving average (VWMA) indicator.

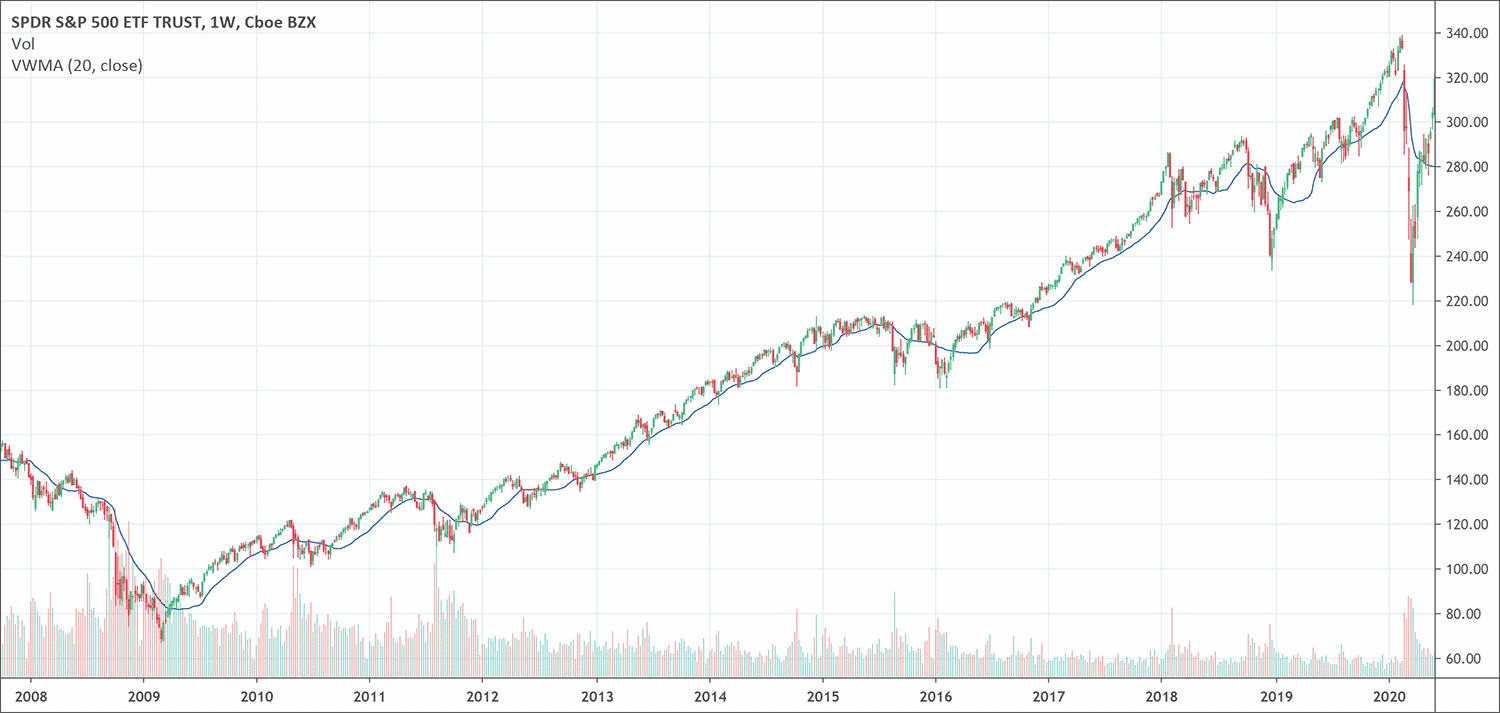

- The Volume-Weighted Moving Average (VWMA) is very similar to a standard Moving Average but it includes volume.

- Each price is weighted with its volume.

- Traders can apply the indicator on any timeframe.

Before you keep looking down this article, you should check 2 of courses I shortlisted in the New Trader University from Steve Burns (a very famous trader with about 400k followers on Twitter)!

- Moving Averages 101: this professional video series that will teach you how to use moving averages to be more profitable with less stress.

- Moving Average Signals: this course will illustrate how trading moving average signals with confidence and consistency can lead to profitability; consistently creating bigger wins and smaller losses.

What is the VWMA?

The volume-weighted moving average indicator is a tool that combines moving averages and volume. It gives more weight to heavy-volume bars as compared to bars having low volume. The VWMA allows the volume-weighted moving average to calculate a moving average that will be close to areas where most of the trading happens. It would not be possible if it does not give value to volume.

In simple terms, the volume-weighted moving average (VWMA) functions by giving great importance to volume by weighing prices with respect to trading activity in a predefined period of time. Traders of VWMA can set the length, an offset, and the source according to their own preferences. During periods of low trading activity, the values of simple moving averages and VWMA are almost similar. The volume-weighted moving average indicator helps to identify and trade trends in the market. Price crossing may well be a sign of the change of direction. However, technical analysts and expert traders use it in conjunction with other technical tools and analysis techniques.

The calculations and the formula of the volume-weighted moving average (VWMA)

The volume-weighted moving average indicator applies the moving average to both, price times volume and simple volume. The next step of the calculation involves simply dividing price times moving average to volume moving average. The result will be your volume-weighted moving average.

Volume weighted moving average (VWMA) = [(Price 1 × Volume 1) + (Price 2 × Volume 2) + (Price 3 × Volume 3)] / (Volume 1 + Volume 2 + Volume 3)

Where: Price (n) is closing price from n period and volume (n) is volume from n period

What does the volume weighted moving average (VWMA) indicator tell traders?

Is it possible to interpret or read the VWMA indicator in a similar fashion to how traders interpret other moving averages?

The answer is yes.

The reason is that its main advantage arises only when it is used in combination with a simple moving average (SMA). This unique combination is of significant importance for trend identification. The movements of the VWMA above SMA indicates a bullish trend. The movements of the VWMA below the SMA refer to a bearish trend and the trend lacks the support of the volume. This leads to the weakening of the bullish trend. The movement of the VWMA between the SMA and price chart suggests a trending market.

What about the exit point then? When you observe that both of these lines are getting closer to each other, it will be an indication of an exit point. This is the time when traders might want to collect their profit and exit the market.

How to use the volume-weighted moving average (VWMA) indicator?

VWMA has a lot of potential

There are plenty of potential ways to use the volume-weighted moving average (VWMA) for your advantages. It is also important to learn how expert traders incorporate the VWMA in their own particular trading strategy. As we have discussed earlier that the interpretation as well as the implementation of the VWMA is very similar to SMA. However, for most of the markets, timeframes, or, trading strategies, the VWMA is always a better choice to increase the odds of getting maximum gain from your trading activities.

Some background check on historical data is crucial to understand different types of markets and trading strategies that perform well with the VWMA indicator. It is important because this background search will allow you to assess what has worked in the past and what will deliver in the future?

However, there are a few very popular strategies among expert traders who are the veterans of this financial trading. Moving average crossovers, mean reversion trading, and breakout trading (divergences) are at the top of the pecking order.

Some strategies

Average crossover strategy means when a short term average intersects a long term average. Now, it is wise to replace the short-term small moving average with the volume-weighted moving average (VWMA). This improvisation will increase the chances of less false signals as compared to the use of a simple moving average.

The mean reversion trading strategy seeks to gain profits by using the mean-reverting characteristics of many financial markets. It is possible through taking profits from mean reversion. Mean reversion occurs when prices tend to extend themselves to extremes of both, upside and downside. This tendency to reach extreme levels gives rise to a counter-reaction leading to price swing in the opposite direction. This reversion to mean gives great profits to traders. Now, if the volume-weighted moving average (VWMA) indicator is used in this mean reversion strategy, the odds of maximizing profits considerably increase.

The volume-weighted moving average (VWMA) has given a new path to users of breakout trading strategy. The use of the VWMA and SMA for the same period generates two similar lines. However, at very particular times, the VWMA deviates significantly suggesting that recent up days enjoyed more activity and volume as compared to recent down days. This deviation suggests that the VWMA indicator has deviated or broken out.

The pros and cons of the volume-weighted moving average (VWMA)

There are certain advantages of using the volume-weighted moving average (VWMA).

- It is very easy to use for expert traders as compared to certain other sophisticated analysis tools.

- The second advantage is that it has significantly improved the SMA with the introduction to volume to moving averages.

- It is one of the most reliable tools to identify trend reversals and confirm a trend in the market.

- It becomes a more influential indicator when it is combined with other trading indicators.

On the other hand, it has certain disadvantages as well. One of the most major drawback is that most of the trading platforms do not include the volume-weighted moving average (VWMA) indicator. It is manually downloaded and installed which is a trick and difficult for some of the traders.

Conclusion

The volume-weighted moving average (VWMA) indicator is one of the most user-friendly indicators. It is the biggest strength of the volume-weighted moving average that it emphasizes on the volume. The VWMA is a significant improvement upon the simple moving averages and it can also work in conjunction with SMA as well.

The volume-weighted moving average is a simple way of improvement for traders who are accustomed to using simple moving averages for market analysis. It provides signals of an upcoming trend, the continuation of a trend, trend reversal, and the identification of the divergences. However, technical analysts always advise not to use a single indicator for trading.

It is always a wise move to work a combination of indicators for confirmation. Therefore, it is important to learn about the working of the volume-weighted moving average (VWMA) indicator. It is crucial to practice the VWMA indicator before incorporating it into your live account.

Before you go, check this two tremendous courses to expand your understanding of the moving averages: Moving Averages 101 & Moving Average Signals.

They both are created by Steve Burns. You surely saw him on Twitter as he has about 400000 followers. These courses will teach you how to use moving averages to be more profitable with less stress.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!