- The Triple Exponential Moving Average (TRIX) helps investors determine the price momentum and identify oversold and overbought signals in a financial asset.

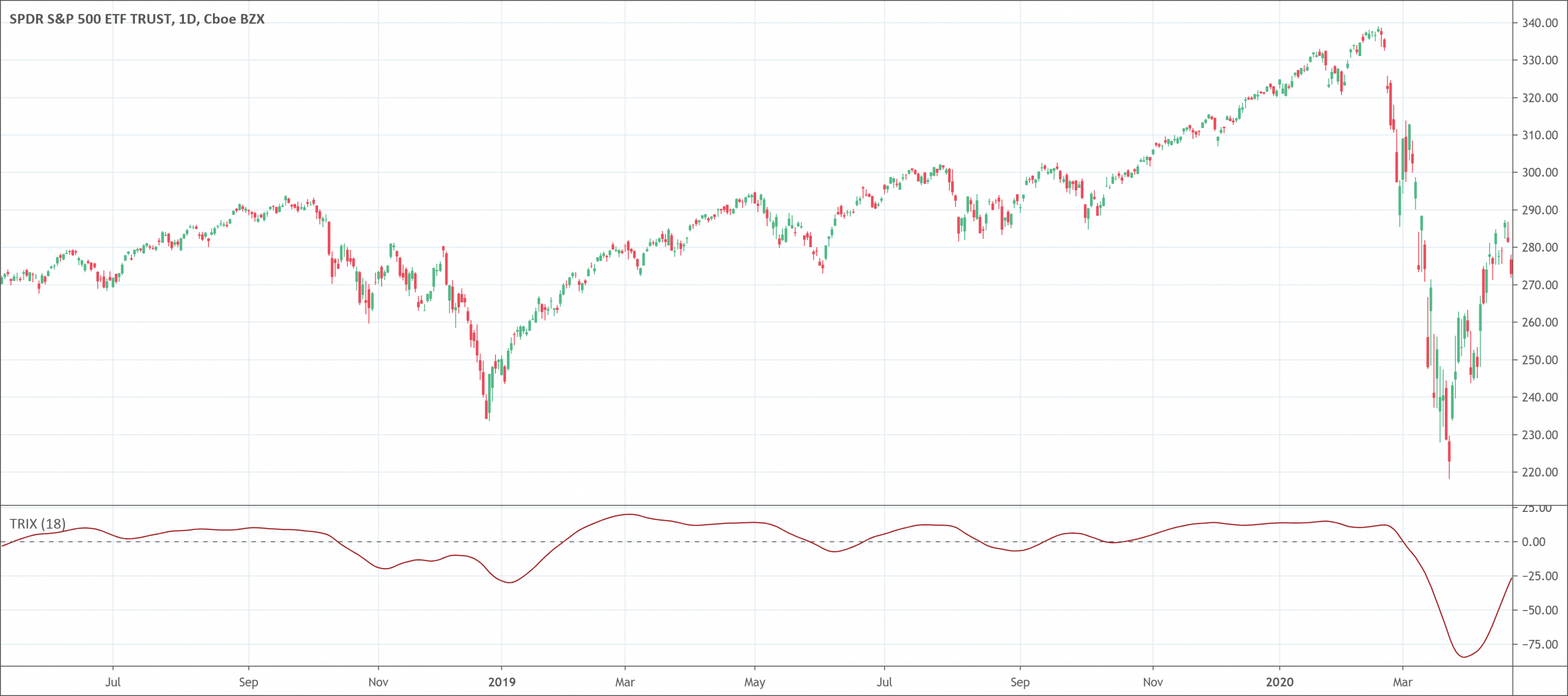

- It is composed of 3 main components: Zero line, TRIX line, Percentage Scale

What is the TRIX Indicator?

The Triple Exponential Moving Average (TRIX) indicator is a strong technical analysis tool. It can help investors determine the price momentum and identify oversold and overbought signals in a financial asset.

Jack Hutson is the creator of the TRIX indicator . He created it in the early 1980s to show the rate of change in a triple exponentially smoothed moving average.

The indicator has three major components:

- Zero line

- TRIX line

- Percentage Scale

Investors use TRIX to generate signals that are similar to the Moving Average Convergence Divergence (MACD).

What does the TRIX indicator tell traders?

The TRIX indicator determines overbought and oversold markets, and it can also be a momentum indicator. Just as it is with most oscillators, TRIX oscillates around a zero line. Additionally, divergences between price and TRIX can mean great turning points in the market.

TRIX calculates a triple exponential moving average of the log of the price input. It calculates this based on the time specified by the length input for the current bar.

How to use the TRIX indicator?

When used as an oscillator, it shows a potential peak and trough price zones. A positive value tells traders that there is an overbought market while a negative value means an oversold market. When traders use TRIX as a momentum indicator, it filters spikes in the price that are vital to the general dominant trend.

A positive value means momentum is rising while a negative value means that momentum is reducing. A lot of analysts believe that when the TRIX crosses above the zero line it produces a buy signal, and when it closes below the zero line, it produces a sell signal.

TRIX indicator calculation

TRIX, which is a triple smoothed EMA, is an EMA, of an EMA, therefore the “triple”. Exponential moving averages place more weight on recent price information.

Most traders use a default 14-period when calculating TRIX. But traders can adjust the parameters based on the needs of the trader. Below are the steps used when calculating a 14-period TRIX:

- Single-smoothed EMA = 14-period EMA calculated based on the price’s close

- Double-smoothed EMA = 14-period EMA of the single-smoothed EMA

- Triple-smoothed EMA = 14-period EMA of the double-smoothed EMA

- TRIX = 1-period percent change of the triple-smoothed EMA

Trading TRIX indicator signals

Zero line cross

TRIX can help determine the impulse of the market. With the 0 value acting as a centerline, if it crosses from below, it will be mean that the impulse is growing in the market.

Traders can, therefore, look for opportunities to place buy orders in the market. Similarly, a cross of the centerline from above will mean a shrinking impulse in the market. Traders can, therefore, look for opportunities to sell in the market.

Signal line cross

To select the best entry points, investors add a signal line on the TRIX indicator. The signal line is a moving average of the TRIX indicator, and due to this, it will lag behind the TRIX.

A signal to place a buy order will occur when the TRIX crosses the signal line from below. In the same way, a signal to place a sell order will come up when the TRIX crosses the signal line from above. This is applicable in both trending and ranging markets.

In trending markets, a signal line cross will indicate an end of the price retracement, and the main trend will resume. In ranging markets, a signal line confirms that resistance and support zones have been upheld in the market.

Divergences

Traders can use the Triple Exponential Average can to identify when important turning points can happen in the market. They can achieve this by looking at divergences. Divergences happen when the price is moving in the opposite direction as the TRIX indicator.

When price makes higher highs but the TRIX makes lower highs, it means that the up-trend is weakening, and a bearish reversal is about to form. When the price makes lower lows, but the TRIX makes higher lows, it means that a bullish reversal is about to happen.

Bullish and bearish divergences happen when the security and the indicator do not confirm themselves.

A bullish divergence can happen when the security makes a lower low, but the indicator forms a higher low. This higher low means less downside momentum that may foreshadow a bullish reversal.

A bearish divergence happens when the commodity makes a higher low, but the indicator forms a lower high. This lower high indicates weak upside momentum that can foreshadow a bearish reversal sometimes.

Bearish divergences do not work well in strong uptrends. Even though momentum appears to be weakening due to the indicator is making lower highs, momentum still has a bullish bias as long as it is above its centerline.

When bullish and bearish divergences work, they work very well. The secret is to separate the bad signals from the good signals.

Combining TRIX with other technical indicators

As an indicator based on EMA, the TRIX produces leading signals. It is, therefore, necessary to combine it with other technical indicators. This can help traders choose high probability opportunities when tracking a price.

The best TRIX combinations are:

TRIX and RSI

The Relative Strength Index (RSI) measures the momentum and strength of a trend. When joined with TRIX, RSI can help offer perfect buy and sell signals. It gives these signals mostly when the price of an underlying asset is range-bound.

A strong buy signal will happen when both RSI and TRIX are in the oversold region and signal a potential reversal. Also, a strong sell signal forms when both RSI and TRIX are in the overbought region and indicate a potential reversal.

TRIX and MACD

The Moving Average Convergence Divergence (MACD) is a momentum and trend-following indicator. Joining MACD and TRIX can give definitive signals for entering new trends and leaving when a reversal will happen. An entry signal will comes up when the TRIX crosses the zero line and a crossover of the MACD happens.

Pros & Cons of using the indicator

Pros

Two main pros of TRIX over other trend-following technical indicators are

- Its excellent filtration of market noise and

- Its tendency to be a leading indicator

TRIX filters out noise in the market by using the triple exponential average calculation. It thereby gets rid of minor short-term cycles that indicate a change in market direction.

It can lead a market because it measures the difference between the smoothed versions of the price information of each bar. When interpreted as a leading indicator, the TRIX indicator is best used together with other market-timing indicators. This reduces false indications.

Cons

The indicator will have the same problem as other oscillators – range-bound trading.

When price action starts coiling the three EMAs, the indicator starts overlapping. This makes a tight range in the indicator which produces crosses below and above the zero line without a major price move.

This is where these indicators get in trouble. So, if a stock or market is not in an impulse trend move, the indicator starts pumping out false signals.

Conclusion

TRIX is an oscillator that joins trend and momentum. The triple smoothed moving average covers the trend, while the one-period percentage change measures momentum. Due to this, TRIX is similar to MACD and PPO.

Traders looking for more sensitivity should use a shorter timeframe. This will make the indicator more volatile and better suited for centerline crossovers. Traders looking for less sensitivity should try a longer timeframe. This will smooth the indicator and make it better suited for signal line crossovers.

As with all technical indicators, traders should use TRIX together with other parts of technical analysis, such as chart patterns.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!