- Trailing stop helps trader secure their trade automatically when it moves in their favor.

- It can let traders book profit or mitigate risk if the price reverses.

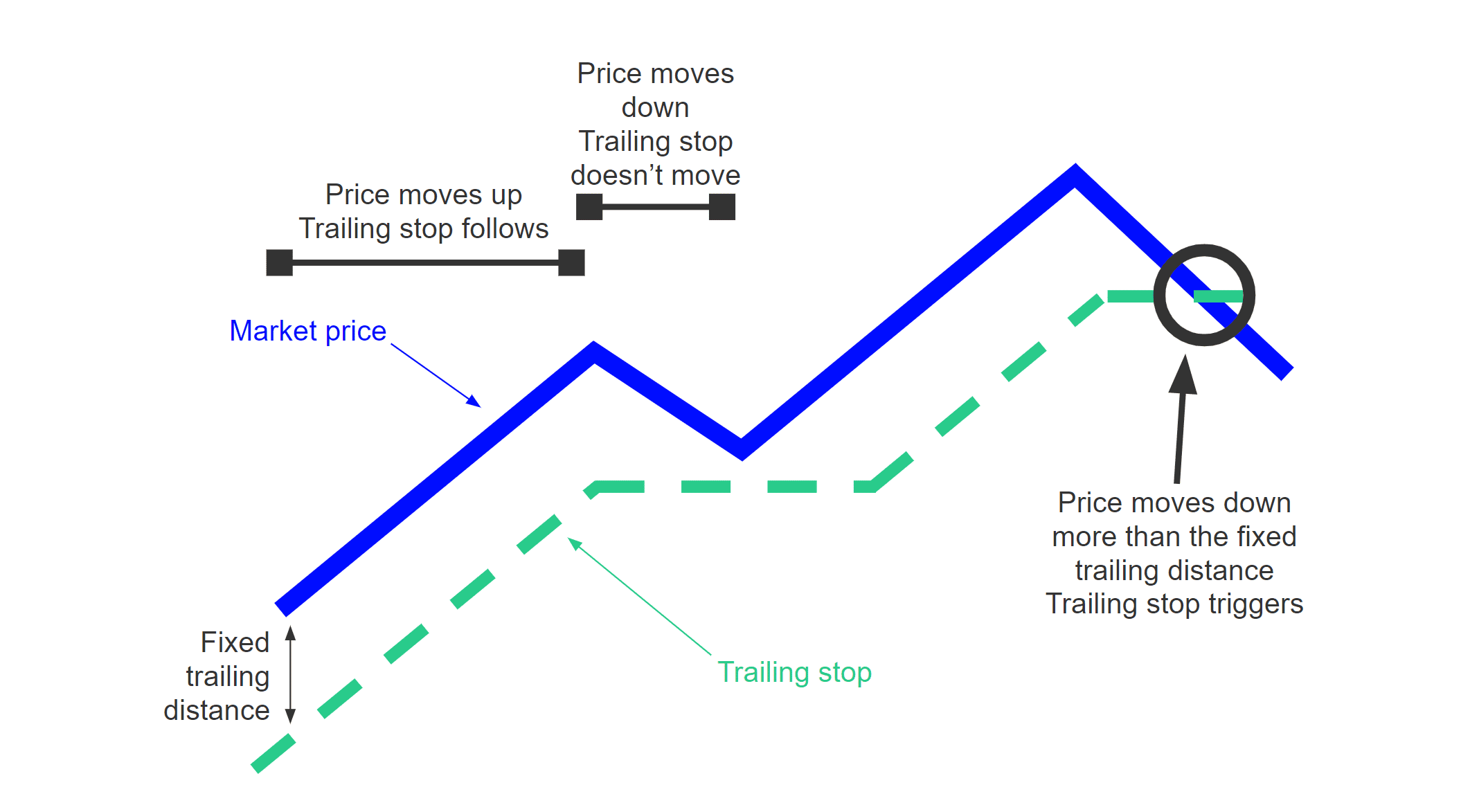

- Trailing stop only moves in one direction as price progresses.

- It can be set as a percentage of price or a fixed distance.

A Trailing Stop Loss Order establishes a market order when the trailing stop loss mark appears. Whereas, a trailing stop limit order will forward a limit order as soon stop price mark appears.

This means that the order will get filled only at the present limit mark or better. Trailing stop limit orders gives investors more control over their trades although, it gets risky when the price comes down fast.

Why is a Trailing Stop so Important?

Right before you dive into the market, it is important to make sure you have this sorted out. You can simply maximize profit and minimize loss with just one move. It is dependent on a simple concept.

All investing should note to this. Countless number of traders get emotional with their investments. They find it difficult to identify losers. And this happens to be the errors that cost the large chunk of money. Even trading professionals cannot be correct all the time. As no one can predict the future, getting it wrong is also part of the process.

In order to have a better chance for surviving in trading, you need something like trailing stop. It totally lowers your downside risk. A trailing stop will enable you ride the market up, and get you out if it ends up crashing. It hugely maximizes profit and minimizes loss, without compelling you to think about it.

How a Trailing Stop Loss works?

Trailing stop loss and the price of a stock goes alongside one another. Basically, a trailing stop loss lacks a fixed price but just as the market rises, the stop loss level also continually re-aligns itself with it.

There are numerous approaches for calculating the trailing stop loss. One of the approaches is to basically set the stop at a specified distance from the maximum high or minimum low if you are going short. That way, the stop level gets continually high as the market moves, hence, turning to a trailing stop.

Downside of Trailing Stops

The main challenge with trailing stop-loss orders is that they are capable of throwing you out of a trade early enough. In order to avoid this, trailing stops should occur far from the present price which you do not expect to attain except the market switches its direction.

For example, a market that normally varies between a 10 cent range when it is still going in a similar trending direction would require a trailing stop much bigger than 10 cents, but not large to the extent where the trailing stop ends.

Another downside of trailing stop is that it fails to protect you from big market moves that are larger than your stop placement. If you put a stop to avoid 10% loss in place, but the market unexpectedly goes out of your favor by 20%, the stop will fail to be helping you because there won’t be an opportunity for your stop to get invoked and your market order to get filled close to 10% loss point.

Alternative to Trailing Stop Loss

The major alternative to a trailing stop-loss order is the trailing stop limit order. The only difference is that as soon as the stop price occurs, the trade comes up at the limit price you have configured or a better price rather than at the previous available market price.

How to place or move a Stop Loss

Majority of the brokers give a trailing stop-loss order opportunity. Decide on the number of space you intend to give for trading, for instance 5 to 10 cents, and cross-check your order. The movement of your stop loss should move as the price moves.

Traders can as well trail their stop loss manually. They basically change their stop loss price as the price moves.

A trailing stop loss is a form of trading order which enables you to set the highest value or percentage of loss you could have.

The stop price and the market price moves together when the market is swinging in your favor. On the other hand, when the market is unfavorable, the stop price stays in place.

Your profits should are with this type of order and you will not experience tangible losses.

The best of both Stop-losses and Trailing Stops

When matching traditional stop-losses with trailing stops, it is crucial to calculate your highest risk tolerance. For example, you could set a stop-loss at 5% lower than the present stock price and the trailing stop at 5.5% lower than the present stock price.

With a rise share price, the trailing stop will exceed the fixed stop-loss, making it become repetitive. Additional rise in price will denote further reducing potential losses with each upward price tick.

The protection included means that trailing stop will only go up, where during market periods, the stop’s indicator point will be consistently recalculated by the trailing feature.

Using the Trailing Stop and Stop-Loss combo on Active Investors

Trailing stops can be difficult to incorporate with active traders. As a result of price instability and the volatile nature of some stocks, majorly during the first hour of the market day. Also, fast-moving stocks basically entice traders. This is due to their possibilities to realize tangible sum of money within a short period.

The trailing stop/stop-loss combo gets rid of the emotional reaction from trading, enabling you to make rational decisions going by statistical information.

Trader risk

Traders encounter some risks in imploring stop-losses. At the initials, market makers are well-informed about any stop-losses you make with your broker and can mandate a whipsaw in the price, thereby kicking you out of your spot, then hiking the price again.

In the scenario of a trailing stop, there exists the likeliness of making it too tight during the initial stages of the stock garnering its support. In this scenario, the output will be the same where the stop initiated by a temporal price. This can be a difficult psychological state to be at.

Why Use a Trailing Stop Loss?

As humans, we are not able to always predict accurately how long a trend will go for. Hence, the need for a trailing stop loss. Traders can leverage on the trailing stop loss to take positions in the market.

Disadvantages of Trailing Stop Loss

- At times (even when you make use of a trailing stop loss) you might not still get a trend right. It still involves some forms of risk

- It is possible for you winning right now to equally run into a loss instantaneously. The price that has been swinging in your favor just now might go to hit your trailing stop loss and you start to loose.

All these makes traders to get fed up and they go on complaining that it is not effective. But the trick about it is that it will only work for those who are able to withstand the emotional swings tied to it. And they can eventually get a hold on a huge trend.

Conclusion

Both the trailing stop limit and the trailing stop loss have benefits. The way you use them will differ according to the way you trade and your target for that specific stock. You should note that order type is important, but setting stop loss at an appropriate price is more crucial. This ensures that the trailing stop loss only gets invoked when the market is not favoring you anymore.

Though there exists quite a number of risks associated with using trailing stops, merging them with traditional stop-losses can prove to be very effective in order to reduce losses and to safeguard profits.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!