If I have to name a single tool that is absolutely imperative for a trader’s success, it would be a stop-loss order. A stop-loss (abbreviated as SL) order is a crucial part of a trader’s exit plan when the market goes against expectations.

How stop-loss orders are traders’ best friends? Because they are necessary beyond your imagination. They are so important that they pull us out of a dangerous situation and limit our losses. Therefore, if you want to limit your trading risk, then forget about trading without stop-loss orders.

In today’s post, we are going to explain everything you need to know about stop-loss orders. If you are serious about your success as a trader, pay your utmost attention. Remember that, stop-losses can make as well as break traders depending on how traders use them.

What is a stop-loss order?

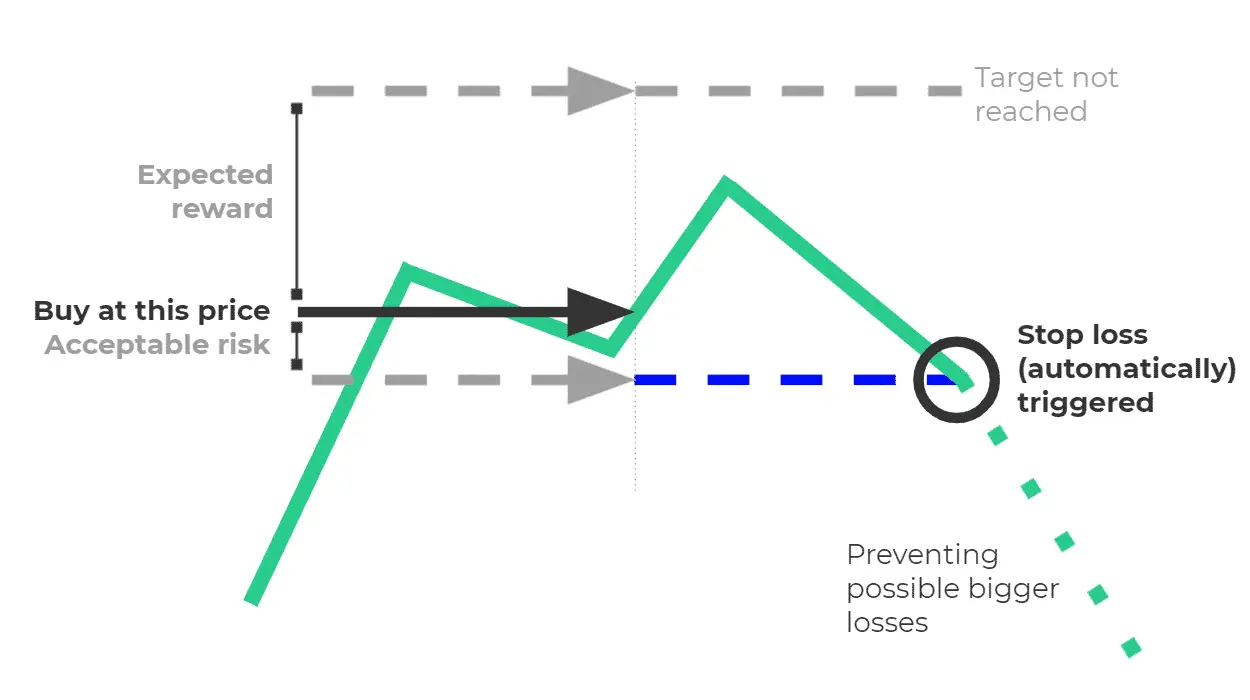

A stop-loss order is an instruction given to the trading platform to automatically close an open position when the price of the asset drops to or below a predetermined level.

On the other hand, a stop-loss order becomes a buying order when using short positions. In short positions, price increasing above the predetermined level triggers the stop-loss order.

Let’s see how a stop-loss order works by using a short example. Let’s suppose that you buy stocks at $200 in an XYZ company. You do not want to hold stocks if the price goes below $180. So, you want to sell stocks at a pre-specified level that is $180. You have two ways to do it.

The first way is to sit in front of your computer’s screen all day long and manually close your position when the stock price drops below $180. The other way is the stop-loss order. You can instruct your trading platform to sell your stocks when the price drops below $180. The second way is the better one. It saves you from closely watching stock prices. Moreover, trading platforms never sleep, they always follow the market and close your position according to the stop-loss order.

Why stop-loss orders are your best friends?

As we have already discussed that financial markets are volatile. There is always an unknown risk that prevails in the market. No one can predict what will happen in the next few hours or the next day when the market opens. For example, the pound’s price declined significantly on 27th June 2016 after the voters of the UK unexpectedly voted to leave the European Union.

Therefore, traders need a strategy to protect themselves against the market’s volatility and unknown risk. They need a strategy to limit their losses and stop-loss orders are the best exit strategies. If they don’t use stop-losses, it is quite possible that they may lose their entire trading profit, even their entire account when a large losing position gets out of control. Thus, stop-loss orders are a must for traders who are serious about their careers and want to last long in this uncertain trading world.

Advantages of stop-losses

Stop-losses have the following other key benefits.

- Stop-losses not only help you limit your losses, but they also help you lock in profits.

- They grant you freedom as you don’t have to sit all day long in front of a computer screen to watch price movements.

- Stop-losses cost you not a single penny.

- Stop-losses enable you to make trading decisions free of emotional influences.

Disadvantages of stop-losses

Stop-losses are traders’ best friends without a shadow of a doubt. However, there are a few disadvantages associated with stop-losses as well.

- There are no clear rules that describe how and where should traders place stop-loss orders.

- A very small and routine price fluctuation may trigger a stop-loss order.

- Some brokerage platforms may not allow traders to place stop-loss orders on certain securities such as penny stocks.

Who needs stop-loss orders the most?

Stop-loss orders are crucial for everyone who wants to avoid big losses. However, short-term traders and traders of some particular assets need stop-loss orders the most.

- Market volatility is a key player for short-term traders. Long-term traders least bother about volatility because they remain in the market for long and short-term volatility doesn’t affect them.

- Some assets are more volatile than others. For example, stocks are more volatile than bonds and currencies are more volatile than stocks. So, the importance of stop-losses also depends on the asset class you are trading. Stock and forex traders need stop-loss orders the most.

Popular stop-loss order strategies

The following are the most popular stop-loss strategies depending on how traders identify stop-loss levels and use stop-losses.

1. Chart SL Strategy

There are various but important technical levels on charts such as trendlines, areas of support and resistance, Fibonacci levels, etc. A trader looking for a long-term position places a stop-loss order just below one of the important technical levels. The idea behind this approach is that these important technical levels hold a huge number of buying orders. The increased number of buying orders at those levels is because of those traders who miss the opportunity earlier but now want to enter the market at the most favorable price possible. As soon as the price breaks those key areas, the stop-loss order automatically closes the trade.

On the other hand, traders looking for short positions place stop-loss just above the key technical levels on charts. The idea is that those key technical areas such as resistance level hold a huge number of sell orders. As soon as the price breaks a resistance level, a stop-loss order automatically closes the trade. Chart stop-loss strategy works in this way and yields the best results. Therefore, you should incorporate chart stop-losses in your trading strategy.

2. Volatility SL Strategy

Volatility stop-losses work on the basis of volatility. They constantly look at the market’s volatility to close trading positions. Traders using volatility stops use technical indicators that measure market volatility.

The first key indicator is Bollinger Bands is one of the most important indicators used for measuring market volatility. When the market volatility is high, Bollinger Bands widens whereas when the volatility is low, it contracts. Traders using volatility stops place stop-losses just outside the Bands.

Another key indicator that traders use for measuring market volatility is the Average True Range. Traders who use this indicator to place stop-losses place their stop-losses just outside the average range.

3. Time SL Strategy

Time stop-loss strategy, as the name suggests, refers to a strategy where the stop-loss order is placed based on a predefined period of time. For example, day traders place stop-loss orders near the end of trading hours.

4. Percentage SL Strategy

The percentage stop-loss strategy is to limit the total risk associated with a trade. It is based on the percentage of your trading capital. Traders can adjust the position size by calculating the total risk and place their stop-losses accordingly.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!