If we have to define the stock market using just one word, we would most probably define it as “volatile.” The world of stock markets is full of uncertainties. Although we conduct detailed technical and fundamental analysis, we cannot tell when the market will suddenly turn the tides. We may examine charts with the utmost care, thoroughly analyze all the patterns, and develop various strategies to trade with the market. Still, the market may surprise us. The market will move beyond any stretch of our imagination on several occasions. One such sudden market movement is “pullback.” In today’s post, we are going to explain what is a pullback? And how can you profit from it in your trading?

What is a pullback?

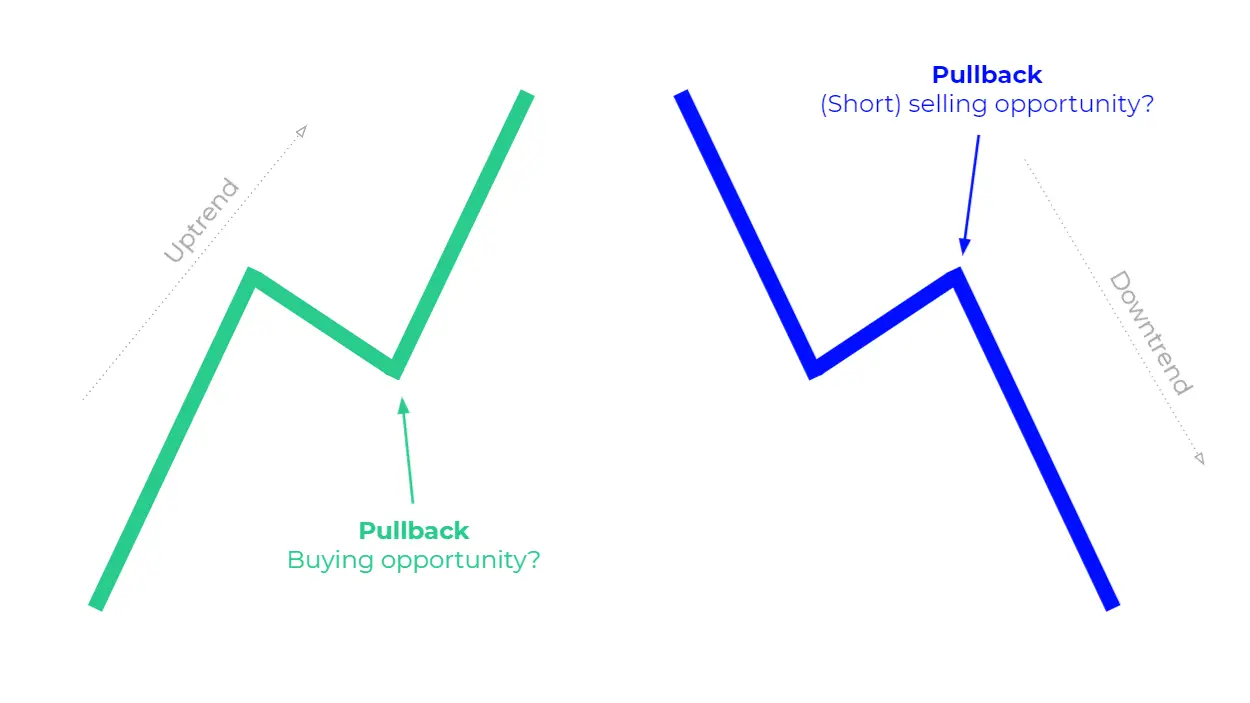

A pullback is a pause or a temporary reversal in the prices of stocks or securities during an uptrend. If you are familiar with price charts, you probably understand how stock prices behave. Prices never move straight. Prices continue to move up and down even during the strongest trends. Every time a price goes down during an uptrend, it is a pullback.

Pullbacks, retracement, and consolidation are the terms that are related. A very short temporary reversal during an uptrend is a pullback. A pullback’s duration is generally a few sessions before the uptrend continues on its original course. On the other hand, a relatively long pause before the original trend continues indicates consolidation.

There can be numerous reasons why a pullback happens. One thing is clear that market sentiment plays a key role in the occurrence of a pullback. For example, there can be news that brings changes in the overall market sentiment. Anyhow, no matter why a pullback happens, traders typically see it as a great buying opportunity. For example, a company’s positive earnings announcement push prices to new highs. However, when existing investors take their profits by selling their stocks of that company, a pullback may occur before the original uptrend continues.

Pullback Trading Strategies

The idea of trading pullbacks revolves around waiting for the price to pull back during a trend. A price pullback gives traders an opportunity to enter a trade with a better entry price. It is quite natural that everyone wants to enter a trade for the lowest possible price. So, when there is a strong uptrend in the market and you can easily predict that the uptrend will continue, traders wish to enter the trade when the price drops. Thus, pullbacks help traders find the opportunity to enter a trade for the lowest possible price.

Taking advantage of the pullbacks is a very common trading strategy. Beginners like it because it is a simple strategy. Whereas, more experienced traders wish to exploit pullbacks while trading with the trend. So, what should be your strategy to enter the market when a pullback occurs? The following is a simple but effective pullback trading strategy. Our aim is to explain the basic idea of the strategy for your comprehension.

Step-by-step example of a Pullback Trading Strategy – Trade in the Direction of the Trend

Trading in the direction of the trend is one of the simplest pullback trading strategies. To execute this strategy, you need to understand and follow simple steps.

Step 1 – Identify the trend

The first step in this pullback strategy is to identify the trend. You need to be careful here because you need a trend that is relevant to a timeframe of your choice. For example, if you are following a 1-hour timeframe, then you need to have a trend on the hourly timeframe.

Step 2 – Classify the trend

If you know about market trends, you understand that all trends are not the same. Some trends are weak while some others are strong. The three most common types of trends are;

- Strong Trend – A trend is considered strong when the price remains above 20MA.

- Healthy Trend – A trend is considered healthy when the price remains above 50MA.

- Weak Trend – A trend is considered weak when the price remains above 200MA.

You need to classify the trend before entering a trade. It is important because it helps you identify the area of value on the charts where you will enter the trade.

Step 3 – Pinpoint the area of value

The area of value is the area on charts where buying pressure plays a vital role in pushing prices higher. The area of value is different for each type of trend.

- The area of value of a strong trend is 20MA.

- The area of value of a healthy trend is 50MA.

- The area of value of a weak trend is 200MA.

Step 4 – Define entry triggers to enter the pullback trade

An entry trigger is a pattern to enter the pullback trade when all your conditions are fulfilled. However, entry triggers are different for all three types of trends.

- Buying on a pullback during a strong trend is always difficult because pullbacks during strong trends are always short. So, the plan is to buy a breakout of the swing high.

- Buying on a pullback during a healthy trend is easy because pullbacks during a healthy trend are always healthy. The plan is to look for buying opportunities in 50MA (the area of value).

- The plan during a weak trend is to look for buying opportunities in 200MA (the area of value).

Step 5 – Exit the trade to protect your gain

When you enter a trade, you act on your anticipation that the trend will continue after a pullback. You can either be right or wrong. What if you are wrong? If the trend never gets back on its original course, what should you do then? So, here are two exit strategies.

- When your anticipation is right – During a strong trend, hold on to your position to maximize your gains. However, trailing stop-loss using 20MA is always a prudent strategy. During a healthy trend, you can exit the trade before the swing high. During a weak trend, you need to exit at resistance level or the prior swing high.

- When your anticipation is wrong – During a strong trend, you can exit the trade when the price breaks below the area of value 20MA. During a healthy trend, exit the trade when the price breaks below a support level. During a weak trend, exit the market when the price breaks below 200 MA (the area of value of a weak trend).

The wrap-up

A pullback is a pause or a temporary reversal in the prices of stocks or securities during an uptrend. Traders typically see it as a great buying opportunity. There are various pullback trading strategies you can use. Trading with the trend is a simple pullback trading strategy that all traders can follow. Do you have a particular pullback trade strategy in your mind? We shall be glad to hear from you.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!