Gann Angles is among the most powerful and useful technical analysis tools. Traders use it to forecast future price movements of financial instruments like stocks, currencies, commodities, etc. According to the Gann Angles idea, price and time are interrelated. Therefore, price tends to move at certain angles.

What is Gann Angles, how does it help traders, and how to use it are some important questions. If you wanted to master the art of trading with Gann Angles, then you are on the right platform. Because we are going to help you learn how to apply Gann Angles to your trading strategy for more accurate forecasts and better trading decisions. Let’s begin right away.

Introduction to Gann Angles

Gann Angles is a powerful and effective technical analysis tool. Traders use it to forecast future price movements of financial assets like stocks, currencies, and commodities. William Gann, a veteran trader of the early 20th century, developed the concept of Gann Angles.

Gann proposed that price and time are interrelated. He believed that the market moves in predictable patterns. That’s why traders can predict those patterns by analyzing the angles that price movements form over time. The basic principle of Gann Angles is that a trendline with a certain slope indicates the direction of the market.

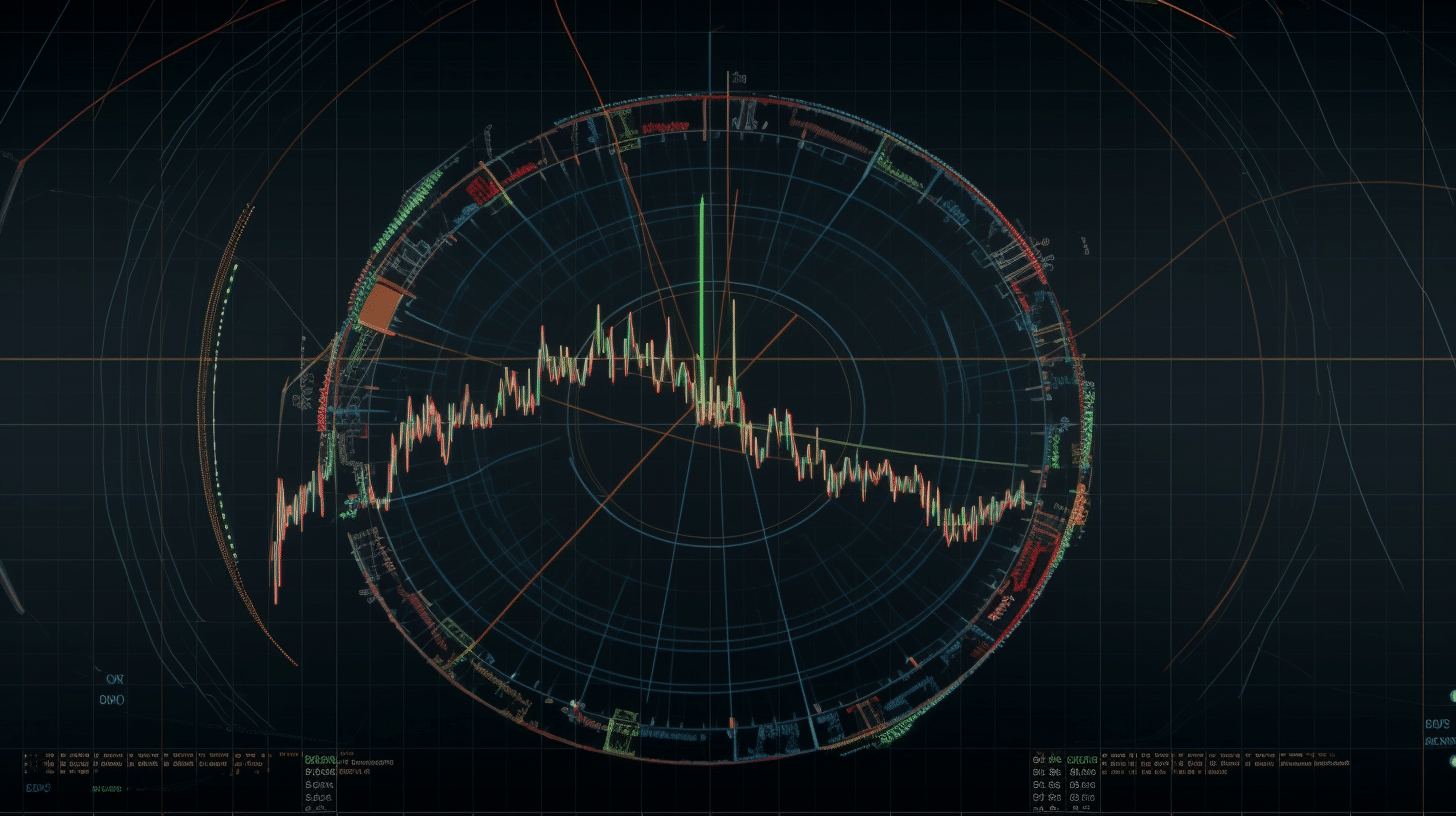

The 1×1, 1×2, and 2×1 Angles are among the most widely used angles. The 1×1 angle indicates a healthy market trend. It is a 45-degree angle that represents a balance between price and time. Whereas, the 1×2 angle represents a steeper trend and the 2×1 angle represents a more gradual trend.

What does Gann Angles tell traders?

The Gann Angles is among the most useful technical analysis tools. It helps traders in various ways.

Entering and exiting a trade

Firstly, traders use Gann Angles to enter or exit a trade. They can make these decisions by identifying potential trend lines which gives signals to enter or exit a trade.

Identifying support and resistance levels

Traders also use the angles to find potential levels of support and resistance. When the Angles are drawn on a price chart, they give a clear indication of key support and resistance levels. Afterward, traders can use these levels to set stop-loss orders and take-profit targets.

Trend reversals

Finally, traders can also use the Angles to identify potential turning points in market trends. As you know, Gann Angles is based on the premise that the market moves in predictable patterns. Traders and analysts can predict and analyze these patterns using mathematical principles. Thus, they can forecast the direction of market trends because price tends to move at certain angles. When the market trend approaches such an angle, traders seek trend reversal signals such as a shift in momentum or a break of a trend line.

How to draw the Gann Angles?

Drawing Gann Angles is relatively complex and requires you to follow the following steps.

1. The first step in drawing the Angles involves choosing a starting point. The starting point should always be a significant high or low point on the price chart.

2. Secondly, you need to determine an angle you want to use such as 1×1, 1×2, 2×1, etc. The determination of the angle depends on how much price movement you want to represent with each unit of time. For example, a 1×1 angle indicates one unit of price movement for each unit of time. Similarly, a 1×2 angle represents two units of price movement for each unit of time.

3. Thirdly, you can go on to draw the angle line from the starting point at the chosen angle. For example, you need to draw a line at a 45-degree angle from the starting point if you chose a 1×1 angle.

4. To draw multiple Angle lines at different angles, you can simply repeat the previous steps. For example, you can draw a 1×1 angle, a 1×2 angle, and a 2×1 angle to analyze price movement at different rates.

How to use the Gann Angles?

Using Gann Angles in trading involves plotting the angles on a chart by drawing a trendline at a particular angle. You can calculate the angle by dividing the price range by the time range. Afterward, traders use the angle to determine key support and resistance levels.

Using the angles isn’t an easy task. It entails following some steps to ensure accurate forecasts and better trading decisions.

1. Understand the basics of the Angles

The Angles is among the complex technical analysis tools. You cannot use the tool effectively without understanding the basics of the tool. Therefore, you need to understand the basic idea and principles of the Gann Angles to use it effectively.

2. Identify the trend

Secondly, you need to identify the current trend of the asset you want to analyze. You can use other technical analysis tools to accurately determine the trend.

3. Draw the Gann Angles

After identifying the trend, you can go on to draw the angles by following the steps explained in the previous section.

4. Draw multiple Angles

By drawing multiple angles, you can identify key levels of support and resistance. These levels help you in making key trading decisions such as entry and exit levels.

The wrap-up

Gann Angles is among the most useful technical analysis tools. It helps traders to predict future price movements and identify support and resistance levels. However, it is also important to note that using the Angles effectively requires a lot of practice and experience. Therefore, refine and hone your skills over time. Moreover. It is also a fact that the Angles is not infallible and foolproof. Therefore, you should use it in conjunction with other technical analysis tools to make more informed trading decisions.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!