The Fisher Transform indicator is an oscillator that helps traders to satisfactorily identify significant trend reversal. It identifies trend reversals through normalization of prices over a predefined number of periods by the users. It also helps to visualize the signals on the chart because of having distinct and sharp turning points reflecting points where the rate of change is highest. Traders can apply the Fisher Transform to any financial asset for increasing the odds of maximizing the overall gain. Its functioning is based on an assumption that prices in the market do not seem to have a Gaussian probability density function (Gaussian PDF). Although it is a common assumption that prices have a Gaussian or normal probability density function.

- The Fisher Transform tries to normalize asset prices (but it rarely is the case).

- Traders use it to smooth price moves and make turning points in price clearer.

- It can work in two ways, traders look for:

- extreme readings to signal potential price reversal areas

- or change in direction

- The Fisher Transform formula is applicable to other indicators (and not only the price).

What is the Fisher Transform Indicator?

The Fisher Transform indicator works by transforming prices into Gaussian normal distribution. Now, it is crucial to understand what exactly is the Gaussian probability density function. When 68% of the total samples fall within a standard deviation about the mean, a familiar bell-shaped curve is formed. This curve is known as the Gaussian PDF.

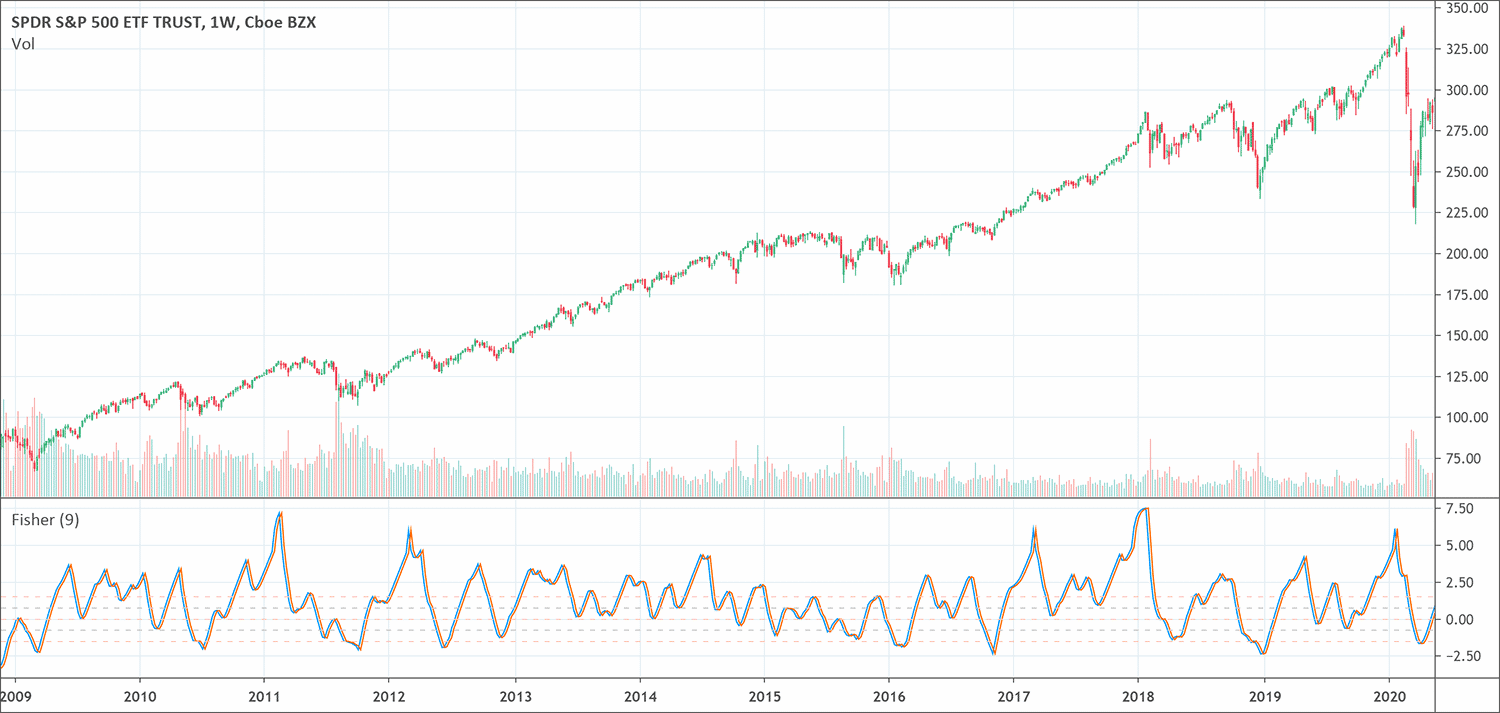

Its appearance on the chart as a pair of lines that oscillate above and below 0 having extreme points at both sides. Both of these lines track close to each other. One of the lines is the current Fisher Transform line (FTL). The second line is the signal line that is in fact FTL of the previous trading day. A bullish or bearish signal generates when the FTL intersects or when the indicator touches the extreme points (bullish or bearish extremes).

The Fisher Transform indicator transformation highlights that prices have touched the highest. This indication helps to identify the turning points in the financial asset’s price. It is also useful to identify trends and to isolate the trend’s different price waves. It is very interesting to know that the Fisher Transform indicator works well with other indicators as well for confirmation. In the Stock and Commodity Magazine, John Ehlers presented Fisher Transform in 2002. Ehlers was an academic and trading professional whose mighty pen always wrote something exceptional for the traders.

The calculation of the Fisher Transform

The Fisher Transform indicator has the following formula.

Fisher Transform = ½ * ln (1 + X / 1 -X)

where ln shows the natural logarithm while X is the transformation of price to bring it to a level between +1 and -1

How does the indicator function?

The Fisher Transform indicator functions to transform prices into a sine wave. The purpose of this wave creation is to identify extremes in the market. These extremes represent the levels where prices normally begin to revert to a more normalized state. This wave formation may depend on the closing, opening, high, low, or average prices. When the Fisher Transform Line (FTL) intersects the signal line, a basic signal appears. It produces more advanced signals when it reaches extreme levels. After reaching extremes as compared to the recent price action, the indicator also reaches the extremes. Hence, after the extremes, a reversal to mean prices is expected by the traders.

What does the Fisher Transform indicator tell traders?

When the top and bottom guides are adjusted well, the Fisher Transform indicator gives quality trading signals. As we have already discussed that it has a range between +1 and -1. If the Fisher Transform Line crosses the signal line, it is definitely a strong signal that demands a response. A sell signal is generated when the Fisher touches the extreme and crosses the below signal line as well. Conversely, a buying signal is generated when the Fisher is reaching the lowest extreme and crosses above the signal line. Some

How to use the Fisher Transform?

The Fisher Transform indicator transforms prices into a normal distribution. Traders can use this normal distribution for technical analysis. When the Fisher Transform is above 0 and ascending, it is an overbought market condition. When the Fisher Transform indicator is below the 0 and descending, it is an oversold market condition. Both of these conditions indicate an upcoming trend reversal. For example, after a solid price increase and the Fisher Transform indicator reaches the extremes, it indicates that the price will drop or has already started to drop.

This indicator has also other ways for traders to use it. For example, when the Fisher Transform Line drops below the Zero Line after touching the extreme point, traders consider it a signal to sell a long position. However, every signal of the Fisher Transform indicator isn’t always a valid signal. It may produce some invalid signals like the rest of the indicators. That is the reason that technical analysts and experts advise to use the Fisher Transform indicator in conjunction with other technical indicators.

What are the pros and cons of the indicator?

Technical analysis tools are essential tools that assist traders to predict currencies, cryptocurrencies, stocks, etc. will move upward or downward. And it is also crucial to be aware of the strengths and weaknesses of your analysis tool to avoid any misfortune from happening.

The pros of the Fisher Transform indicator

- The Fisher Transform indicator produces sharper and timely price reversal signals than most of the other technical analysis tools.

- The Fisher Transform indicator makes turning points in prices more clear because it tries to normalize asset prices.

- Its transfer response is expansive.

- It helps traders to identify a trend and then enter a pop in the direction of the trend.

- Traders like it for having no lag.

- It is also an exceptional medium to improve upon other technical indicators.

- Its signals are easy to identify and its tool is adaptable to day trading.

Cons of the Fisher Transform indicator

- It may not always provide reliable signals because it tends to normalize asset prices that are not distributed in a normal routine.

- It may prove noisy sometimes because it is not necessary that price reversal follows extreme readings every time.

- The financial data is usually more diverse making tails of the curve fatter as compared to the normal distribution. It is always a risky strategy to assume that financial markets follow a normal distribution. This strategy may well lead traders to underestimation of the probabilities of outliers.

- It is also confusing to what qualifies to be branded as extremes.

- Many of the price movements may be short-lived making it difficult for the Fisher Transform indicator to give the timely signal.

Conclusion

There are many indicators for many purposes. Some of them are complex and some are comparatively easy to handle. The Fisher Transform indicator is an oscillator that is easy to handle. It highlights the potential price reversal in the market by transfiguring price into a Gaussian normal distribution density function. It makes turning points in prices more clear. The clarity of the signals sings the benefits of the indicator. However, there is always a downside. Applying normal distribution to financial data may produce some false signals. Therefore, technical analysts and experts suggest using the Fisher Transform in tandem with technical analysis tools and analytical methods to take full advantage of this indicator. Moreover, it is always wise to study and observe an indicator well before incorporating it into your trading plan.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!