- Fibonacci Retracement gives traders levels for the price to retrace after

- 23.6%, 38.2%, 50%, 61.8% and 78.6% are the most common levels.

Fibonacci Retracement or Fib Retracement is a technical analysis tool that traders use to predict areas of interest on a chart. Fib Retracement is a predictive indicator because it tries to predict future price reversals. Technical analysts and traders believe that after a period of declining or rallying, price will often return or retrace back to the previous level before continuing its journey in the original direction.

It is based on the Fibonacci sequence and Fibonacci ratios introduced by Leonardo Fibonacci. Leonardo was an Italian mathematician from Pisa. He introduced the Hindu-Arabic numeral system to Europe about 700 years ago. Fibonacci sequence and Fibonacci ratios are very interesting not only on theoretical grounds. They are interesting and fascinating because they are present around us in the physical world. It is mesmerizing to know that these mathematical calculations are in fact crucial for the balance in nature, architecture, and many more. These calculations are also vital in the financial markets. Traders widely use it to find out support and resistance levels in the trading strategies.

The Fibonacci Sequence

The Fibonacci sequence defines as the sequence 1,1,2,3,5,8,13,21 and so on. The previous two numbers in the sequence add to give the next number in the Fibonacci sequence such as 1 and 2 give 3 and 2 and 3 give 5, and so on.

The Fibonacci Ratios

The Fibonacci sequence is interesting but not as much as the Fibonacci ratios. The ratio of any number in the sequence to the next gives approximately .618. Such as:

13/21 = 0 .618 21/34= 0.618 34/55 = 0.618

That is not all. The ratio of any number in the sequence to two numbers ahead gives approximately. 382 and three places ahead give approximately 0.236.

On the other hand, if dividing a number in the Fibonacci sequence by the previous number gives approximately 1.618. Traders call this Fibonacci ratio as Golden Ratio, Golden Mean, or Phi. The inverse of the Golden Ratio is .618 and both of these Fibonacci ratios play a vital role in biology, the cosmos, and throughout nature. It is an astonishing fact that Greeks had great regard for Fibonacci ratios as these ratios were foundations of their art and architecture.

This was brief information about the Fibonacci sequence and Fibonacci ratios. Now let us talk about how the Golden ratio and other Fibonacci calculations are used in financial trading?

First of all, these Fibonacci ratios convert into Fibonacci Retracement levels. The Fibonacci Retracement level calculations then provide potential turning points where changes in the market are expected.

What are Fibonacci Retracement Levels?

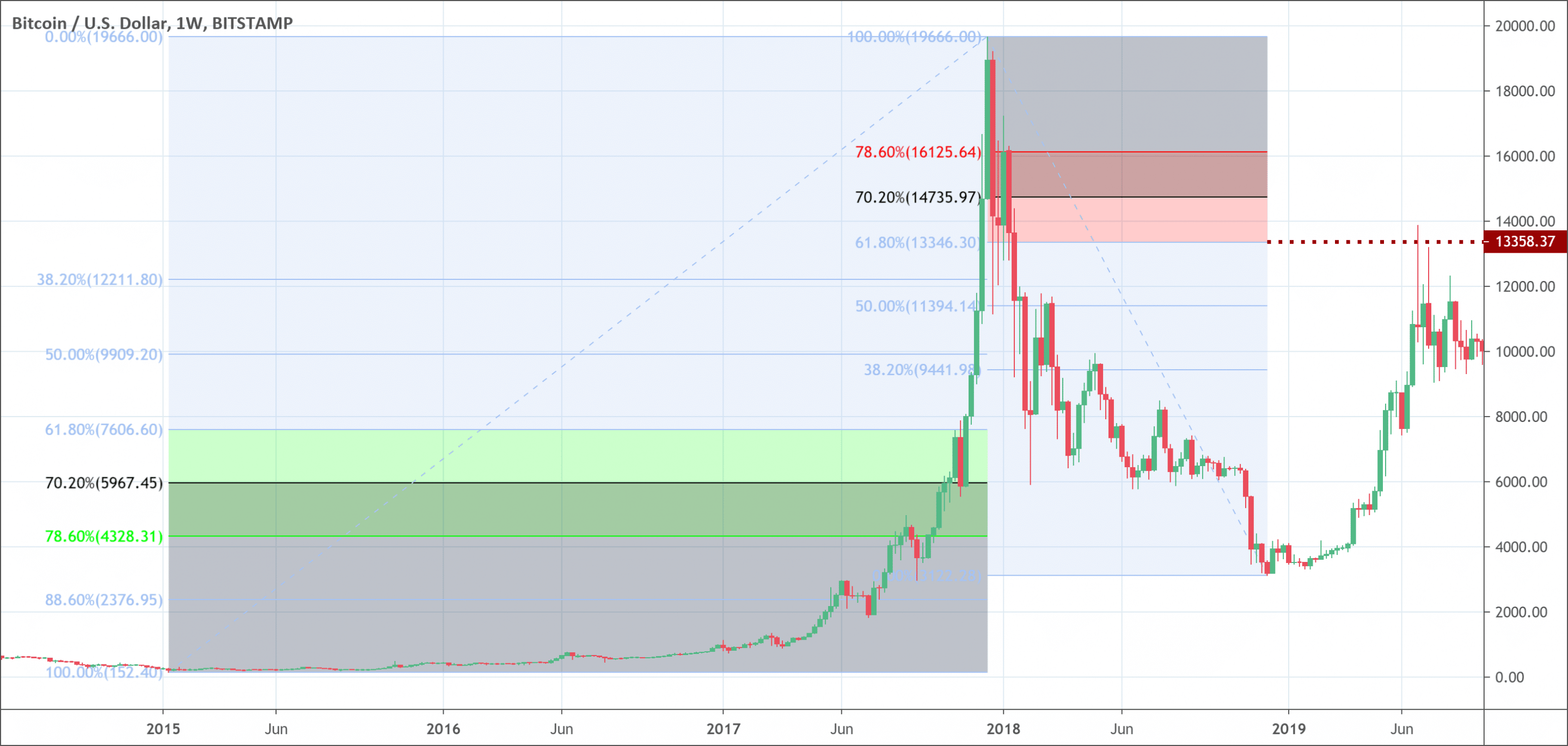

The horizontal lines on the chart that indicates occurring points of support and resistance are known as Fibonacci retracement levels. They are derived from the Fibonacci sequence and each level is represented with a percentage. The percentage tells about the retracement level. Fibonacci retracement levels connect any two relevant points. A high and a low point are by default connected by the Fibonacci Retracement. 23.6%, 38.2%, 50%, 61.8%, and 78.6% are percentages that are most common. These percentages tell traders about the areas where the price may stall or reverse. There is no formula to calculate Fibonacci retracement levels. The user of the Fib Retracement indicator chooses two points after small calculations, the chosen points connect through lines. For example, if the price rises from $10 to $20, and these two points are chosen as well. Then, the 23.6% level will be:

{20 – (10 × .236)} = 17.64

And the 50% level will be:

{20 – (10 × .50)} = 15

How to use Fibonacci Retracement Levels?

The prior move in the market defines Fibonacci retracement levels.

- Traders measure the rise of price from bottom to top to determine the retracement level. This level will tell about the retracement of the price before rising and continuing in the upward direction.

- Traders measure the fall of price from top to bottom to find the retracement level. It will indicate the retracement of the price before going further low and continuing in the downtrend.

- The uptrend makes traders use the buying pattern. After determining the retracement of a move, let us suppose move A before it finds support and jumps higher to point B. These support levels can be any of the Fibonacci retracement levels 23.6%, 38.2%, 61.8%, and 78.6%.

- The downtrend makes traders use the selling pattern. After determining the retracement of a move, let us suppose move A before it finds resistance and moves further lower to point B. Point B can be any level among the Fibonacci levels listed before.

However, it is a common practice among technical analysts and traders to use other technical analysis tools in combination with the Fibonacci retracement for confirmation. Such combinations increase the odds of assessment of the levels on which the price may take a turn.

What does the Fibonacci Retracement tell traders?

Traders can use the Fibonacci retracement to determine potential points to enter the trade, stop-loss points, and price targets. The strategies may vary from person to person based on the individual set up, trading style, risk management, and overall trading strategy. Some traders prefer to profit from the range between the two retracement levels. For example, during an uptrend, buying at 61.8% and selling at 38.2% after retracement could be an enticing strategy.

Elliot Wave Theory is the perfect partner of the Fibonacci Retracement. The couple exquisitely finds potential areas of interest and the relationship between the waves. This can be a very interesting strategy to try to predict the level of retracement in different waves. Moreover, the experts also advise using the Fib retracement indicator with other technical analysis tools to make it a more powerful indicator. It is necessary for better signals confirmation, risk management, and overall trading.

Limitations of the Fibonacci Retracement

Despite being one of the most useful trading tools, the Fib retracement also has certain limitations. It doesn’t identify the exact turning point in the market. It may give an estimated entry level but cannot indicate an exact entry point. Moreover, it also doesn’t guarantee that prices will move as the Fib retracement predicts. It also fails for very small price movements. So, it is absolutely imperative to keep tabs on the limitations of the Fibonacci retracement.

Furthermore, another point of debate is the numerical anomaly of the Fibonacci retracement. That numerical calculations are only products of a mathematical process and have no ground in any logical proof. Even though it doesn’t make Fib retracement inherently undependable or unreliable. The fact is, it can be and it is uncomfortable for the traders who want to understand the reasoning, logic, and rationale behind the Fibonacci retracement strategy.

Conclusion

Nature seems heavily rely on the Fibonacci ratios, Golden Ratio, and sequence. These are interesting calculations that have found their use in financial trading. Fibonacci retracement is a significant useful trading tool to identify areas of interest on the chart. The usefulness of the Fib retracement, however, also depends on the attention of the number of participants in the market. Other indicators such as Elliot Wave Theory dramatically increase the power of the Fibonacci retracement. But, there are certain limitations as well that must be accounted for before riding the luxury wheels of the Fibonacci retracement.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!