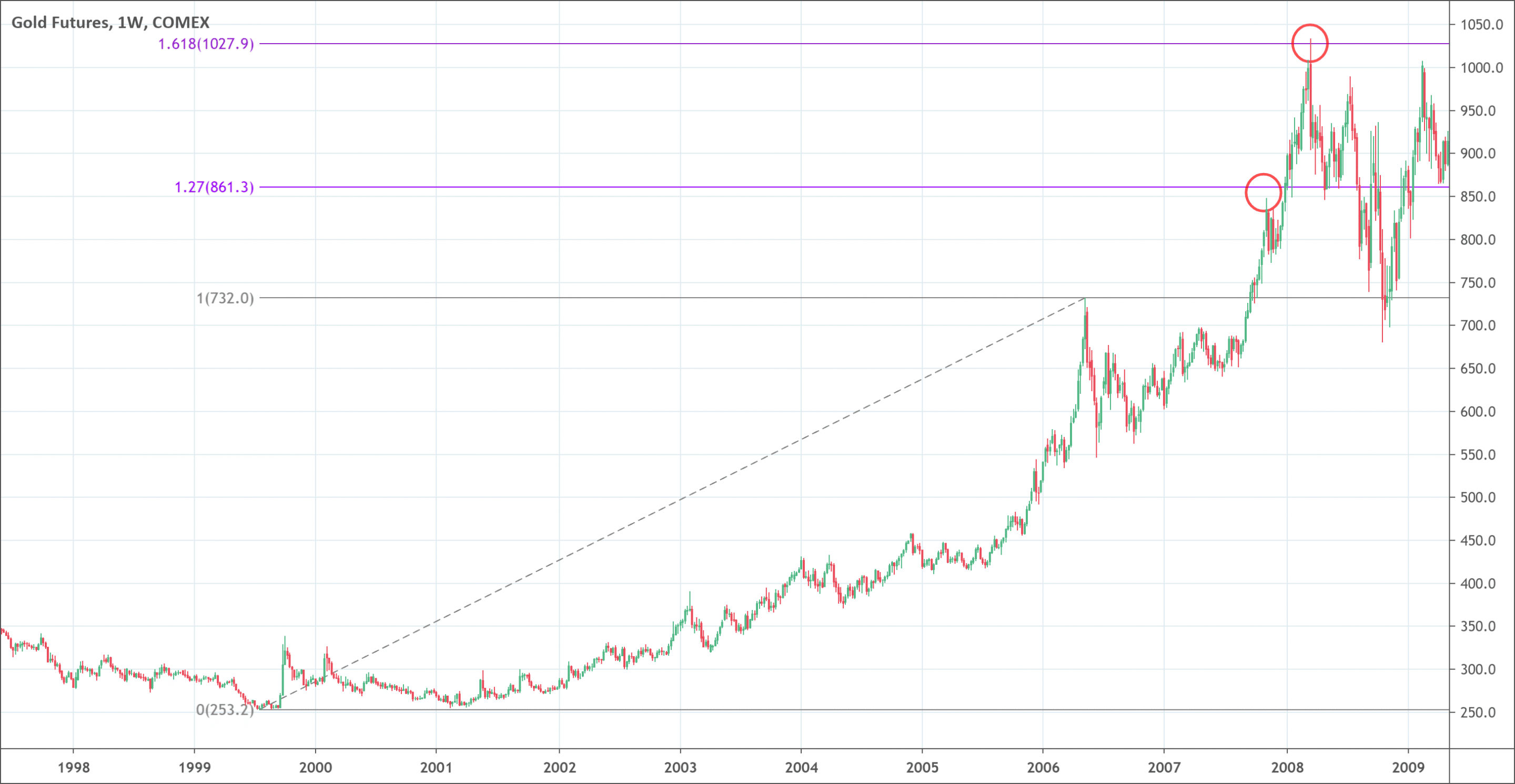

- Fibonacci extensions are projections to give clues about where price could reverse in unchartered territories.

- 123.6%, 138.2%, 150%, 161.8%, and 178.6% are the most important Fibonacci extensions levels.

Fibonacci extensions, also known as Fibonacci expansions or Fibonacci projections, are external levels because they go beyond the 100% level. You may already know about the Fibonacci levels. 23.6%, 38.2%, 50%, 61.8%, and 78.6% are known as the Fibonacci levels. These are all internal levels as they lie inside the threshold. But there are also levels that go beyond the threshold of 100%. Price actions react regularly to these external levels.

Some traders use the Fibonacci extension levels to identify the areas of support and resistance. It also helps measure the price moves that are larger than the last one because Fib extensions go beyond 100%. However, Fib extension, unlike Fibonacci retracement, relies on three points. These three points join to form a Fib extension. 123.6%, 138.2%, 150%, 161.8%, and 178.6% are the most important Fibonacci extensions.

These extensions are based on the Fibonacci sequence and Fibonacci ratios introduced by Leonardo Fibonacci. Leonardo was an Italian mathematician from Pisa. He introduced the Hindu-Arabic numeral system to Europe about 700 years ago. Fibonacci sequence and Fibonacci ratios are very interesting not only on theoretical grounds. They are interesting and fascinating because they are present around us in the physical world. It is mesmerizing to know that these mathematical calculations are in fact crucial for the balance in nature, architecture, and many more. These calculations are also vital in the financial market. Traders widely use it to find out support and resistance levels in the trading strategies.

The Fibonacci Sequence

The sequence 1,1,2,3,5,8,13,21 and so on is known as Fibonacci sequence. The previous two numbers in the sequence add to give the next number in the Fibonacci sequence such as 1 and 2 give 3 and 2 and 3 give 5, and so on.

The Fibonacci Ratios

The Fibonacci sequence is interesting but not as much as the Fibonacci ratios. The ratio of any number in the sequence to the next gives approximately .618. Such as:

13/21 = 0.618

21/34= 0.618

34/55 = 0.618

That is not all. The ratio of any number in the sequence to two numbers ahead gives approximately. 382 and three places ahead give approximately 0.236.

On the other hand, if dividing a number in the Fibonacci sequence by the previous number gives approximately 1.618. This Fibonacci ration is known as Golden Ratio, Golden Mean, or Phi. The inverse of the Golden Ratio is .618 and both of these Fibonacci ratios play a vital role in biology, the cosmos, and throughout nature. It is an astonishing fact that Greeks had great regard for Fibonacci ratios as these ratios were foundations of their art and architecture.

This was brief information about the Fibonacci sequence and Fibonacci ratios. Now, let us discuss the Fib levels above 100. Fib extensions are calculated by simply adding 100 to retracement levels such as 23.6 plus 100 yields 123.6.

The transition from the Fibonacci retracement to Fibonacci extension

Fib retracement is used when the price moves are within the trend. When the price goes above the 100% Fib level of the base trend, the transition takes place from retracement to the Fib extension. This transition signifies that reversal is of a large magnitude as compared to the measured base trend before the transition.

How to draw Fibonacci extensions?

As we have discussed earlier that three points are involved in the Fibonacci extension. The identification of all these three points is necessary to draw the Fib extension. During a bullish trend, the three points are the minimum point from where the trend begins, the maximum point where the trend ends, and the minimum point where the pullback reaches. The bearish trend also follows the same logic but in reverse.

What does the Fibonacci extension tell traders?

The Fibonacci extension tells traders about the support and resistance levels or to establish the price targets. Sometimes prices move into areas where all other indicators fail but the Fib extension doesn’t. The traders who go long on stock can use the Fib extension to predict where the stock may reach. Similarly, it also tells traders about profit target placement. It allows the traders to assess their options whether or not they want to cover positions at that level. One of the main advantage of the Fib extensions is that they can apply to different timeframes. When multiple levels from different timeframes with different waves meet at one point, that area is considered a very important one.

How to use Fibonacci extensions?

The Fibonacci extensions can help identify the entry point. When the prices conform or react on a level, it can be a breakout or a bounce. Prices may stall or change direction after bouncing. In this situation, the traders may follow a price move to the previous level of the Fib extension. In the case of the breakout, it is wise to trade in the direction of the breakout and set the next extension level as the target.

The Fibonacci extension can also help to place a stop-loss. It suggests placing the stop-loss level beyond the level of current trade. When this distance is too long from the entry point, then the use of a swing top/bottom closer to entry point is suggested. However, it is important to assess and analyze market conditions at each level of the Fibonacci extension. Moreover, consideration of other factors such as the average daily range and volatility increases the odds of setting better take profit targets. For example, more volatility indicates possibilities of bigger moves and vice versa.

The limitations of the Fibonacci extensions

The Fibonacci extensions does not indicate about buying or selling of a stock. It also does not ensure whether or not the price will reach or reverse at a given extension level. It is always a tough cookie to decide which extension level is more important. The price may ease pass through many extension levels or it is also possible that it may not reach any one of them. So these are the difficulties that come with the Fibonacci extension. That is the reason that traders are advised to use other technical analysis tools in conjunction with the Fib extensions to enhance the chances of successful trading.

Conclusion

The Fibonacci extension is a fascinating tool for financial trading to determine the areas of support and resistance. It works where most of the other technical tools fail. Feel free to use the Fib extension on all timeframes and in any market. It can also be used to predict points of reversal, however, it is not advised in this particular sense. Keep in mind that the Fibonacci levels are just a guide because prices may or may not stop exactly at the Fibonacci levels. It is also impossible to predict the behavior of the prices through the Fib extension. Some of the experts also prefer the Fibonacci extension for long-term trading and advise not to use for short-term trading. However, it is one of the most reliable trading tools out there in the market. There are certain tools that can help the Fibonacci extension and enhance its power significantly.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!