- The downside gap three methods is a 3-bar candlestick pattern.

- It appears during a downtrend.

- The first two candles have a gap down between them while the third candle covers the gap between the first two.

Statistics to prove if the Downside Gap Three Methods pattern really works

Are the odds of the Upside Gap Three Methods and Downside Gap Three Methods pattern in your favor?

How does the Upside Gap Three Methods and Downside Gap Three Methods behave with a 2:1 target R/R ratio?

From our research the Upside Gap Three Methods and Downside Gap Three Methods pattern confirms 38.5% of the time on average overall all the 4120 markets we analysed. Historically, this patterns confirmed within 7 candles or got invalidated within 5 candles. If confirmed, it reached the 2:1 R/R target 37.8% of the time and it retested it's entry price level 94.9% of the time.

Not accounting for fees, it has an expected outcome of 0.133 $/$.

It means for every $100 you risk on a trade with the Upside Gap Three Methods and Downside Gap Three Methods pattern you make $13.3 on average.

Want to account for your trading fees? Have the detailled stats for your favorite markets / timeframes? Or get the stats for another R/R than 2:1?

🚀 Join us now and get fine-tuned stats you care about!

How to handle risk with the Upside Gap Three Methods and Downside Gap Three Methods pattern?

We analysed 4120 markets for the last 59 years and we found 36 932 occurrences of the Upside Gap Three Methods and Downside Gap Three Methods pattern.

On average markets printed 1 Upside Gap Three Methods and Downside Gap Three Methods pattern every 422 candles.

For 2:1 R/R trades, the longest winning streak observed was 11 and the longest losing streak was 17. A trading strategy relying solely on this pattern is not advised. Anyway, make sure to use proper risk management.

Keep in mind all these informations are for educational purposes only and are NOT financial advice.

If you want to learn more and deep dive into candlestick patterns performance statistics, I strongly recommend you follow the best available course about it. Joe Marwood (who's a famous trader with more than 45 000 Twitter followers) created an online course called "Candlestick Analysis For Professional Traders" in his Marwood Research University. There he will take you through the extensive backtesting of the 26 main candlestick patterns. He then summarizes which one is THE best pattern. Do you know which one it is?

Remember, don't trade if you don't know your stats. Click here to signup to the course now!

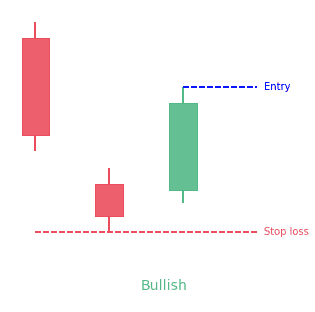

What is the downside gap three methods candlestick pattern?

The downside gap three methods candlestick pattern appears during a downtrend and consists of three candles. The first two candles have a gap down between them while the third candle covers the gap between the first two. The gap between the first two candles simply gets filled. Whenever the black candles own higher volume than the white ones, it is not a concern for the traders to take full advantage of one white profit-taking day for the shorts. The reason is that the downside gap three methods pattern ensures that the downtrend will continue. However, technical analysts and experts suggest investigating the previous weeks to see if this is the first gap. Hence, the downside gap three methods is a bearish continuation pattern.

How to identify the candlestick pattern?

The downside gap three methods pattern is a three stick pattern. It is more reliable than any other pattern with a single candle. However, it occurs very rarely and it is always a bit tricky to identify a three candlestick pattern. For a downside gap three methods candlestick pattern to form, the following characteristics must be there.

- It must occur during a downtrend.

- The first candle must be a long black candle.

- There must be a gap down between the first and second candle and their shadows must not overlap.

- The second candle is also long and black.

- The third candle is white with open within the real body of the second candle. It closes within the real body of the first candle.

- The third candle must also fill the gap between the first two candles.

If all these characteristics are there in a pattern, it means it is a downside gap three methods candlestick pattern.

What does the pattern tell traders?

The downside gap three methods candlestick pattern tell traders about the possibility of the continuation of a downtrend or bearish trend. When the market is facing a downtrend, the appearance of the first candle with the close well below the open suggests that the decline continues. The wide range real body of the first candle enhances the confidence of the bears and push bulls to the defensive line. The formation of the second candle with a down gap and prevalent selling pressure justifies the concerns of the bulls. It is due to security prices continuing to drop and this time droping to a new low.

Now, the gap between the first and the second candle is covered by the third as a result of short coverings. The filling of the downside gap indicates to the bears that the downtrend will resume. Traders may look for the following possible trading opportunities to take full advantage of the downside gap three methods pattern.

- Enter a long position in the direction of the trend by setting risk parameters.

- Initiate a trade at the closing price of the third candle.

- Place a stop-loss just below the low of the first candle.

Moreover, traders can use the downside gap three methods candlestick pattern in combination with other technical analysis tools as per their trading strategies.

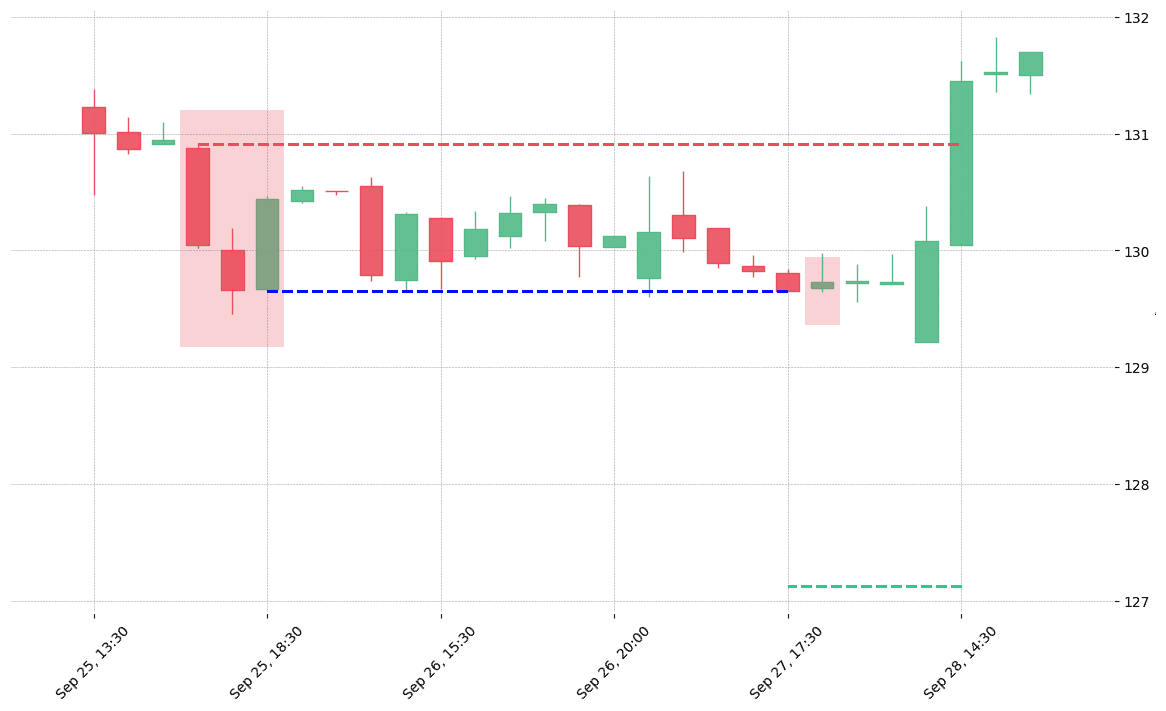

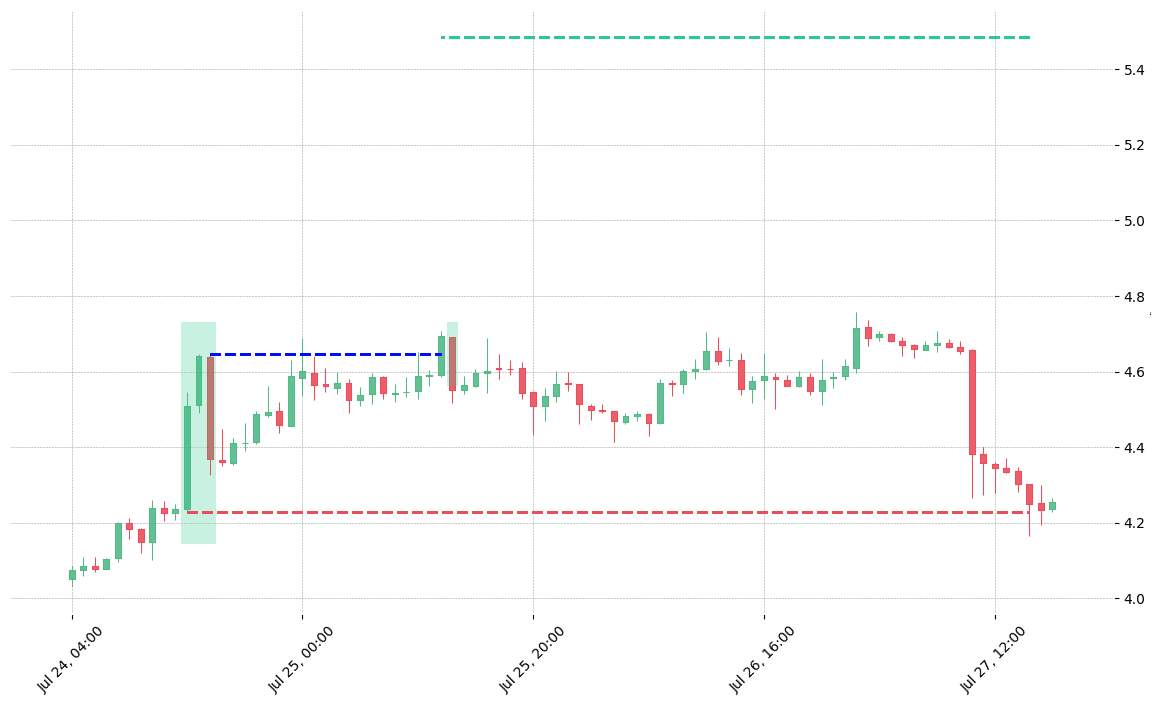

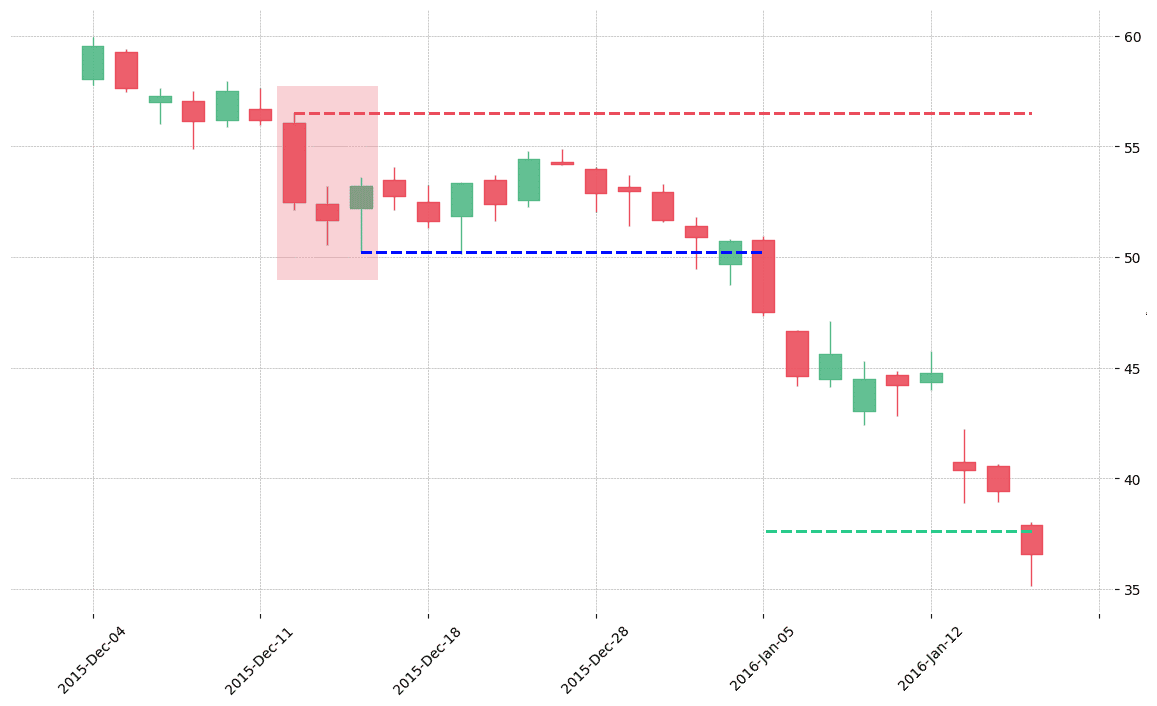

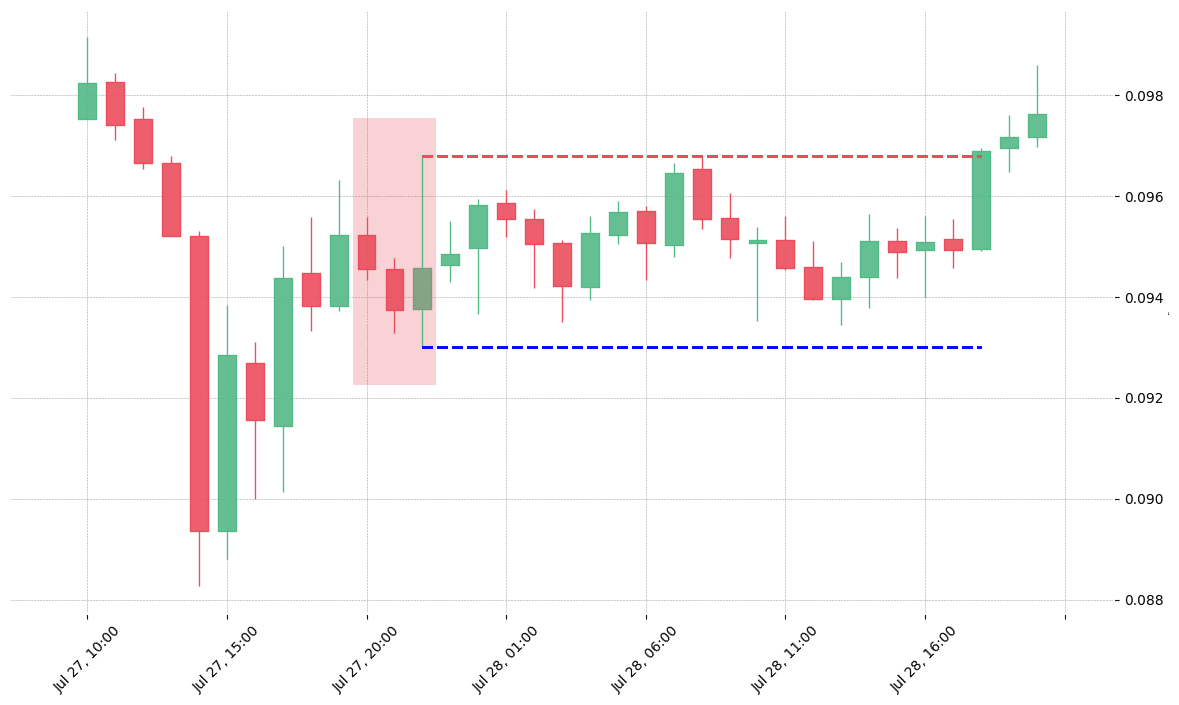

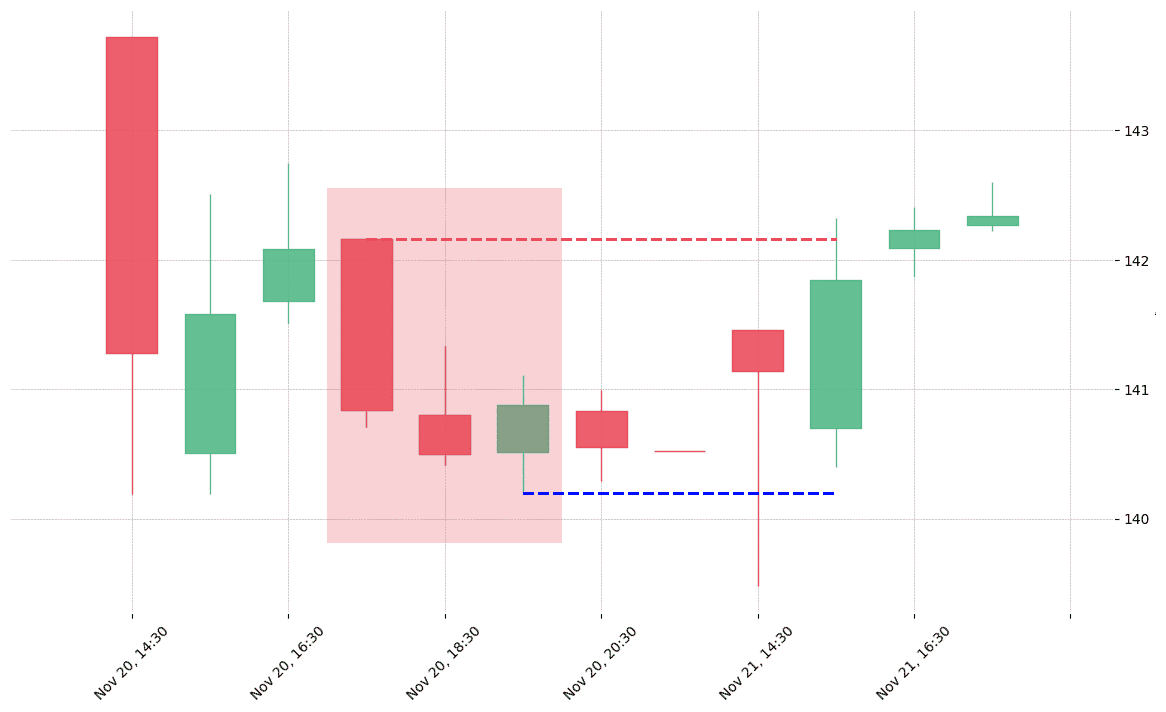

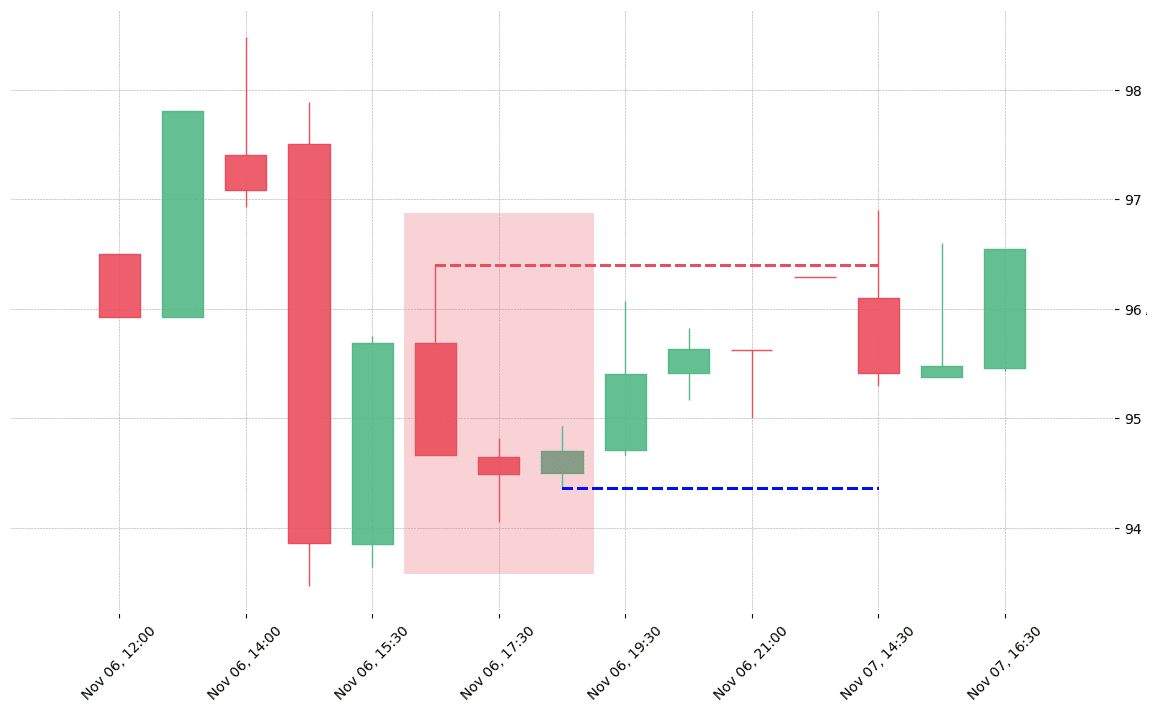

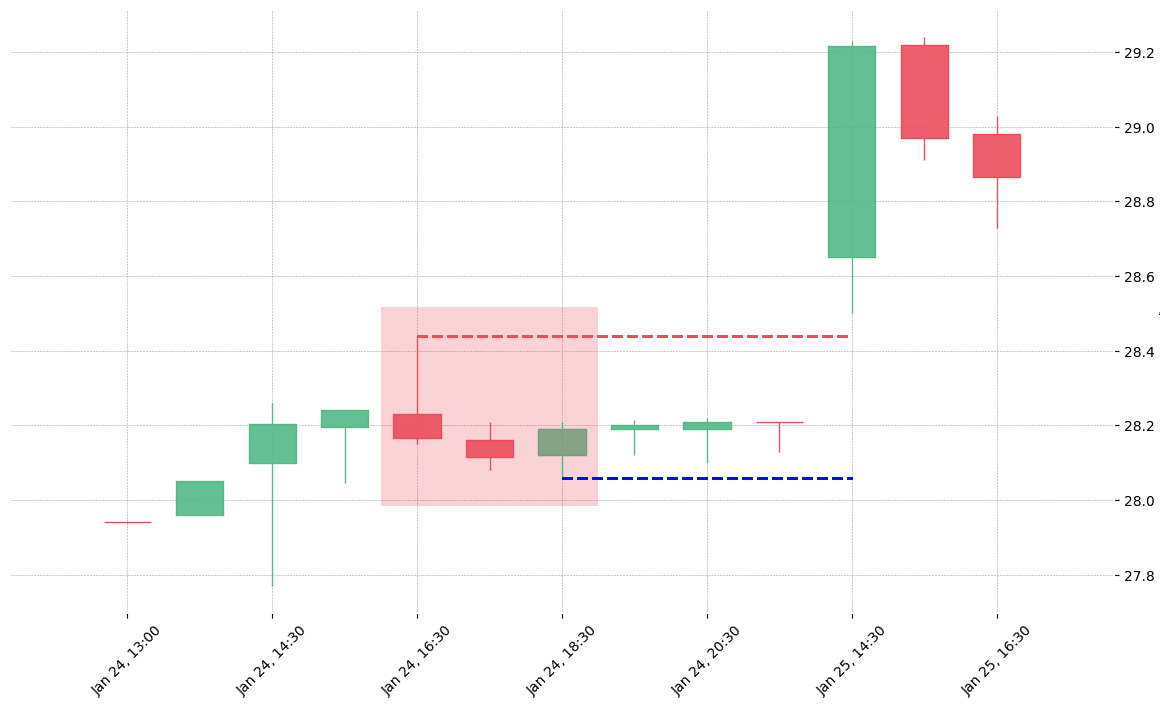

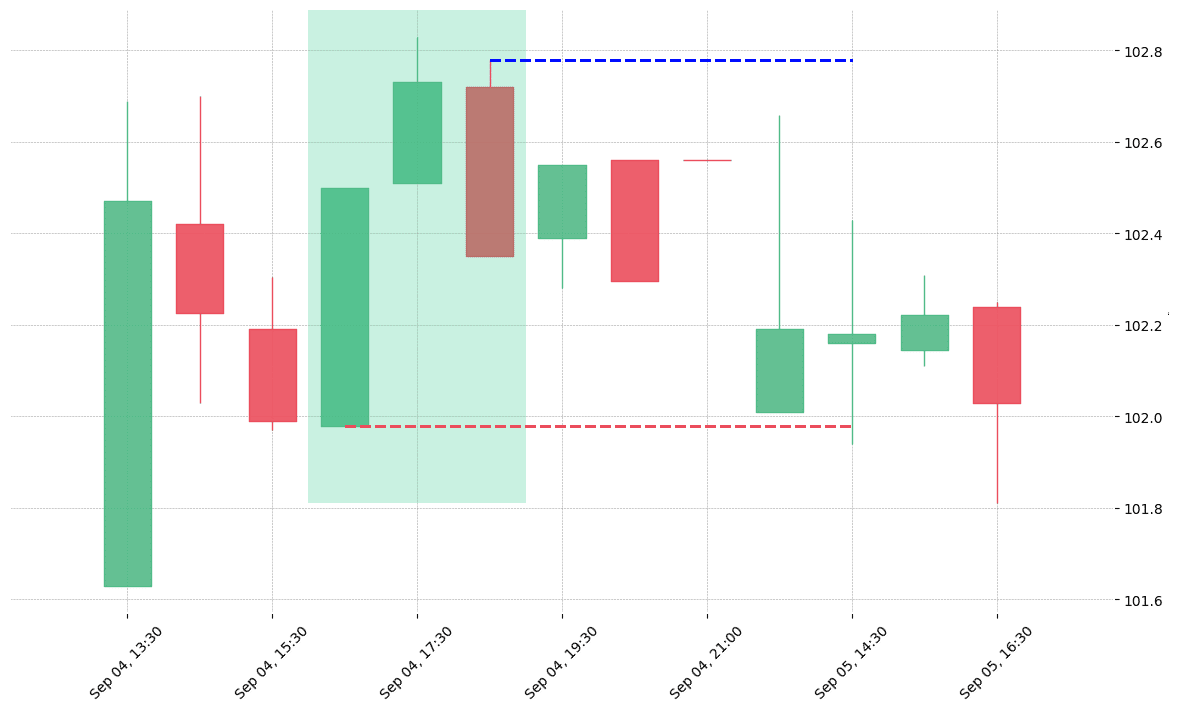

How does the Downside Gap Three Methods pattern look in real life?

Looking to learn more about this pattern?

You should take a look at Joe Marwood's online course. In his course, he backtested the 26 main candlestick patterns before to summarize which one is THE best pattern. I really liked his course and you shouldn't miss it!

Click here to signup to his "Candlestick Analysis For Professional Traders" course now!

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!