- The down-gap side by side white lines candlestick pattern is a 3-bar bearish continuation pattern.

- It appears during a downtrend.

Statistics to prove if the Down-Gap Side By Side White Lines pattern really works

Are the odds of the Up Gap Side by Side White Lines and Down Gap Side by Side White Lines pattern in your favor?

How does the Up Gap Side by Side White Lines and Down Gap Side by Side White Lines behave with a 2:1 target R/R ratio?

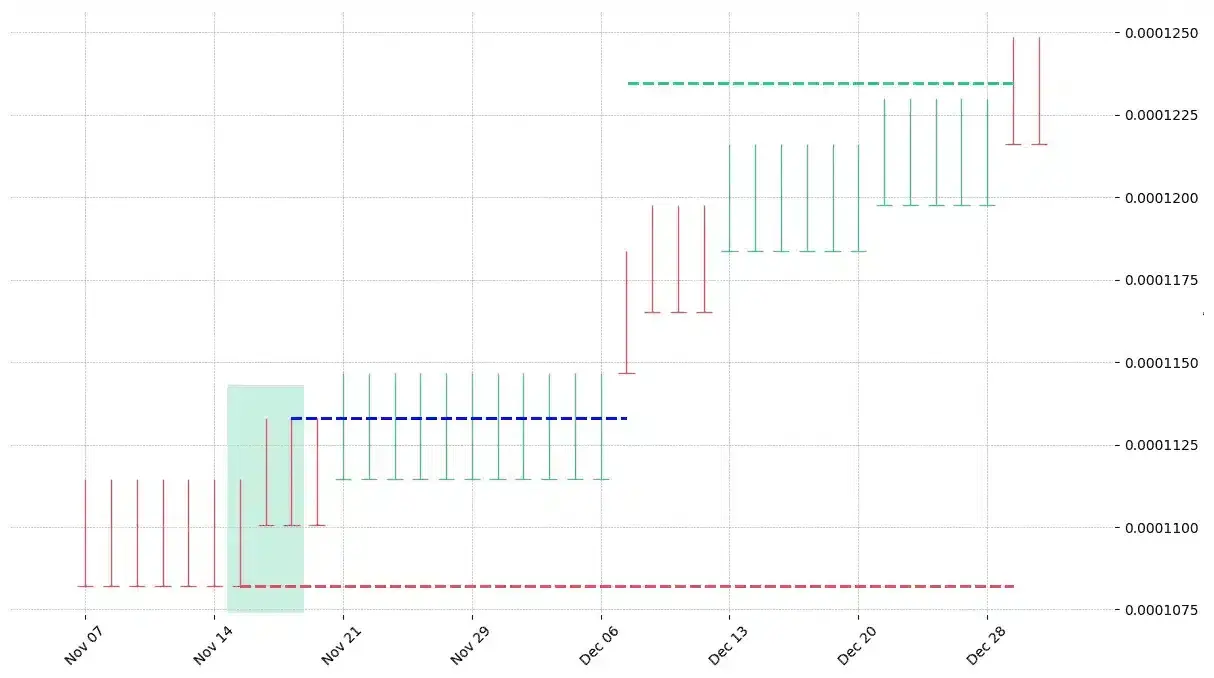

From our research the Up Gap Side by Side White Lines and Down Gap Side by Side White Lines pattern confirms 88% of the time on average overall all the 4120 markets we analysed. Historically, this patterns confirmed within 1.1 candles or got invalidated within 6.6 candles. If confirmed, it reached the 2:1 R/R target 33.8% of the time and it retested it's entry price level 98.6% of the time.

Not accounting for fees, it has an expected outcome of 0.013 $/$.

It means for every $100 you risk on a trade with the Up Gap Side by Side White Lines and Down Gap Side by Side White Lines pattern you make $1.3 on average.

Want to account for your trading fees? Have the detailled stats for your favorite markets / timeframes? Or get the stats for another R/R than 2:1?

🚀 Join us now and get fine-tuned stats you care about!

How to handle risk with the Up Gap Side by Side White Lines and Down Gap Side by Side White Lines pattern?

We analysed 4120 markets for the last 59 years and we found 64 743 occurrences of the Up Gap Side by Side White Lines and Down Gap Side by Side White Lines pattern.

On average markets printed 1 Up Gap Side by Side White Lines and Down Gap Side by Side White Lines pattern every 241 candles.

For 2:1 R/R trades, the longest winning streak observed was 18 and the longest losing streak was 52. A trading strategy relying solely on this pattern is not advised. Anyway, make sure to use proper risk management.

Keep in mind all these informations are for educational purposes only and are NOT financial advice.

If you want to learn more and deep dive into candlestick patterns performance statistics, I strongly recommend you follow the best available course about it. Joe Marwood (who's a famous trader with more than 45 000 Twitter followers) created an online course called "Candlestick Analysis For Professional Traders" in his Marwood Research University. There he will take you through the extensive backtesting of the 26 main candlestick patterns. He then summarizes which one is THE best pattern. Do you know which one it is?

Remember, don't trade if you don't know your stats. Click here to signup to the course now!

What is the down-gap side by side white lines candlestick pattern?

The down-gap side by side white lines candlestick pattern is a bearish continuation pattern that appears during a downtrend. It appears when the bearish pressure begins to overpower the market and price creates a gap-down. It indicates that sellers are ready to cover their positions. However, the down-gap side by side white lines pattern is a very rare pattern. It is very unusual to have two wicks on the small candlesticks. Furthermore, the down-gap side by side white lines can be invalid if the next candlestick is not a bearish one or if it does not open in a bearish gap.

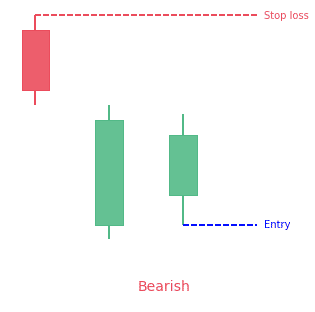

How to identify the pattern?

The down-gap side by side white lines candlestick pattern is a bearish pattern occurring during an uptrend. It also has the following characteristics that can be used as hints to identify the pattern.

- The first candle must be a black candle.

- The second candle must be white opening below the close of the first candle creating a gap down.

- The third candle must be a white candle with a real body equal in length to the second candle. It should open at the same level or below the real body of the first candle.

- The second and third candles must be side by side.

What does the down-gap side by side white lines pattern tell traders?

The down-gap side by side white lines candlestick pattern conveys multiple things to the traders. During the downtrend, a black candle appears that indicates the continuation of the downtrend. It suggests that the market is in complete control of the bears. The decline in prices is extremely dramatic that it makes a gap down before the start of the second day’s trading session. However, in the next trading session, the bears lose control and the bulls take charge of the market. The price jumps up, and white candlestick forms. On the third day, the prices open at the same level as it did on the previous day. Again, the bulls continue the effort to increase the prices. The two white candles appearing side by side are similar on the surface but they actually tell traders about this moment of discord. It shows that nothing changed during the two days.

Despite the brilliant efforts of the bulls, the down-gap side by side white lines pattern indicates a continuation of the downtrend. The reason is that the bulls do not have enough power to overwhelm the bears and their efforts for the rally aren’t just enough. The signal is generally considered more powerful when the length of the second and third similar candles is longer.

The down-gap side by side white lines pattern is a strong indicator with a very clear message although it appears very rarely. However, trusting a single candlestick pattern is always risky. The traders must wait for the formation of a black candle and a downward gap before initiating a trade. Other technical analysis tools can also prove very helpful for further confirmation.

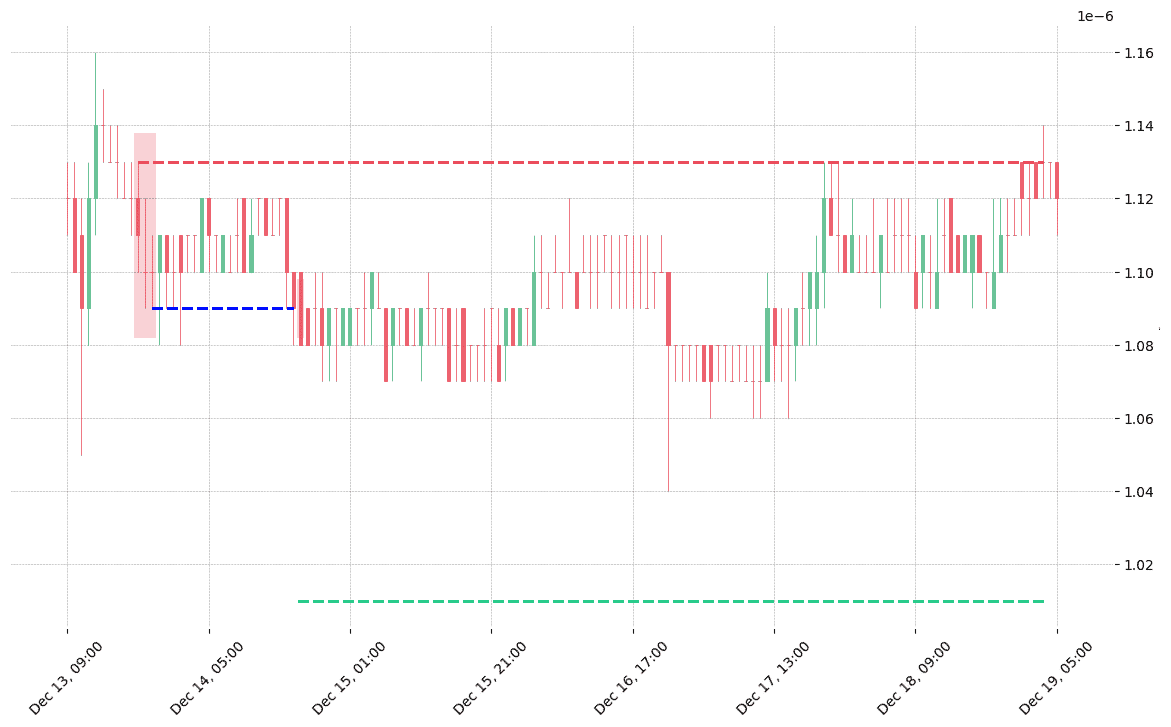

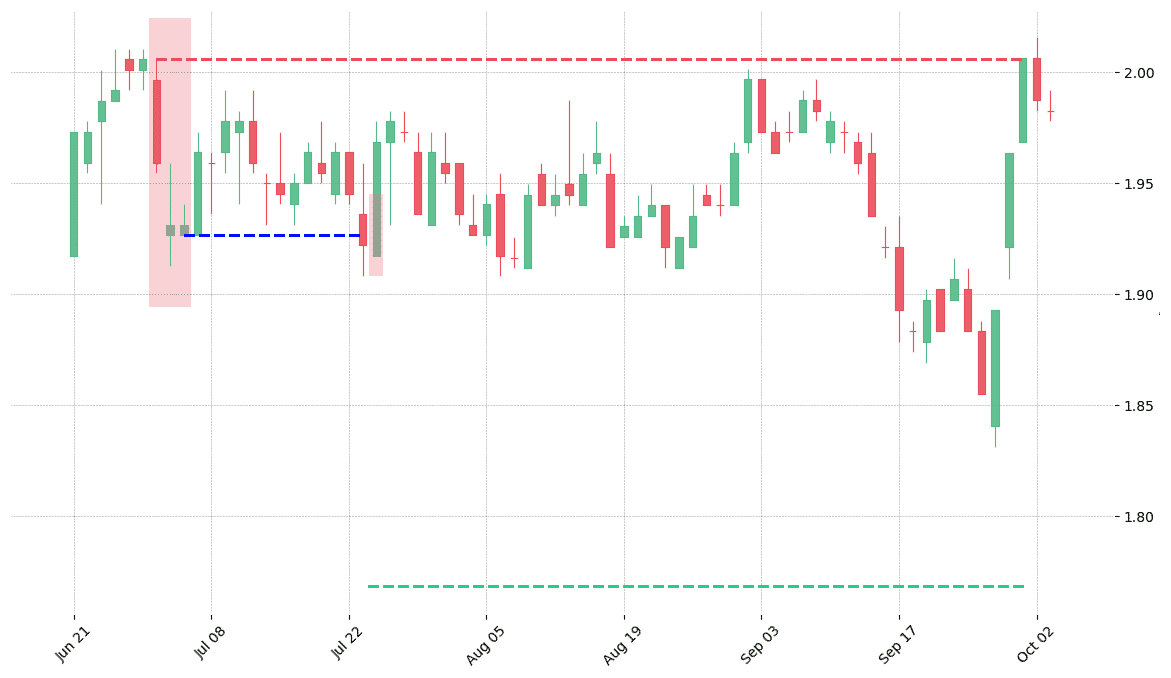

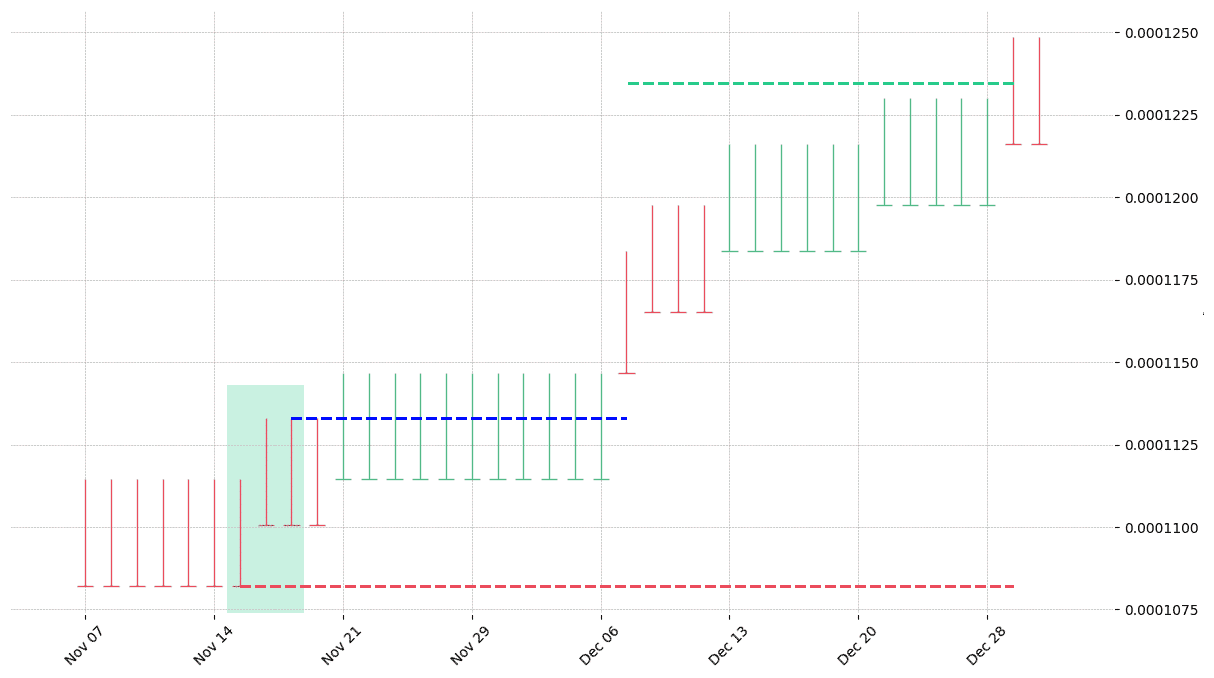

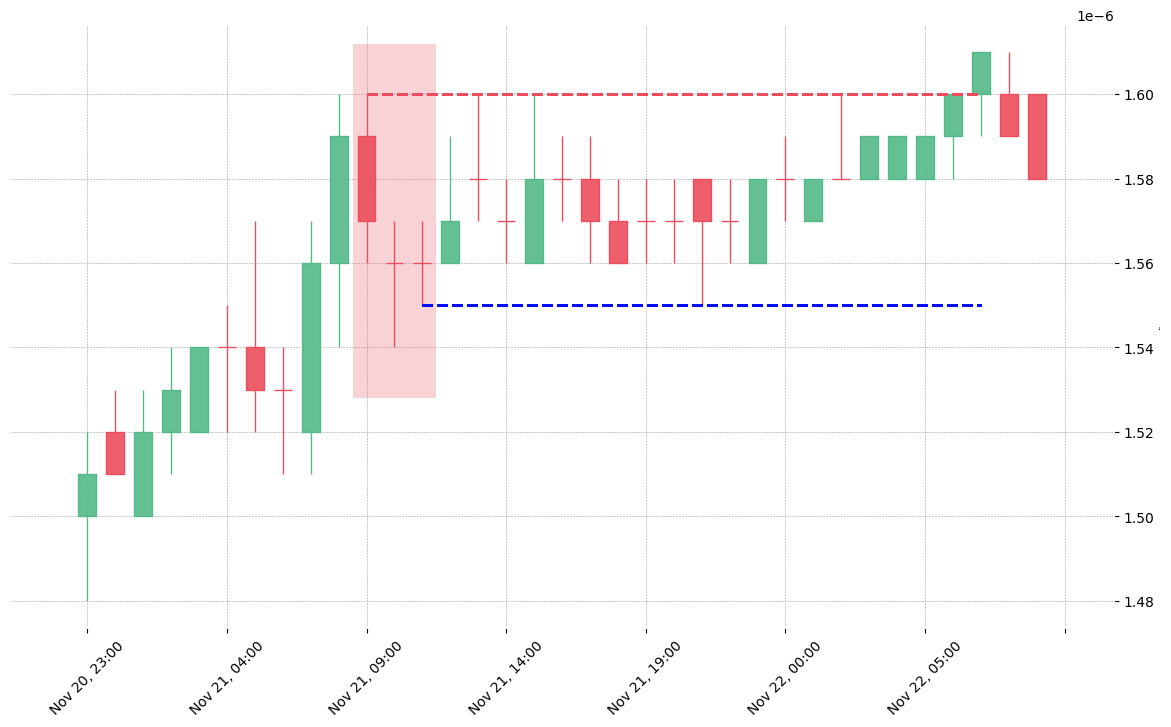

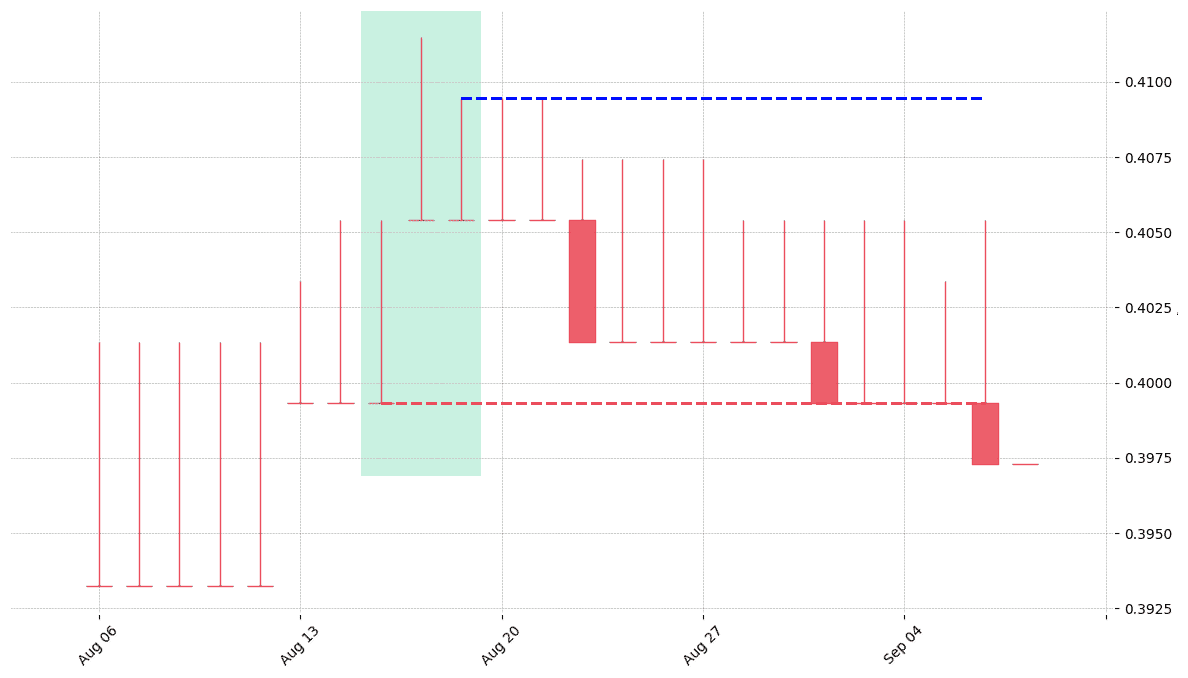

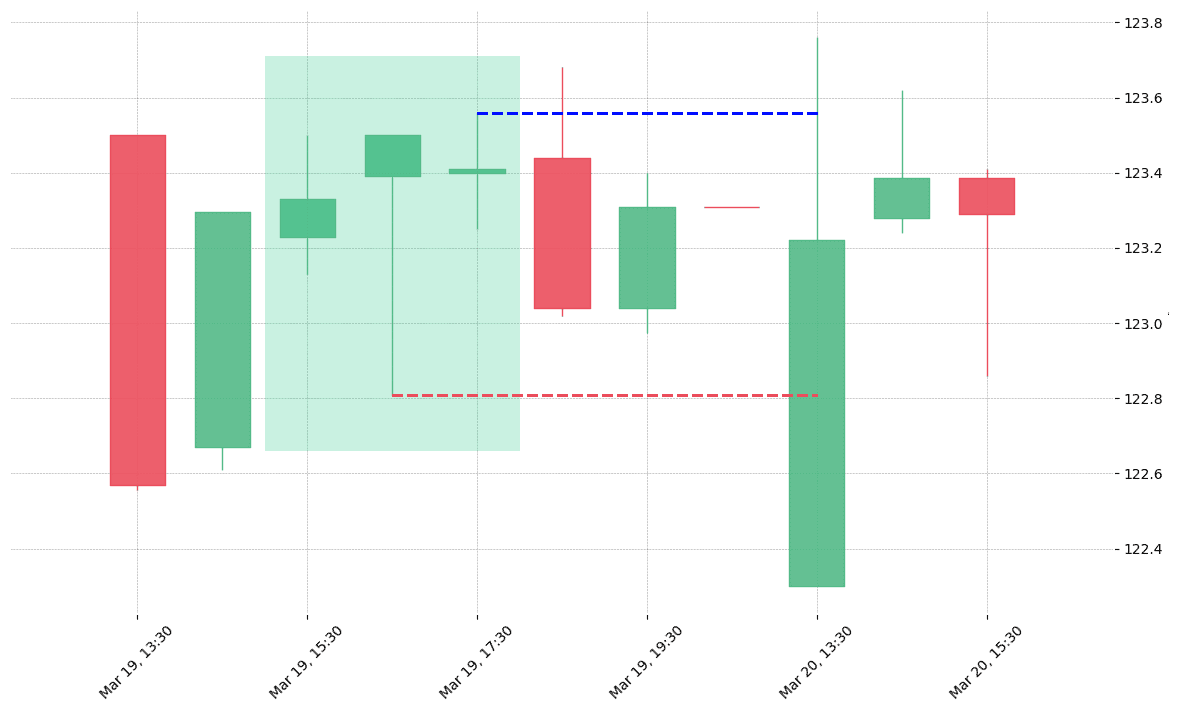

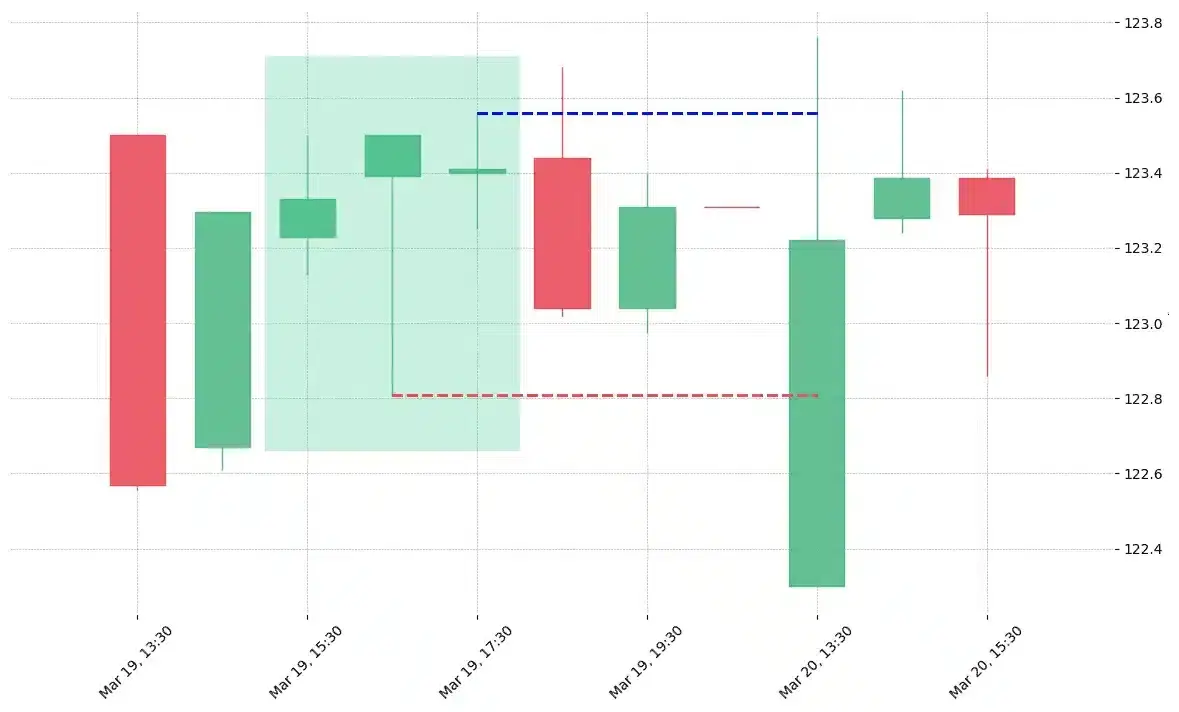

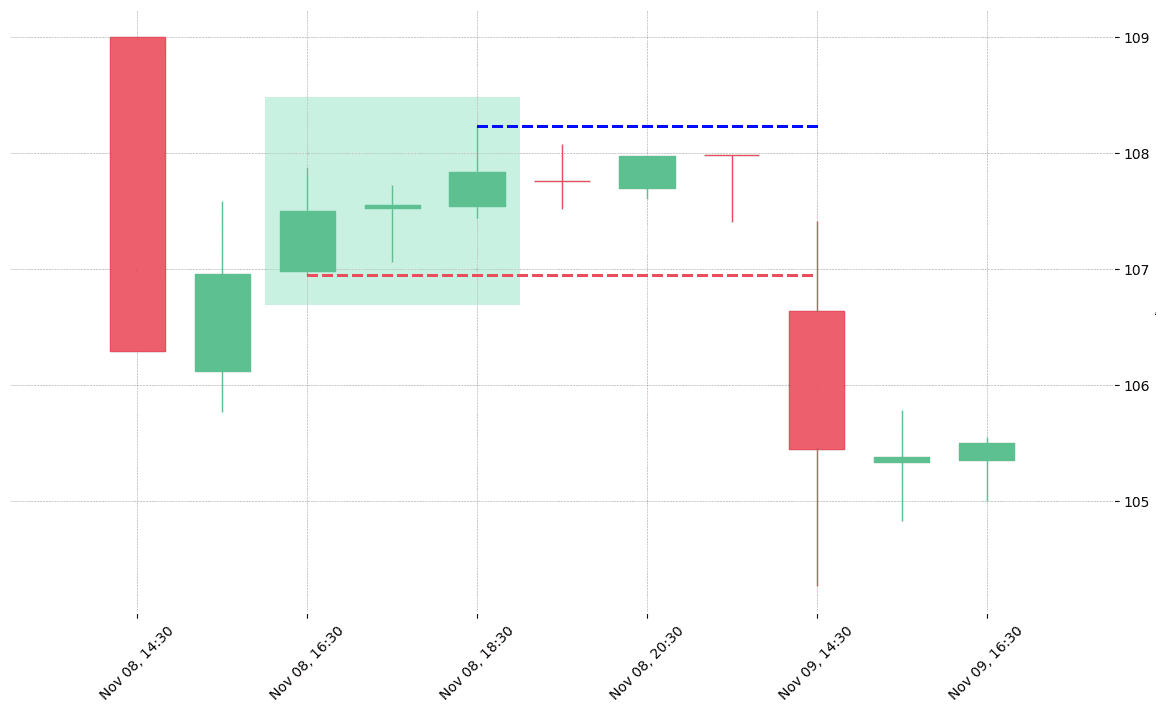

How does the pattern look in real life?

Looking to learn more about this pattern?

You should take a look at Joe Marwood's online course. In his course, he backtested the 26 main candlestick patterns before to summarize which one is THE best pattern. I really liked his course and you shouldn't miss it!

Click here to signup to his "Candlestick Analysis For Professional Traders" course now!

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!