The counterattack candlestick pattern is a reversal pattern that indicates the upcoming reversal of the current trend in the market. There are two variants of the counterattack pattern, the bullish counterattack pattern and the bearish counterattack pattern.

- The counterattack candlestick pattern is a 2-bar reversal pattern.

- It should appear in a strong trending market.

- The first candle must be a long candle with a real body.

- The second candle must also be a long (ideally, equal in size to the first candle) but an opposite candle body.

- The second candle must close near the close of the first candle.

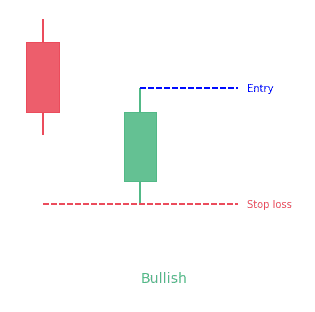

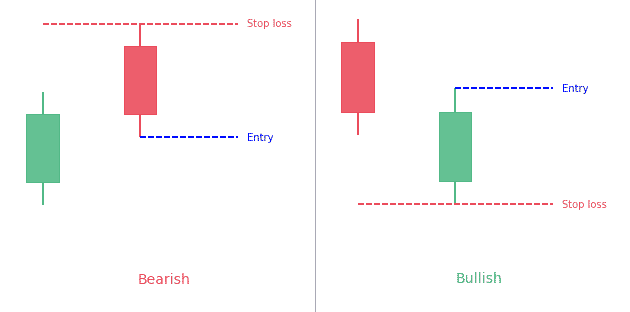

The bullish counterattack candlestick pattern

The bullish counterattack pattern is a bullish reversal pattern that predicts the upcoming reversal of the current downtrend in the market.

How to identify the bullish counterattack candlestick pattern?

The bullish counterattack candlestick pattern is a two-bar pattern that appears during a downtrend in the market. A pattern needs to meet the following conditions to be a bullish counterattack pattern.

- There must be a strong downtrend in the market for the formation of the bullish counterattack pattern.

- The first candle must be a long black candle with a real body.

- The second candle must also be a long (ideally, equal in size to the first candle) but a white candle with a real body. The second candle must close near the close of the first candle.

What does the bullish pattern tell traders?

The bullish counterattack candlestick predicts that the reversal of the current downtrend in the market is imminent. The appearance of the first black candle with a long real body indicates that the downtrend is continuing in the market. The close of the first candle well below the open boosts the morale of the bears at the expense of bulls’ confidence. The second candle opens and creates a gap below the previous session’s close. However, the opening of the second candle also indicates that selling pressure and the overall downtrend is losing and the bullish reversal is near. The candles of the third or fourth day provide confirmation of the trend reversal.

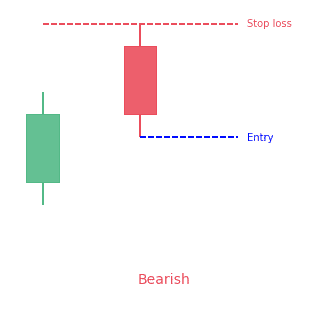

The bearish counterattack candlestick pattern

The bearish counterattack candlestick pattern is a bearish reversal pattern that appears during an uptrend in the market. It predicts that the current uptrend in the market will make and the new downtrend will take over the market.

How to identify the bearish counterattack candlestick pattern?

The bearish counterattack candlestick pattern is a two-bar pattern with the following characteristics.

- The market must be in a strong uptrend.

- The first candle must be a long and white candle with a real body.

- The second candle must be a black candle and equal or close in size to the first candle.

What does the bearish pattern tell traders?

The bearish counterattack pattern predicts the reversal of the current trend. The appearance of the first bullish candle indicates that the uptrend is continuing. The second candle’s close well above the open further confirms the uptrend. The control of the bulls is also indicated by the second candle that creates an up gap from the close of the first candle. However, the opening of the first candle causes the decline of demand allowing the bears to further pull the prices low. Hence, it becomes clear that the uptrend will reverse in favor of the downtrend after the formation of the bearish counterattack candlestick.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!