- The broadening top pattern is a bearish reversal pattern.

- It’s tougher to trade than other classical patterns as lows and highs get taken out one by one.

- It can also be called the “megaphone pattern”.

What is the broadening top pattern?

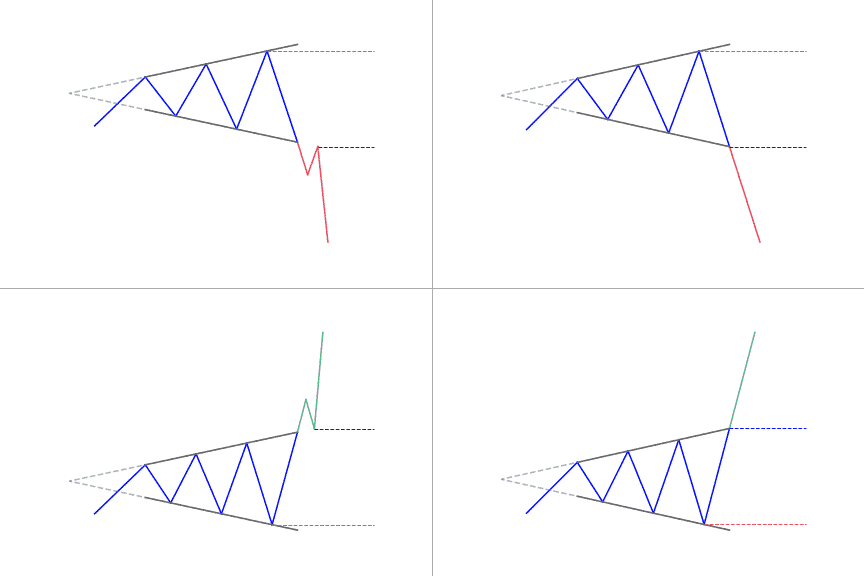

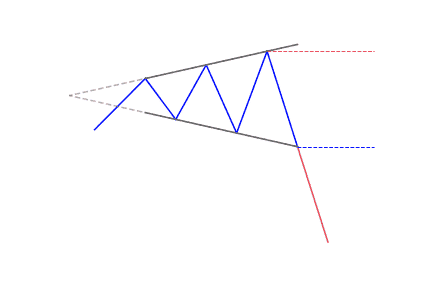

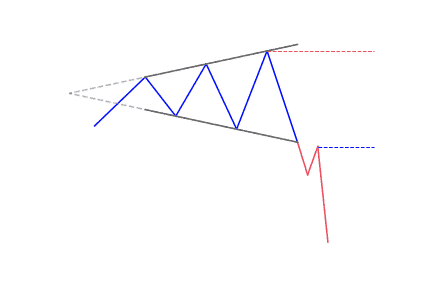

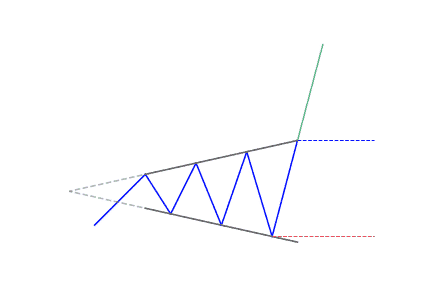

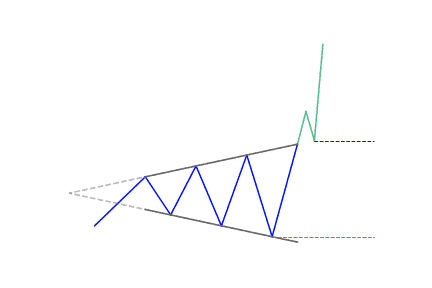

The broadening top pattern is a bearish reversal pattern used in technical analysis. The broadening top predicts an upcoming reversal of the current trend. Following two widening trend lines, prices tend to progressively make lower lows and higher highs. When this happens, we have a broadening top pattern. Depending on the broken line, the price may move up or down past the pattern. Generally, it moves up because the broadening top formation appears mostly on top.

The broadening top pattern is also popular for reflecting the nervousness and indecisiveness of the traders. If traders fail to spot the chart pattern on time, they may trap because of the random appearance of the movements. Whenever the market experience a severe disagreement among traders during a short period of time about an appropriate price of a security. This agreement leads buyers to buy at the highest prices and sellers to take profits. This discord leads to interim peaks in prices and interim lowest lows in the market. This chart pattern appears in a megaphone shape. It has higher peaks and lower valleys, hence, it is also known as megaphone pattern.

Thomas Bukowski states in his book on trading patterns that the broadening top pattern only validates a pattern when it gets at least two minor lows or two minor highs. The megaphone pattern may go in any direction, mostly upward. It takes a direction when the price moves up or below the pattern end or when the price intersects the trendline.

How to identify the broadening top pattern?

The broadening top pattern occurs after a significant upward or downward movement in the security prices’ action. The identification of the broadening top pattern is easy although it seems tough. When the two trend lines connecting widening highs and lows diverge from each other, it is an indication of the broadening top pattern. It is necessary to note that the upper trendline should be ascending while the bottom line can be descending or horizontal. The most common broadening formation occurs toward the end of a very long uptrend and it predicts a potential downtrend.

What does the broadening top tell traders?

Broadening top pattern technical analysis leads to multiple revelations. The megaphone pattern occurs very rarely but traders and technical analysts consider its signals most reliable. It indicates an upcoming reversal of the prevailing trend in the market.

How to trade when you see the pattern?

There are different types of trading strategies that a trader can opt for when using the broadening top pattern as technical analysis tools. For example, day traders and swing traders may wish to trade with an uptrend when the price breaks from the broadening top pattern. A selling option is available when prices rebound off the lower trend line. Traders may go short at the highest high when price begins to fall. Similarly, a buying option is available when the price touches the bottom trend line for the thirds time.

As we know that broadening formations rise volatility because they do not move in a single clear direction. That is the reason that broadening formations are usually bearish for most long-term traders and trend traders. On the other hand, day traders and swing traders always have great opportunities while exercising broadening top trading strategy to take profits because they seek to profit from volatility in the market by not relying on anything else. They always attempt to profit by quickly entering or exiting the markets to capitalize on short-term movements.

Bottom line

The broadening top pattern, also known as the megaphone pattern, is a bullish reversal pattern. It has the potential to predict an upcoming change in the prevailing trend in the market. It also shows the nervousness and indecisiveness of the traders. The broadening top trading strategies may vary depending on the overall trading strategy of traders. It is important to note that the broadening top pattern only validates a pattern when it gets at least two minor lows or two minor highs. Despite being extremely useful and reliable, the broadening top may also trap traders if the traders fail to understand the broadening top pattern on time. Therefore, technical analysts and experts advise using the pattern in conjunction with other technical analysis tools. It helps confirm the trend before entering or exiting the market.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!