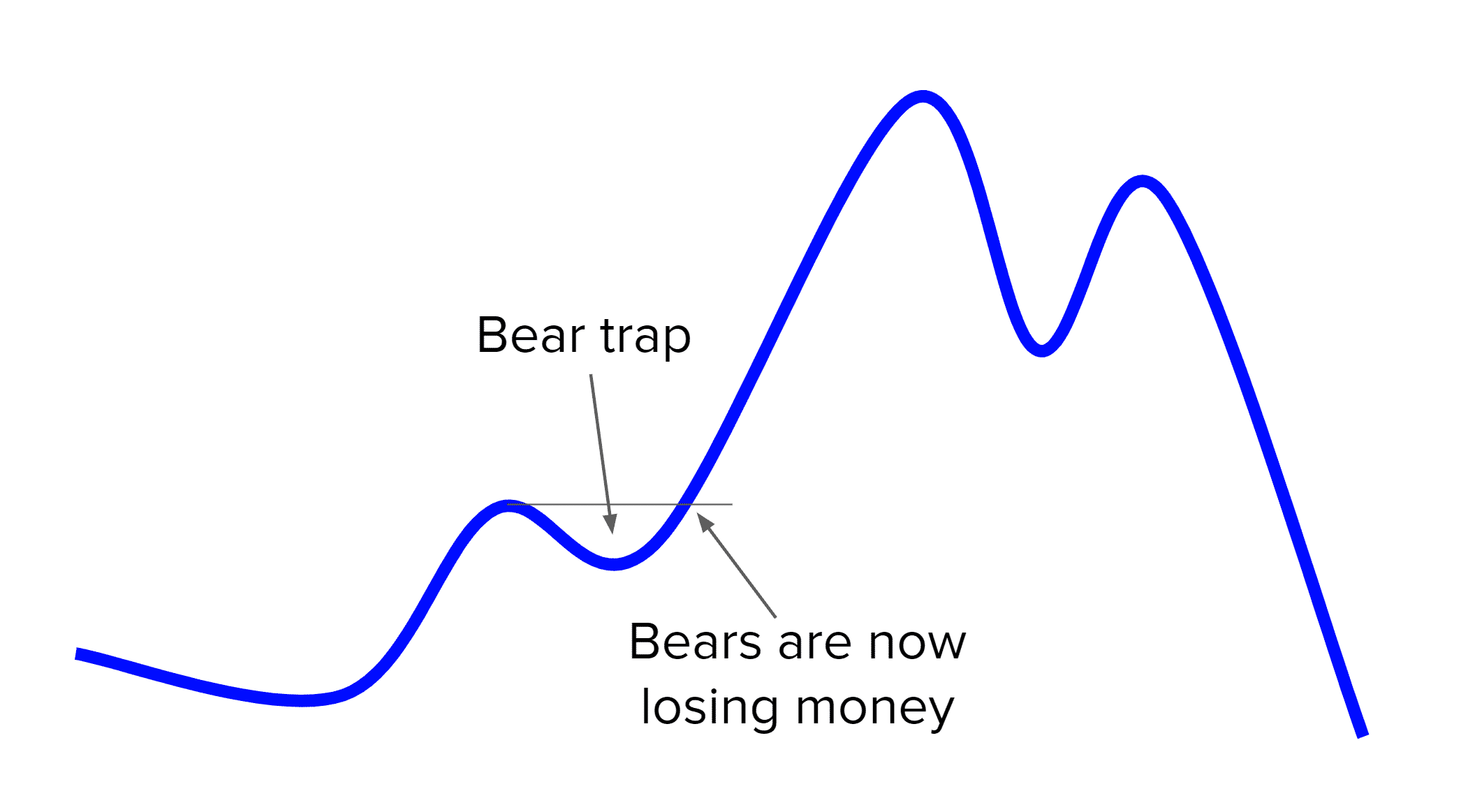

- A bear trap occurs when stocks, indexes, or other financial assets issue false signals of reversal of an uptrend in the financial market.

- Market participants expect a decline in prices but prices either remain unchanged or increase.

- Bear traps cause substantial losses for the traders because traders make moves according to the trend but out of nowhere, an opposite scenario arises.

Stock market and financial trading in general are all about finding investment and trading opportunities that are less risky. Despite all the efforts and dedications of financial traders, all trading strategies are not profitable because financial markets are full of surprises. A bear trap is among such surprises that catch traders off guard. A bear trap always proves dangerous and causes substantial losses for financial traders. So what is a bear trap?

What is a bear trap in financial trading?

A bear trap occurs when stocks, indexes, or other financial assets issue false signals of reversal of an uptrend in the financial market. Market participants expect a decline in prices but prices either remain unchanged or increase. Bear traps cause substantial losses for the traders because traders make moves according to the trend but out of nowhere, an opposite scenario arises. It is actually a classic situation of a false breakout breaking a previous resistance level. A bear trap deceives traders acting on the sell signal and entering short positions. Hence, it causes significant losses for investors. The real problem lies in the fact that it is very difficult to identify a bear trap because prices are likely to move lower after a breakout and do not usually reverse.

Why does a trap occur?

There are two explanations as an answer to this question.

- There is a common technical analysis-based strategy of financial trading that traders sell stocks breaking out of the support level. As soon as prices move below the support level, traders start to sell. Strong downward movements often follow breakouts but not every time. Sometimes, prices of stock suddenly reverse. Traders who intended to take advantage of the breakout are trapped in a bear trap.

- Usually, traders place stop-losses above the support level. That support level is supposed to turn into resistance when prices break it properly. However, no proper breakout occurs in bear traps. Just a piercing occurs before prices begin to move higher. Traders who start selling as soon as the piercing occurs get caught off guard.

Bear traps are detrimental to the morale of traders and they begin to suspect their trading abilities as well as trading strategies. Therefore, it is absolutely imperative for financial traders to know how to avoid a bear trap before entering into a trade.

How to avoid a bear trap in financial trading?

Traders may follow the following suggestions to avoid a bear trap.

- Traders should widen their stop-losses and should not place them just below the support and resistance line. They should take support and resistance to a buffer zone and not just a line. Widening the stop-losses lets traders have some breathing room even when false breakouts happen.

- Patience is the key to financial trading. A trader should not act immediately after piercing the support. They should wait for confirmation and should wait for the candlestick to close.

- Traders may also trade the retrace rather than trading breakouts. They can sell when prices come back up and test the support level that was once broken. If it holds the ground and turns into resistance, it is a perfect confirmation of the breakout.

Anyway, always follow your plan!

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!