Bart Simpson Pattern has emerged as a very unpleasant but important pattern in cryptocurrency trading. In fact, any discussion regarding Bitcoin price doesn’t conclude without this mystic pattern.

But what is this Bart Simpson Pattern? Why do we observe this Bart Pattern on the Bitcoin price chart and other cryptos? These questions are the key aspects of our today’s guide on Bart Simpson Pattern.

Introduction to the Bart Simpson Pattern

Bart Simpson is a very popular cartoon character from the TV series “The Simpsons”. But how does this yellow cartoon character make his way into the crypto world? What is its connection with cryptocurrency trading and technical analysis? Let’s see!

When the weaknesses associated with Bitcoin appeared back in 2017, its price, as well as liquidity, collapsed. This didn’t happen on one or two exchanges but on all of them. Thus, the bull market faced its ending. The world observed and experienced what happened later on.

The influencers of the market, known as whales, and exchanges had to find a way to make money. So, the cryptocurrency traders began to see a pattern on cryptocurrency price charts. Early on, people looked at it as a simple pump and dump scheme. So, what actually happens that forms the Bart Simpson Pattern?

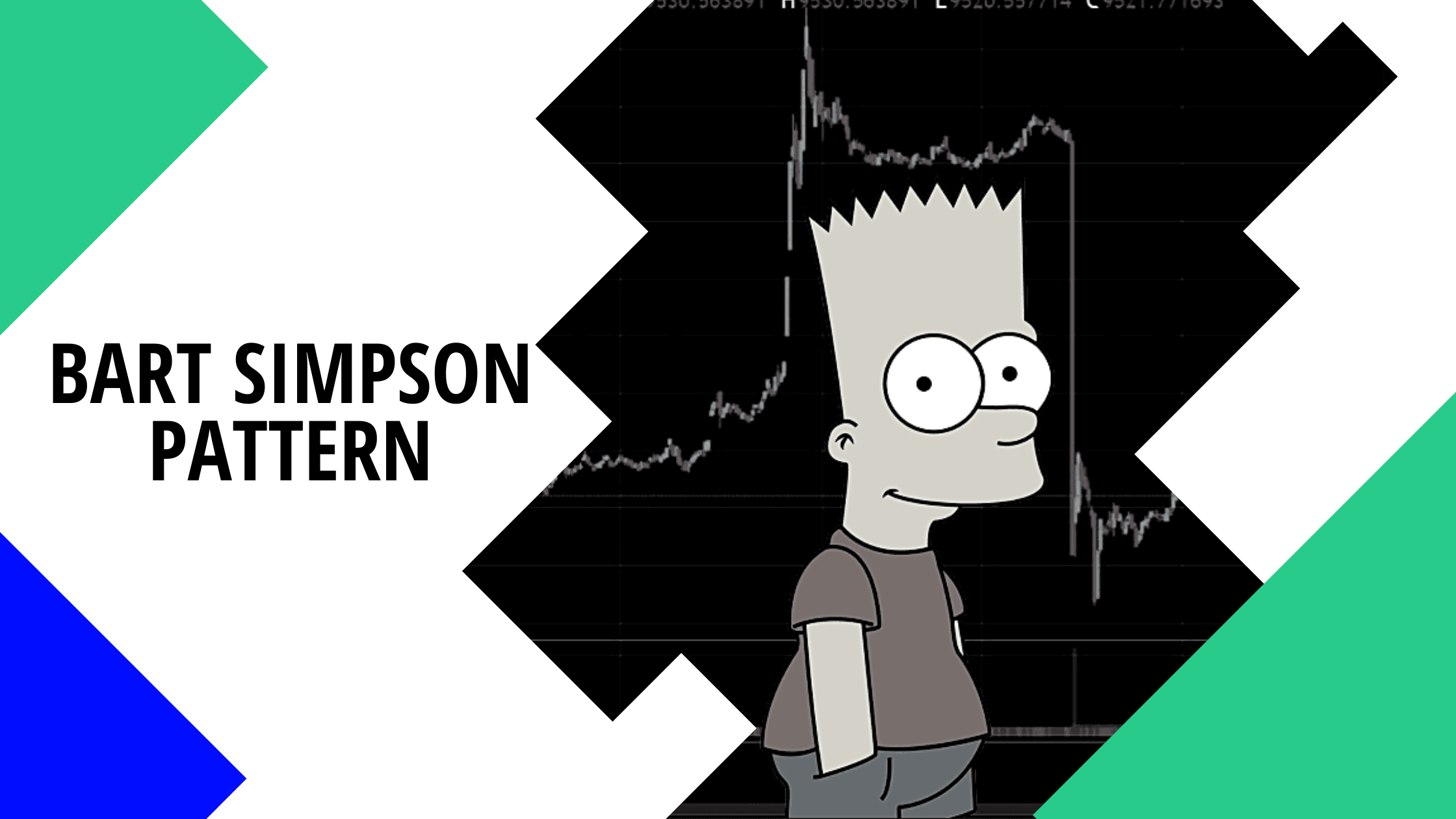

Bart Simpson Pattern forms during a sideways market trend when the price suddenly increases or falls. In other words, a sudden boom or decline happens when the cryptocurrency market is quiet and nothing seems to happen. But huge buying or selling orders stir the market in an upward or downward direction. After a sudden but significant price movement, things return to normal and prices consolidate at a new level. The pattern that forms is known as Bart Simpson Pattern. Technical analysts named this pattern Bart Simpson because of its resemblance to Bart Simpson’s head.

What is the possible reason for the formation of the Bart Simpson Pattern?

Most traders agree on the fact that the Bart Simpson Pattern forms because of a lack of liquidity in the crypto market, especially the Bitcoin market. On the other hand, some traders also believe that this is actually a pump and dump scheme that whales follow. Traders also believe that big exchanges are also part of the scheme. But for what reasons though? To capitalize on the inexperience of the beginners trading on big margins. Firstly, they influence prices to go high all of a sudden. Secondly, they dump the price again and wipe out the initial gains.

In more simple terms, inexperienced margin traders go short because they think prices will further decline. However, whales enter the market and their big buy orders move the market in the opposite direction. Contrarily, when the margin traders go long thinking that prices will rise, whales begin to sell and prices fall to the bottom.

Moreover, lack of liquidity also plays a huge role in Bart Simpson’s Pattern formation. As a general rule, higher liquidity doesn’t allow prices to exponentially go up or go down. For example, when the liquidity of a particular asset is high, it can be traded without spikes in its prices. Contrarily, when liquidity is low, that asset’s price will suddenly go up or down. For example, big supplies of an asset push prices down because the market cannot accommodate such huge supplies. Conversely, an increase in demand pushes prices higher as the market fails to fulfill the needs of the traders.

How to trade the Bart Simpson Pattern?

As we know that Bart Simpson’s Pattern resembles a cartoon character, especially the head of the character. We also know that this pattern appears after a very long quieter period in the market. So, it is easy to spot the Bart Simpson Pattern. That means you should always have in mind the probability of this pattern when the consolidation periods are quite long.

But how to trade this Bart Pattern? The best way to trade during such circumstances is to aim for middle or long-term trades. Bart Simpson Pattern can affect you less when you trade for longer time frames. In fact, you can make significant gains by aiming for long-term trades.

The wrap-up

Bart Simpson Pattern is a popular pattern in cryptocurrency trading. It is unfortunately a big pattern that adversely affects numerous inexperienced margin traders. Is it only a part of the crypto market? Yes. It is more likely a part of the crypto market because of the lack of regulations in this area. It may happen in other traditional markets but the possibility is quite low. Traders trade in a regulated environment and quite a rational manner in regular traditional markets. So, cryptocurrency traders need to be well aware of Bart Simpson’s Pattern. Otherwise, they may lose huge sums of money. Moreover, the best strategy to cope with the Bart pattern is to go for long-term trades.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!