Traders use momentum indicators to have a better understanding of the speed or rate at which the price of a security changes. Momentum indicators are best used with other indicators and tools because they don’t work to detect the direction of movement, only the timeframe that the price change is happening. It’s a category of indicator but the momentum indicator is also an indicator by itself.

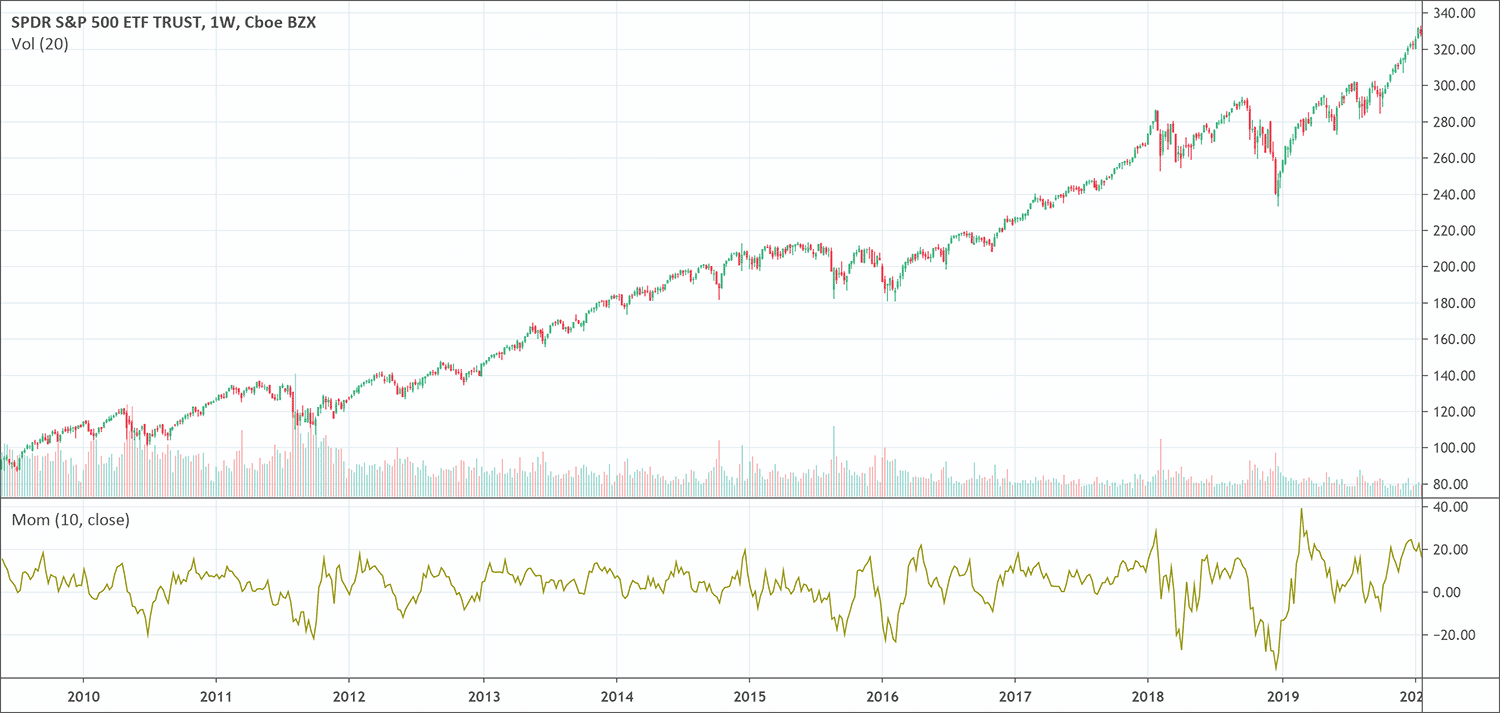

The strength of a price movement by using a momentum indicator line in a price chart can be changed. The formula for this indicator compares the most current closing price to a former closing price from any time frame. The momentum indicator prints as one line in a different part of a chart than the price line or bars.

Momentum is one of the most significant concepts in technical analysis. Different trading indicators can measure momentum such as Williams’s %R, RSI, Stochastics, and the Momentum Indicator among others. This article focuses on the later (MOM indicator).

- The Momentum indicator is an oscillator that shows the speed or strength of a price movement

- The indicator compares the most current price to a previously determined price and measures the velocity with which price changes.

- It helps traders hint for price reversal

What is the Momentum indicator?

Momentum indicator is an oscillator that shows the speed or strength of a price movement. The indicator compares the most current price to a previously determined price and measures the velocity with which price changes.

The momentum indicator is another member of the oscillator family of technical signal indicators. The creator of the indicator is unknown, but Martin Pring has written much about it. Traders use the index to determine overbought and oversold conditions and the strength of prevailing trends.

The indicator is termed as an ‘oscillator’ since the resulting curve fluctuates between values about a 100 centerline, which may or may not be drawn on the indicator chart. Overbought and oversold conditions are imminent when the curve gets to maximum or minimum values.

Forex momentum is the rate of change in price and is based on the trend lines on a price chart. It shows the volume in a forex market and if the currency is overbought or oversold. High momentum shows overbuying and low momentum shows the opposite, overselling.

It can be used to show a buying or selling opportunity. If momentum is low, only to sudden shoot back up towards the zero line will indicate a buy signal. And the opposite is true for a sell signal.

What does the Momentum indicator tell traders?

The MOM indicator helps traders hint for reversal

The Indicator falls within the oscillator class of technical indicators. It oscillates to and from the 100 centerline, which may or may not appear based on the settings of the indicator. Also, traders see the indicator as a leading indicator, which means that it can predict potential trend changes before they happen.

It essentially measures the rate of change or speed of price movement of a financial instrument. It measures the recent end bar to a previous end bar in periods ago. By analyzing the rate of change, we can determine the strength or momentum in a forex currency pair or financial instrument.

Decreasing momentum indicates that the market is getting tired and may be due for a retracement or reversal. A rising momentum condition shows that the trend is strong and likely to continue. Many momentum trading techniques such as a breakout of a new range depends on this idea of accelerating momentum.

Many ways to interpret the MOM indicator

The MOM indicator is a very versatile indicator and can be used in different ways. Traders use it as a signal to confirm trends and trend reversals. It is the job of the trader to understand the market environment that is present, and apply the most appropriate signal with that context in mind.

For instance, in a trending area, traders consider continuation signals, while in a range bound market, they consider Mean Reversion type signals. It is important to keep in mind, that the MOM trading indicator offers vital information in both range bound markets, and trending market conditions.

The Momentum indicator is made up of a single line, But a lot of traders also prefer to include a secondary line on the indicator which acts to smooth the signals. The second line is typically an X period moving average of the momentum indicator. A popular setting for the X period look back is 9, 14, or 21. Have it in mind that the shorter the X period setting is, the noisier the signal will be, which can cause false signals. Longer period inputs for the X setting will lead to better quality signals, but the signals will occur much later.

How to use the MOM indicator?

Buy signal with the Momentum indicator

When the momentum indicator crosses above the zero line, it means that the price of the stock, future, or currency pair is reversing course, either by having bottomed out or by breaking out over current highs; traders view it as a bullish signal.

Sell signal

When the momentum indicator crosses below the zero line, it can slowly mean two things; the price of the future, currency pair, or stock has topped out and is reversing or that the price has broken below recent lows. Either way, traders mostly interpret these events as bearish signals.

Exit signals

Generally, the potential buy and sell signals are poor exits; either selling out of a long position or buying to cover a short position. By the time the momentum indicator comes back to the zero line, most or all of the profits might have eroded, or even worse, the trader has let a winning position turn into a losing position.

When the momentum is reversing course and is getting back to the zero line, that indicates that profits have been eroded. How much of a retracement back towards the zero line before an exit triggers is up to the trader. Another possible alternative is to draw a trend line; when the trend line is broken, that might be the exit indication. Like other technical analysis indicators, interpreting them is part science and part art form.

Potential buy and sell signals are not the only use of the indicator. It is also used to detect divergences, which is an important trading concept. Past performance is not necessarily an indication of future performance. Inherently, trading is risky.

Pros & Cons

Pros for the momentum indicator

Momentum indicators indicate the movement of price over time and how strong those movements are/will be, regardless of the direction the price moves, up, or down.

They are also particularly important, because they assist traders and analysts detect points where the market can and will reverse. Divergence between momentum and price movement helps traders detect potential reversal points.

Momentum indicators show the strength of price movements but leave out the directionality of the price movements. Traders best use those indicators together with other technical indicators such as moving averages and trend lines, which show price trends and directions.

Cons for the momentum indicator

The momentum indicator does not provide a lot of information beyond what can be seen just by looking at the price chart itself. If the price is aggressively moving higher, it prints on the price chart and on the momentum indicator.

Also, traders will have to wait for the momentum indicator crossover signal before executing any trade. And that signal comes up shortly after the resistance test.

Conclusion

Momentum indicators are important tools for traders and analysts; therefore, traders hardly use them in isolation. Traders mostly use them together with other technical indicators that show the directions of trends. Once a direction has been confirmed, momentum indicators are vital. They show the strength of price movement trends and when they will end.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!