- The Moving Average Convergence Divergence (MACD) is both a momentum and trend following indicator.

- It is calculated by subtracting the 26-period EMA (Exponential Moving Average) from the 12-period EMA.

- There are several ways to read it:

- When the lines cross

- When the histogram creates a divergence with price

What is the MACD indicator?

Gerald Appel created the Moving Average Convergence Divergence (MACD) indicator in the late 1970s. The indicator is one of the simplest and most efficient momentum indicators out there. The MACD turns two indicators, moving averages, into a momentum oscillator. It does so by subtracting the longer moving average from a short one. Due to this, the indicator gives the best of both worlds: momentum and trend following.

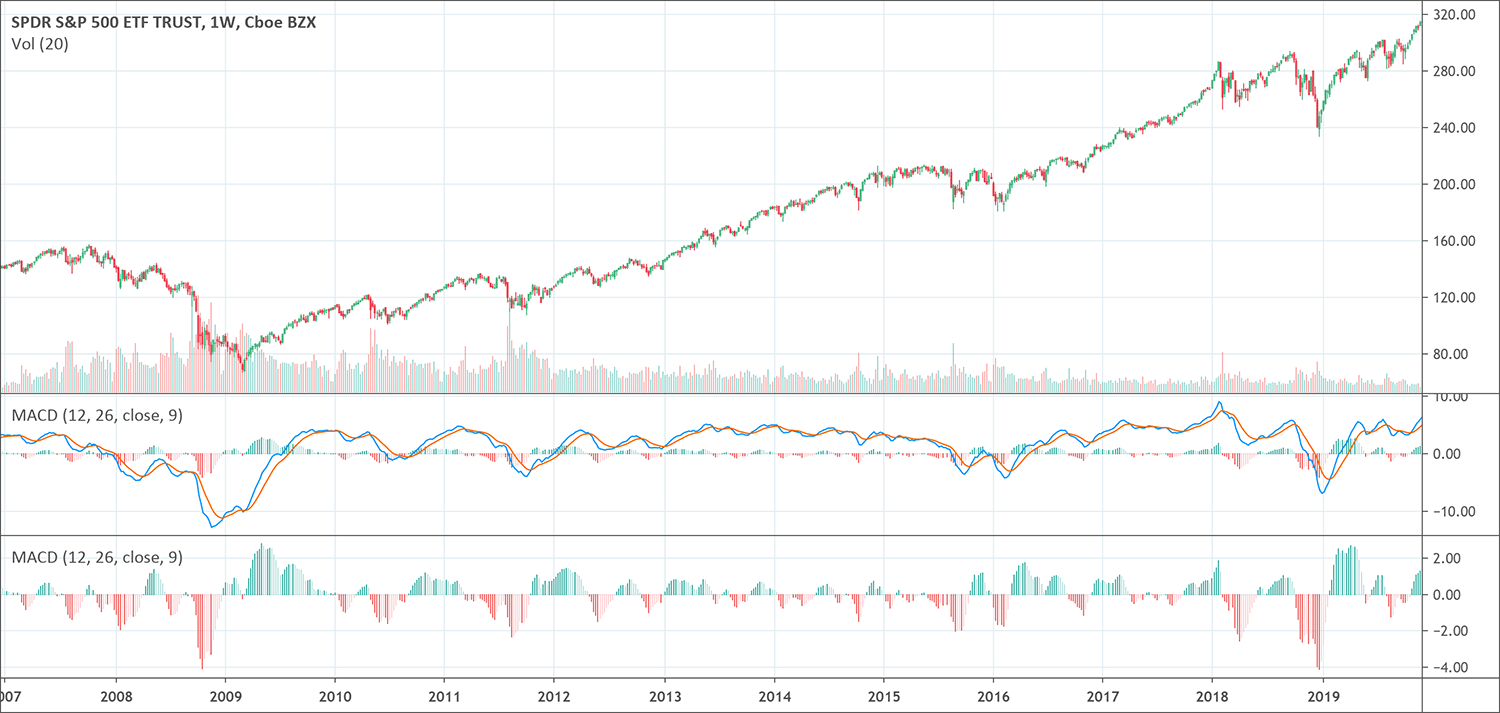

The moving average convergence divergence is a technical indicator that measures the relationship of exponential moving averages (EMA). The indicator shows a MACD line (which is blue), signal line (red in color) and a histogram (green in color). It shows the variation between the MACD line and the signal line.

The moving average convergence divergence fluctuates above and below the zero line as the moving averages converge, cross and diverge. As you trade, you can look for signal line crossovers, centerline crossovers and divergences to produce signals. Because the indicator has no boundaries, it doesn’t help identifying overbought and oversold levels.

A nine-day EMA of the MACD is referred to as the signal line and is plotted on top of the MACD. It normally indicates triggers for buy and sell signals, which is a default setting. The MACD is a lagging indicator. It also is one of the best trend-following indicators that have been around for a long time.

Traders mainly use the indicator to trade trends. Even though it is an oscillator, it doesn’t print overbought or oversold conditions (as it’s unbounded). It shows up on the chart as two lines which oscillate without boundaries. The crossover of the two lines produces trading signals similar to a two moving average system.

What does the MACD indicator tell traders?

Understanding MACD convergence divergence is very necessary. When the price is experiencing a lower low but the MACD is making a higher low, it creates a bullish divergence. If the MACD is making a lower high, but the price is making a higher high, it creates a bearish divergence. Divergence will almost always happen right after a sudden price movement higher or lower. Divergence is just a cue that the price might reverse, traders usually confirm it by a trend line break.

How to use the MACD indicator?

- Traders often see the MACD crossing above zero as bullish, while crossing below zero as bearish. Secondly, when MACD turns up from below zero it is bullish. When it turns down from above zero it is bearish.

- When the line crosses from below to above the signal line, traders consider it bullish. The lower the zero line the stronger the signal.

- When the MACD line crosses from above to below the signal line, the indicator is considered bearish. The further above the zero line the stronger the signal.

- During trading phase, the MACD will whipsaw with the quick line going back and forth across the line of the signal. Traders that use the MACD generally avoid trading in this situation or close positions to lower volatility within the portfolio.

- Divergence between the MACD and the price action is a better signal when it confirms the crossover signals.

How to trade using the MACD

Because there are two moving averages with various speeds, the quicker one will obviously be faster to react to price movement than the one that is slower. When there’s a new trend, the quick line will react first and eventually cross the slower line.

When this crossover happens and the fast line begins to diverge or move away from the slower line, it mostly signifies that a new trend has been made. As the downtrend starts and the fast line moves away from the slow line, the histogram gets larger, which is a good indication of a strong trend.

Just as its name implies, the MACD is all about the convergence and divergence of two moving averages. Convergence happens when the moving averages move towards themselves. Divergence happens when the moving averages move away from each other. The shorter moving average (12-day) is quicker and responsible for most movements of MACD. The longer moving average (26-day) is less reactive and slower to price changes in the underlying security.

Differences between the MACD and the RSI

The relative strength indicator (RSI) seeks to indicate if a market is overbought or oversold in relation to recent price levels. The RSI is an oscillator that calculates average price gains and losses over a given time; the default time period is 2-week periods with values bounded from 0-100.

MACD measures the relationship between two EMAs, while the RSI measures price change in relation to recent lows and highs of prices. These two indicators are mostly used together to give traders and analysts a more complete technical picture of a market.

Biggest mistakes to avoid with the MACD

These indicators both measure market momentum, but, because they also measure various factors; sometimes, they give different indications. For instance, the RSI may show a reading more than 70 for a sustained time, showing a market is overextended to the buy side in relation to current prices, while the MACD shows the market is still increasing in buying momentum. Both indicators can signal an upcoming trend change by showing divergence from price.

These indicators both measure market momentum, but, because they also measure various factors; sometimes, they give different indications. For instance, the RSI may show a reading more than 70 for a sustained time, showing a market is overextended to the buy side in relation to current prices, while the indicator shows the market is still increasing in buying momentum. Both indicators can signal an upcoming trend change by showing divergence from price.

One of the major issues with divergence is that it can often indicate a possible reversal but then no actual reversal really happens – it gives a false positive. The other problem is that divergence does not forecast every reversal. In other words, it predicts a lot of reversals that don’t happen and not enough real price reversals.

False positive divergence often happens when the price of an asset goes sideways, like in a range or triangle pattern following a trend. A slowdown in the momentum (sideways movement or slow trending movement) of the price will make the MACD pull away from its prior extremes and drive it toward the zero lines even in the absence of a true reversal.

Pros and Cons

The demerit of applying the indicator is that it is very notorious for causing whipsaws in traders. Whipsaws can be prevented by not using the MACD as the major indicator of trade signals. The MACD is a great tool to help confirm trades in a trending market, but it is not applicable for ranging markets. As a new trader, the MACD is a great tool to help you train and learn about how indicators function. Spend some time watching markets live on smaller time frames and look at how the MACD works and moves with that market.

Conclusion

The indicator is unique because it serves as an oscillator as well as MACD crossover indicator. This double purpose provides two signals in one indicator allowing for a less cluttered chart. Traders may find this useful which makes understanding the MACD worthwhile.

The indicator is special because it joins momentum and trend in one indicator. This unique blend of trend and momentum can be applied to daily, weekly or monthly charts. The standard setting for MACD is the difference between the 12 and 26-period EMAs. Chartists looking to get more sensitivity may try a shorter short-term moving average and a longer long-term moving average, and might be better suited for weekly charts. Chartists looking for less sensitivity may consider lengthening the moving averages. A less sensitive MACD will still oscillate above/below zero, but the centerline crossovers and signal line crossovers will be less frequent.

The MACD is not especially good for detecting overbought and oversold levels. Even though it is possible to detect levels that are historically overbought or oversold, the indicator does not have any upper or lower limits to bind its movement. During sudden moves, the MACD can continue to over-extend beyond its historical extremes.

Lastly, have it in mind that the MACD line is calculated by using the actual difference between two moving averages, meaning that MACD values are dependent on the price of the underlying security. The indicator values of a lower stock may range from -1.5 to 1.5, while the MACD values for a higher one may range from -10 to +10. It is not possible to compare MACD values for a group of securities with different prices. If you want to compare momentum readings, you should make use of the Percentage Price Oscillator (PPO), rather than the MACD.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!