What are Rounded Top Pattern?

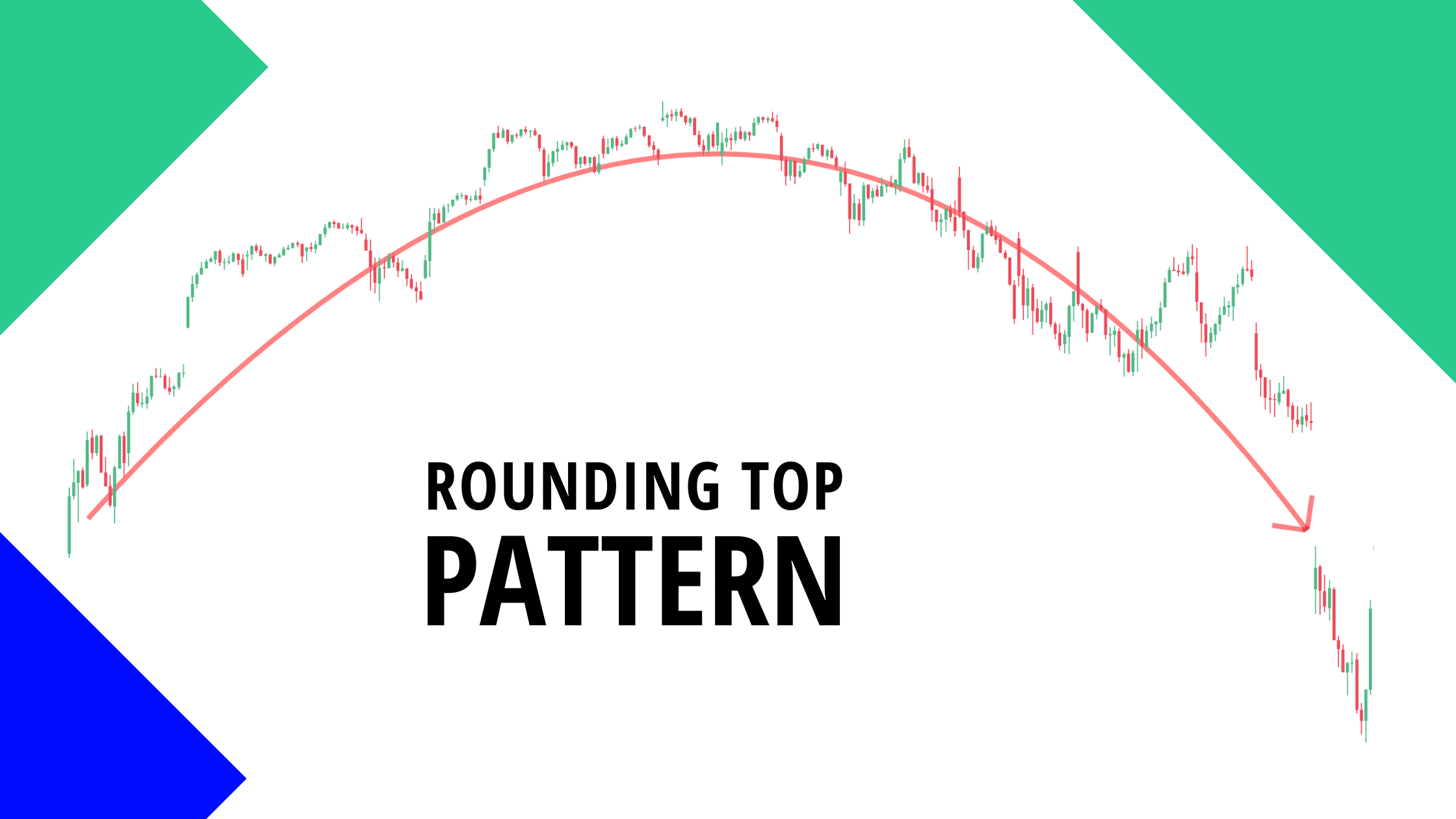

The rounded top are reversal patterns used to signal the end of a trend. It notifies traders a likely reversal point on a price chart. Rounded top pattern is represented in form of an inverted ‘u’ shape and is also known as an ‘inverse saucer’. It denotes the stop of an uptrend and the likely start of a downtrend. This simply means that the rounded top can signal a time frame to go short.

How to recognize a rounded top pattern?

A rounded top pattern is made up of an uptrend, rounded top and a neckline. For this pattern to take place, the price has to initially go in the upward direction. It then stabilizes for an elongated duration, creating a rounded top. And then it financially drops down beneath the neckline of the consolidation area. At this point, this pattern is regarded to be complete. At a certain time, the rounding top pattern can equate with a double or triple top pattern. The important thing to note here is that a likely change in the trend could happen. Traders need to be cautious if they are holding long positions and might need to go short as soon as the price falls below the neckline.

Profit Target

Watch the neckline area closely and immediately the price breaks through and a candle closes beneath the neckline, then it is time to go short, with a sell order into the market. When price goes beyond this mark, there is a reduction in the opportunity of this pattern’s functionality. It is best to leave the market at this point.

Components of Rounding Top Pattern

The rounded top pattern is composed of three major components:

- A rounded top shape: this is where prices trend upward, taper off and then trend downward.

- An inverted volume pattern: it’s elongated on either end, and shorter in the middle of the pattern.

- The neckline level: which is also referred to as the support price level located beneath the pattern. Each time traders are using the rounding top volume, they need to closely observe volume which is usually higher as price pattern increases and decreases on a downtrend.

Price Prediction after a Rounding Top

Similarly with all technical chart patterns, the rounded top pattern is not a completely perfect forecasting device. It is simply a technical pattern that informs traders that investors in the stock market are losing their hold on the stock and may go ahead to sell off their shares in massive figures. This does not happen all the time. Whenever the price fails to head in the downtrend direction after the pattern has been formed, it has been noticed to bounce back from the neckline (support) level and begin to produce higher prices.

Certain analyst suggest that if the price goes beyond thirty percent of the distance from the neckline level returning in the support direction, that the chances for it to hit new highs becomes higher. At this stage, the price pattern is displaying a bullish prediction until it attains the previous high.

Relationship to the Double Top Pattern

When a rounding top pattern fails to experience a reversal, then it is likely to revert to the previous highs. If at the point of those highs, it is faced with resistance again, it would most probably result in to a double top pattern.

Price Target: Take the measurement of the length of the actual pattern and increase that distance downward from the neckline.

How to determine the take profit target?

The guidelines below can be followed to set a suitable take profit target:

In a rounding top pattern, the proximity between the top and the neckline is equivalent to the proximity between the neckline level and the take profit level. Therefore, with this technic, the take profit target is determined by first measuring the distance between the price limit on the chart (the topmost price level for a rounding top) and the breakout point on the chart. And then you place the take profit target at a proximity from the breakout point that is equivalent to the distance measured in the previous step.

Advantages and Disadvantages of Trading Rounded Top Patterns

As with any other technical pattern analysis, there are numerous advantages and disadvantages of trading with the rounded top pattern.

Advantages of Trading Rounded Top Patterns

- This pattern has been considered to be immensely dependable at aiding with trading decisions.

- Rounding top pattern is simple enough to go through and understand by a novice trader.

- This pattern can proof to be very profitable when the pattern takes a successful turn and the market behaves in the manner it was forecasted.

Disadvantages of Trading Rounded Top Patterns

- This pattern can take an overly long period to develop

- The breakpoint for this pattern can be difficult to pinpoint

- This pattern can easily be mixed up with the Cup and Handle, and other closely related patterns

NOTE: It is imperative to note that you should never trade without a stop loss. A pattern is not completely assured until it breaks out successfully. And there are also false breakouts existing in trading. And for this reason, ensuring to include a stop loss will guard against massive loss when price movement goes against your forecast.

How to improve reliability of Rounding Top Patterns?

The rounding top pattern is one of the most dependable pattern for trading, with little failure rate of about 9 – 12%. This does not imply that this pattern is all that simple to trade with. And this is owing to two major reasons:

- There exist other chart patterns that are similar to this pattern in shape. And as such, it makes confirmation of this pattern difficult when they are in the development stage.

- Even when you are sure as to which pattern it is during development, determining precisely when reversal and breakout would happen can be very challenging.

Nonetheless, there are two strategies with which you can increase the rate of credibility of the rounding top pattern to maximize trading profits.

- Developing an agile trading strategy: it is crucial to have an agile trading strategy that allows you to swiftly change when your chart pattern goes wrong. Until there is an obvious signal on the formation of the new trend and the development of this pattern is assured, your trading strategy should help you to profit from any of the likely patterns that may be in development.

- Integrating other technical analysis pattern and indicators into your trading strategy: in order to effectively incorporate these patterns into your own trading strategy, you need to have a definite way of determining trade entry and exit points. Thereby increasing the chances of having a successful trade.

Conclusion

The rounding top chart pattern is a reversal pattern that is created to determine the ending of an ongoing trend. It helps traders figure out early trading chances in the area of the new trend.

Trading breakouts in line with the new trend is where you realizes the most profits when trading these patterns. Although, it may seem somewhat easy to trade this pattern, you must however exercise enough patience. Indeed it sometimes takes huge amount of time for these patterns to develop.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!