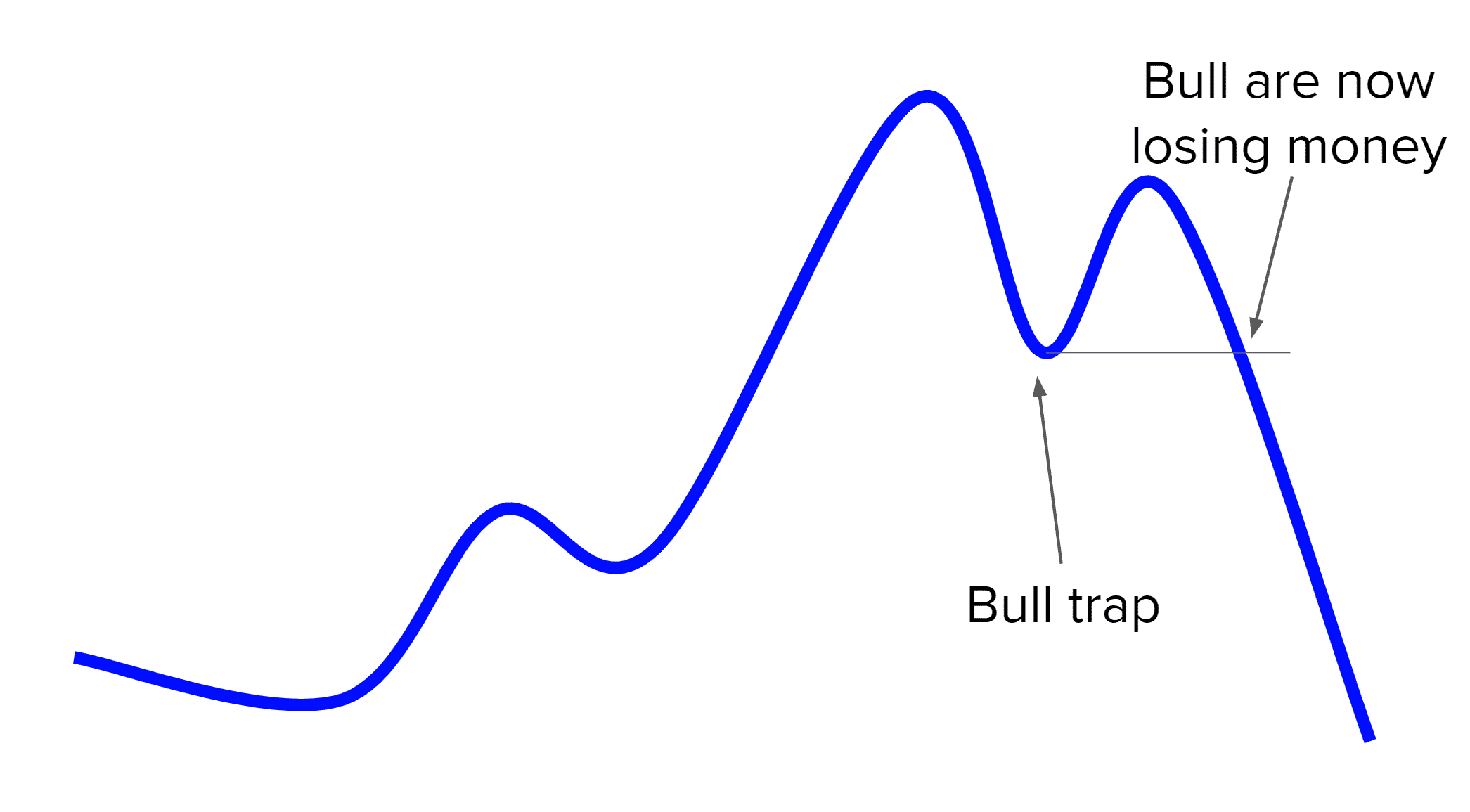

- A bull trap occurs in financial markets when prices begin to move high and then suddenly reverse and decline.

- A trap deceives traders acting on the buy signal and entering long positions.

- Hence, it causes significant losses for investors.

Financial trading is not a simple game as it seems rather it is loaded with problems, difficulties, and surprises. A bull trap is among such difficulties that financial markets bring at times. A bull trap is a real problem for financial traders because it causes substantial losses. It is actually a counter price move that causes a trap and very often leads to significant sell-offs. So what is a bull trap?

What is a bull trap?

A bull trap occurs in financial markets when prices begin to move high and then suddenly reverse and decline. It is actually a classic situation of a false breakout breaking a previous support level. A trap deceives traders acting on the buy signal and entering long positions. Hence, it causes significant losses for investors. The real problem lies in the fact that it is very difficult to identify a bull trap because prices are likely to move higher after a breakout and do not usually reverse.

Why does they actually occur?

The answer to this question is very straightforward. There are two explanations regarding this question. The first one is the technical explanation and the other psychological explanation of why does a bull trap occur.

There is a common technical analysis-based strategy of financial trading that traders buy stocks breaking out of the resistance level. Strong upward movements often follow breakouts but not every time. Sometimes, prices of stock suddenly reverse. Traders who intended to take advantage of the breakout are trapped in a trap.

From a psychological standpoint, buyers enter the market with a determination to accelerate an upwards trend. However, sometimes the market fails to deliver an upward move rather it hits the stop-loss of traders or levels of support. Traders fail to support the upwards surge because of low momentum or profit-taking.

Bull traps are detrimental to the morale of traders and they begin to suspect their trading abilities as well as trading strategies. Therefore, it is absolutely imperative for financial traders to know how to avoid a bull trap before entering into a trade.

How to avoid a bull trap?

It is crucial for traders to avoid bull traps. The best way to avoid a trap is to act ahead of time. Traders should recognize warning signs such as low volume breakouts. They should exit their trade whenever they suspect a bull trap. Moreover, traders should also act with caution when following breakouts. They can look for confirmation before buying breakouts. So, what should traders do to avoid a bull trap?

- Traders should look for higher than average momentum when following a breakout.

- Traders should also look for bullish candlesticks that confirm that prices are likely to rise.

- All traders should act on warning signs as soon as they experience such signals.

- Traders should analyze whether the market is overbought which indicates a bearish reversal from the current bullish trend.

- Traders should also wait for confirmation and see if the uptrend continues or not before entering a long position.

- Placing stop-losses is the best strategy in such circumstances to avoid losses. It is more important when the market is moving too quickly.

Anyway, always follow your trading plan!

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!