- The Relative Vigor Index indicator is an oscillator.

- It measures the strength behind a price move.

- It compares the end price range and offers a reading of the strength of price movement up or down.

The Relative Vigor Index compares the end price range and offers a reading of the strength of price movement up or down. Higher values for the RVI show rising trend strength. Lower values show a reduction in momentum.

In a long-term uptrend, there are back-and-forth movements of price as it goes in the direction of the general trend.

Traders can use the RVI rather than making use of a buy-and-hold trend trading strategy, intended to maximize profits. They achieve this by moving in and out of buy positions in accord with peaks and retracements that happen within the trend.

Traders should use other indicators to confirm signals given by the RVI. The strategy is as follows:

- When the trader has established a long position in an overall uptrend, he/she observes the RVI for bearish divergence from price. This means that the price makes a new high, but the RVI does not make a corresponding new high.

- Confirmation of an impending retracement is achieved by making use of another indicator. If the RSI shows overbought conditions in the market by readings higher than 70, this is seen as a confirming signal of the RVI divergence. The trader takes profit on half of the existing buy position.

- If a retracement happens, the trader looks to re-establish his/her full long position. They do this when the RVI shows a bullish divergence from price and the RSI signifies oversold conditions.

The trader keeps on taking half profits, and then resumes a full long position. The overall uptrend will remain intact, as determined by the price staying above the 100-period moving average (MA). On a close lower than the 100 MA, the trader closes out his/her whole position.

What is the Relative Vigor Index?

Relative Vigor Index indicator is an oscillator that measures the strength behind a price move. It tries to give a guide to the strength of the market, to go on in the same direction of that move – or for the price move to break down.

The main point of RVI is that on the bullish market, the end price is, as a rule, greater than the opening price. It is the other way round on the bearish market. Therefore, the idea behind this indicator is that the vigor of the move is thereby established by where the prices end up at the close.

How to calculate the Relative Vigor Index

- Select an N-period to examine

- Determine the open, high, low and close values for the current bar

- Determine the open, high, low and close values for look-back periods following the current bar

- Calculate simple moving averages for numerator and denominator over the N-period

- Divide value of the numerator from that of the denominator

- Put the result in the signal line equation and plot on a graph

What does the Relative Vigor Index tell traders?

The RVI indicator calculates similarly as the Stochastics Oscillator. The difference is that it compares the close relative to the open rather than comparing the close relative to the low. Traders expect the RVI to increase as the bullish trend gains momentum. This is because, in this positive setting, the closing price of security tends to be at the top of the range while the open is close to the low of the range.

Traders can interpret the Relative Vigor Index indicator the same way as other indicators, like moving average convergence-divergence (MACD) or the relative strength index (RSI). Even though oscillators tend to fluctuate between set levels, they may remain at extreme levels over a long time. Therefore, interpretation should be in a broad context to be actionable.

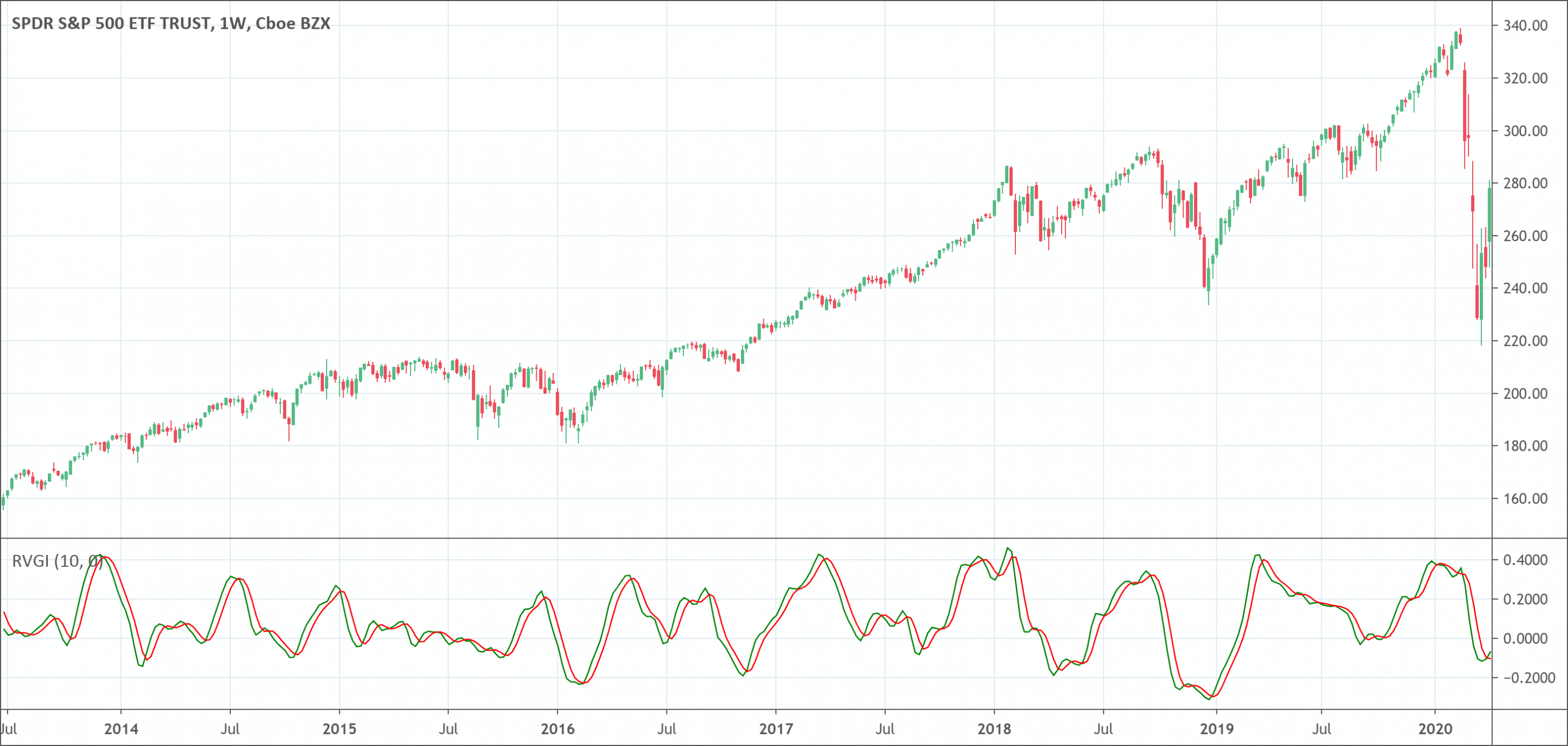

The RVI is centered rather banded, which means that it is typically shown above or below the price chart. It moves around a centerline rather than the actual price. It is a good idea to use the RVI indicator together with other kinds of technical analysis so as you can find the highest probability outcomes.

How to Interpret RVI Indicator

The RVI moves across a centerline

It is interpreted in the same way as many other oscillators, for instance, MACD and RSI. The RVI is displayed when the market is oversold or overbought and sends signals when it diverges with the price chart.

Overbought/oversold conditions

If the market is flat, look for the RVI to exit the overbought or oversold areas for an indication to sell/buy. Note that the indicator does not give exact levels for overbought and oversold areas. So, traders have to figure this out themselves.

Also, it is important to remember that indicators can remain at extreme levels over a long time.

Signal line crossovers

Watch for crossovers between the RVI and the signal line. When the indicator goes above the signal line, it is a bullish sign. When the indicator goes below the signal line, traders interpret it as bearish.

Convergence/divergence

If a new price high is higher than the initial, while the new RVI high is lower than the previous one, notice for the RVI to cross the signal line to the downside and then sell. If a new price low is below the previous one, while the new RVI low is higher than the previous one, look for the RVI to cross the signal line bottom-up and then buy.

Relative Vigor Index is necessary for trading but may give false signals. Therefore, traders have to use it in combination with other indicators and trading tools.

Example of how to use Relative Vigor Index

For instance, a trader may examine potential changes in a trend with the RVI indicator by looking for divergences with the current price. He/she can then identify particular entry and exit points with traditional trend lines and chart patterns. The two most popular trading signals are:

RVI Divergences: Divergence between the RVI indicator and price means that there will be a near-term change in the trend in the direction of the trend of the RVI. Thus, if the price of a stock is rising and the RVI indicator is falling, it means that the stock will reverse over the near-term.

RVI Crossovers: Just as many other oscillators, RVI has a signal line that is often calculated with price inputs. A crossover above the signal line is a bullish indicator while a crossover below the signal line is a bearish indicator. These crossovers are made to be leading indicators of future price direction.

Relative Vigor Index calculation method

Traders calculate the RVI indicator using some steps. The vital step is calculating the basic RVI value using the following equation:

RVI = (close – open) / (high -low)

The calculation method for the Relative Vigor indicator is similar to that of the Stochastic Oscillator. The Stochastic Oscillator uses price in comparison to the low of the day. On the other hand, the RVI uses price in comparison to the high of the day.

Limitations of using the Relative Vigor Index

Relative Vigor indicator works best in trending markets while creating false signals in range-bound markets. Improve results by setting longer-term look-back periods, to reduce the impact of whipsaws and short-term countertrends.

Conclusion

The indicator builds on an assumption that the closing price of time, say the end of the day, is a vital characteristic tied to the force behind a market move.

When the momentum of a market is bullish, observe for higher closes. In a bearish market, observe for lower closing prices. By making use of this simple principle, the RVI indicator gives clear signals of when to trade, through its use of a signal line.

Conventional wisdom dictates that leading indicators tend to be useful mainly in a range-bound market. Be wary of using the indicator in a trending market.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!