- The Mass Index indicator helps traders determine trend reversals.

- It examines the difference between low and high prices in a security over a period.

- It calculates with the exponential moving average (EMA) of price over a nine-days period and the exponential moving average of this average, and adding the ratio of these two over a given number of days (usually 25).

The mass index indicator is the tool some traders recommend to use to detect market reversals. Reversal trading is a dangerous game, it’s dangerous for the beginner trader. Trend reversal can be like trying to catch a falling knife. A falling knife has no handle. Don’t try to catch it.

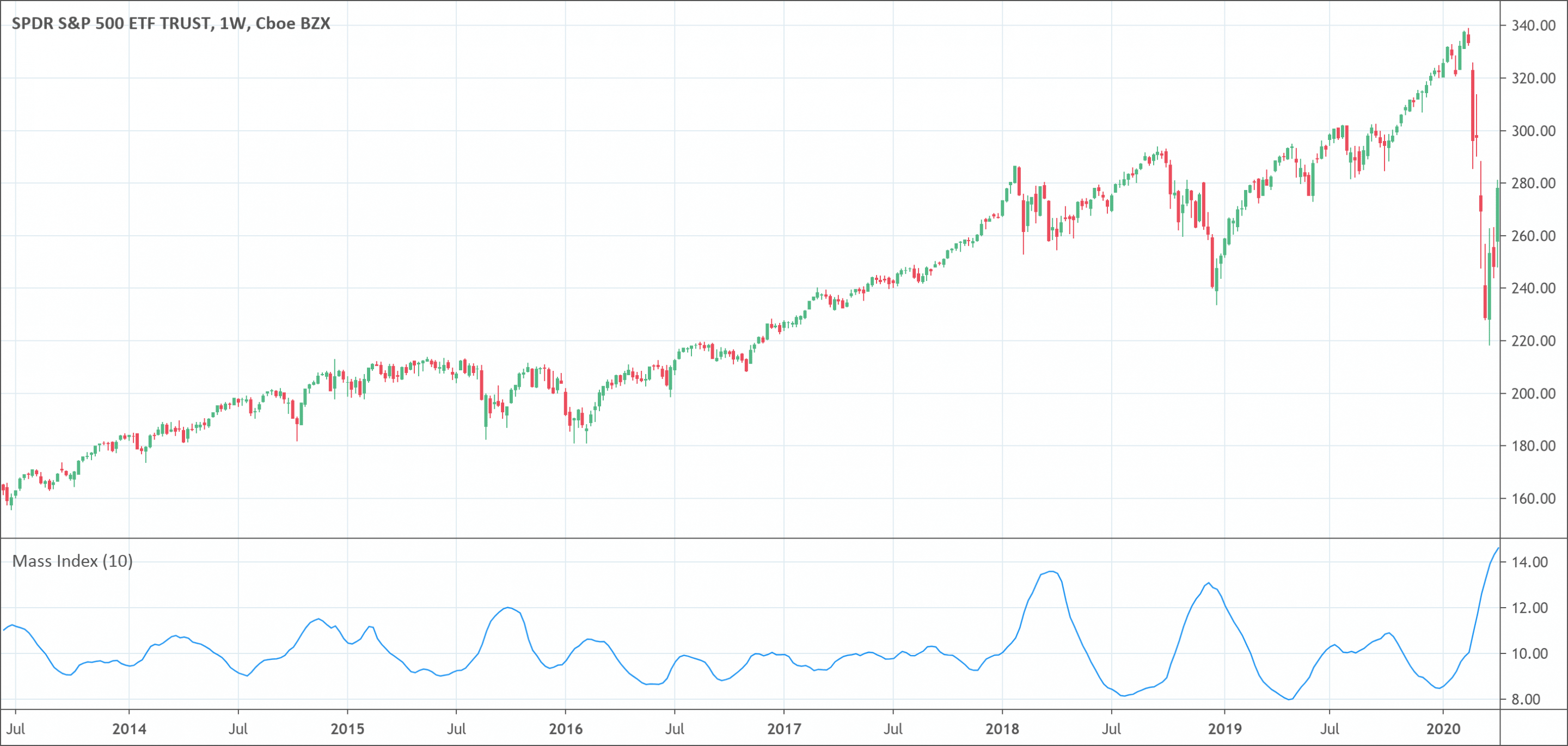

The mass index examines the difference between low and high prices in a security over a period. You can see it as a study on volatility. Once the indicator moves higher than a particular level, then drops, traders can take it as a signal that a trend change could be on the way.

Just as it is with most technical analysis indicators, it was originally made for the daily chart. Although traders are entirely free to use it on any timeframe.

What is the Mass Index Indicator?

Donald Dorsey created the mass index indicator in the early 1990s. Traders use it in technical analysis to determine trend reversals. It depends on the notion that there is likelihood for reversal when the price range widens, and thus compares previous trading ranges.

Traders can get the mass index for an asset by calculating its exponential moving average (EMA) over a nine-days period and the exponential moving average of this average, and adding the ratio of these two over a given number of days (usually 25).

By analyzing the widening and narrowing of trading ranges, mass index detects potential reversals based on market patterns that are not often considered by technical analysts mainly focused on singular price and volume movements. But since the patterns do not offer insight into the direction of the reversals, traders should combine the readings of the indicator with directional indicators.

Hypothetical illustration of the Mass Index

To get a good idea of what mass index truly does, consider the mass index calculator, which shows the volatility of the stock, to be like the speedometer of a car.

The speedometer will only show how fast or how slow you are traveling, therefore, you will likely need to use a compass to determine if you are going north or the south – the compass, in this case, will be another technical indicator for determining direction. In other words, if you are not sure about your direction, your speed doesn’t matter.

Calculation of the Mass Index

The calculation includes four steps and depends on an EMA, a double EMA, a ratio between the two, and a final 25-day moving sum of the ratio. Traders mostly use four steps to calculate the mass index. These steps include:

- Calculating a nine-day exponential moving average (EMA) of the difference between high and low prices for any time.

- Calculating a nine-day EMA of the moving average produced in step one

- Dividing the EMA produced in step one by the EMA produced in step two

- Adding the values in step three for the intended number of periods

The single EMA gives the average for the high-low range, which is then smoothed for the second time by the double EMA. The ratio between the two normalizes the data and indicates when the single EMA grows relative to the double EMA. While the last 25-period moving summation further irons out the data.

How to use the Mass Index Oscillator?

It is very simple to interpret the readings of this indicator. Donald Dorsey reveals that a reversal signal can be seen when there’s a reversal bulge. It is nothing more than following a combination of two trade signals.

- Max index value needs to go higher than 27 level

- Then wait for the index reading to drop less than the 26.5 level

The previous reading higher than the 27 level shows that the volatility expansion is at the extreme. You need to be nimble at this stage because the reversal signal is not yet completed. You can consider that the prevailing trend may end in a short time.

To determine a change in trend direction, the mass index reading has to drop lower than the 26.5 points. At this stage, the reversal bulge is completed and you can open a trade. But traders should use other technical tools to establish the direction of the reversal.

Usually, if a reversal bulge happens during a downtrend, it shows a bullish trend reversal. But if it happens during an uptrend, it indicates a bearish trend reversal.

When to use the Mass Index?

It is best to use the mass index indicator together with the price action. The indicator has shown that it can measure the daily high-low range and predict market turns with high accuracy.

Trend reversals are estimated by using a meticulous step-by-step process using the daily high-low range expansion. It is difficult to spot market turning points on a naked price chart. But when you use this amazing trend reversal tool, you can select tops and bottoms.

Regardless of the various market conditions, when a reversal signal is given by this indicator, the results are the same. It does not matter the degree to which the market will reverse. The certainty is that at least a pullback will follow the trend reversal signal. Learning how to profit from trading pullbacks is the most profitable approach to trading.

Why use the indicator?

Reversal trading is the most profitable form of trading. Catching top and bottoms allows traders to participate in a trend, right from the beginning. Determining the beginning of a new trend can open up the door for potentially riding bigger swing waves and subsequently making bigger profits.

Below are three ways traders can use the mass index indicator to detect trend reversals.

1. Watch out for mass index reversal bulges

The creator of this indicator discovered that when the mass index indicator value goes higher than 27, the chance of the trend to reverse increases. He then created some mass index trading strategies based on this hypothesis.

2. Use basic technical analysis to spot trend reversals

If you join basic technical analysis tools such as trend lines with mass index trading strategies, you’ll have fascinating results. The price has to make higher highs to form a trend line. Additionally, all trends will have reversals at some point. Based on these facts, you can trade the market with the mass index.

3. Spot a trend reversal by combining mass index with other technical indicators

Since the mass index is a volatility indicator, use it in combination with other technical indicators to validate trade signals.

Conclusion

The mass index aims to detect potential price reversals in a market by analyzing its trading ranges. Traders can calculate it by taking an exponential moving average of trading ranges and dividing it by double exponential moving average. Next, will be, to sum up the totals over a particular time.

When the indicator increases, it means that the rate of change in the trading range is going down. That is, the magnitude of the trading range is getting less volatile – and will probably cause the price to trend in one direction or another. Traders then assume that this assumption will produce higher volatility.

An indication of a potential trend reversal was originally characterized as a break above the 27 levels and then back below the 26.5 level.

The mass index indicator offers no sign of the future trajectory of the trend – if a shift is indeed in store – whether that means going from positive to negative, sideways to positive, positive to more positive, and so forth.

It is also prone to false signals. As usual, this means it traders should use it together with other indicators to improve the accuracy of any trading system this indicator is in.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!