- The dead cat bounce pattern is a specific stock chart phenomenon that occurs during a long downtrend.

- It is a short term reversal bounce that takes place in the context of a very long downtrend.

- In simple words, the pattern is a correction of a long bearish trend.

The dead cat bounce is the name of a rock band. Ok… but we are not going to talk about this side of the topic.

Let’s deep dive into what “dead cat bounces” are for financial markets!

We are actually talking about the dead cat bounce pattern. The term is rarely used because it is offensive for pet owners and lovers but the trading pattern is something really interesting for the traders. Anyways, let us get back to the point and look at the DCB definition and description.

What is the dead cat bounce pattern?

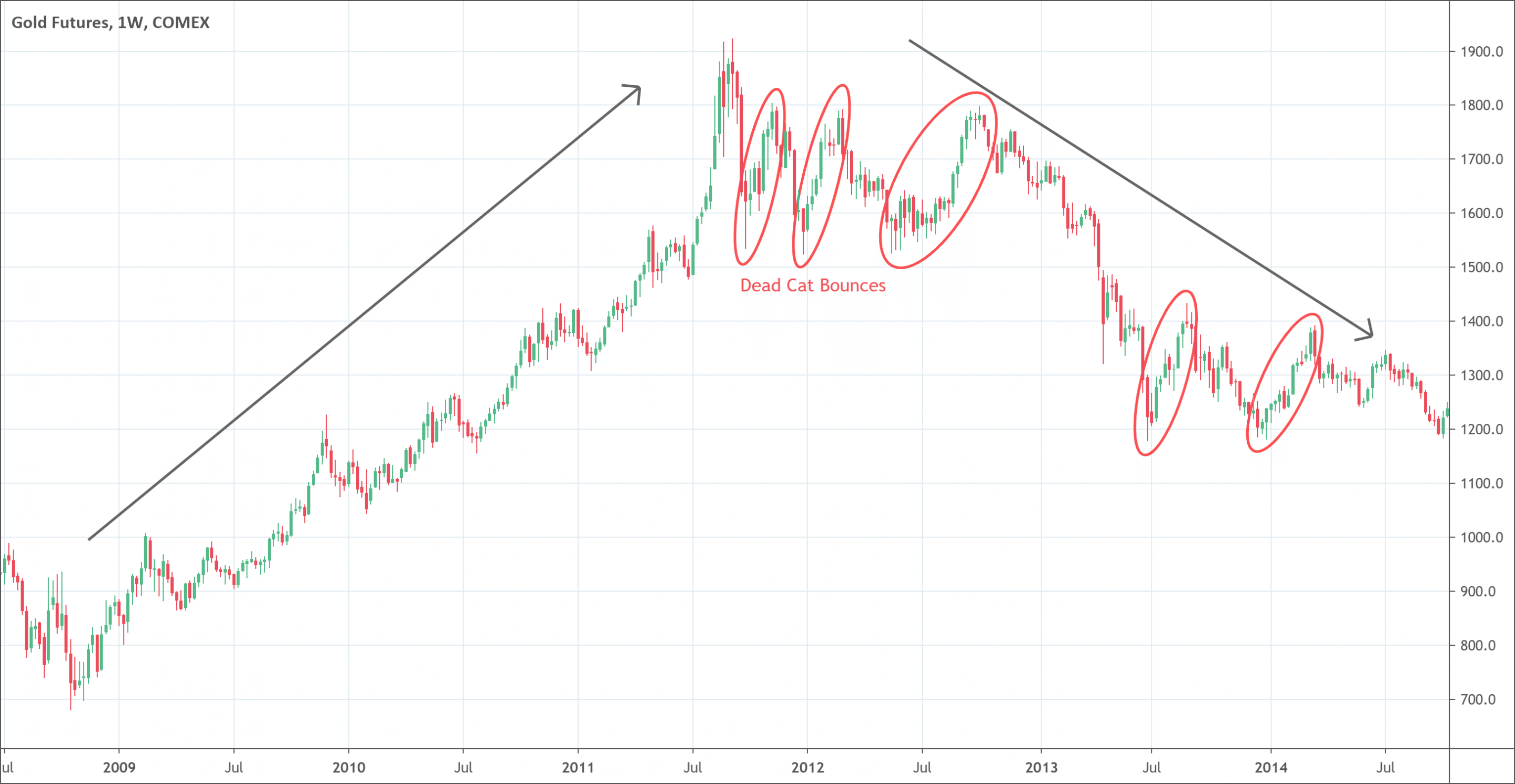

“The dead cat bounce pattern is a specific stock chart phenomenon that occurs during a long downtrend.” It means, as the term suggests, that anything can rebound when it falls from a significant height. It is a short term reversal bounce that takes place in the context of a very long downtrend. In simple words, the pattern is a most-welcomed correction of a long bearish trend, even though it occurs for a very short duration that is followed by the descent again.

It is often triggered by short-covering and it appears on the chat as a sharp V-shaped reversal. The V-shaped pattern of the bounce forms at the very bottom of an extensive sell-off in the stock market.

A dead cat bounce pattern is generally considered only as a price pattern but that is not all. It can also help to explain the participants’ repositioning in the market. When the traders assume that the market has reached the lowest, they tend to close short positions to lock profits. Hence, traders move to the long side of the market hoping that market has already oversold and now is the time to bounce back. That is the reason that it got its funny name “dead cat bounce”. The stock markets of Malaysia and Singapore bounced, after a long downtrend, for a very short interval in December 1985. The Financial Times used this term for the very first time to describe the incident.

What are the causes of the dead cat bounce?

The dead cat bounce means a stock takes a big dive, bouce back for a short interval of time, and the dives back again. But what are the factors that cause the bounce? There are two main factors of its happening.

- When the shorts seek a point to gain profits during the downtrend

- When the dip buyers start looking for a place to buy stocks at discounted rate

These two sets of players set up the buying pressure that causes the prices to move up. However, this buying pressure is not sustainable. New shorts begin to emerge after a short period of activity. The downward crash begins once again when there is no one left to buy. This is a pattern that happens every now and then. Some big examples are there to quote here such as rally in stock prices, before the continuation of the downtrend, of dotcom in early 2000s and the bitcoin in 2017-18.

How to identify the dead cat bounce pattern?

The identification of the pattern is tricky and you need a solid approach to trace it. You should keep in the mind that whenever the price breaks the low of the last bottom, it is time of confirmation of the dead cat bounce pattern. You can easily identify the pattern by following the steps below:

- First of all, the identification of a strong bearish trend or downtrend on a chart is necessary.

- Look for an increase in prices that puts an end to the slope of the long downward movement. It will be very minor bounce as compared to the downward slope of the downtrend.

- Wait for the occurring of the first step again

What does the dead cat bounce pattern tell traders?

As we have discussed earlier that the dead cat bounce is a price pattern and a continuation pattern as well. At first glance, it seems like the reversal of the current trend but it quickly gets followed by the continuation of the same downward pattern. Shot-term traders seek to capitalize on the short rally interval while regular traders and investors prefer to initiate a short position.

The dead cat bounce pattern is difficult to recognize in advance as analysts are only able to recognize it after its occurring. Technical analysts and experts can predict the temporary nature of the trend reversal only with the help of other technical tools such as Fibonacci retracement indicator. Traders can observe the pattern in both, the broader economies and individual stock or group of stocks.

How to trade when you see the pattern?

Is it easy to trade a dead cat bounce?

The dead cat bounce trading strategy is not a simple one. The reason is that the market may change its perceptions over the long course of downtrend. During the period of extended downward movement, any further lower movement is generally regarded as a harbinger foretelling further collapse. Similarly, any upward movement in such markets is taken as temporary that will not last long. There isn’t any surety that it is the dead cat bounce or is it simply a trend reversal. However, there is one technical analysis tool that helps to determine whether it is the pattern or not. That tool is the Fibonacci retracement indicator.

Theoretically, it is easier to talk about the dead cat bounce trading strategy but practically it is a bit complex. Theoretically we can say that any rebound with a shallow 38.2% retracement of losses during a long downtrend indicates that it is the pattern. This shallow rebound itself suggests that market activity is based on the assumption that there is no confidence among the traders to trust rebound. However, it is not a hard and fast rule because evidences suggest that the retracement may reach 50% before freefall again.

Wait for confirmation

After confirmation of the dead cat bounce, the time comes to make a trading strategy. First of all, it is important to search for a breakout of the latest low level. Once the price reaches in the vicinity of the opening price, be on high alert to take a short position. But it is important to note that take short position only when the price begins to fall again. After taking the short position, it is ideal to place the stop-loss a few points above the most recent high. As a general rule, normal fluctuations should not reach the stop while keeping the risk control and at the same time, permitting the potential profit from the trade to overpower the risk.

Limitations of the pattern

The biggest limitation of the pattern is the confusion attached to it. Traders may consider a trend reversal as a dead cat bounce resulting in failed trading strategy. It is a tricky phenomenon. If someone with superpowers may correctly identify the pattern every time, he/she would become billionaire.

Conclusion

The dead cat bounce pattern occurs during a long downtrend for a very short interval followed by the downward movement once again. The bounce trading strategy is difficult to apply because of the complexities involved in the confirmation of the pattern. Similarly, trading bounce stock is also a sophisticated option that requires keen observation of minute details. However, the dead cat bounce offers numerous benefits especially for the short-sellers.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!