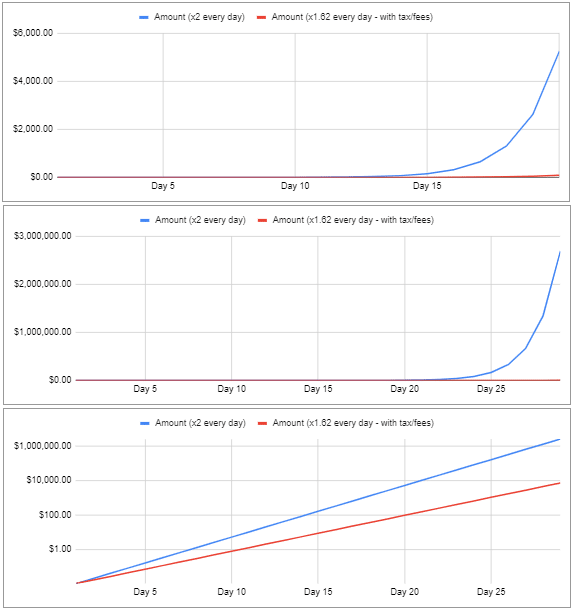

- 1 penny doubled every day for 30 days = $5,368,709.12 (which is way more than $1 million)

- If you consider 10% fees and 10% taxes, after 30 days you “only” have $11,910.65 (only 0.22% of $5,368,709.12)

- You can play with these figures and charts here

What will you like to pick? 1 penny or a 1 million dollar check? You can maintain your personal finances by answering this question. But how? We are here and going to tell you in this blog post.

Many financial experts have got experience from their lives. Whenever you get any advice from them, the certainty is that they will ask the same question. What would you like to prefer? $1 Million or a single penny that will double its price?

For those studying finance subjects, this question is very common for them. Many students answer that they will take one penny, while many say that they will prefer one magical penny.

Golden Penny

Suppose you are wandering on the street, and suddenly you see 1 penny on the street. After you pick it up, you realize that this is not an ordinary penny but a golden or magical penny! The reason it’s magical is that this penny doubles its value every month.

You may say that when you wake up the next day, you will have two pennies instead of one. You will get two pennies, then 4, then 8 and so on.

Now here the question is, what will be the worth of that magical 1 penny after 31 days. And what if you are given $1million as a one-time payment, and someone asks you to give that penny? What will you do? Which one will you prefer? Before scrolling down, think about it by yourself!

We would have chosen the magic penny if we were given the options. It will get worth it, and you can get up to $10 million or even more than that.

You can say that taking the 1 penny is a better option than anything else. It will be more profitable for you as compared to the $1 million payment. If you are still confused, how? Then simple, you can calculate the answer through brute force formula and get the answer.

Power of Compound Interest

You can easily turn 1 penny into $10 million by the power of compound interest. The simple example of taking compound interest is explained above. Taking one penny and then making its value double. But do you know that there are also many other lessons that you can learn from a single penny? We will tell them as well!

You can play with a custom spreadsheet (from which the above chart is taken from) here: https://docs.google.com/spreadsheets/d/1GDKbniKrOW-721dPr6kTrGvYXxTEBdwvqwUFTH3wnLg/edit?usp=sharing

Early Investments are Important Which one you will pick? 1 Penny or $1 million

The first and most important saving lesson is that investing early can help you. If you want to earn profits, then early investments are crucial. If you save early, you will get more. Moreover, saving early is also one of the crucial axioms for personal finances.

The magical penny does not only give you a tip to grow your money, but you will also know how you can save early and increase your growth exponentially.

Think about the other side, what will happen if you miss a chance of picking a magic penny one day and get it the next day? And you have only 30 days to double the money. As a result, you will only get $5 million by the end of 30 days.

This means that you missed out on the last day of doubling your amount. And what if you missed that penny and picked it up on day 10? You will only get $20 thousand.

Similarly, if you will start saving late, you will probably get less profit, or you may save less money. The total balance of your saved amount can grow really fast if you save it at right them, then invest it at the right time and at the right place. Another important thing is that the doubling will provide the largest growth in dollars.

Delay can have Negative Consequences

You always need to remember that if you do not save money early, then delay can cause negative consequences. These consequences can continue for years. And another main thing is that they can also divert additional funds of yours to catch up.

Just like we told you about a penny. On day 10, you will have more amount. Suppose you received 1 penny on the 10th day, and someone else received it on day 1, then who will get profit? Obviously, the one who got it earlier.

Only getting the money is not enough; saving it is also necessary. So, you need to consider both things at the same time.

Small Amounts Can Matter A lot

Here is the third most important lesson for you. Small amounts can add up and make huge sums ultimately. There are many people who consider the value of even a single penny. But still, there are many who do not know the importance.

Once you are in the position to put large amounts in your saving or retirement amount, you must consider some important factors as well. You must know that even a single penny can matter a lot. There are many people who worry about managing their loans, their expenses and budgets. The reason is that they have put the maximum amount in the account. They do not know what to do.

Here you can do one thing. Reduce one penny from the amount you will need to save. It will reduce your anxiety, and you will know that your savings choice is not binary at all. Here, the magical penny adds up one of the major things. And that thing is the small amounts can add up quickly over a short time.

So, a lot can be better than a small amount. Keep in mind that something is better than having nothing at all. Moreover, you can also increase the amount you have to save over time. In other words, you may say that not only does amount is matter in the market, but time is also important.

Perception of Increasing your Money

There are many people who also think that they cannot double their money realistically, just like the magical penny. But if the above experiment is implemented, it can open the doors of real growth for many people.

Have you studied about rule of thumb? Well, you can take number 72 and then estimate how long you can grow your money. Divide 72 by the rate of the return that you expected. Then you will roughly get an idea of how long it will take to double the money.

Let’s take an example! Suppose your tool is $1000 and then you are expecting to earn 8% every year for 9 years, you can get approx—$ 2000.

Do not rely on this only, and you can research from real-life examples too. It will help you get a better insight. Let’s take an example; between the years 1985 to 2014, McKinsey figured out that the US and Western Europe stocks have a return of 7.9% every year. These stocks were high as compared to 100-year averages. Even these were much higher than he ever thought or expected. So, he was interested in investing in them.

If The Investment is Too Good to be true, then you must be careful!

While you are devoting more time to workshops for getting financial advice, the important thing to remember over there is about fiduciaries. Try to focus on better investment opportunities.

If someone is trying to give or sell you a guaranteed investment and he also promises to double your amount in only a year, then you must not grab that opportunity. Or you can say that doesn’t spend a single penny on them.

To get back to the original question, would you prefer to have one cent or $1 million today that will eventually double every day for 30 days? If you chose only one million dollars, you would leave millions on the table.

Only invest when you are sure that you will get the amount that you want. Otherwise, you can get the loss. Wait for the other options as well. And then invest in the one best option.

Conclusion

You must know what you are investing, how much time it will take, and how can you earn through that. One thing that you must also keep in mind is that compound growth usually takes time for making a dramatic difference. If you want to get enough money so you can retire early, then you must start saving a small amount from now onwards. It will help you a lot.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!