What is Rounding Bottom?

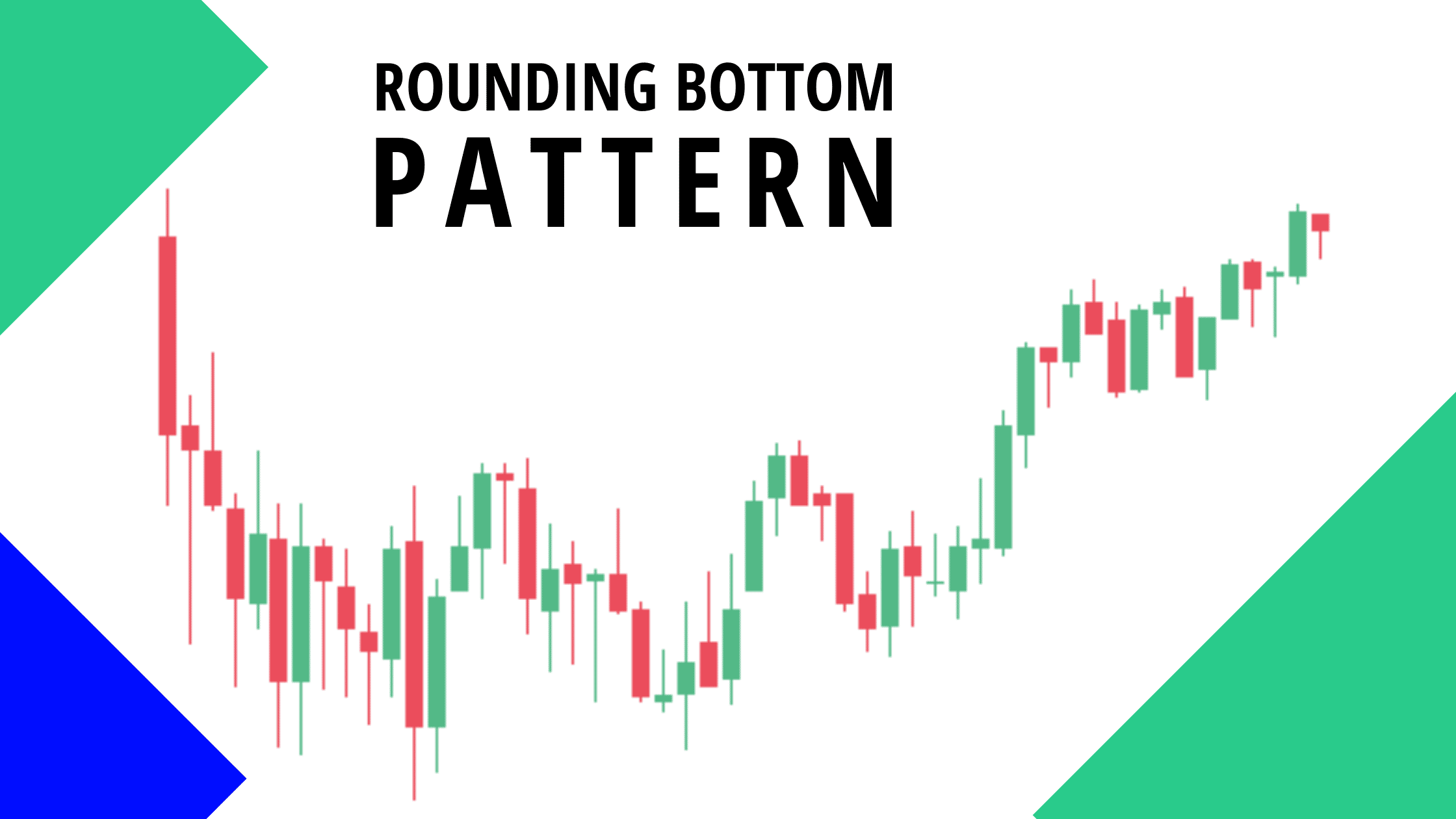

A rounding bottom is a chart pattern used in technical analysis. It can be recognized by various price movements that graphically makes up a U-shape. Rounding bottoms are situated at the close of an elongated downward trend. They signify a reversal in long duration price movement. The time duration for this pattern can range from weeks, to months, and many traders consider it to be a rarity.

How a Rounding Bottom Works

The rounding bottom pattern has six main components:

Prior trend

For a reversal pattern to exist, there has to be a prior trend to reverse. Usually, the base of a rounding bottom will signify a new low. There are instances when the low is registered several months earlier on the security trade flat before making up the pattern.

Decline

The first part of the rounding bottom is the decline that result to the low of the pattern. This decline can appear in different forms. Some trade with a high number of highs and lows while others trade lower in a straight line.

Low

The low of the rounding bottom can take the form of a ‘V’ bottom, but should not appear too sharp and must take some weeks to develop. Since prices are a long duration decline, the chances of the selling climax appears and can form a lower spike.

Advance

The advance off for the lows makes the right half of the pattern and would require about the same duration of time as the prior decline. If the advance appears too sharp, then the credibility of a rounding bottom may be a problem.

Breakout

Bullish affirmation exists when the pattern breaks at the top of the reaction high which shows the beginning of the decline at the initial stage of the pattern. As many resistance breakout, this line becomes a support level. Even though rounding bottom represent long duration reversal and this new support mark may not be so important.

Volume

With a normal pattern, volume levels will mark the image of the rounding bottom. Volume levels are not very significant on the decline, but there should be an addition in volume on the advance and suitable on the breakout.

Profit Target for the Rounding Bottom Pattern

The rounding bottom pattern has a bullish potential. After the trend changes from bearish to bullish, the anticipated outcome is for the price to continue going higher. But will need to answer the question of how much higher. The basic answer is the Forge higher should be at least the size of the rounding bottom development.

Rounding bottom neckline (support line)

To calculate the likely outcome of the rounding bottom, you must first figure out the support level of the pattern. To achieve this, you will draw a line running across the high bearish treasure and the bullish trend just before the break out happens. Now measure the distance between the support line and the lowest level of the pattern. Whenever the price level breaks the support line, traders should open a long position.

How to trade with the Rounding Bottom Pattern

- Verify the rounding bottom image: in order to verify this pattern, you need to locate the price decrease which gradually changes to a range succeeded by a price increase. The strongest verification occurs when the volume indicator display high volume on the decline, flat volumes on the range and a gra volume on the reversal.

- Round Bottom Support line: as soon as you figure out the pattern, you need to draw the support line. In order to achieve this, you will draw a horizontal line running across the high of the bearish and bullish sides of the rounding bottom pattern.

- Round Bottom Breakout: the rounded bottom breakout occurs wherever the price breaks the support line in a bullish direction. To simply put it, the trade should display strength as it cuts across the support line. This trend should appear by itself through price expansion and additional volume.

- Round Bottom Trade Entry: a trader should be prepared to go long after the trade successfully breaks the support line.

- Round Bottom Stop Loss: the rounding bottom pattern is somewhat dependable. But since you should never ignore the rule of protecting your capital at any point in time, it is very essential to always apply a stop loss. The stop loss should be placed at the midpoint of the pattern. A much safer approach is to place it below the low of the breakout candle. In case the trade fails, you can immediately exit your position and resolve to a better trading chance.

- Rounding Bottom Target: the size of the pattern is equivalent to the smallest target for the pattern when added to the breakout. As soon as the price hits the target mark, you should ensure to exit the position.

Improving the reliability of rounding bottom patterns in trading

The rounding bottom is one of the top most dependable chart patterns in trading, with a minute failure rate of about 3 – 6%. This does not exactly make trading this pattern all that easy because of two main reasons:

- There exist other chart patterns that are similar to this shape. And when making use of this trade, it can be a bit daunting to pick out this pattern when still under development.

- Even when you are certain of the pattern it is, determining when the reversal and the breakout would happen can be really challenging.

And for these reasons, it can be difficult for an amateur trader to make profits with this strategy.

But the good news is that there are methods you can take advantage of to combat this issue of reliability. They include:

- Developing an Agile Trading Strategy: don’t be overly dependent on the price graph to form this pattern. Having an agile trading strategy will ensure you don’t lose out on a profitable trade entry even when your initial prediction is false. Also, this will drastically reduce the risk of losing money as a result of going into the trade at a wrong time.

- Integrating other technical analysis and indicators to your trading pattern: the idea that this pattern would simplify trading would not be sufficient in most cases and therefore, the need to incorporate other patterns to increase the chances of having a successful trading experience.

Some examples of this indicators and technical analysis tools that can be implemented to increase the reliability of rounding bottom pattern includes:

- Support and Resistance

- Japanese Candlestick patterns

- Volatility indicators

- Momentum indicators

Trading Rounding Bottom Chart Patterns

Figuring out a rounding bottom pattern on a price chart can be fairly simple. However, trading these pattern can be very tricky. This is why it is very essential to have an holistic trading plan before going into an actual trading. An example of trading strategy is the breakout trading. The breakout strategy remains one of the most trusted and dependable trading method for trading rounded bottom pattern.

The trading breakout consist of four stages associated with this pattern:

Recognizing tradable waves

The breakout trading pattern targets making an early trade entry in the direction of the new trend immediately rounded bottom gets completed. This trading strategy focuses on trading anywhere on the curve after a breakout.

Deciding Trade Entry

With this strategy, you will get into a trade as soon as the price breads the resistance for a rounding bottom pattern. The breakout after the resistance line shows that the reversal will continue. You should therefore lookout for trading prospects in this new trend direction. And you must always patiently wait for a confirmed signal when going into a trade after a breakout.

Deciding stop loss target

When trading rounding bottom pattern using this strategy, you will need to apply stop loss beneath the resistance level. Patterns cannot be fully verified until breakout has been completed. You should beware as there are false breakouts.

Deciding Take profit Target

In a rounding bottom pattern, the proximity between the low and the resistance line is equivalent to the proximity between the resistance line and the take profit line.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!