- The Polarized Fractal Efficiency (PFE) indicator helps determine the price efficiency.

- It determines the strength and direction of the trend.

What is the Polarized Fractal Efficiency indicator?

The Polarized Fractal Efficiency (PFE) indicator is a technical analysis tool that helps traders and technical analysts on two aspects. It helps to identify the level of effectiveness of price movements. Secondly, the PFE indicator helps to determine how price changes chaotically or directionally behaved in the recent past. Hans Hannul was the developer of the PFE indicator. He developped it in an edition of Technical Analysis of Stocks and Commodities in 1994.

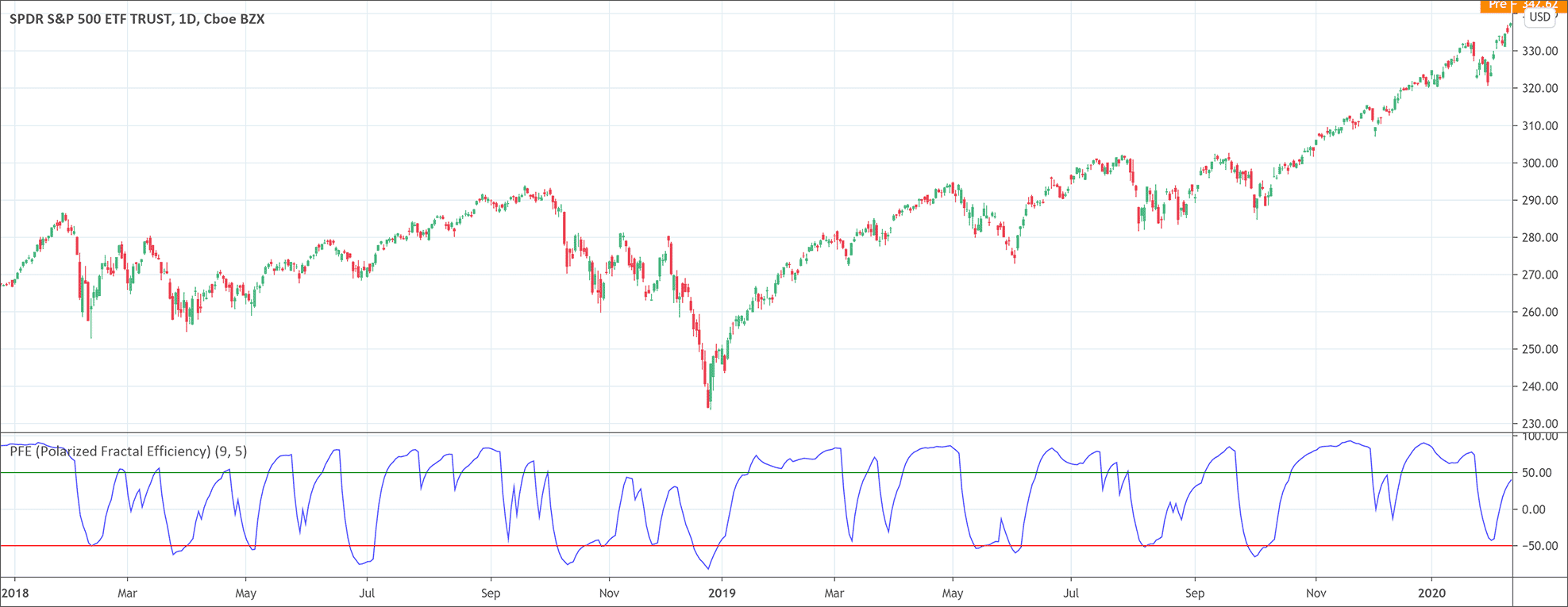

The Polarized Fractal Efficiency is a unique indicator that measures the effectiveness of price changes based on the fundamental assumption of geometry. The most effective price change for the PFE indicator is linear. Thus, it represents the changing prices in a linear fashion rather than showing in ups and downs. The linear movement suggests a more definite and stronger trend. The values of the PFE indicator lies between the range of -100 and +100. The zero line acts as a barrier to distinguish positive and negative PFE values.

How to interpret the PFE indicator?

The Polarized Fractal Efficiency measures the effectiveness of the price movement and the strength of a trend with the help of the zero lines. The PFE values further from the zero line indicate a more effective price movement and a stronger trend. The PFE prices exceeding zero indicate a bullish trend in the market. The higher PFE values suggest an effective upward price movement. A trend is 100% effective only when the PFE indicator shows it at a right angle and vice versa. Conversely, the PFE values lower than zero suggest a bearish trend in the market. The lower PFE values indicate a stronger and effective downtrend in the market.

How to trade with the Polarized Fractal Efficiency indicator?

A reversal in the direction of the PFE indicator and its movement away from zero is generally considered a buy signal. Traders should close their trading position when the PFE values reach a peak above zero. On the other hand, the PFE indicator issues a sell signal when the PFE values fall from peak to zero. Traders should cover short positions by buying after the PFE indicator forms a new low.

However, it is important to note that every analysis tool has certain weaknesses and the Polarized Fractal Efficiency is no exception. It helps greatly when combined with other technical analysis tools such as the Simple Moving Average, Stochastic Oscillator, price action analysis, etc. Moreover, money management is also extremely important because almost every tool issues false signals and traders may lose a lot.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!