- The Pivot Point indicator automatically draws potential resistance/support levels.

- It make use of the high, low, and close of the previous period to estimate future support/resistance levels.

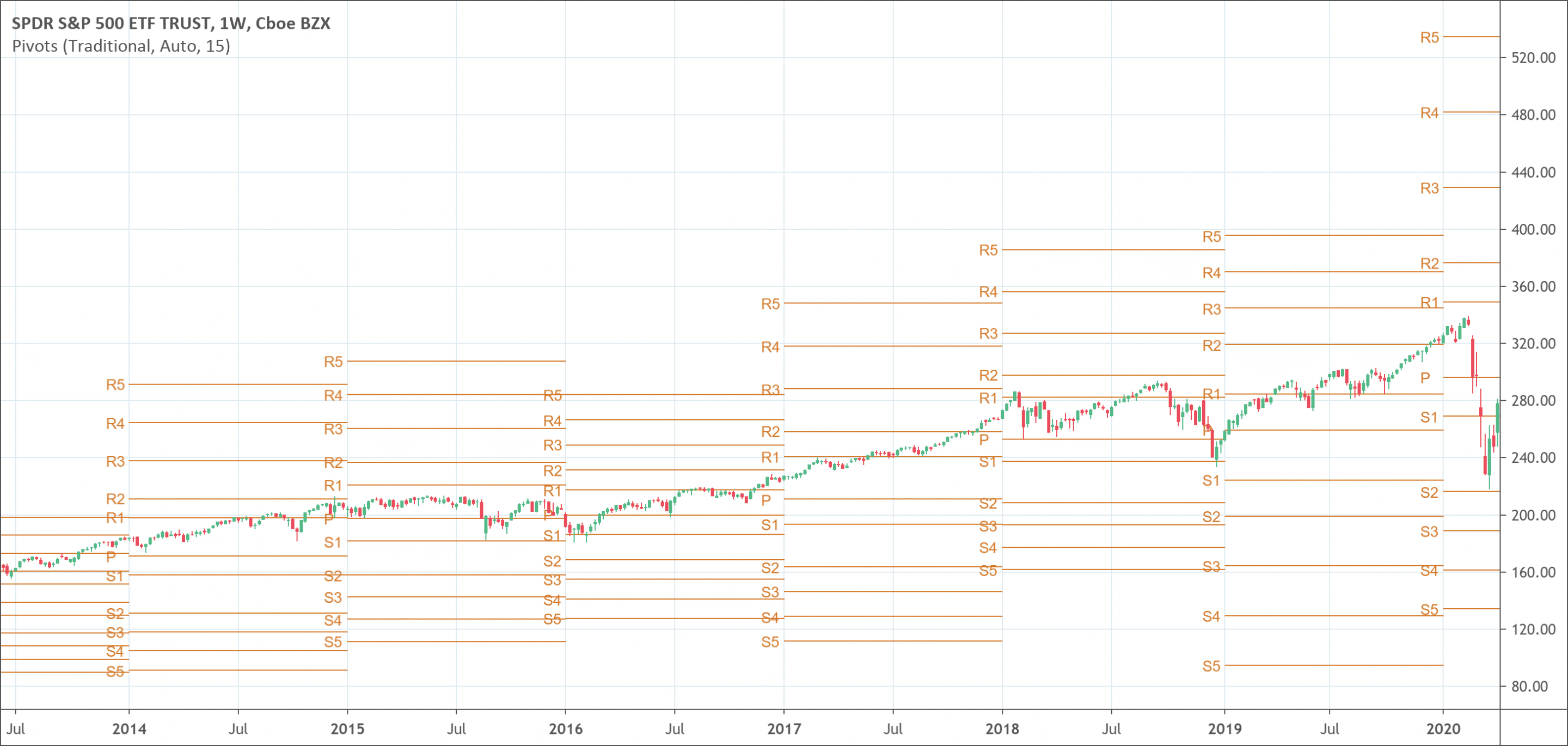

Pivot points are important levels chartists that traders use to detect directional movement and potential resistance/support levels. They make use of the high, low, and close of the previous period to estimate future support/resistance levels. Due to this, pivot points are termed leading or predictive indicators. Let’s go into the details of the pivot point indicator.

Floor traders originally used pivot point indicators to set significant levels. Such as modern-day traders, floor traders operated in a quick-moving setting with a short-term focus. At the start of the trading day, floor traders would look at the high, low, and close of the previous day. They look at it to calculate a pivot point for a trading day.

What is the Pivot Point Indicator?

It is a technical analysis indicator to determine the general trend of the market over various time frames. The pivot point itself is simply the mean of the high, low, and close prices from the prior trading day. Trading above the pivot point on the current day indicates ongoing bullish movement. Trading below the pivot point shows a bearish sentiment.

The pivot point is the base of that indicator, and it is also made up of other support/resistance levels that are shown based on the pivot point calculation. All these levels assist traders to see the direction the price may experience support/resistance. Also, if the price goes through these levels it tells the trader that the price is trending in that direction.

What do Pivot Points tell traders?

Pivot points indicators are intra-day signals for trading futures, commodities, and stocks. Unlike other moving oscillators, they are static and stay at the same prices throughout the day.

Thus, traders can use the levels to plan out their trading in advance. For instance, they know that, if the price goes down below the pivot point, they will probably be shorting early on. If the price rises above the pivot point, they will be buying.

Traders commonly use pivot points in combination with other trend indicators. A pivot point that also overlaps with a moving average or a Fibonacci extension level becomes a powerful support/resistance level.

Pivot Point levels

Pivot points have seven basic levels on the chart. When you add these levels, you’ll notice five parallel horizontal lines on the chart. The levels are:

- Basic Pivot Level (PP) – It is the middle and basic pivot point on the chart

- Resistance 1 (R1) – It is the first pivot level above the basic pivot level

- The Resistance 2 (R2) – The second pivot level above the basic pivot point, and the first above R1

- Resistance 3 (R3) – The third pivot level above the basic pivot point, and the first above R2

- Support 1 (S1) – It is the first pivot level below the basic pivot point

- The Support 2 (S2) – The second pivot level below the basic pivot point and the first below S1

- Support 3 (S3) – The third pivot level below the basic pivot, and the firs below S2

How Pivot Points work

A pivot point indicator gives a standard support and resistance function on the price chart. When price action gets to a pivot level it could be:

- Supported/Resisted

- Extended (breakouts)

If you notice the price action getting to a pivot point on the chart, treat the situation as a normal trading level. If the price begins hesitating when getting to this level and suddenly bounces in the opposite way, trade in the direction of the bounce.

How to trade with the indicator

The indicator is usable on all the timeframes

They are technical indicators that show an average of the high, low, and ending prices from the previous trading day. Traders can use it to find probable support/resistance levels.

Use the hourly, daily, monthly, and weekly pivot points to locate possible support/resistance levels and increase your trading consistency.

How to use the Pivot Point indicator on the different timeframes

The pivot point indicator for 1-, 5-, 10- and 15-minute patterns make use of the high, low, and close of the prior day. That is to say that pivot points for intraday charts today would be based on the high, low, and close of yesterday. Pivot points don’t change once they are set. They remain in play throughout the day.

Pivot point oscillators for 30-, 60- and 120-minute patterns use the high, low, and close of the prior week. These calculations depend on calendar weeks. At the beginning of the week, the pivot points remain constant for the whole week.

How to calculate Pivot Points

These indicators can be added to a chart, and the levels will be calculated and shown automatically. If you want to calculate them yourself, keep in mind that pivot points are used predominantly by day traders and depend on the high, low, and close from the previous trading day.

If it is Tuesday morning, use the high, low, and close from Monday to make the levels of the pivot point for the Tuesday trading day.

- After the market closes, or before it starts the next day, locate the high, low, and close from the most recent day.

- Add the high, low, and close and divide by three

- Mark this price on the chart as P

- After you have determined the P, calculate S1, S2, R1, and R2. The high and low in these calculations are from the prior trading day

Types of Pivot Point Indicator

Standard Pivot Points

They start with a base pivot point. This is just an average of the high, low, and close. The mid-point is indicated as a strong line between the support and resistance points. Remember that the high, low, and close all come from the previous period.

Fibonacci Pivot Points

They begin the same as standard pivot points. From the base point, Fibonacci multiples of the high-low differentials are included to make resistance points and subtracted to make support points.

Demark Pivot Points

These begin with a different base and make use of various formulas for support and resistance. They depend on the relationship between the open and the close.

Limitations of the Pivot Point Indicator

These indicators depend on a simple calculation, and even though they work for some traders, others may not find them significant. There is no certainty the price will stop at, reverse at, or even get to the levels made on the chart.

Other times the price travels back and forth through a level. Just as it is with all indicators, traders should only use it as part of a complete trading plan.

Conclusion

Pivot point indicators give traders a means of determining the direction of the price and then place support and resistance levels. Price direction is estimated by observing the price action of the current period relative to the pivot point. Start above or below the pivot point, or cross it in either direction during trading.

The set support and resistance points are needed after traders have determined the price direction. The concepts behind pivot points can be used across different timeframes, even though they were originally made for floor traders.

Traders must confirm the pivot point indicator with other parts of technical analysis. A bearish candlestick reversal pattern could mean a reversal at second resistance. An oversold RSI could mean oversold conditions at second support. An upturn in MACD can apply to confirm successful support tests.

Lastly, at times, the second or third support/resistance levels are not obvious on the chart. This is because their levels go beyond the price scale on the right. That is to say that they are off the chart.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!