You want to write a guest post for us? We welcome articles from experts willing to share their insights and knowledge with our audience. Before to go into the guest post topic, let me share a bit about our context so you can know us better.Everyday at PatternsWizard,...

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

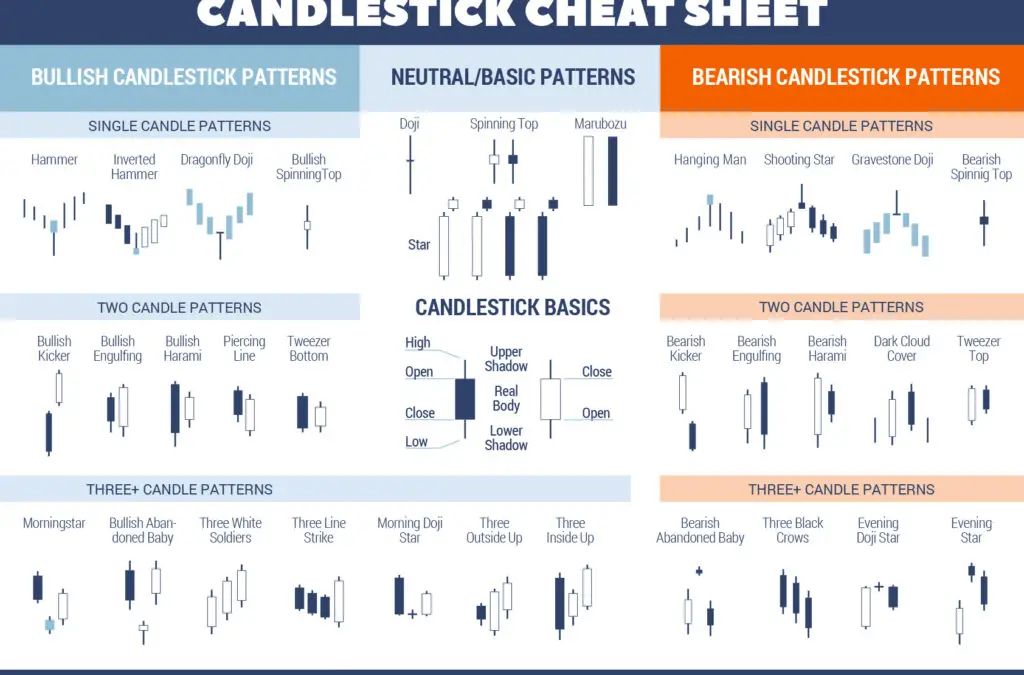

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!