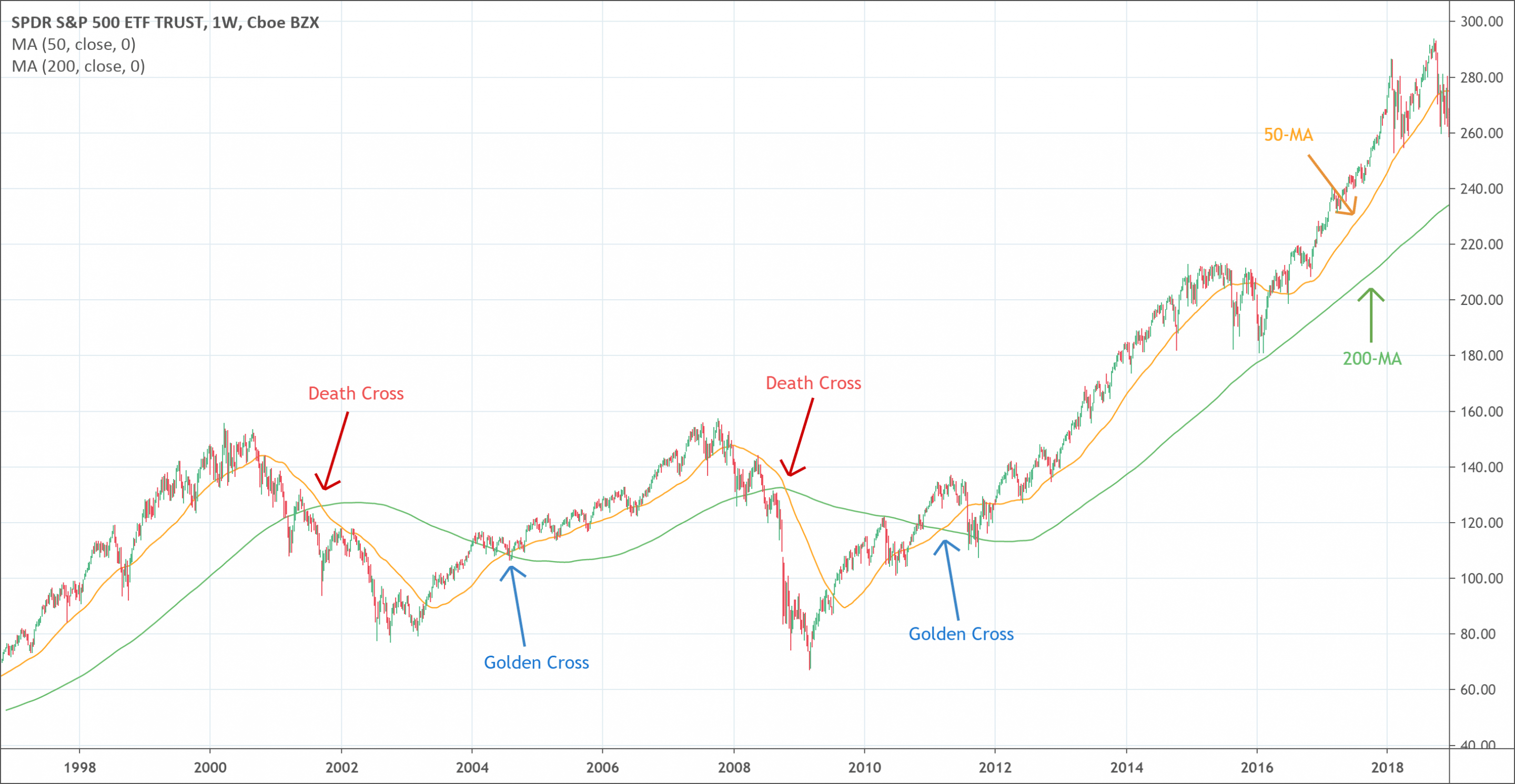

- Moving Average Crossover signals a trend reversal.

- The most popular one is between the 50-MA & 200-MA.

- The bullish cross is the golden cross and the bearish cross is the death cross.

Before you keep looking down this article, you should check 2 of courses I shortlisted in the New Trader University from Steve Burns (a very famous trader with about 400k followers on Twitter)!

- Moving Averages 101: this professional video series that will teach you how to use moving averages to be more profitable with less stress.

- Moving Average Signals: this course will illustrate how trading moving average signals with confidence and consistency can lead to profitability; consistently creating bigger wins and smaller losses.

What are the Moving Average Crossovers?

Moving Average (MA) Crossover indicator signals a crossover of a slower moving average or a longer period moving average by a faster moving average or a shorter period moving average. The MA crossover shows when the longer period moving average line cross a shorter period moving average line. The Moving Average cross does not predict future prices. This MA crossover simply indicates a market structure or an upcoming change in trend. In order to understand the Moving Average Crossover indicator, it is crucial to understand what moving average actually is?

A moving average indicator is among the most popular technical analysis tool that creates a constantly updated average price to smooth the price data. It indicates price trends. A simple moving average indicator calculates by taking the arithmetic mean of given prices over a specific period of time. The exponential moving average gives greater importance to prices in recent days and gives a weighted average. Moving averages serve different purposes for different traders. Some traders use them as primary trading tools while some others use them in conjunction with other trading tools for confirmation. And Moving Average Crossover uses simple moving averages with different degrees of smoothing to help traders analyze the market.

When a shorter moving average crosses above the longer moving average, it is a bullish crossover. This is known as the golden cross. When the shorter moving average goes below the longer moving average, it is known as a bearish crossover, also known as a death cross.

The most popular Moving Average Cross is with a 50-period MA and a 200-period MA (golden cross & death cross).

Bullish Moving Average Crossover: The Golden Cross

What is the golden cross chart pattern?

The golden cross indicates an upcoming bullish turn. A short term moving average reflects recent prices. When a short term moving average goes above the long term moving average, the golden cross occurs. Traders closely watch the golden cross indication. Recents news affect it as well. It is most commonly used even though it occurs less frequently. The golden cross is considered a buying signal because prices begin to rise.

How to trade the golden cross?

However, the profit potential of the golden cross has not clear yet. The main purpose of its use is to recognize the trajectory of price changes to uptrend and to trade during this uptrend. This uptrend may last for a period of time. Subsequently, when the trend ends and the short term moving average crosses the longer-term moving average, it helps to take advantage and gain profits.

Is the golden cross valid?

Just like the rest of the indicators, oscillators, patterns, and any other technical analysis tools, the golden cross also has certain limitations. The golden cross is a lagging indicator that is one of its main drawbacks. Its dependence on historical prices limits its ability to predict future prices. However, the backtesting of the golden cross upon different trading instruments can generate many interesting results. It is frequently used in combination with other technical indicators for fundamental analysis to make decisions.

Bearish Moving Average Crossover: The Death Cross

What is the death cross chart pattern?

The death cross chart pattern is exactly the opposite of the golden cross. It indicates a transition from bulls to bear market. The death cross occurs when the shorter moving average crosses below the longer moving average. The pattern is named the death cross because it indicates a bearish strength. The death cross forms after three following phases. It is a selling signal as the trend is shifting to downward.

- The existing uptrend or bullish strength is the first phase. When it begins to reach the highest point, the buying momentum begins to fade. Then the bears begin to take over as the price begins to fall.

- When the shorter moving average crosses below the longer moving average, it is the second phase. This movement indicates an upcoming long term bearish trend in the market.

- The third phase is marked by the continuation of the bearish trend. If the bearish trend is not sustained for a longer period, the bullish trend begins to form. This scenario makes the death cross signal false.

Is the death cross valid?

The death cross is a lagging indicator because it relies on historical data. It may not be able to generate a signal until the bearish trend begins. That means that before the signal the price may have already substantially fallen. It is more useful when used in conjunction with other technical indicators.

Conclusion

The moving averages help to simplify the data by smoothing it and representing it through a single flowing line. It makes easier to spot the trend. The Moving Average Crossover indicator is among the most popular moving averages. The MA crossover signals buying after the golden cross while it signals to sell after the death cross. MA crossovers are hence better strategies for entry or exit. However, it has certain drawbacks that traders must keep in mind before relying on the MA crossover indicator. Technical analysts and experts always advise not to use the Moving Average Crossover indicator as a standalone indicator. It works well when used in conjunction with other indicators and technical analysis tools.

Before you go, check this two tremendous courses to expand your understanding of the moving averages: Moving Averages 101 & Moving Average Signals.

They both are created by Steve Burns. You surely saw him on Twitter as he has about 400000 followers. These courses will teach you how to use moving averages to be more profitable with less stress.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!