- The Balance of Power indicator measures the strength of buyers in the market against sellers.

- It does so by assessing how able each side are to drive prices to an extreme level.

- Balance of Power = (Close price – Open price) / (High price – Low price)

- The result can be smoothed with a moving average.

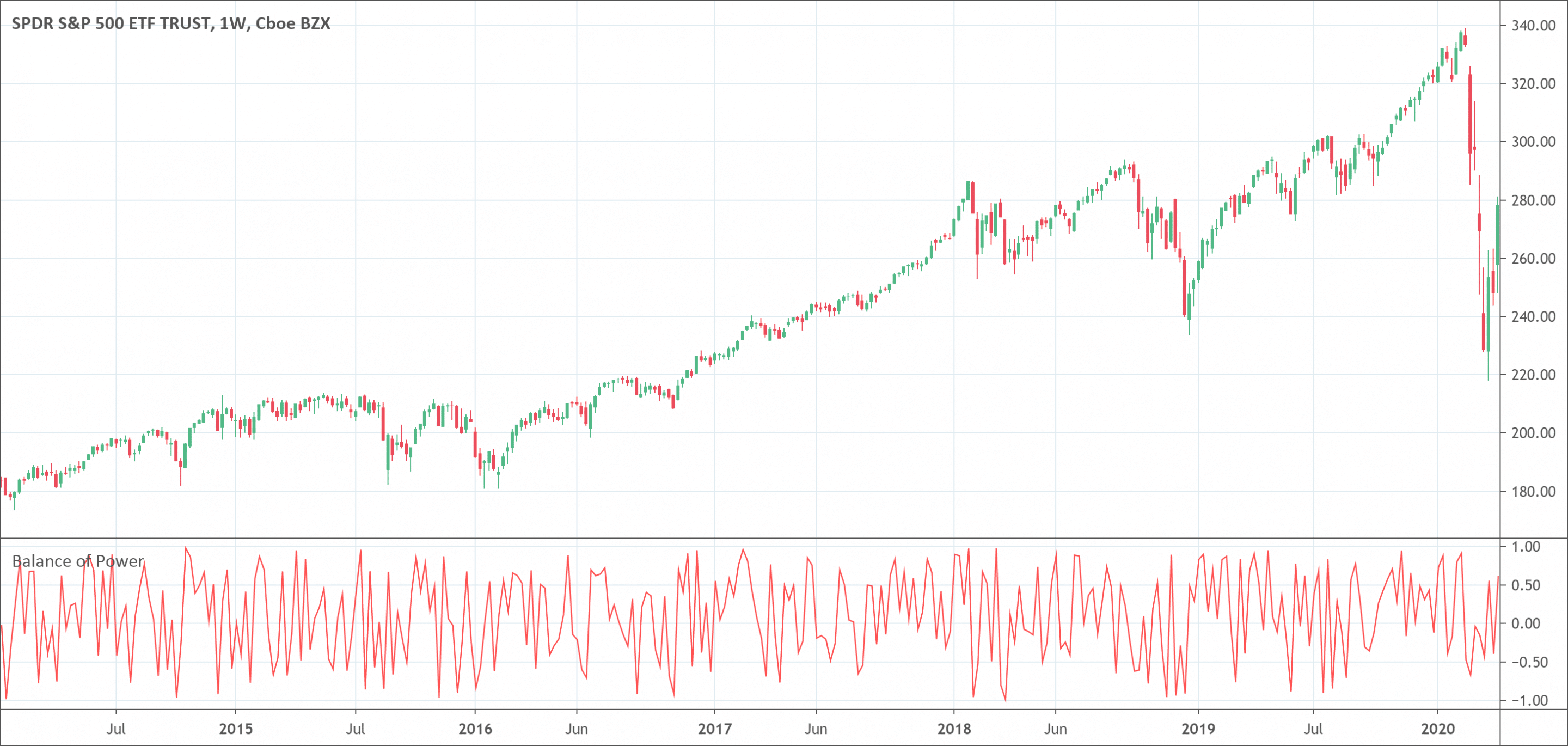

The Balance of Power (BOP) indicator is a unique price-based indicator that observes the strength of buyers and sellers. It basically measures price trends by assessing the powers of buyers and sellers. It also evaluates the strength of the market by measuring the total strength of the buyers as compared to the total strength of the sellers. The BOP indicator is a very volatile indicator that oscillates above and below the Zero Line very often.

The Balance of Power indicator is valued as a remarkably useful trading tool that is handy for all trading styles as well as trading instruments such as index futures, single stock futures, exchange-traded commodities, E-minis, currencies, options, and stocks. The BOP indicator has the extraordinary ability to lead price. It has also the potential to reveal Dark Pool activity before the movement of price. The BOP is well known for exposing the hidden activities of the huge institutional traders possessing $90 trillion worth of assets across the globe in every financial market worldwide.

What is the BOP indicator?

The Balance of Power was first introduced by Igor Livshin in the August 2001 issue of Stocks and Commodities Magazine. Igor recommends that:

- A 14-period moving average is recommended for daily charts. Although the number of periods may vary depending on the nature of the market and timeframes.

- The level at which it clusters its bottoms and tops is considered one of the most important properties of the BOP indicator. During uptrends, its highs often touch the upper limits and never go back to the bottom level and the situation reverses during the downtrend.

- The BOP indicator assists overbought/oversold levels, trends, and price divergences.

- Traders take a change in the BOP trend as a warning and it is wise to confirm by a change in the direction of the price.

How does the Balance of Power indicator work?

The Balance of Power indicator is a unique indicator although it may look like an average indicator. This indicator is not an oscillator despite rapidly oscillating above and below Zero Line. It doesn’t indicate the performance of the bullish or bearish swings. It has a very unique logic of its own. The Balance of Power formula is:

Balance of Power (BOP) = (CLOSING PRICE – OPENING PRICE) / (HIGH PRICE – LOW PRICE)

The presence of the BOP indicator above the Zero Line indicates a positive market sentiment with bulls in power. The movement of the BOP below the Zero Line shows bears have the power. This is the main principle behind the functioning of the BOP indicator. The working of the BOP is interesting in the sense that it miraculously traces market conditions in real-time.

What does the Balance of Power indicator tell traders?

The Balance of Power indicator tells traders about the underlying activity in the trading market. More specifically, it shows whether the systematic buying is going on or the systematic selling activity is on the boom. The ability to contradict price movements is the most fascinating of the BOP. Its movement totally against the price is a normal scenario. For example, when the prices make new highs, the BOP may well be making new lows at the very same time.

It has the remarkable potential to trace divergences in the market. It is this aforementioned characteristic that is unmatched by any other simple indicator. The price and the BOP tend to move side by side. When the price reaches a new high but the BOP indicator fails to confirm this movement, it is an indication of a market divergence. Moreover, its movement above and below the Zero Line does not follow the price. It has its own very unique mechanism. As a general rule, movement above the Zero Line indicates systematic buying and movement below the Zero Line shows the systematic selling.

How to use the Balance of Power indicator?

The use of the Balance of Power indicator is comparatively easy as compared to some other complex indicators. However, it offers a challenge as well. It is not easy to assess whether the BOP is following the price trend or not. As we have discussed earlier that it follows its own way of working rather than following the price. Most of the traders believe in the general rules mentioned before. A movement above zero is buying opportunity while a movement below zero is a selling opportunity. But the real concern is that it may not be true always. Because of its unique style of working, it may move above or below the Zero Line regardless of the current trend. Furthermore, the BOP indicator can be teamed up with other indicators, it is easier to get an unbiased picture of the market.

The limitations of the Balance of Power indicator

Just like the rest of the technical analysis tools, the BOP indicator has also some shortcomings. These cons are so significant that traders should keep them in mind before solely believing in the Balance of Power indicator. The limitations are as follows:

- The BOP indicator’s an inside glimpse of the distribution or accumulation does not guarantee traders to enter a long or short position on each signal provided.

- The BOO indicator is not well-known for the identification of a trend.

- The BOP indicator provides bearish and bullish divergences signals but it may quickly reverse after entering a trade.

Final words about the indicator

The Balance of Power indicator tells traders about the buyer and seller patterns as prices increase or decrease depending on the systematic selling or systematic buying. The BOP indicator plots above or below the Zero Line but it is not an oscillator. The BOP doesn’t follow prices. It has its own unique way of functioning.

Traders should seek clustered bottoms or tops from the Balance of Power indicator to confirm their trading position. Day traders need to analyze the history books to search for the success rate of the Balance of Power for the stock of their preference. If the BOP has provided successful signals to identify trends, the traders can closely observe the BOP for signals. However, technical analysts advise not to use the Balance of Power indicator as a standalone indicator. It is due to the fact it may generate false signals. Therefore, it is always the best strategy to use the Balance of Power indicator as an add-on.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!