The legendary chartist, Bill Williams created the Awesome Oscillator indicator. He showed it as the best momentum indicator that is as simple as it is elegant. Traders use it to determine the momentum of the asset at hand in the course of recent events within the context of a wider time frame. The indicator can also confirm or disprove trends and estimate possible reversal points.

- The Awesome Oscillator indicator measures market momentum.

- Traders use it for its crossing with the zero line, and for its peaks.

What is the Awesome Oscillator indicator?

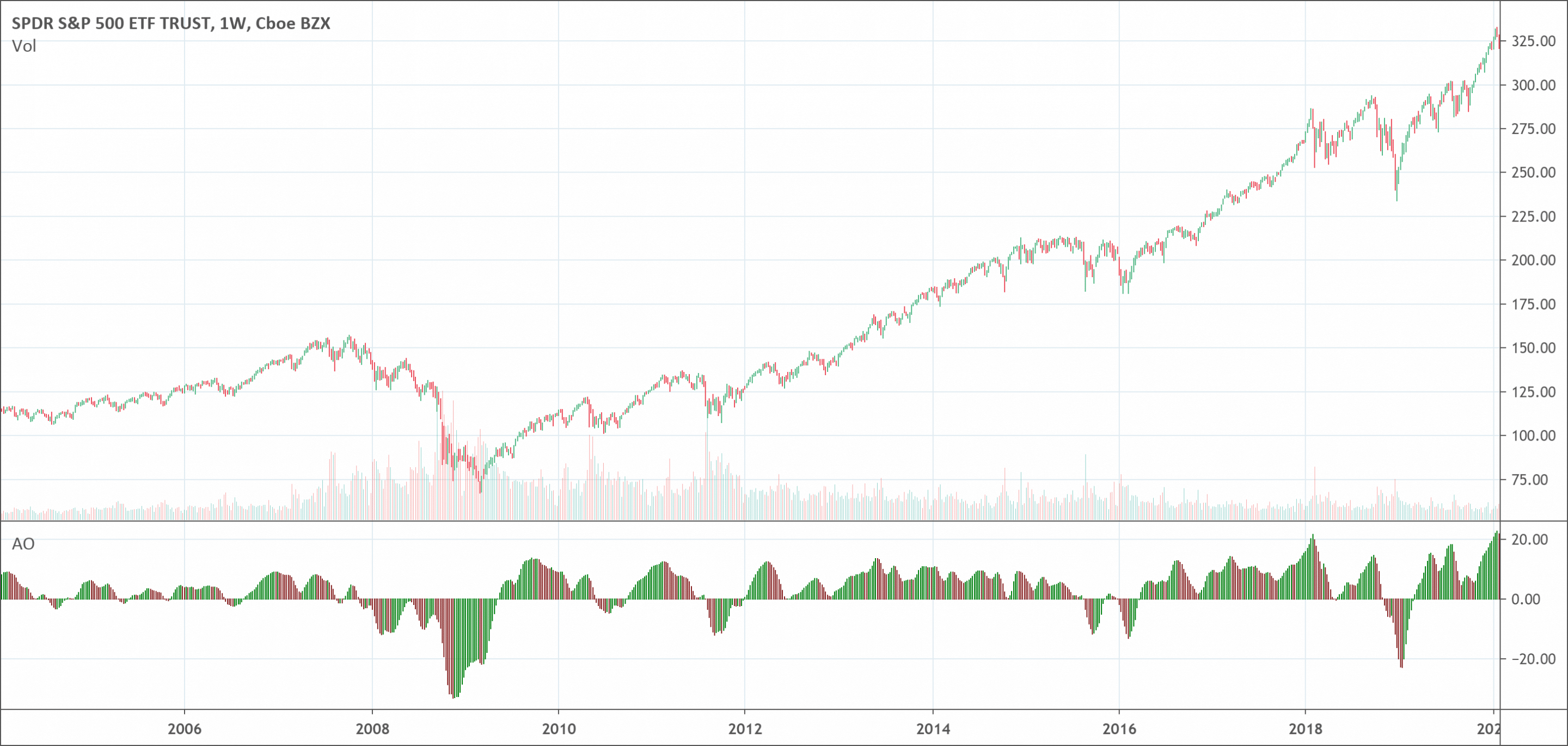

The Awesome Oscillator (AO) is used to measure market momentum. It calculates the difference between a 34 Period and 5 Period Simple Moving Average. The Simple Moving Averages that are used are not calculated using closing price but rather the midpoints of each bar. AO is generally used to affirm trends or to anticipate possible reversals.

The oscillator attempts to measure if bullish or bearish forces are regularly driving the market. It does this by comparing the recent market momentum, with the overall momentum over a broader frame of reference.

What does the AO indicator tell traders?

Because it plots the variation between a slow-moving and a fast-moving average, the indicator prints both positive and negative values. A positive reading means that the fast-moving average (5-period) is more than the slow-moving average (34-period). Also, a negative reading indicates that the slow-moving average is more than the fast-moving average.

Therefore, the basic interpretation of the AO indicator is that a reading greater than zero means an uptrend is happening, while a reading lower than zero implies that a downtrend is happening.

The bar colors of the AO indicator are based on indicator values within a particular time. Therefore, it is possible to have red bars over zero, and green bars lower point zero. An increasing green histogram shows that the AO value is more than the initial bar. While a falling histogram shows that the value of the AO is less than the previous bar.

How to use the Awesome Oscillator?

The Awesome Oscillator gives a lot of signals by assisting in predicting price corrections and reversals. First, it fluctuates around the zero line. If it rises higher than 0, the signal is bullish. If AO drops lower than 0, the signal is bearish.

Secondly, it is considered to be a bearish signal if AO indicator has formed two highs greater than 0 and the trough between them is also higher than 0. The second peak has to be less than the first, and it should be followed by a red bearish bar. Similarly, it is considered a bullish signal if AO has formed two lows below 0, and the trough between them is also lower than 0. The second peak has to be greater than the first, and should be followed by a green bullish bar.

The third signal is referred to as a saucer. It is a pattern made up of the three bars of the indicator. A bullish saucer is made up of a red bar, followed by a smaller red bar, then by a green bar. All the bars have to be higher than 0. A bearish saucer is made up of a green bar, followed by a smaller green bar, and then followed by a red bar, all of them have to be lower than 0.

Confirmation

The awesome oscillator makes a lot of signals. It is natural that not all of them should be functional. A bullish trend of the indicator means that the price is probably going to rise, but the chance of that is not 100 percent. That is why experts recommend traders to use other tools of technical analysis together with the AO indicator and design a good trading system.

Trading the Awesome Oscillator indicator

The best signals to trade with when using the Awesome Oscillator are:

Zero line crosses

It is a straightforward method because of the computation of the Awesome Oscillator. A cross higher than zero confirms that an uptrend has formed, and traders should seek chances to place only buy orders in the market; while a cross below zero confirms that a downtrend has formed in the market and traders should only seek to place sell orders.

Saucer Strategy

The AO indicator serves buy and sell opportunities to saucers by using three histogram bars as follows:

Buy signal conditions

- The Awesome Oscillator is above zero

- Two consecutive histogram bars are red (which means they are falling)

- The third histogram bar is green and higher than the second one

- Place a buy order on the open of the fourth bar

Sell signal conditions

- The AO is below zero

- Two consecutive histogram bars are green (which means they are rising)

- The third histogram bar is red and below the second one

- Place a sell order on the open of the fourth bar

Specificities of the saucer strategy

Saucer is another signal that can be used for early trend forecasting. It follows the changes in three consecutive bars. When the AO is above zero and two consecutive red bars are followed by a green one, the saucer is considered to be bullish.

This helps in selecting a maximum trade entry point in a trending market. It’s also made to ensure traders get trading opportunities when there is a sudden change in the price momentum.

Twin peaks

This strategy makes it possible for traders to pick out high probability contrarian opportunities in the market. It needs the awesome oscillator indicator to form two peaks and a trough on the same side of the zero-line.

A bullish twin peak will form lower than the zero-line. The second peak will be above the first one and followed by a green bar. On the other hand, a bearish twin peak creates higher than the zero-line. And the second peak will be below the first one and followed by a red bar. A bullish twin peak is an indication for traders to place a buy order. And a bearish twin peak is an indication to place a sell order.

Biggest mistakes to avoid with the Awesome Oscillator indicator

As a detailed indicator, AO indicator can be even more efficient when used with other technical analysis tools. It can pair with another oscillator that shows oversold and overbought situations such as RSI or Stochastics. This can make it possible to trade zero-line and saucer trading signals more efficiently.

A buy signal will be more qualified when the oscillator shows oversold situations. And a sell signal will carry more weight when the oscillator indicates overbought conditions.

Price and momentum divergence with the Awesome Oscillator indicator

As with a lot of momentum indicators, divergence between the momentum and the price can also be useful to determine what is happening in the market. For instance, traders see it as a bearish divergence if the price makes new highs, but the AO indicator fails to make new highs. Also, it is a bullish divergence if the price sets new lows and the AO fails to follow suit.

Conclusion

You need to experiment with different trading strategies. They decide on the best way for you to implement as part of a trading system. Find out for yourself whether the AO is indeed a great indicator for you. Do this by giving it a test drive with a demo trading account.

You may also find it beneficial to set up notifications for your trading signals. There are some custom AO indicators that you can download, some of which come with in-built alert functionality. This will probably be the simplest way to make Awesome Oscillator alerts.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!