- The Average Directional Index is built on top of the Directional Movement Index.

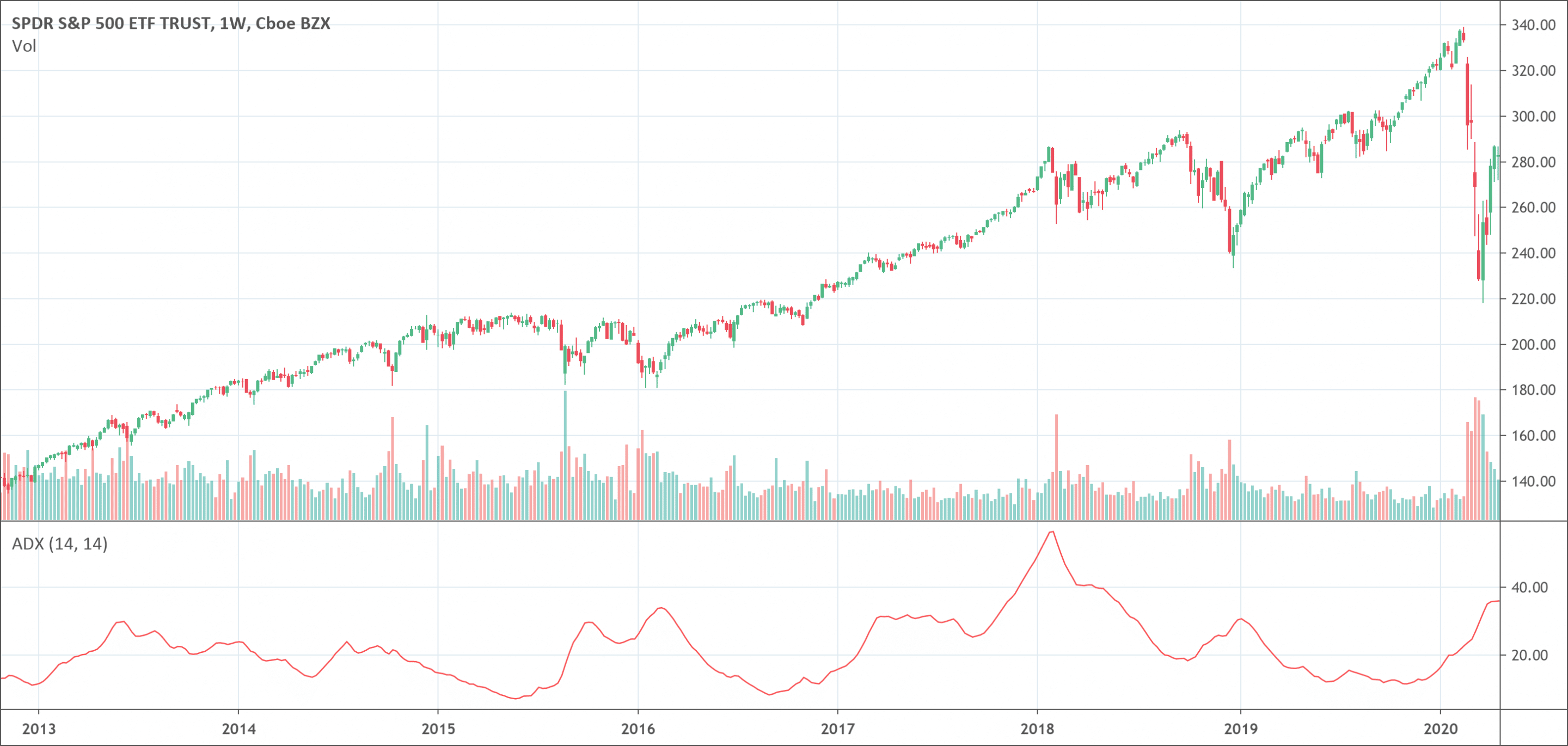

- When ADX > 25, the trend is considered to be strong.

- When ADX < 20, the trend is considered weak or trendless.

What is the Average Directional Index (ADX)?

Average Directional Movement Index (ADX) is capable of measuring the complete strength of a trend. This is another example of an oscillator. The ADX Indicator is an average of increasing price range values. J. Welles Wilder developed the ADX and it is a component of the Directional Movement System.

This system is used to determine the strength of price movement both in positive and negative directions, making use of DMI+ and DMI- indicators coupled with the ADX. It can be used on any trading product such as stocks, exchange-traded funds and mutual funds.

Traders can plot the ADX by the use of a single line with values between a low 0 and a high 100. This indicator is non-directional, and it records trend strength, whether the price is trending up or down. Mainly, the ADX is the ultimate trend indicator.

ADX calculations are on the basis of moving average of price range expansion over a specified period of time. The oscillator usually involves three different lines. These are used for determining if a trade should be taken long or short or if a trade should even be taken at all.

How does the Average Directional Index work?

J. Welles Wilder created the ADX indicator for commodity daily charts, and it could as well be used in other types of markets. In ADX Indicator, the price is going up when +DI is higher than –DI, and the price is going down when –DI is higher than +DI.

Crosses between +DI and –DI are likely trading clues as bears or bulls gain the upper hand. The trend is strong when ADX is higher than 25. It is considered weak or having a trendless price when the ADX is below 20.

Non-trending doesn’t necessarily denote that the price is not moving. It simply means either the price is making a trade change or is varying constantly for a visible direction to exist. If ADX Indicator is declining, it is possible to be a sign that the market is getting less directional and the current trend is becoming weak. You might have to avoid trading trend systems as the trend changes.

When the ADX moves downward from high values, then that may denote that the trend is ending. You might be required to do extra research to know if closing open positions is the right step to take.

When ADX is rising then that would mean the market is indicating a strong trend. The figure of the ADX is proportional to the slope of the trend. The ADX line slope is proportional to the acceleration of the price movement. The value will become flat when the trend has a constant slope then the ADX.

Formulas for the Average Directional Index (ADX)

The ADX makes use of a sequence of calculations as a result of the multiple lines in its indicator.

+DI = (Smoothed +DM) / ATR * 100

-DI = (Smoothed –DM) / ATR * 100

DX = (+D – -DI) / (+DI + -DI) * 100

ADX = (Prior ADX * 13) + Current ADX / 14

Where:

+DM (Directional Movement) = Current High – PH

PH = Previous High

-DM = Previous Low – Current Low

Smoothed +/-DM = ∑t=114DM- (t=114DM14) + CDM

CDM = Current DM

Strength for the Average Directional Indicator

Basically, the Average Directional Index can be used to predict if a market is either trending or not. This prediction helps the traders to decide if to choose a trend following system or a non-trend following system.

Wilder’s position of a strong trend is when ADX is above 25 and when it is below 20, then there is no trend at all. There seems to be a gray area existing between 20 and 25. In ADX, there is a small amount of lag as a result of the smoothing techniques in it. Most technical analyst uses the figure 20 as the benchmark for ADX.

ADX informs traders about changes in trend momentum in order for them to be able to efficiently manage risk. The possibility of being able to quantify trend strength is a really crucial factor for traders. ADX also recognizes range conditions, so a trader won’t end up in a deadlock while attempting to trend trade in sideways price action.

Limitations for the Average Directional Indicator

Crossovers can happen often, sometimes too often and this can turn into confusion and possibly loss of money on trades and things going sideways. These are referred to as false signals.

This is more popular when ADX figures are beneath 25. With that in mind, sometimes, the ADX climbs beyond 25, but only temporarily stays there and later goes down with the price.

Just like with any other indicator, it is a good practice to ADX along with price analysis and possibly other indicators to be able to filter our signals and control risk at a reasonable level.

Use of the Average Directional Indicator

Price is the most crucial signal on a chart. Price is the first thing that should be read, and then followed by ADX in the view of what price is doing. Regardless of the indicator we make use of, traders need to make use of other indicators, else they wouldn’t get accurate results. For instance, the really good trends come out of periods of price range consolidation.

When a disagreement occurs amongst buyers and sellers on price, breakouts from a range can happen, and this will put in check the balance of supply and demand. Price momentum can be seen, whether it is more supply to demand or more demand to supply.

Traders can easily locate breakouts, but they sometimes tend to fail to move forward or end up becoming a trap. ADX informs you when breakouts are valid by indicating when ADX is very strong for price to trend after breakout. When ADX moves from beneath 25 to beyond 25, then price is strong enough to keep heading to the point of breakout.

Conclusion

The Directional Movement Indicator is complex and it has a straightforward interpretation. For one to successfully implement it, several practices have to be involved. Both +DI and –DI crossovers are quite repetitive and traders are required to filter signals with complementary reviews.

Chartists may need to take ADX to the back burner and concentrate on the Directional Movement Indicators (+DI and –DI) to create signals. These crossover signals will be closely related to those created making use of momentum oscillators. Hence, it is advisable for chartists to make additional research for confirmation help.

Strong crossover signals can be differentiated form weak crossover signals making use of basic trend, chart patterns and volume-based indicators. For instance, traders can pay look out for +DI buy signals when the bigger trend is up and –DI sell signals when the larger trend is low.

The possibility to quantify trend strength is a major advantage for traders. A popular misconception is that a diminishing ADX line means that the trend is reversing. A diminishing ADX line simply denotes that the trend strength is weakening, but it really doesn’t denote that the trend is reversing. Not unless a price climax has occurred.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!