- The advance/decline (A/D) line is a breadth indicator that plots the difference between advancing stocks and declining stocks.

- A/D line should move in the same direction as major indexes to confirm the move.

- If it doesn’t, it’s a sign the rally or decline is nearing its end.

What is the A/D line ?

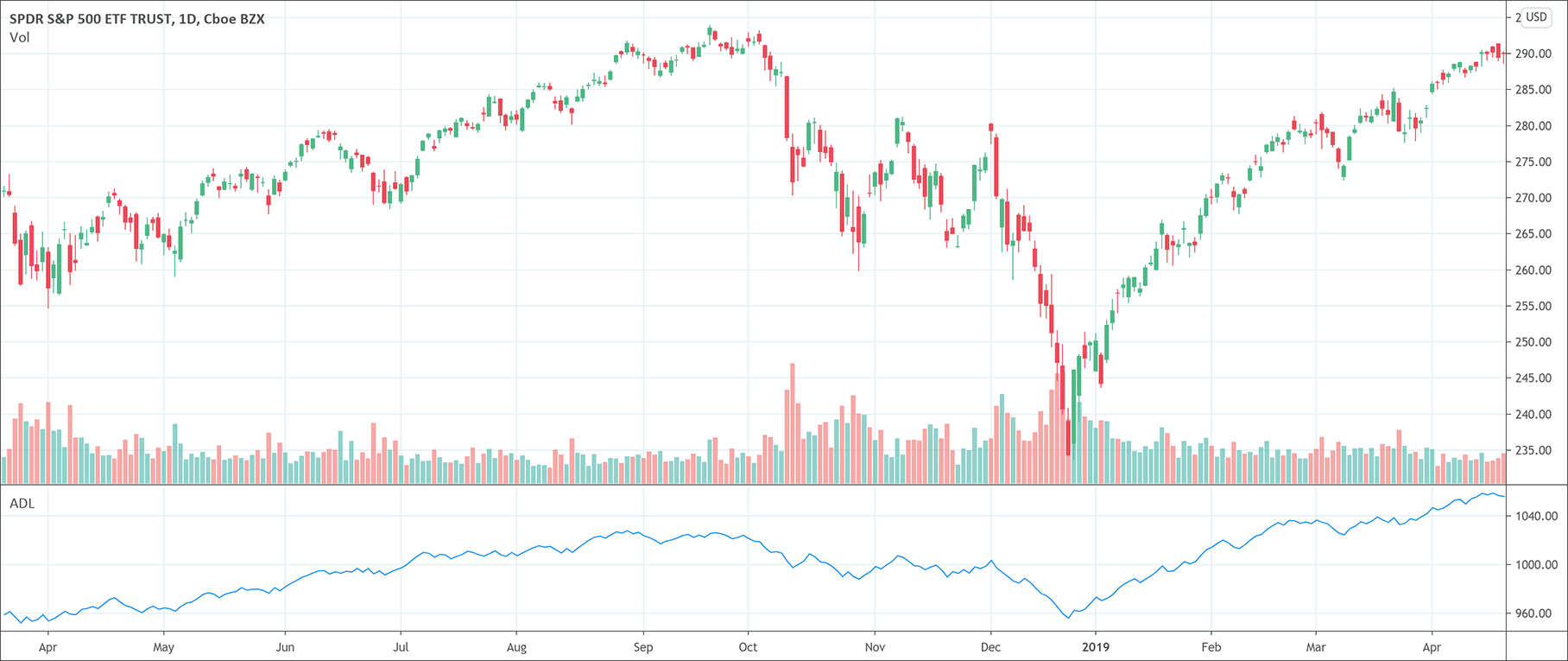

The advance/decline (A/D) line is a breadth indicator that plots the difference between advancing stocks and declining stocks. The difference indicates the participation of all the securities in the overall movement of a market’s index. The value is positive when the number of advancing stocks is greater than the declining stocks and vice versa. Once the A/D ratio confirms the movements in the same direction when compared with the index, it indicates either bullish or bearish momentum divergence. The failure of confirmation highlights the risk of a trend reversal. The advance/decline line indicator is especially more useful when trading the main indexes such as the S&P 500, DAX, Dow Jones Industrial Average, etc.

Basically, the advance/decline ratio gives an idea of what the market participants are doing when the market is slumping or rallying. A/D ratio actually indicates a key market sentiment that highlights whether more stocks are rising or declining at a particular point of the trading day. The purpose of the use of the A/D line is the confirmation of trends in the market indexes and to indicate the reversals when divergences occur. Moreover, it is also interesting to note that the advance/decline indicator is a cumulative one that works by adding positive numbers to the previous value and subtracting negative numbers from the previous value.

How to calculate the advance/decline ratio?

The advance/decline ratio or advance/decline line calculation is very simple. The A/D ratio has the following formula.

Advance/decline line = Net advances + Previous advances

* Net advances = Daily advancements – declining stocks

* Previous advances = Previous reading of the indicator

There are two simple steps to calculate the advance/decline ratio.

- Calculate the net advances by subtracting the stocks finishing lower on the day from stocks finishing higher.

- Calculate the net advances on the next day by adding positive value to the prior day’s total or subtracting negative value from the previous total.

What does the advance/decline line indicator tell traders?

The advance/decline line is very useful for traders to confirm trend strength. It has also the potential to indicate a possible reversal of the current trend in the market. A/D ratio also tells traders about the market stock’s participation in the direction of the market.

How to interpret the advance/decline line indicator?

It is a bearish divergence when the indexes move up but the A/D line slopes downwards. It is actually an indication that the market is losing its breadth and there is a strong chance of market reversal. The market is strong when the market is trending upwards and the A/D line also slopes up. It is a bullish divergence when the indexes continue to move downwards but the A/D line turned upwards. It is a signal that sellers are disappointed. Finally, there is a strong chance of a continuation of declining prices when the indexes and A/D both move downwards.

Conclusion

The advance/decline line indicator is a unique breadth indicator that helps traders to determine the total of stock participating in a stock market advances or decline. The A/D ratio is a simple calculation that gives the difference between advancing stocks and declining stocks. It helps to determine the strength of the trend and also alerts to a potential upcoming reversal. There are simple rules, discussed above, that help to interpret the advance/decline line indicator. However, traders need to be aware of the most important limitation of the A/D line indicator. Some indexes in the market are market-capitalization-weighted which means those stocks are more significant and greatly affect the index’s movement. They need to be assigned more weight but the A/D line equally weighs all the stocks in the market. Therefore, it is not useful for large or mega-cap stocks.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!