Introduction

When trading options, it is crucial to understand the disparity between in the money vs. out of the money. In simple terms, this is a way to calculate an option’s intrinsic value, relative to the underlying asset’s current price. Having the knowledge of the difference between the two and when an option is in the money or out of the money is important when deciding if or not to exercise options. Specifically, it can predict whether you are capable of making a profit when trading options.

To fully understand the phrases “in the money” and “out of the money,” it is advisable to at least know a little more about options. An option is basically a contract that provides investors the right to buy or sell a security. You’re not mandated to do so, that’s why it is called an option.

There are basically two forms of options: puts and calls. A put option provides you with the right to sell a stock at its strike price at any period before it expires. A call option is the opposite; it provides you with the right to buy a stock at its strike price at any period before it expires.

The price at which an option can be exercised is referred to as its strike price, i.e. bought or sold. This is not necessarily the same as the price of the underlying asset. The worth of an options contract can change depending on the price of the asset attached to it.

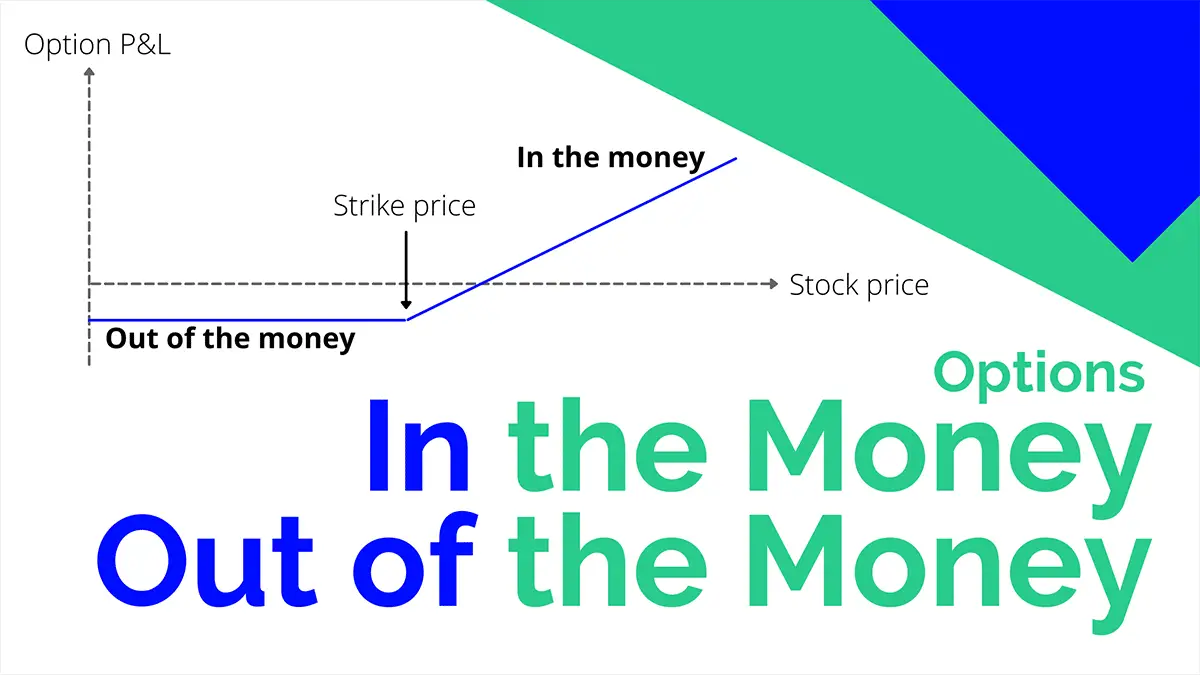

This is where in the money vs. out of the money comes in. These terms are used to define or calculate the intrinsic value of an option at any given period. Intrinsic value refers to the difference between the asset’s current value and option’s strike price.

In the Money (ITM)

Definition

To simply put it, an option is in the money if it has intrinsic value. But the way to measure it is dependent on whether you’re referring to a call option or a put option.

Again, put options provides you with the right to sell an asset at an already predetermined price on or before the preset expiring date. A put option is in the money when the underlying security’s price is lower than the strike price, hence, implying intrinsic value. If you were to exercise the option and sell, the higher strike price would benefit you as it would rake in profit.

For call options, you’re in the money when the current price for the underlying asset is more than the strike price. If you were to exercise an option here, you would be purchasing the underlying asset for less than what it’s actual worth. In such case, being in the money on a call option means you are able to purchase the stock at a discount, with the likelihood to sell at a profit.

Regardless of option type you’re trading be it call or put, the size of the space between the strike price and the underlying asset value is what predicts intrinsic value and if you’re in the money or not. The major factor is having your prediction about whether a stock’s price will rise or fall in a certain time period pays off.

Example of “In the Money”

Let’s assume that Paul has a call option for an energy stock that has a strike price of $10. The stock is trading at $12 per share, which immediately means that Paul is in the money since the underlying price is more than the strike price. The more the stock price increases, the better for Paul. If he choose to exercise the option. For instance, if the stock price were to jump to $50, he could still exercise the option to buy it at $10 per share before the option expires. The higher the price, in this example, the more intrinsic value the option has.

Again, let’s assume that Paul has a put option for the same stock with the same strike price of $10. In this situation, the further the underlying asset’s current price falls beneath the strike price, the better. That’s because it translates to greater intrinsic value. If Paul were to exercise the option, he would benefit from being able to sell at the higher strike price.

Out of the Money (OTM)

Definition

When an option is out of the money, it has no intrinsic value. Again, whether an option is out of the money will be dependent on if it’s a call or put option. For call option, the contract is out of the money if the underlying asset’s current price is beneath the strike price. In such case, it won’t be logical to exercise the option since the price you would pay for the underlying asset, i.e. the strike price, is more than what the asset is trading for.

In the case of put options, a contract is out of the money if the underlying security’s current price is more than the strike price. If you were to exercise a put option that’s out of the money, you would be selling it for less than its current value.

Example of “Out of the Money”

Out of the money usually works in reverse. Let’s assume that Matt has a call option with a strike price of $10 and the underlying stock is trading for $8. The option is obviously out of the money since the strike price is higher and the more the stock’s actual price falls, the more out of the money it becomes.

Now, assuming Matt has a put option at $10 and the underlying stock is trading at $12 per share. Again, Matt is out of the money because if he exercised the option, he would sell for less than what the stock is trading for on the open market. And the higher the price goes, the further he goes out of the money.

In the Money vs. Out of the Money: Which Is Better?

Whether an option is in the money or out of the money, it doesn’t necessarily make one better than the other. It fully depends on your objective as an investor and what you’re aiming to derive. For instance, if you have call options that are in the money then you are able to make money off the deal if the strike price stays beneath the market price. The inverse would be true if you’re having put options that are in the money.

It is also vital to note that out of the money options have lesser premiums, meaning they are less expensive to trade. If you’re concerned about cost as an investor, that’s something else to put into consideration when deciding if to pursue in the money or out the money options in your portfolio.

Conclusion

When calculating an option’s value, intrinsic value is definitely one thing to keep in mind. You also have to put time value into consideration. Time value simply means the amount of time remaining before an option expires. The longer this period, the more time value an option has. It isince the chances of it becoming in the money increases.

All these simply denotes that even if an option is out of the money, with zero intrinsic value, it could still have time value. Taking note of this type of situation can help you determine if it is logical to buy out of the money options.

Lastly, it’s worth knowing that there’s a third path option values can take. When the option’s strike price is equal to the price of the underlying asset, it’s considered to be “at the money”. So if you were to exercise a call or put option at the money, you would make no profit from it. Hence, the option would have no intrinsic value.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!