What is Diamond Chart Pattern?

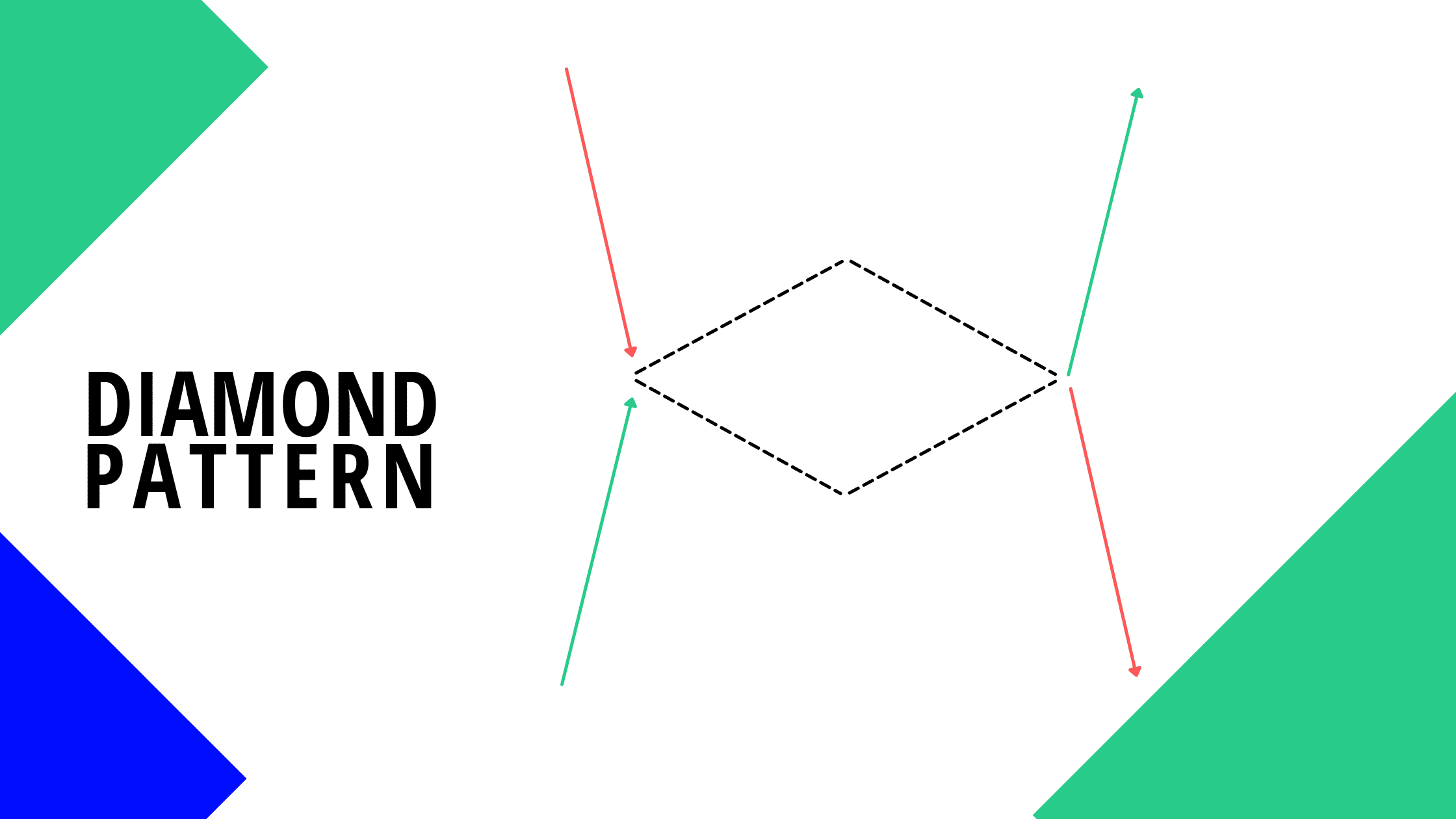

The diamond chart pattern is an advanced chart development that takes place in the financial market. It is not very popular among investors and technical traders. Only very few traders are knowledgeable about its structure and trading usage. The diamond chart pattern is among the family of classical chart patterns such as: flag, head and shoulder, pennant patterns, among others.

Not so many trading prospects associates with this trading pattern as compared to some others in this family. But nonetheless, it pays off for a technical trader to get acquainted with this pattern as it gives concrete trading opportunity if recognized early.

The diamond chart pattern can sometimes be mistaken with the head and should chart pattern. Although, there are close attributes existing between these two patterns, there are also some very dissimilar properties between them. It has a v-shaped neckline.

Diamond Pattern Trading Strategy

Whenever a bullish price move appears before the diamond pattern, it is referred to as “diamond top” and it has a bearish risk. But when a bearish price move appears before the diamond pattern, it is referred to as “diamond bottom” and it also has a bullish risk.

Rules for Trading Diamond Top Chart Pattern

- A visible uptrend must take place before the diamond top formation.

- The diamond top formation must be well stated with four trend lines that links to each other. They should not be far apart from one another.

- Place a sell order at the market after a break and close beneath the uptrend close to the finishing of the pattern.

- Traders often apply the stop loss at the very recent swing high before the breakout level.

- Traders often determine the target level depending on the calculated move measured. We will calculate the proximity between the highest high and the lowest low in the structure, and plot that downward from the breakout level. This plotted line would serve as the profit exit mark.

- The trade will have an additional time stop component. Precisely if 50 candles passes, and the price fails to trigger either the stop loss or target mark, we will have to exit the trade immediately.

Diamond Pattern Trade Entry

All chart pattern has a signal mark, which provides a point where a trading decision is made. In a diamond chart pattern, this occurs at the lower right part of the bearish diamond formation and the higher right part of the bullish diamond formation.

Diamond Pattern Stop Loss

It is vital to always place a stop loss whenever trading the diamond pattern. The ideal positioning of the stop loss should be above the final top inside the diamond for bearish diamond formation. And beneath the final low of inside the diamond for bullish diamond formation.

How to book profits from the Diamond Pattern

The smallest price move expected from the diamond chart pattern equates to the size of the formation. For example, if the proximity between the higher and the lower side of the diamond equals $2.00 per share, then you should go after a move of $2.00 per share.

Diamond Pattern Trading Mistakes

- The costliest mistake an investor can make is trading diamonds too early. You should make sure you plot support resistance lines and work with second half of the diamond like you would with a symmetrical triangle. Each time the price breaks at the top or beneath either threshold, it gives off notification on the direction of the impending price movement.

- Another risky factor is wrongly placing price targets and stop loss. There isn’t much of a technical approach to determining how high or low a diamond’s break could be. This is a result of numerous traders who can sometimes be so conservative in benchmarking.

- Even though most investors often measure the difference between the high and low marks of a diamond and then sum it to the breakout. Hence, the suitable option is to closely observe the initial drop that started the diamond, employing the market momentum in forecasting the correction mark after the break.

Importance of Diamond Pattern Trading

A diamond pattern trading has a lot to do with the investor psychology. This pattern takes into consideration the behavior of stock and a precise way of taking traders. After huge market movement, investors are quick to take either profit bullish or shot bearish. The first form of consolidation occurs as a result of this. It creates a period of instability where traders are fortified by some volumes. Another consolidation is the pullback and this destabilizes the price. And finally, the last breakout takes place where investors capitalizes on their current level.

Diamond Pattern Stock

The diamond stock pattern is a crucial tool in trading. It plays a vital role when determining market trends and forecasting movement. They are very flexible and traders can use them for analysis purpose in various markets. They are: shares, forex, and also commodities. The stock chart patterns are means of watching series of price actions that takes place during a stock trading. It can happen during any time period but the major point about them is that they repeat themselves. When you need to determine the most suitable entry points for your transaction chart, it simplifies the process. It is monitored usually after a strong price movement. It is very imperative to try to look out for the existence of a diamond shape on the chart.

Most often than not, many diamond chart reversals exist at major highs, and with high volume rarely at market base.

Making use of price oscillators with the pattern of price can increase the precision of a trade by measuring price action momentum.

Determining and Trading the Formation

The diamond top formation is created by first separating an off center head and shoulder formation and adding trend lines dependent on the following peaks that has a striking resemblance to a four sided diamond.

The fact is that price pattern consolidates before the unavoidable shortfall. Any penetration at the top of the trend line would utterly render the pattern ineffective. As this would translate that a new peak has been formed. And for this reason, investor would have to either reapply the trend line that goes from head to the right shoulder or abandoning the diamond top pattern since the formation has been disrupted.

How do we Trade using a Diamond Chart Pattern

Both the diamond top and bottom are reversal patterns. It acts as a session to a new high with a fall to the neckline level succeeded by a session to produce a new high and a rapid decline which breaks the neckline to produce a higher low.

The spring back from the higher low precedes a session producing a lower high alternatively. Price begins to break the trend mark linking the first and second lows. It then declines repeatedly when the pattern prints.

With Diamond bottom, prices goes after similar pattern they begin a new low and a new high succeeded by additional higher low and lower high. The best place to search for the diamond pattern is around the head and shoulders pattern or inside the triangle patterns.

It is worth noting for a trader to take other trading pattern. It is a good practice to always out for additional confirmation signal right before going into any trade.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!