- The Alternate Bat pattern is popular for incorporating the 1.13XA retracement.

- Firstly, an important factor is the B point retracement that must be 0.382 retracements or it must be less of the XA leg.

- Furthermore, it only utilizes a 2 or more BC projections.

- The AB = CD pattern within the alternate bat pattern always extends requiring a 1.618 AB = CD calculations.

Before you keep reading this extensive article, you should check this two courses I shortlisted for you on Udemy:

- Forex Harmonic Pattern Trading – With Multiple Chart Examples: it’ll teach you step-by-step how to identify most harmonic pattern applied to forex markets.

- Harmonic Trading: The Art Of Trading With Low Risk: it’ll guide you to your first harmonic trades, what are potential reversal zones and it’ll give you practical applications so you can truly understand how to use it and manage risk.

If you prefer to skip the learning part and are just looking for a harmonic patterns scanner, you might want to check this harmonic patterns screener here. You’ll get a 7-days free trial (+ 50% off your 1st month subscription if you decide to continue).

Or you can just continue reading and learn more with our article below about alternate bat patterns.

What are the Harmonic patterns?

The harmonic trading stemmed from the Gartley pattern. The Gartley pattern appears when the price starts to show correction while moving in an uptrend or a downtrend. With the passage of time, the Gartley pattern became extremely popular and traders started to develop the pattern and now it has several variations such as the alternate bat pattern, shark pattern, AB = CD pattern, the crab pattern, the butterfly pattern, etc. Moreover, specific price structures define the harmonic pattern and the Fibonacci calculations quantify it. A combination of distinct and consecutive Fibonacci retracements and projections is the trademark of the harmonic pattern. The alternate bat pattern is one of the several variations of the harmonic pattern.

What is the Alternate Bat harmonic pattern?

The alternate bat pattern is a variation of the Gartley pattern. Scott Carney developed it in 2003. It is popular for incorporating the 1.13XA retracement as the defining element in the Potential Reversal Zone (PRZ). The alternate bat harmonic pattern is one of the most precise trading patterns that works exceptionally great in the relative strength index (RSI) BAMM set up.

How to identify the Alternate Bat harmonic pattern?

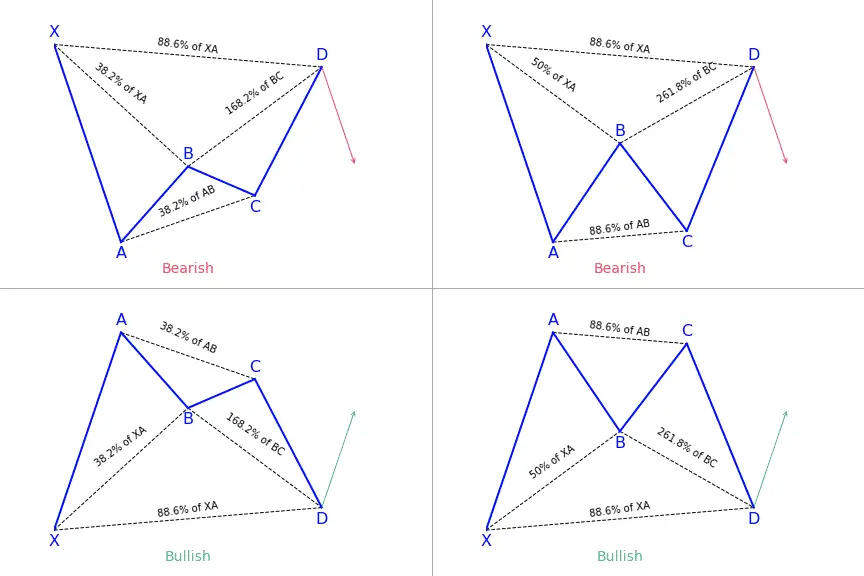

The alternate bat is a unique trading pattern that involves certain precise measurements. Those measures are crucial in order to identify the alternate bat. A pattern must meet the following conditions to be an alternate bat pattern:

- The first important factor is the B point retracement that must be 0.382 retracements or it must be less of the XA leg.

- The alternate bat only utilizes 2.0 BC projections or greater than that.

- The AB = CD pattern within the alternate bat pattern always extends requiring a 1.618 AB = CD calculations.

- Generally, the best structures use 50% retracement at the midpoint.

Looking for a way to automatically find harmonic patterns in your favorite markets?

You definitely need a screener for that! Check out this harmonic patterns scanner here!

If you come from us (simply click the link below), you’ll get a 7-days free trial and 50% off your first month’s subscription fee. Don’t think more, go test it out for free now!

Click here to signup and claim your 7-days free trial to the best harmonic pattern scanner.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!