- The Ichimoku Cloud is composed of five lines. The include a:

- nine-period average,

- 26-period average,

- average of those two averages,

- 52-period average,

- and a lagging closing price line.

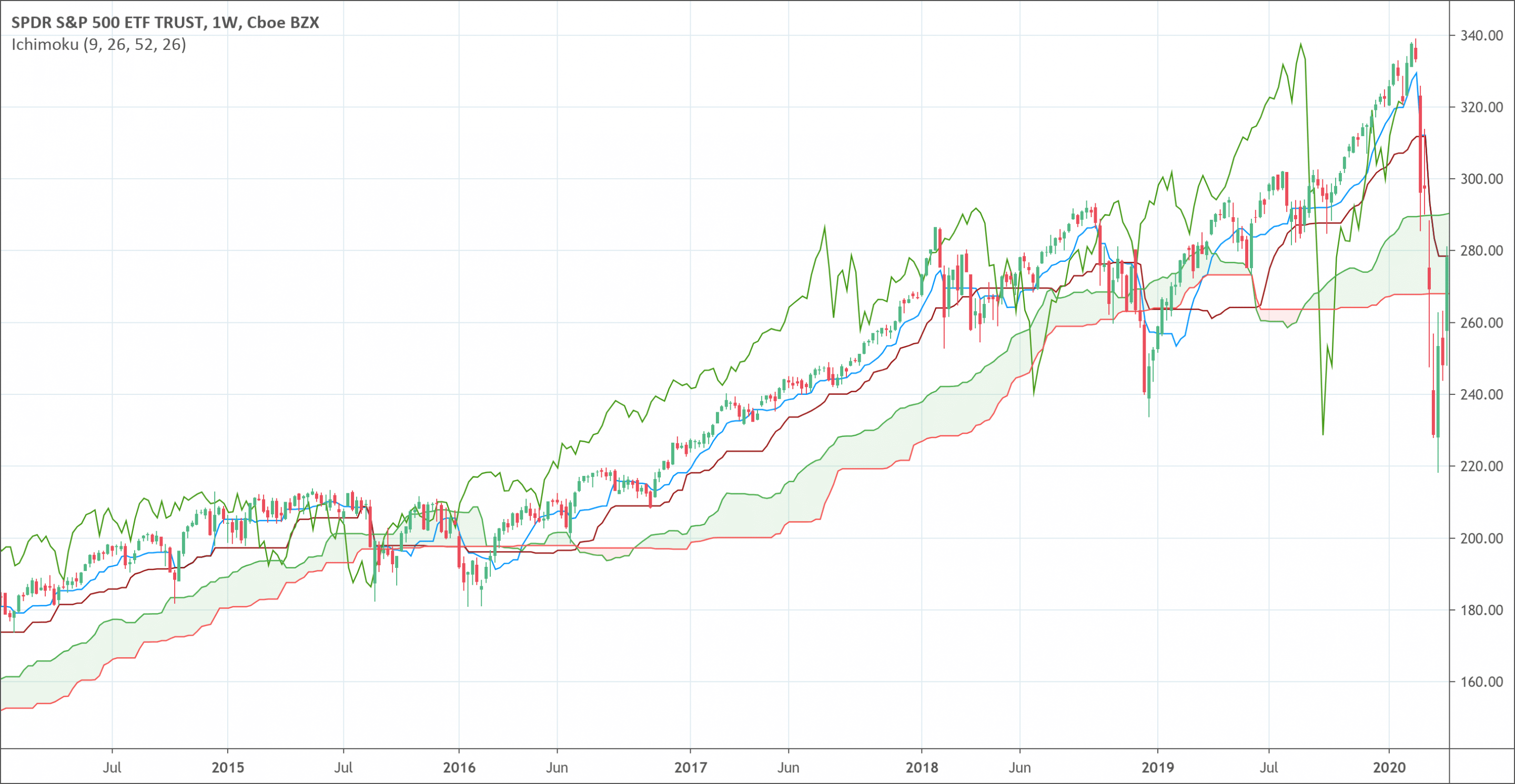

- The Cloud is a key part of the indicator.

- When price is below the cloud the trend is down.

- When price is above the cloud the trend is up.

- Trend signals are considered stronger when the Cloud moves in the same direction as price.

The Ichimoku Cloud indicator, also known as Ichimoku Kinko Hyo, is a technical analysis tool famous for being versatile and all in one indicator. It has the potential to incorporate multiple elements in its calculations. These multiple elements were once covered by multiple indicators but not anymore. The Ichimoku Cloud indicator can provide can cover the work of all those indicators on its own. That is why it is an “all in one” indicator.

The Ichimoku Cloud indicator gives information about the direction of the prevalent trend, momentum, and the support and resistance levels. It surprisingly gives insight into the different features of prices with the help of different data points. The Ichimoku indicator can give such a wholesome picture of the market because it considers multiple pieces of information. The presentation of such a plethora of information makes its chart look confusing and messy just like its Japanese name. However, it is not as complex as it seems.

The brief history of the Ichimoku Cloud indicator

The history of the Ichimoku Cloud indicator is a very interesting one. This wonderful trading tool is the courtesy of a dutiful Japanese journalist Goichi Hosoda. Being a journalist, Goichi covered the rice market of Japan. Although he was a journalist, yet an expert trading analyst as well. He was an exquisite expert at understanding price movements and their reaction (known as support and resistance levels today) at the chart.

Goichi began working on the Ichimoku indicator in 1930. He included a number of students in his endeavor. They had the task to run lots of computations and a number of possible scenarios to arrive at an indicator that would be unique. In their search for an all in one indicator, they finally invented the “Ichimoku Kinko Hyo.” That means a one look equilibrium chart or instant look at the balance chart. After 35 years of continuous efforts, he refined his invention and published it in 1969. It became an instant hit in Japan. Because of a lack of translation and understanding of the Ichimoku tool, it appeared in the West as late as the 1990s. But, once after its introduction, the rest is history.

The structure of the Ichimoku Cloud indicator and calculations

The understanding of the Ichimoku Kinko Hyo is not as hard as it initially seems. The Ichimoku Cloud indicator consists of five different lines on the chart. All of these lines provide an overview of the price action. Two of these five lines form Ichimoku Cloud that looks like a shaded area on the chart. In order to fully understand the working of the Ichimoku Cloud indicator, it is necessary to understand its five component lines and their role in the working of the Ichimoku indicator.

- The Tenkan Sen is the conversion line that is the midpoint of the last nine price bars in a default setting of 9 periods. It computes by adding the highest high and the lowest low divided by two.

- The Kijun Sen is the baseline that is the midpoint of the last twenty-six price bars in a default setting of 26 periods. Its calculations follow the same formula as the Trenkan Sen.

- The Chikou Span is the lagging span. It is the most recent price with price time-shifted backward 26 periods. It always lags behind the price.

- The Kumo Cloud has two lines, the Senkou Span A and Senkou Span B.

- The Senkou Span A is the leading span that is the midpoint of the Tenkan Sen and the Kijun Sen. It computes by adding these two and divide by 2. The resulting value plots on the chart 26 periods ahead in the future.

- The Senkou Span B is the midpoint of the previous 52 price bars. It computes by adding a 52 period high and 52 period low divided by two. The resulting value also plots 26 periods ahead in the future on the chart.

What does the Ichimoku Cloud indicator tell traders?

The Ichimoku Cloud indicator serves many purposes because of its versatility. The Kimo Cloud is probably the best element of the Ichimoku indicator. It gives certain signals to inform traders about the prevailing trend in the market. If the price of the asset is below the Cloud, it signals that currently, it is a downtrend. Similarly, if the price is above the Cloud, it will indicate an uptrend. An uptrend is further confirmed when the Senkou Span A rises above the Senkou Span B. Similarly, a downtrend is confirmed when the Senkou Span A goes below the Senkou Span B. A similar relationship between the Tenkan and Kijun can also be used to confirm an uptrend or downtrend. Moreover, it also helps traders to identify buying or selling points, defining stop-loss, and areas of support and resistance.

How to use the Ichimoku Cloud indicator

The Ichimoku Cloud indicator is popular for its ability to identify trend direction and momentum, therefore, it can give buy or sell signals. It also helps to define the stop-loss level that probably lies in the support area. The indicator also helps to predict future prices. It can be incorporated into the trading strategies in the following possible ways.

- When the Senkou Span A rises above the Senkou Span B, it is an indication to buy because of bullish momentum in the market. Conversely, a sell signal is generated during a bearish trend.

- When the Tenkan Sen, Kijun Sen, and the prices are above the Cloud, it is considered as a buying signal. A selling signal is generated if the scenario is inversed.

- When the Senkou Span A and Span B switch positions, it leads to Ichimoku Cloud twists indicating a trend reversal.

The limitations of the indicator

The Ichimoku indicator has also certain limitations. For example, it makes the chart too confusing and messy with five lines. That makes it one of the most difficult patterns to interpret. Although, most charting software is now popular for being able to hide certain lies.

Furthermore, it also relies on the historical data despite two points being plotted 26 periods ahead in the future. There is nothing in the working of the Ichimoku indicator that can make it inherently predictive.

The Ichimoku Cloud indicator is also useful for short-term trading because it may become irrelevant for the long-term.

Conclusion

The Ichimoku Cloud indicator, also named as Ichimoku Kinko Hyo, is a flexible and versatile indicator that helps to identify the direction of the trend, the momentum, and the levels of support and resistance. It is famous for providing a quick but complete picture of price action. It is one of the most reliable tools known for providing the best buying and selling signals. These signals also assist traders to define entry and exit points. The Ichimoku indicator consists of five lines that make its chart a bit confusing and messy. However, it doesn’t as complex to comprehend as it initially seems. Technical analysts and experts advise using the Ichimoku Cloud indicator in conjunction with other trading tools. This combination will help to confirm signals and also significantly reduce the trading risks.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!